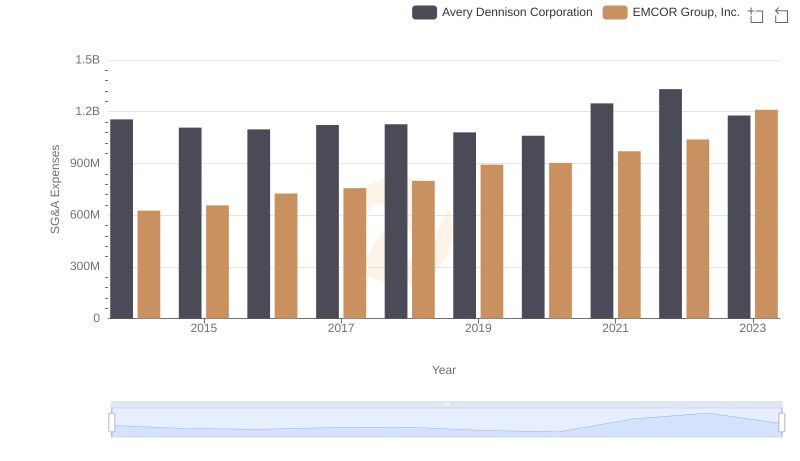

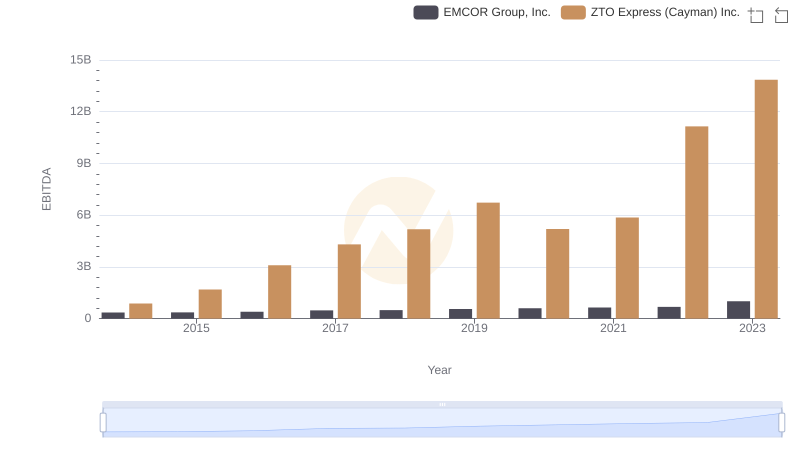

| __timestamp | EMCOR Group, Inc. | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 626478000 | 534537000 |

| Thursday, January 1, 2015 | 656573000 | 591738000 |

| Friday, January 1, 2016 | 725538000 | 705995000 |

| Sunday, January 1, 2017 | 757062000 | 780517000 |

| Monday, January 1, 2018 | 799157000 | 1210717000 |

| Tuesday, January 1, 2019 | 893453000 | 1546227000 |

| Wednesday, January 1, 2020 | 903584000 | 1663712000 |

| Friday, January 1, 2021 | 970937000 | 1875869000 |

| Saturday, January 1, 2022 | 1038717000 | 2077372000 |

| Sunday, January 1, 2023 | 1211233000 | 2425253000 |

Unlocking the unknown

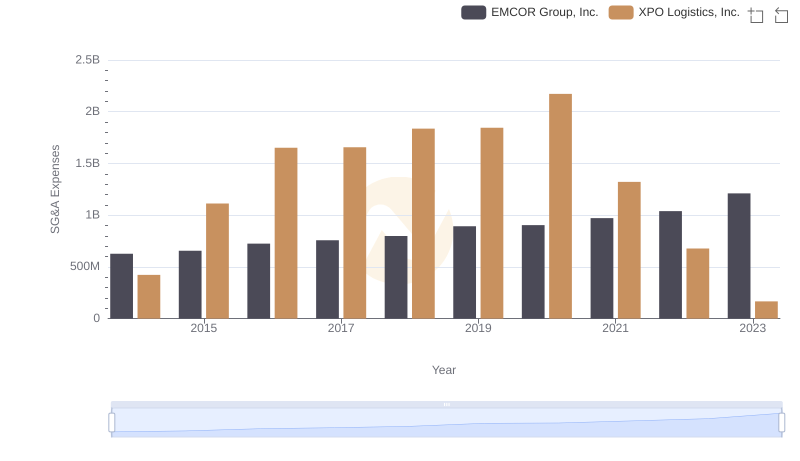

In the ever-evolving landscape of corporate finance, Selling, General, and Administrative (SG&A) expenses serve as a critical indicator of a company's operational efficiency. From 2014 to 2023, EMCOR Group, Inc. and ZTO Express (Cayman) Inc. have showcased contrasting trajectories in their SG&A expenses.

EMCOR Group, Inc., a leader in mechanical and electrical construction services, saw a steady increase in SG&A expenses, growing by approximately 93% over the decade. In contrast, ZTO Express, a major player in the logistics sector, experienced a staggering 354% rise in the same period. By 2023, ZTO's SG&A expenses were nearly double those of EMCOR, highlighting its aggressive expansion strategy.

This comparison underscores the diverse strategies employed by companies in different sectors to manage their operational costs, reflecting broader industry trends and economic conditions.

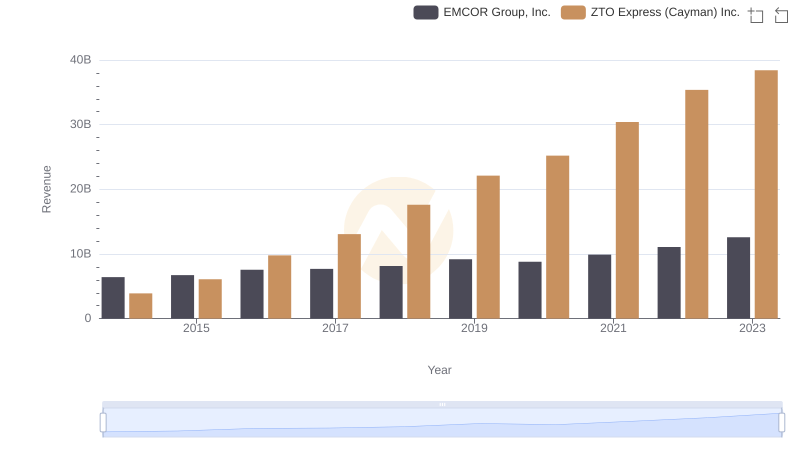

Breaking Down Revenue Trends: EMCOR Group, Inc. vs ZTO Express (Cayman) Inc.

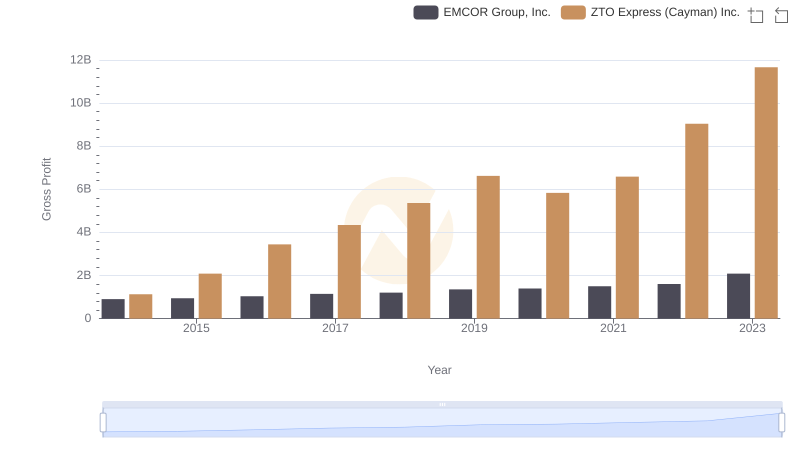

Gross Profit Comparison: EMCOR Group, Inc. and ZTO Express (Cayman) Inc. Trends

Selling, General, and Administrative Costs: EMCOR Group, Inc. vs XPO Logistics, Inc.

Breaking Down SG&A Expenses: EMCOR Group, Inc. vs Avery Dennison Corporation

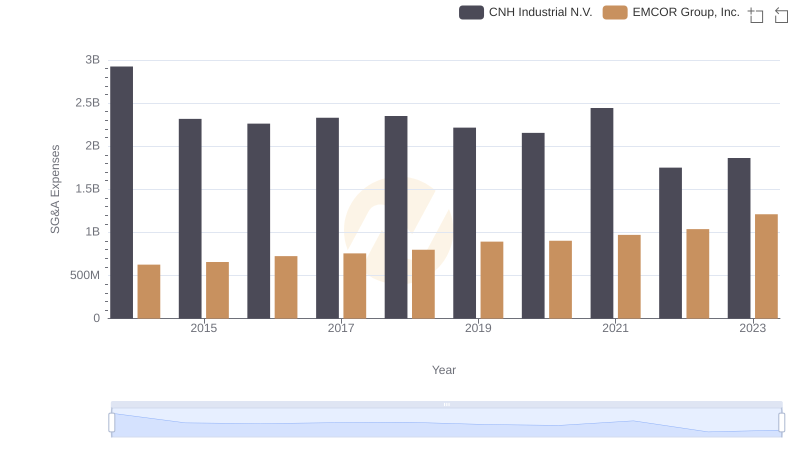

EMCOR Group, Inc. or CNH Industrial N.V.: Who Manages SG&A Costs Better?

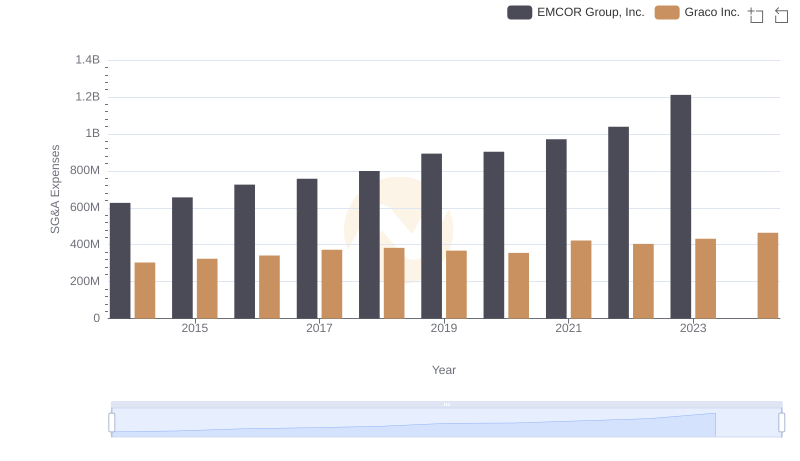

Breaking Down SG&A Expenses: EMCOR Group, Inc. vs Graco Inc.

EMCOR Group, Inc. and ZTO Express (Cayman) Inc.: A Detailed Examination of EBITDA Performance

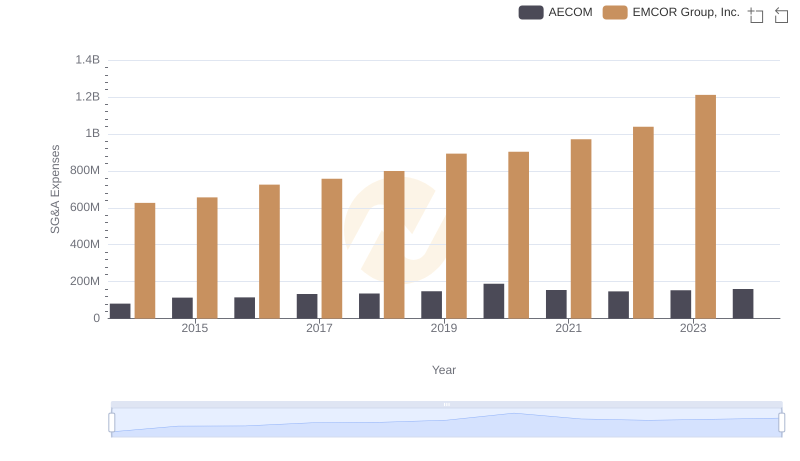

Comparing SG&A Expenses: EMCOR Group, Inc. vs AECOM Trends and Insights