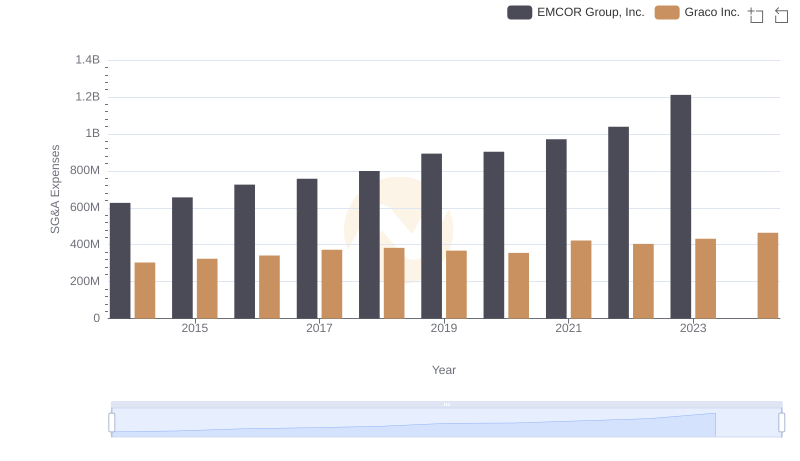

| __timestamp | CNH Industrial N.V. | EMCOR Group, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2925000000 | 626478000 |

| Thursday, January 1, 2015 | 2317000000 | 656573000 |

| Friday, January 1, 2016 | 2262000000 | 725538000 |

| Sunday, January 1, 2017 | 2330000000 | 757062000 |

| Monday, January 1, 2018 | 2351000000 | 799157000 |

| Tuesday, January 1, 2019 | 2216000000 | 893453000 |

| Wednesday, January 1, 2020 | 2155000000 | 903584000 |

| Friday, January 1, 2021 | 2443000000 | 970937000 |

| Saturday, January 1, 2022 | 1752000000 | 1038717000 |

| Sunday, January 1, 2023 | 1863000000 | 1211233000 |

Igniting the spark of knowledge

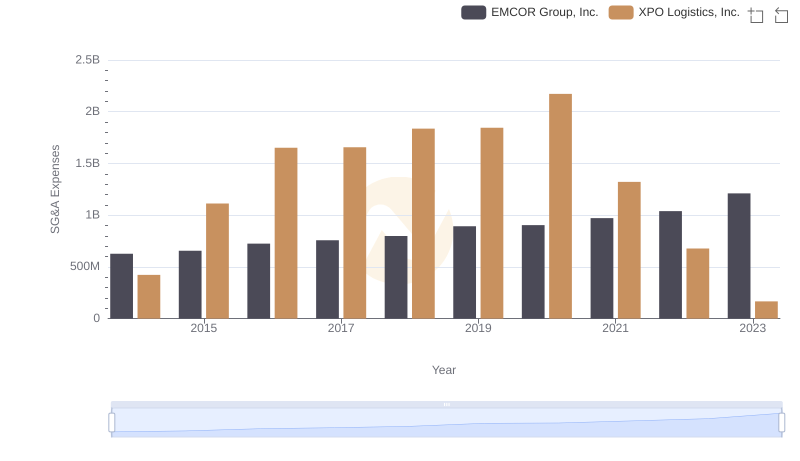

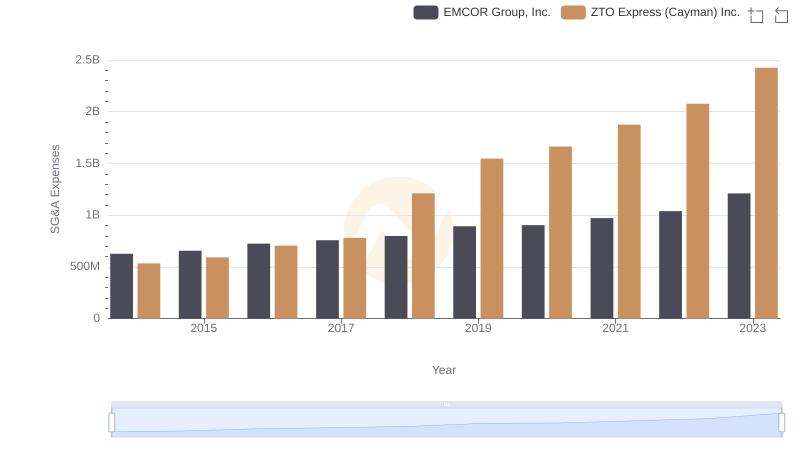

In the competitive landscape of industrial giants, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, EMCOR Group, Inc. and CNH Industrial N.V. have shown contrasting trends in their SG&A management. From 2014 to 2023, EMCOR's SG&A expenses grew by approximately 93%, reflecting a strategic expansion and investment in operational efficiency. In contrast, CNH Industrial's SG&A costs decreased by about 36%, indicating a focus on cost-cutting and streamlined operations.

Key Insights

These trends highlight differing strategic priorities, with EMCOR focusing on growth and CNH Industrial emphasizing cost efficiency.

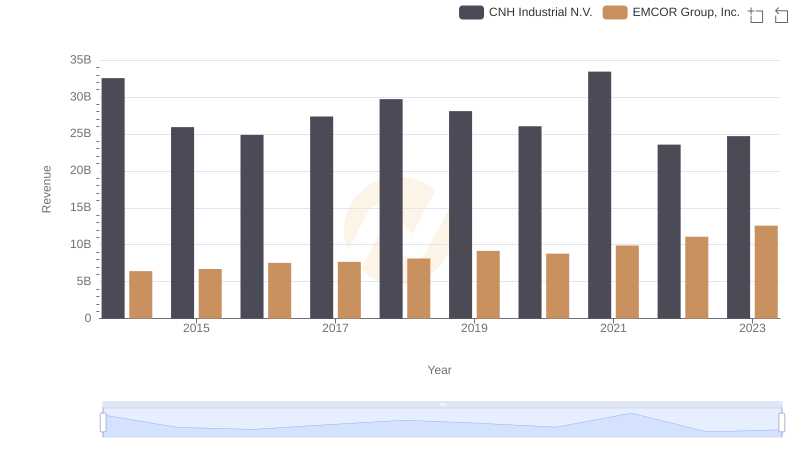

Comparing Revenue Performance: EMCOR Group, Inc. or CNH Industrial N.V.?

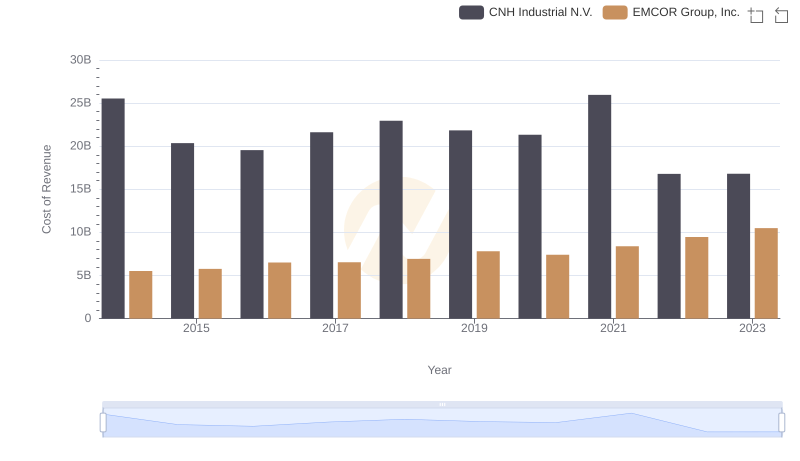

EMCOR Group, Inc. vs CNH Industrial N.V.: Efficiency in Cost of Revenue Explored

Selling, General, and Administrative Costs: EMCOR Group, Inc. vs XPO Logistics, Inc.

Comparing SG&A Expenses: EMCOR Group, Inc. vs ZTO Express (Cayman) Inc. Trends and Insights

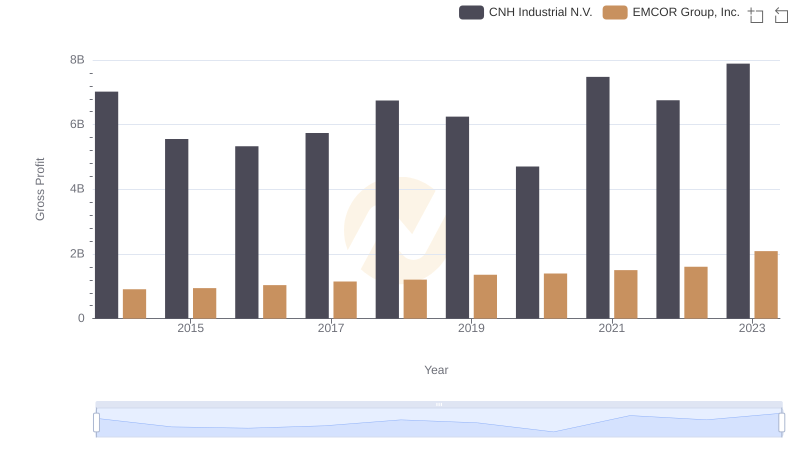

Key Insights on Gross Profit: EMCOR Group, Inc. vs CNH Industrial N.V.

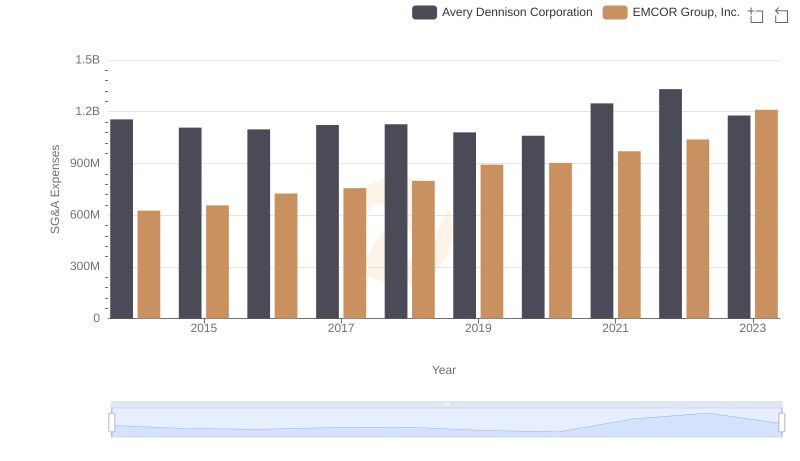

Breaking Down SG&A Expenses: EMCOR Group, Inc. vs Avery Dennison Corporation

Breaking Down SG&A Expenses: EMCOR Group, Inc. vs Graco Inc.

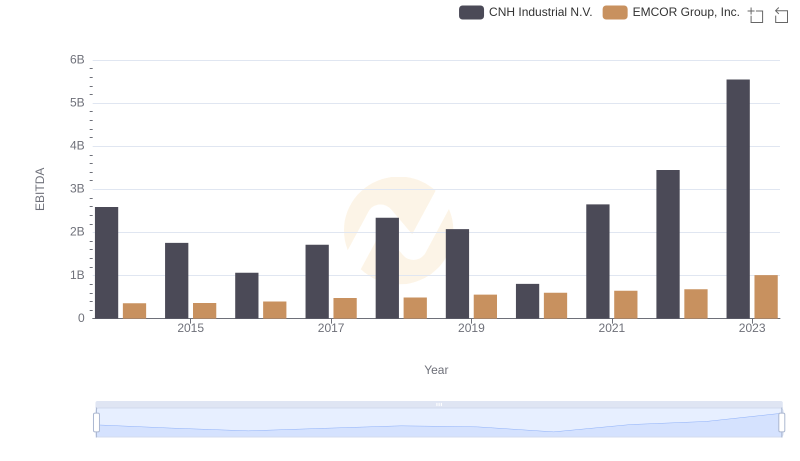

EBITDA Performance Review: EMCOR Group, Inc. vs CNH Industrial N.V.

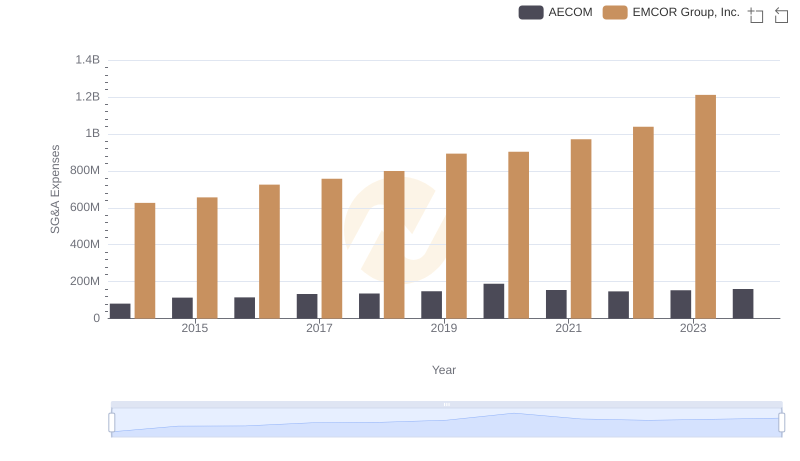

Comparing SG&A Expenses: EMCOR Group, Inc. vs AECOM Trends and Insights

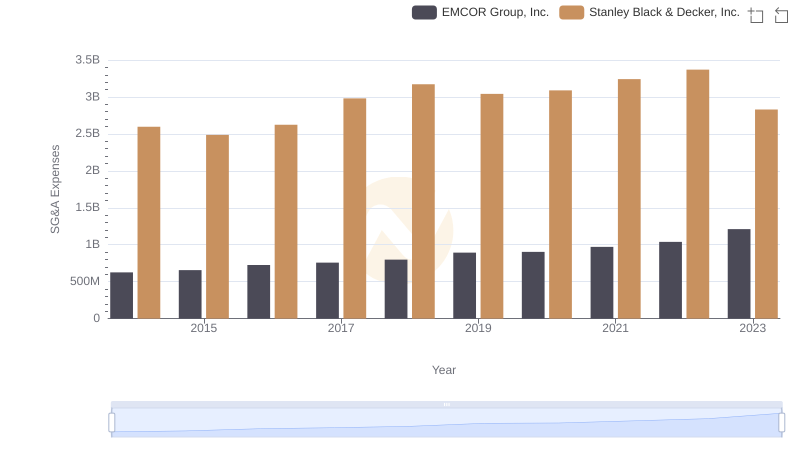

Selling, General, and Administrative Costs: EMCOR Group, Inc. vs Stanley Black & Decker, Inc.