| __timestamp | Equifax Inc. | Hubbell Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 2436400000 | 3359400000 |

| Thursday, January 1, 2015 | 2663600000 | 3390400000 |

| Friday, January 1, 2016 | 3144900000 | 3505200000 |

| Sunday, January 1, 2017 | 3362200000 | 3668800000 |

| Monday, January 1, 2018 | 3412100000 | 4481700000 |

| Tuesday, January 1, 2019 | 3507600000 | 4591000000 |

| Wednesday, January 1, 2020 | 4127500000 | 4186000000 |

| Friday, January 1, 2021 | 4923900000 | 4194100000 |

| Saturday, January 1, 2022 | 5122200000 | 4947900000 |

| Sunday, January 1, 2023 | 5265200000 | 5372900000 |

| Monday, January 1, 2024 | 5681100000 | 5628500000 |

Unlocking the unknown

In the ever-evolving landscape of American business, Equifax Inc. and Hubbell Incorporated have showcased intriguing revenue trajectories over the past decade. From 2014 to 2023, Equifax's revenue surged by approximately 116%, reflecting its robust growth strategy and market adaptation. Meanwhile, Hubbell Incorporated, a stalwart in the electrical and electronic manufacturing sector, experienced a commendable 60% increase in revenue during the same period.

Equifax's revenue growth was particularly notable between 2020 and 2023, where it jumped by nearly 28%, underscoring its resilience amidst global economic challenges. On the other hand, Hubbell's revenue saw a steady climb, with a significant leap of 20% from 2021 to 2023, highlighting its strategic expansions and innovations.

These trends not only reflect the companies' individual strategies but also offer insights into broader economic shifts and consumer behavior in the United States.

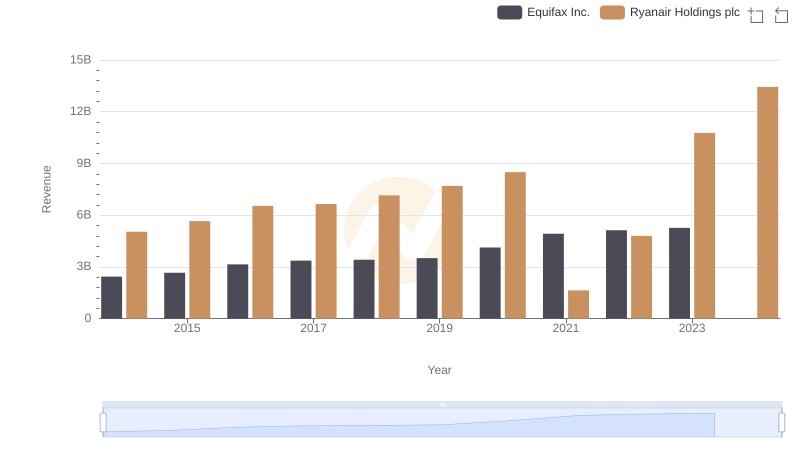

Revenue Showdown: Equifax Inc. vs Ryanair Holdings plc

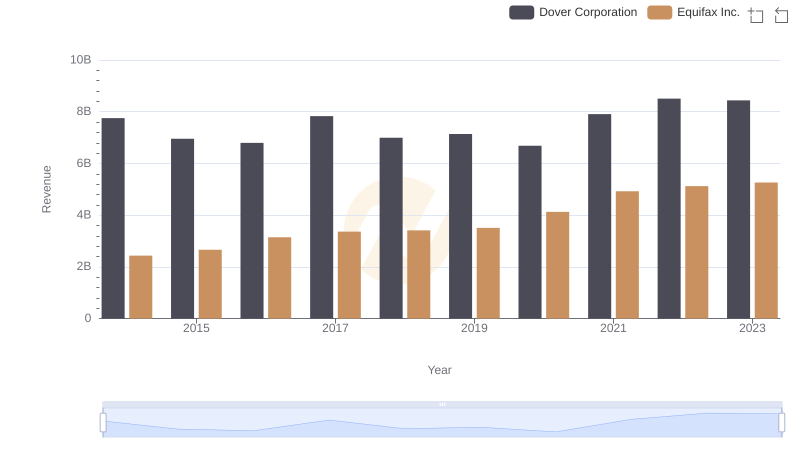

Equifax Inc. vs Dover Corporation: Annual Revenue Growth Compared

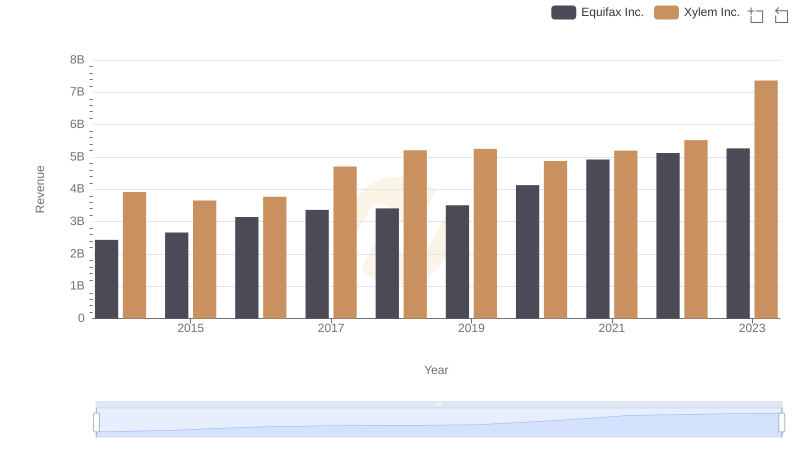

Annual Revenue Comparison: Equifax Inc. vs Xylem Inc.

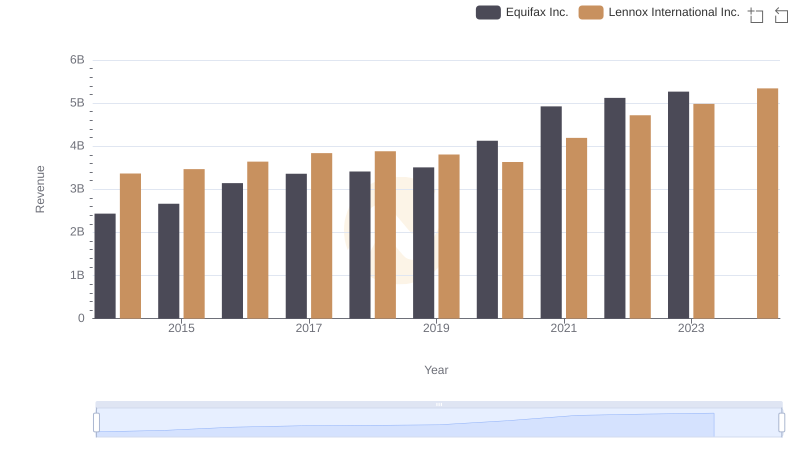

Annual Revenue Comparison: Equifax Inc. vs Lennox International Inc.

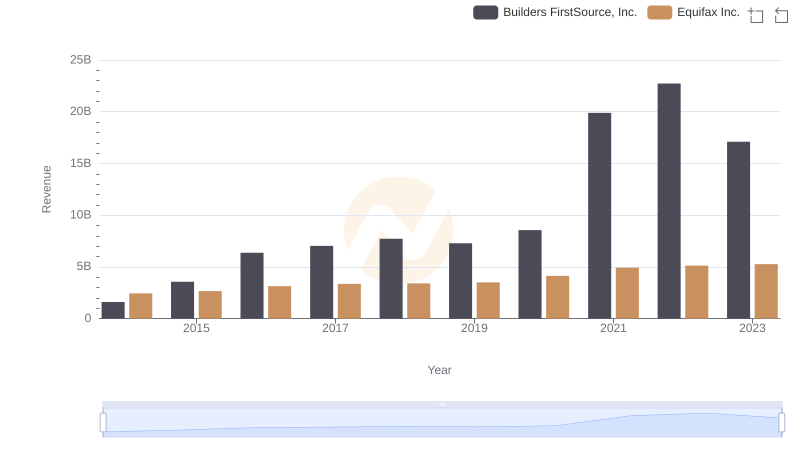

Annual Revenue Comparison: Equifax Inc. vs Builders FirstSource, Inc.

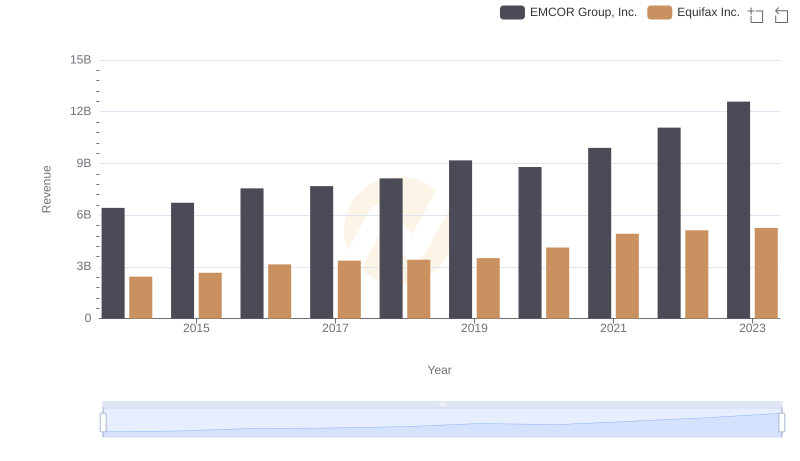

Breaking Down Revenue Trends: Equifax Inc. vs EMCOR Group, Inc.

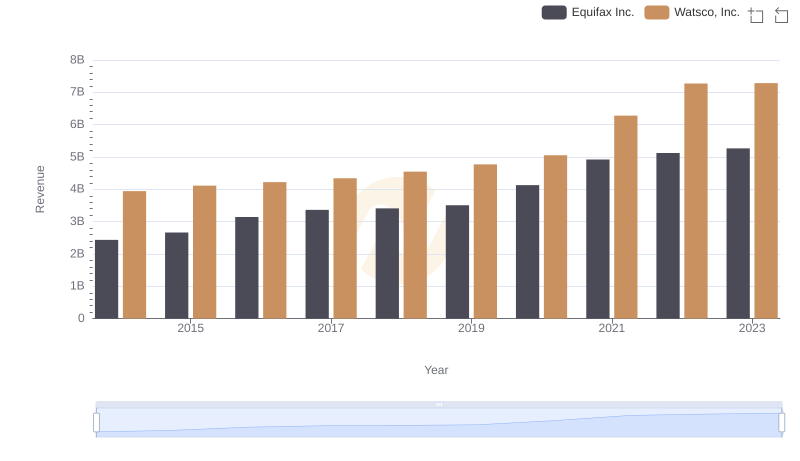

Equifax Inc. or Watsco, Inc.: Who Leads in Yearly Revenue?

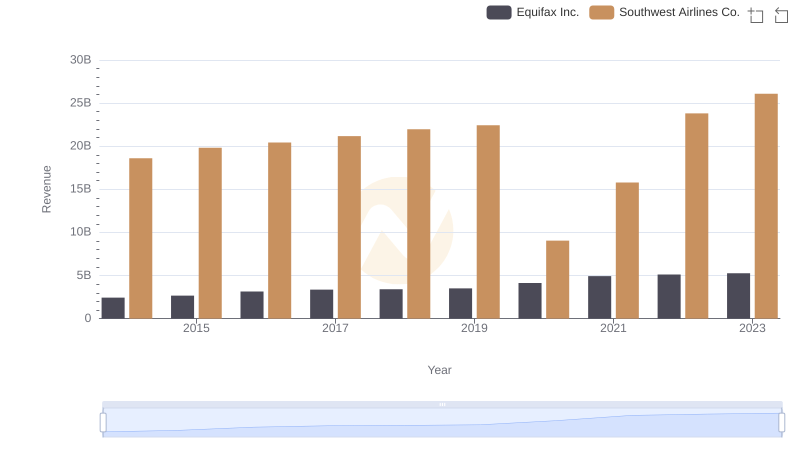

Equifax Inc. vs Southwest Airlines Co.: Annual Revenue Growth Compared

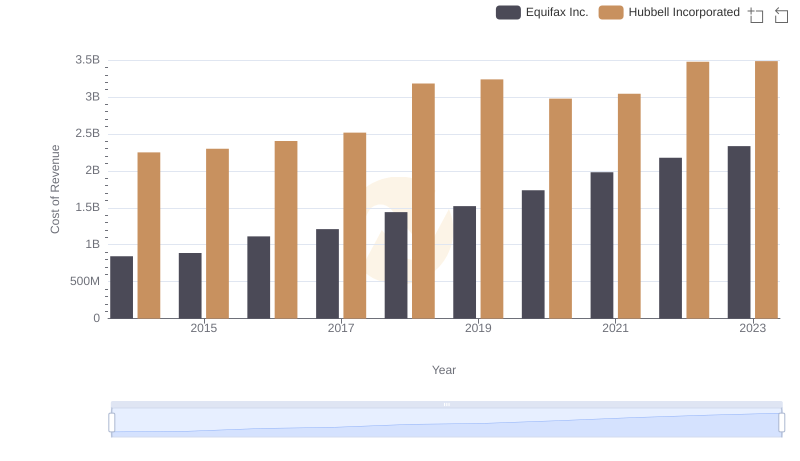

Cost Insights: Breaking Down Equifax Inc. and Hubbell Incorporated's Expenses

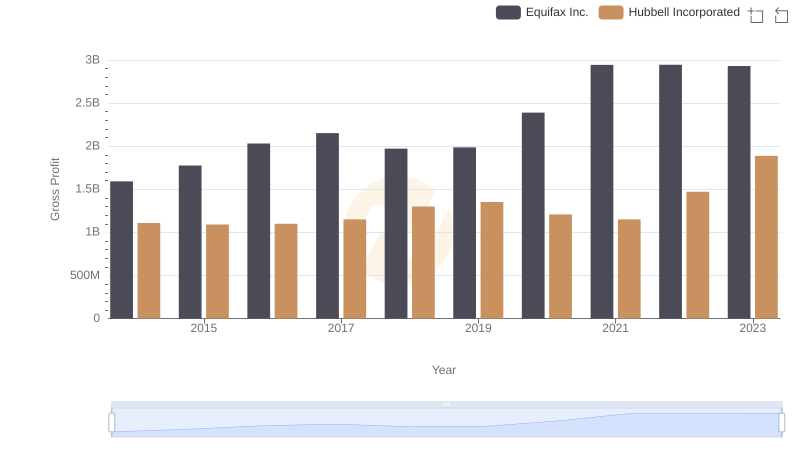

Equifax Inc. vs Hubbell Incorporated: A Gross Profit Performance Breakdown