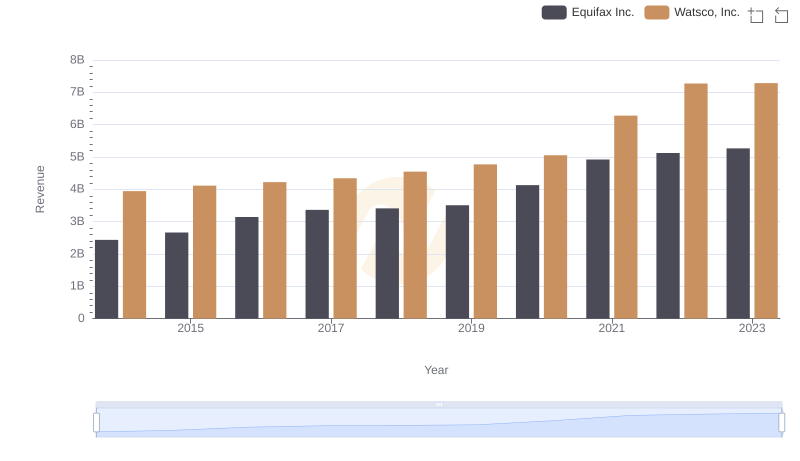

| __timestamp | Equifax Inc. | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 844700000 | 2988138000 |

| Thursday, January 1, 2015 | 887400000 | 3105882000 |

| Friday, January 1, 2016 | 1113400000 | 3186118000 |

| Sunday, January 1, 2017 | 1210700000 | 3276296000 |

| Monday, January 1, 2018 | 1440400000 | 3426401000 |

| Tuesday, January 1, 2019 | 1521700000 | 3613406000 |

| Wednesday, January 1, 2020 | 1737400000 | 3832107000 |

| Friday, January 1, 2021 | 1980900000 | 4612647000 |

| Saturday, January 1, 2022 | 2177200000 | 5244055000 |

| Sunday, January 1, 2023 | 2335100000 | 5291627000 |

| Monday, January 1, 2024 | 0 | 5573604000 |

Unleashing insights

In the past decade, Equifax Inc. and Watsco, Inc. have shown significant shifts in their cost of revenue, reflecting broader economic trends and company-specific strategies. From 2014 to 2023, Equifax's cost of revenue increased by approximately 176%, starting at $844 million and reaching $2.34 billion. This growth highlights Equifax's expanding operations and investments in data security and analytics.

Meanwhile, Watsco, Inc., a leader in HVAC distribution, saw its cost of revenue rise by 77% over the same period, from $2.99 billion to $5.29 billion. This increase underscores Watsco's strategic expansion and adaptation to rising material costs and supply chain challenges.

These trends offer a window into how these companies navigate financial pressures and opportunities, providing valuable insights for investors and industry analysts alike.

Equifax Inc. or Watsco, Inc.: Who Leads in Yearly Revenue?

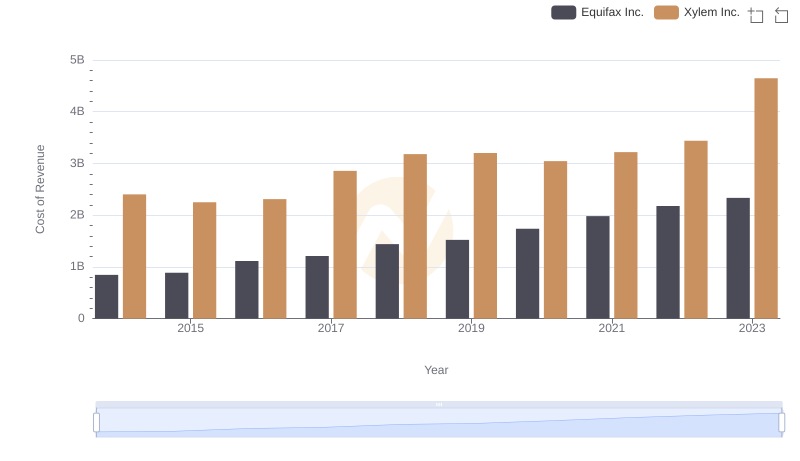

Analyzing Cost of Revenue: Equifax Inc. and Xylem Inc.

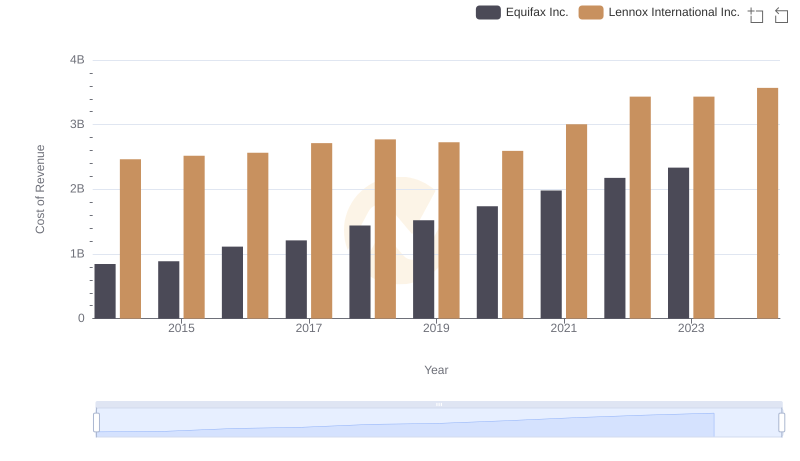

Cost of Revenue Comparison: Equifax Inc. vs Lennox International Inc.

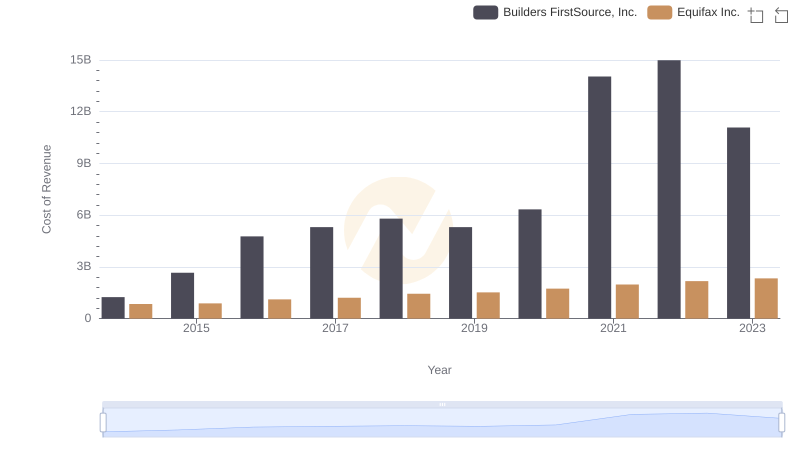

Cost Insights: Breaking Down Equifax Inc. and Builders FirstSource, Inc.'s Expenses

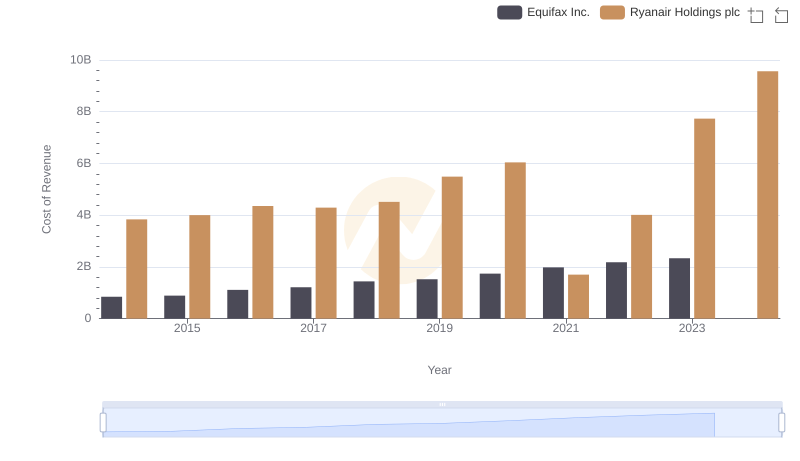

Equifax Inc. vs Ryanair Holdings plc: Efficiency in Cost of Revenue Explored

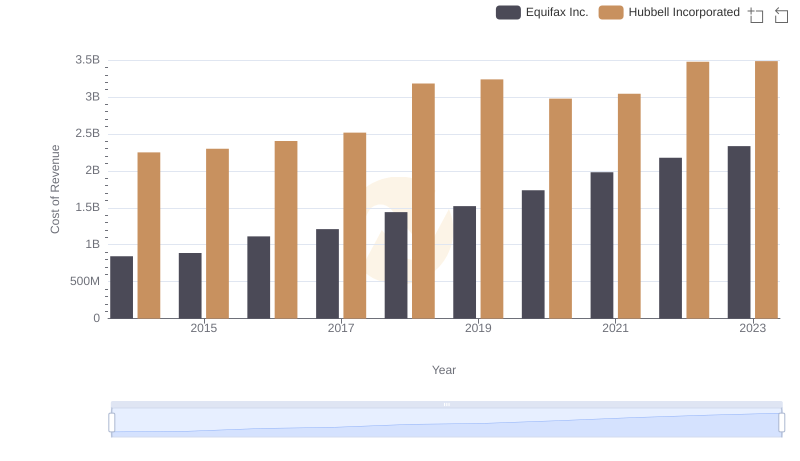

Cost Insights: Breaking Down Equifax Inc. and Hubbell Incorporated's Expenses

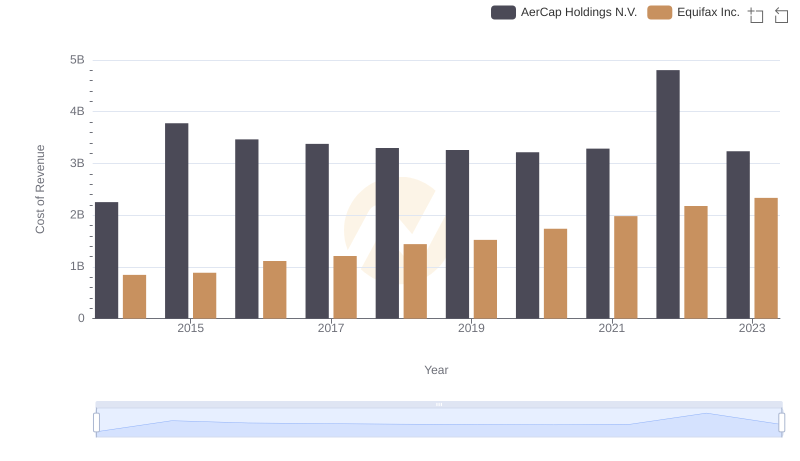

Analyzing Cost of Revenue: Equifax Inc. and AerCap Holdings N.V.

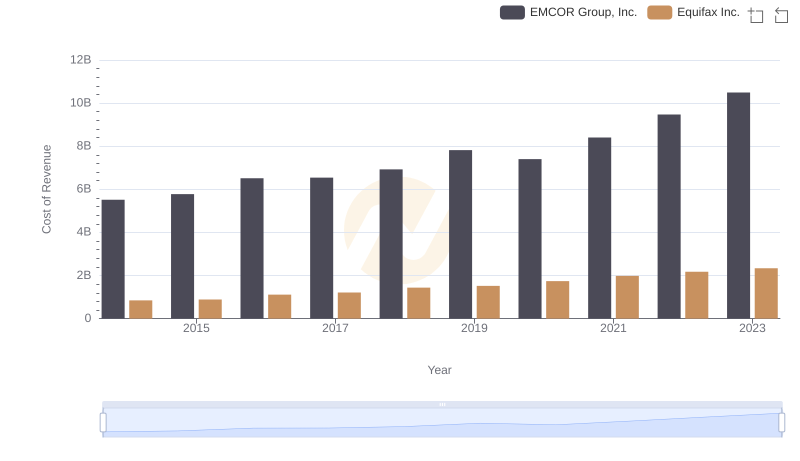

Equifax Inc. vs EMCOR Group, Inc.: Efficiency in Cost of Revenue Explored

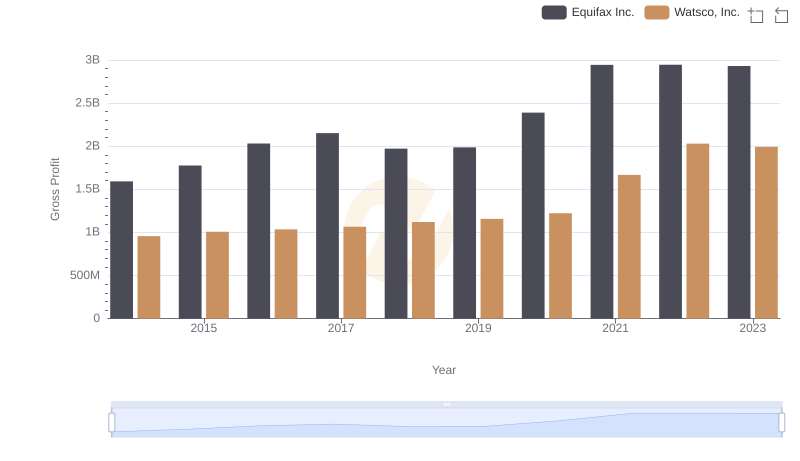

Equifax Inc. vs Watsco, Inc.: A Gross Profit Performance Breakdown

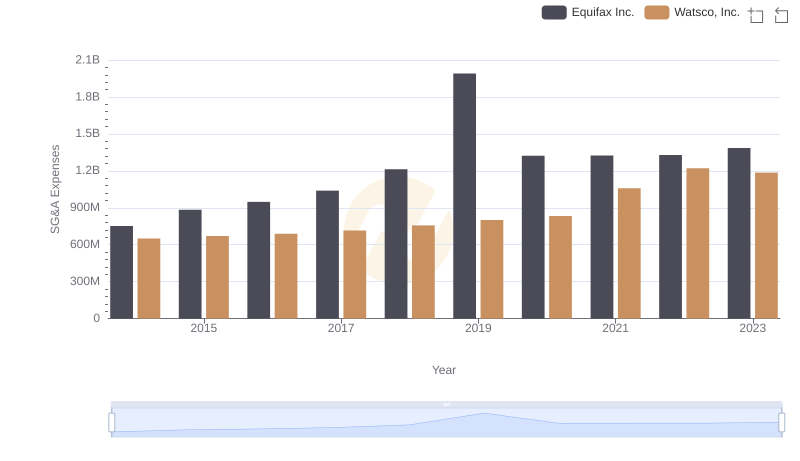

Cost Management Insights: SG&A Expenses for Equifax Inc. and Watsco, Inc.