| __timestamp | Booz Allen Hamilton Holding Corporation | EMCOR Group, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2229642000 | 626478000 |

| Thursday, January 1, 2015 | 2159439000 | 656573000 |

| Friday, January 1, 2016 | 2319592000 | 725538000 |

| Sunday, January 1, 2017 | 2568511000 | 757062000 |

| Monday, January 1, 2018 | 2719909000 | 799157000 |

| Tuesday, January 1, 2019 | 2932602000 | 893453000 |

| Wednesday, January 1, 2020 | 3334378000 | 903584000 |

| Friday, January 1, 2021 | 3362722000 | 970937000 |

| Saturday, January 1, 2022 | 3633150000 | 1038717000 |

| Sunday, January 1, 2023 | 4341769000 | 1211233000 |

| Monday, January 1, 2024 | 1281443000 |

Infusing magic into the data realm

In the competitive landscape of corporate America, understanding the financial health of companies is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry giants: Booz Allen Hamilton Holding Corporation and EMCOR Group, Inc., from 2014 to 2023.

Booz Allen Hamilton, a leader in management and technology consulting, has seen its SG&A expenses grow by approximately 95% over the decade, peaking in 2023. In contrast, EMCOR Group, a construction and facilities services powerhouse, experienced a more modest increase of around 93% in the same period.

Interestingly, while Booz Allen's expenses surged in 2023, EMCOR's data for 2024 remains elusive, hinting at potential strategic shifts. This trend underscores the dynamic nature of corporate financial strategies and the importance of monitoring these key metrics for investment insights.

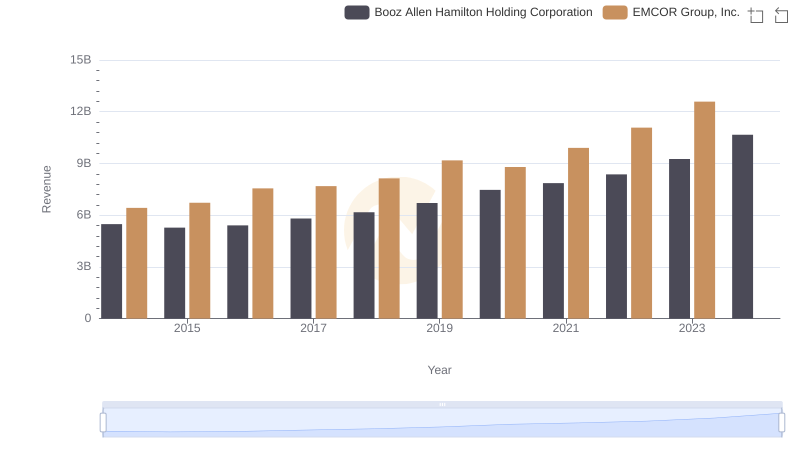

Revenue Insights: EMCOR Group, Inc. and Booz Allen Hamilton Holding Corporation Performance Compared

Cost of Revenue Trends: EMCOR Group, Inc. vs Booz Allen Hamilton Holding Corporation

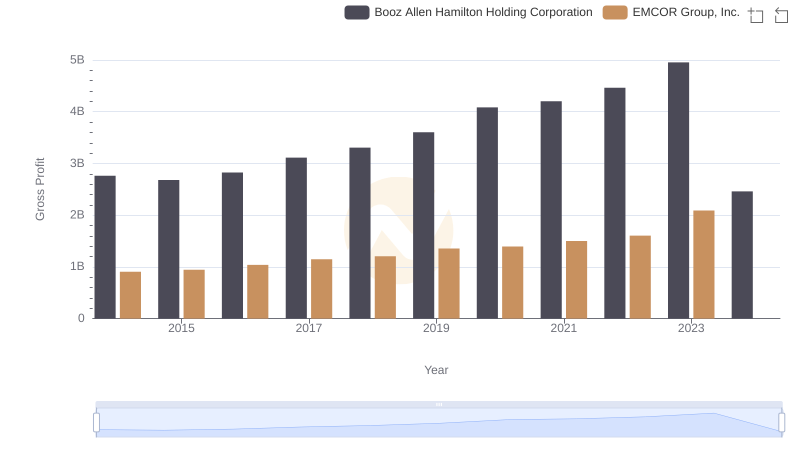

Gross Profit Trends Compared: EMCOR Group, Inc. vs Booz Allen Hamilton Holding Corporation

Breaking Down SG&A Expenses: EMCOR Group, Inc. vs J.B. Hunt Transport Services, Inc.

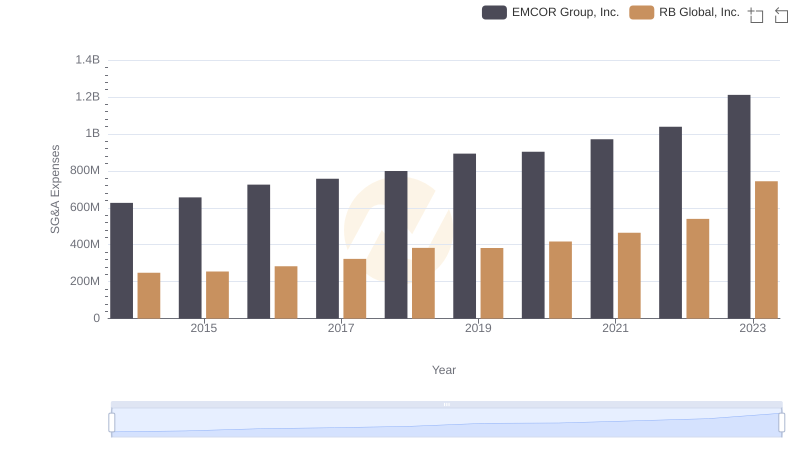

EMCOR Group, Inc. and RB Global, Inc.: SG&A Spending Patterns Compared

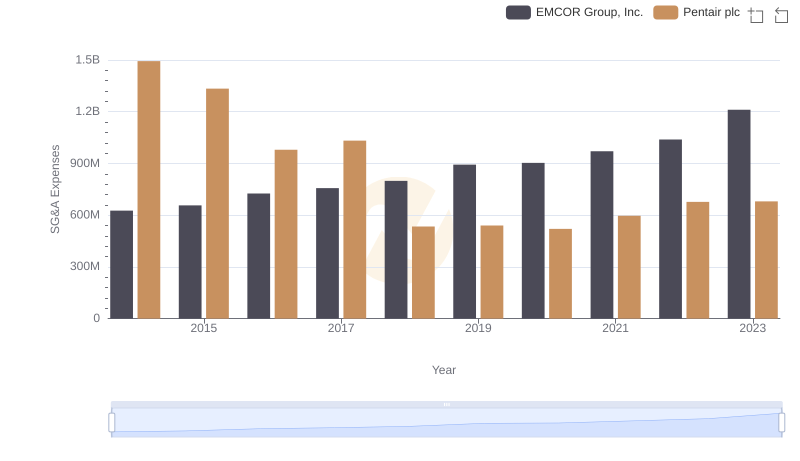

EMCOR Group, Inc. and Pentair plc: SG&A Spending Patterns Compared

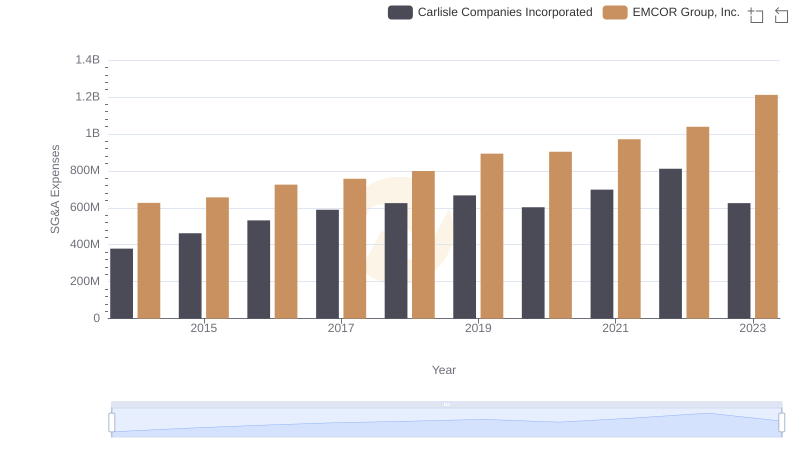

Breaking Down SG&A Expenses: EMCOR Group, Inc. vs Carlisle Companies Incorporated

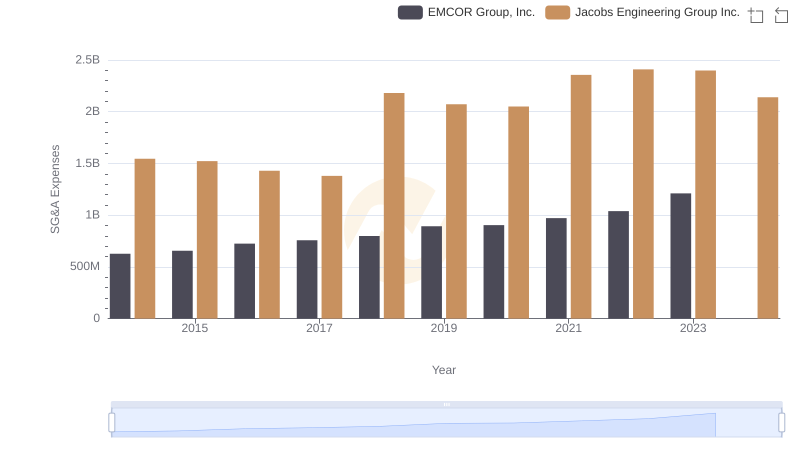

Selling, General, and Administrative Costs: EMCOR Group, Inc. vs Jacobs Engineering Group Inc.

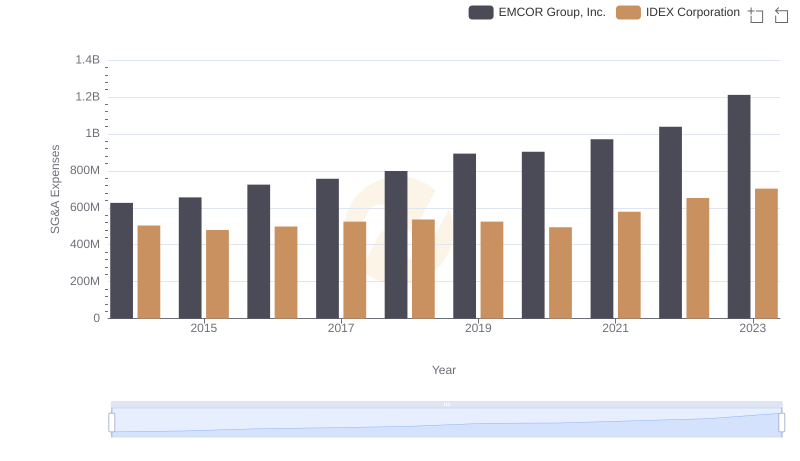

Breaking Down SG&A Expenses: EMCOR Group, Inc. vs IDEX Corporation

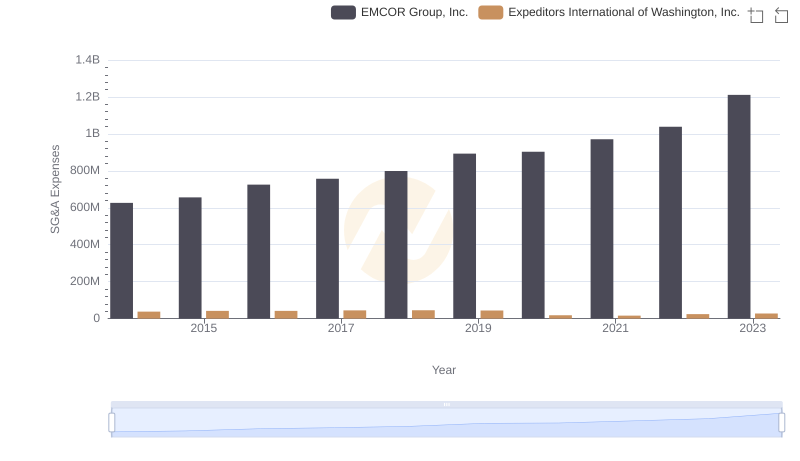

EMCOR Group, Inc. and Expeditors International of Washington, Inc.: SG&A Spending Patterns Compared

A Professional Review of EBITDA: EMCOR Group, Inc. Compared to Booz Allen Hamilton Holding Corporation