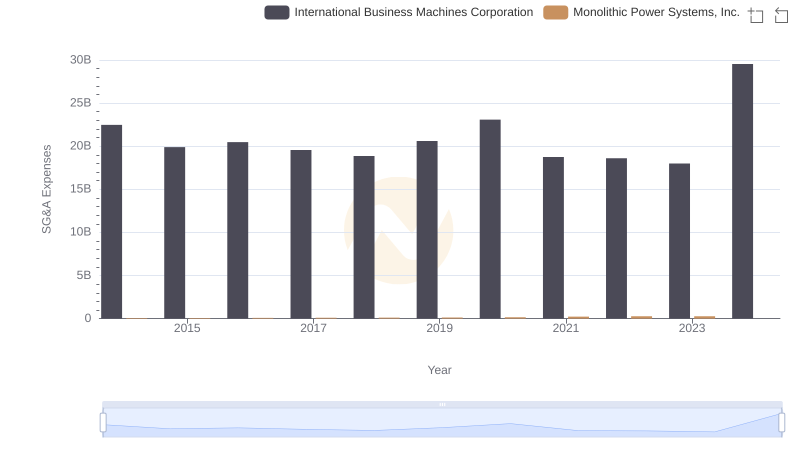

| __timestamp | International Business Machines Corporation | Monolithic Power Systems, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 24962000000 | 41003000 |

| Thursday, January 1, 2015 | 20268000000 | 53346000 |

| Friday, January 1, 2016 | 17341000000 | 65992000 |

| Sunday, January 1, 2017 | 16556000000 | 94768000 |

| Monday, January 1, 2018 | 16545000000 | 127721000 |

| Tuesday, January 1, 2019 | 14609000000 | 119893000 |

| Wednesday, January 1, 2020 | 10555000000 | 185872000 |

| Friday, January 1, 2021 | 12409000000 | 291116000 |

| Saturday, January 1, 2022 | 7174000000 | 563899000 |

| Sunday, January 1, 2023 | 14693000000 | 521904000 |

| Monday, January 1, 2024 | 6015000000 |

Unleashing the power of data

In the ever-evolving landscape of technology, the financial performance of industry titans like International Business Machines Corporation (IBM) and Monolithic Power Systems, Inc. (MPWR) offers a fascinating glimpse into their strategic maneuvers. Over the past decade, IBM's EBITDA has seen a significant decline, dropping from a peak of approximately $24.6 billion in 2014 to around $14.6 billion in 2023. This represents a decrease of nearly 41%, reflecting the challenges faced by the company in adapting to the rapidly changing tech environment.

Conversely, Monolithic Power Systems has demonstrated impressive growth, with its EBITDA surging by over 1,170% from 2014 to 2023. This remarkable increase underscores MPWR's successful expansion and innovation strategies in the semiconductor industry. As we look to the future, these trends highlight the dynamic nature of the tech sector and the importance of agility and innovation.

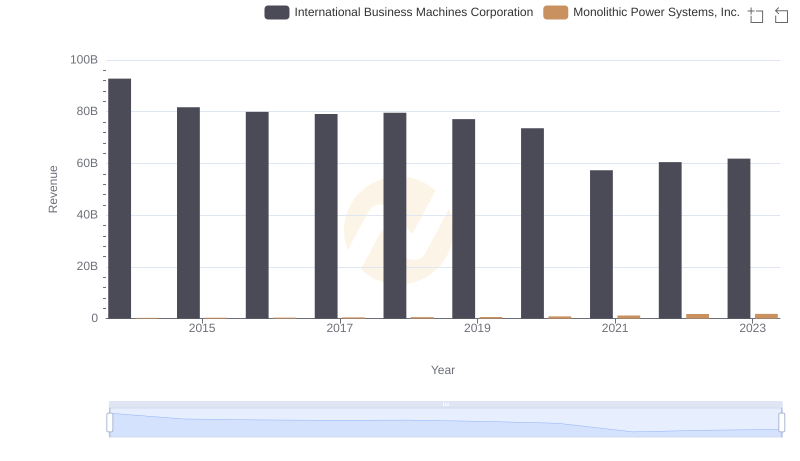

International Business Machines Corporation vs Monolithic Power Systems, Inc.: Examining Key Revenue Metrics

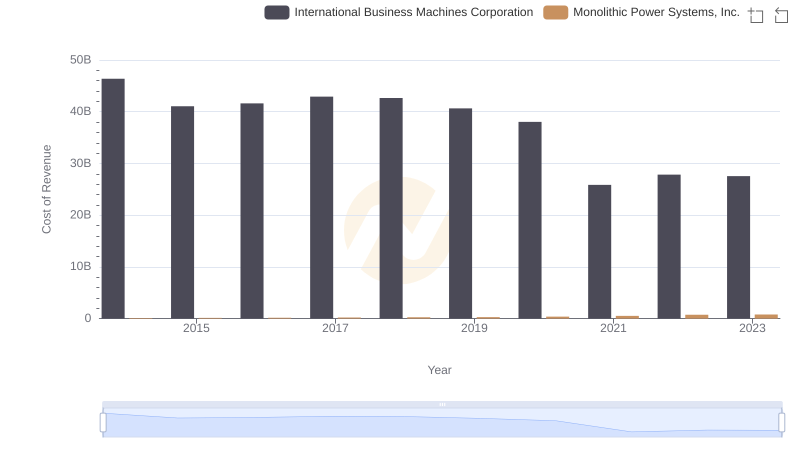

Cost of Revenue Comparison: International Business Machines Corporation vs Monolithic Power Systems, Inc.

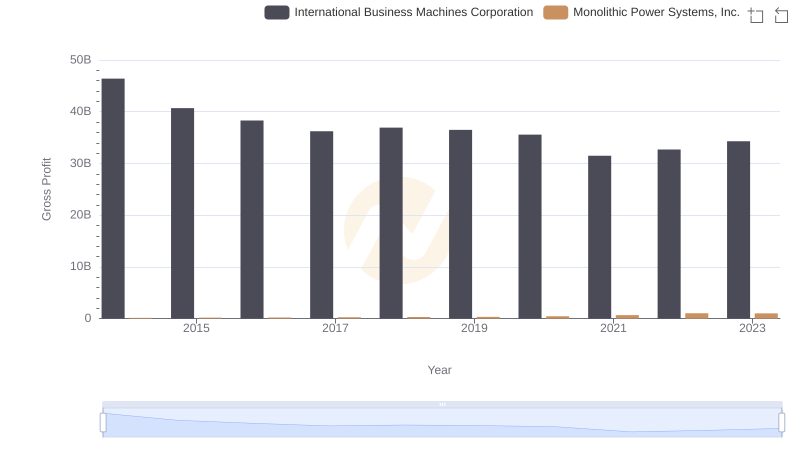

Key Insights on Gross Profit: International Business Machines Corporation vs Monolithic Power Systems, Inc.

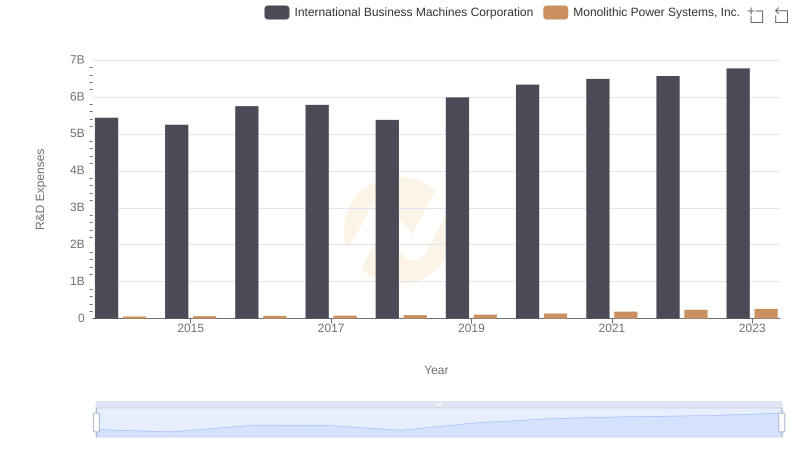

Research and Development: Comparing Key Metrics for International Business Machines Corporation and Monolithic Power Systems, Inc.

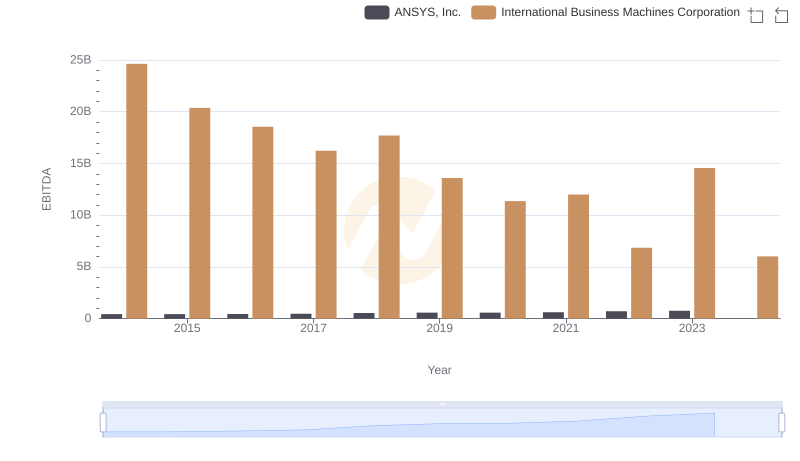

Comparative EBITDA Analysis: International Business Machines Corporation vs ANSYS, Inc.

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Monolithic Power Systems, Inc.

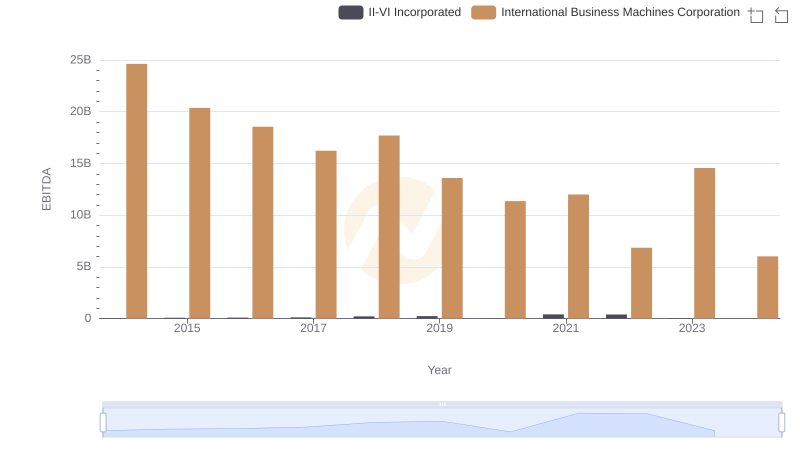

A Professional Review of EBITDA: International Business Machines Corporation Compared to II-VI Incorporated

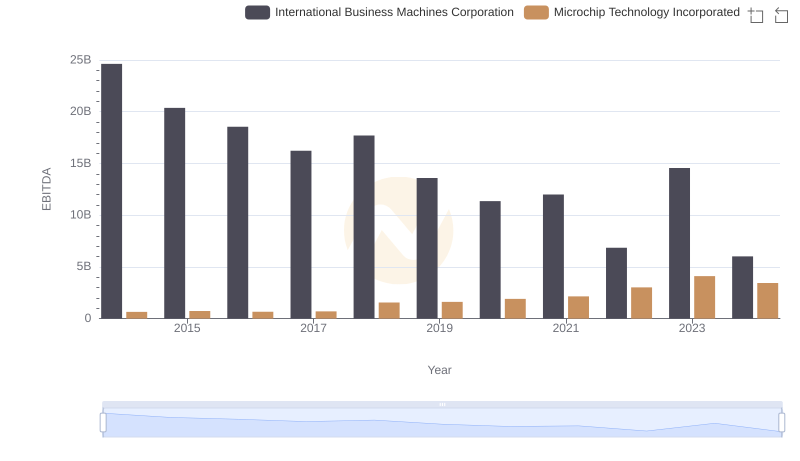

EBITDA Metrics Evaluated: International Business Machines Corporation vs Microchip Technology Incorporated

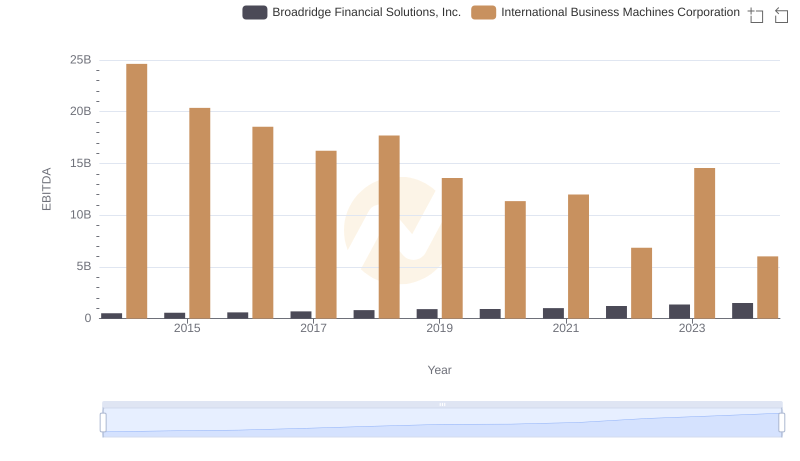

International Business Machines Corporation and Broadridge Financial Solutions, Inc.: A Detailed Examination of EBITDA Performance

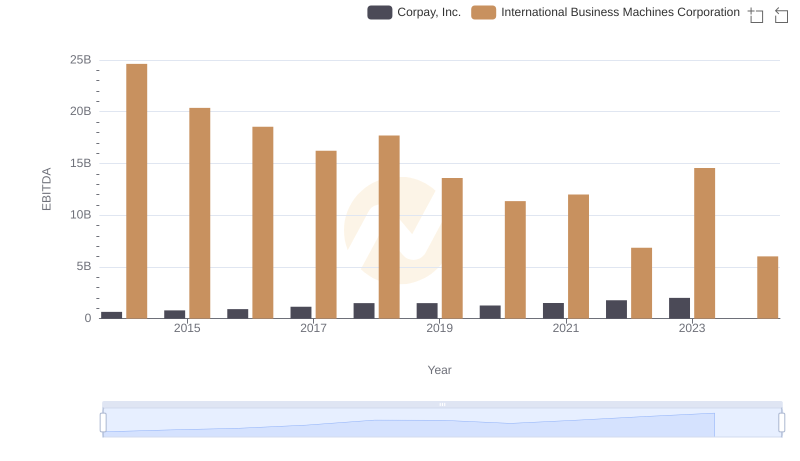

Professional EBITDA Benchmarking: International Business Machines Corporation vs Corpay, Inc.

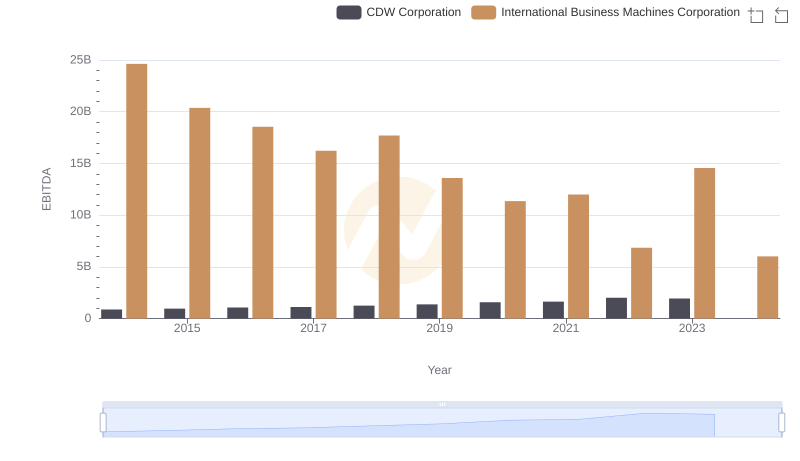

A Side-by-Side Analysis of EBITDA: International Business Machines Corporation and CDW Corporation

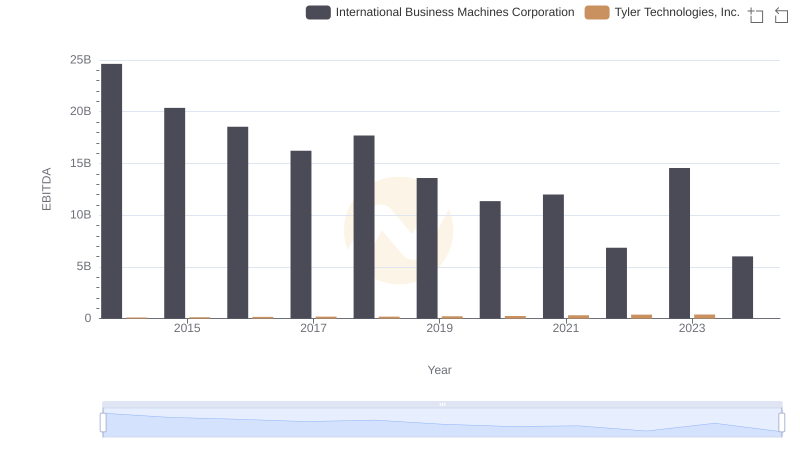

EBITDA Metrics Evaluated: International Business Machines Corporation vs Tyler Technologies, Inc.