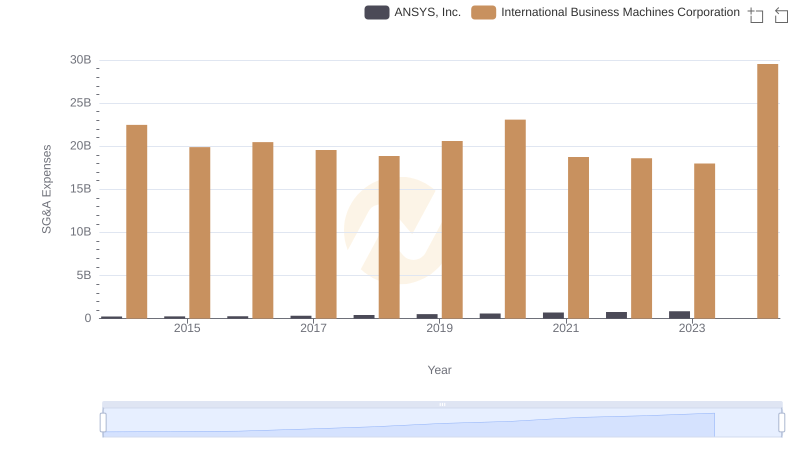

| __timestamp | ANSYS, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 430474000 | 24962000000 |

| Thursday, January 1, 2015 | 431349000 | 20268000000 |

| Friday, January 1, 2016 | 445829000 | 17341000000 |

| Sunday, January 1, 2017 | 466306000 | 16556000000 |

| Monday, January 1, 2018 | 539355000 | 16545000000 |

| Tuesday, January 1, 2019 | 575556000 | 14609000000 |

| Wednesday, January 1, 2020 | 581631000 | 10555000000 |

| Friday, January 1, 2021 | 620138000 | 12409000000 |

| Saturday, January 1, 2022 | 707221000 | 7174000000 |

| Sunday, January 1, 2023 | 758639000 | 14693000000 |

| Monday, January 1, 2024 | 717888000 | 6015000000 |

Cracking the code

In the ever-evolving landscape of technology, the financial health of companies like International Business Machines Corporation (IBM) and ANSYS, Inc. offers a fascinating glimpse into their operational efficiency. Over the past decade, IBM's EBITDA has shown a significant decline, dropping from a peak in 2014 to nearly half by 2022. This represents a reduction of approximately 72%, highlighting the challenges faced by the tech giant in adapting to new market dynamics.

Conversely, ANSYS, Inc. has demonstrated a steady upward trajectory, with its EBITDA growing by about 76% from 2014 to 2023. This growth underscores ANSYS's strategic positioning and resilience in the competitive tech sector. Notably, the data for 2024 is incomplete, leaving room for speculation on future trends. As the tech industry continues to evolve, these financial insights provide valuable context for investors and analysts alike.

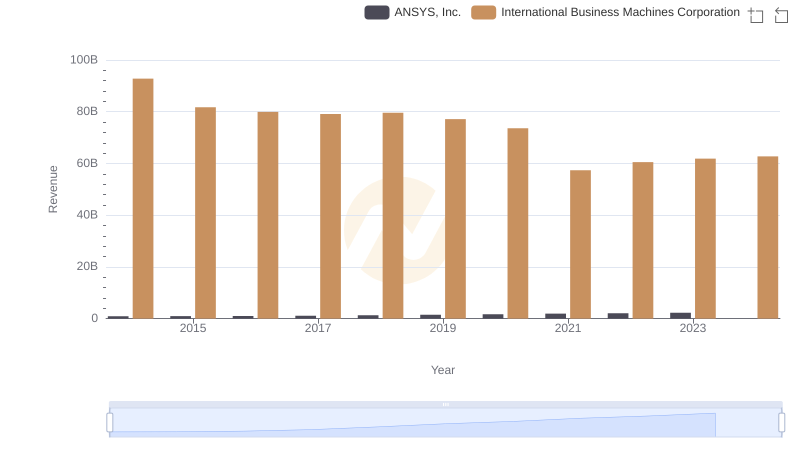

International Business Machines Corporation and ANSYS, Inc.: A Comprehensive Revenue Analysis

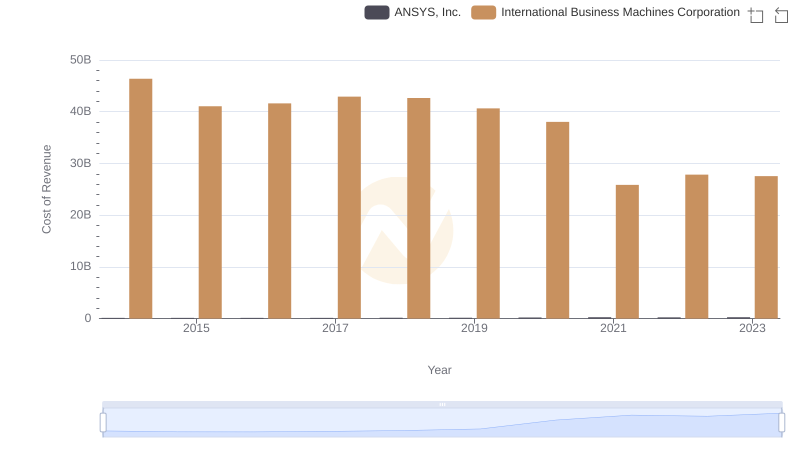

Cost of Revenue: Key Insights for International Business Machines Corporation and ANSYS, Inc.

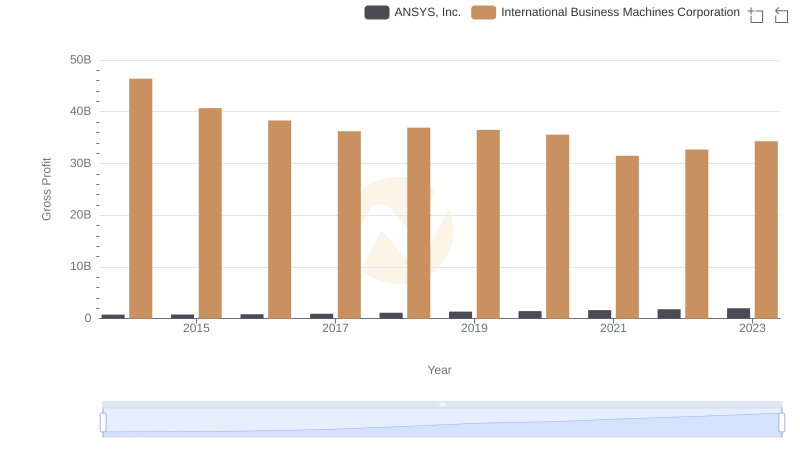

Gross Profit Comparison: International Business Machines Corporation and ANSYS, Inc. Trends

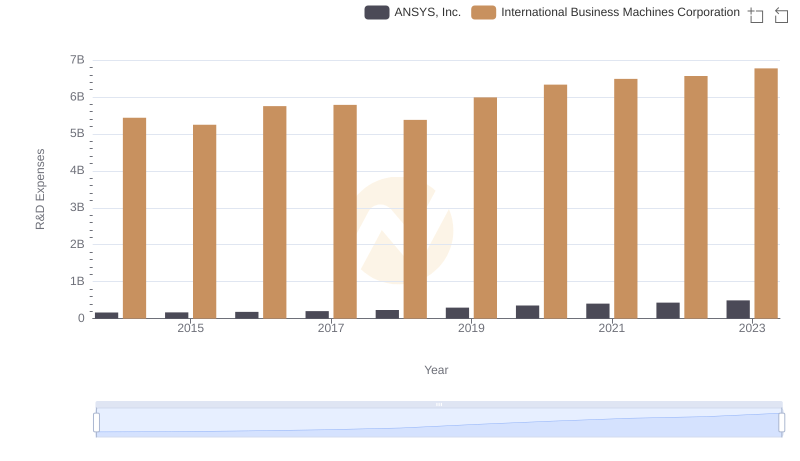

International Business Machines Corporation or ANSYS, Inc.: Who Invests More in Innovation?

Comparing SG&A Expenses: International Business Machines Corporation vs ANSYS, Inc. Trends and Insights

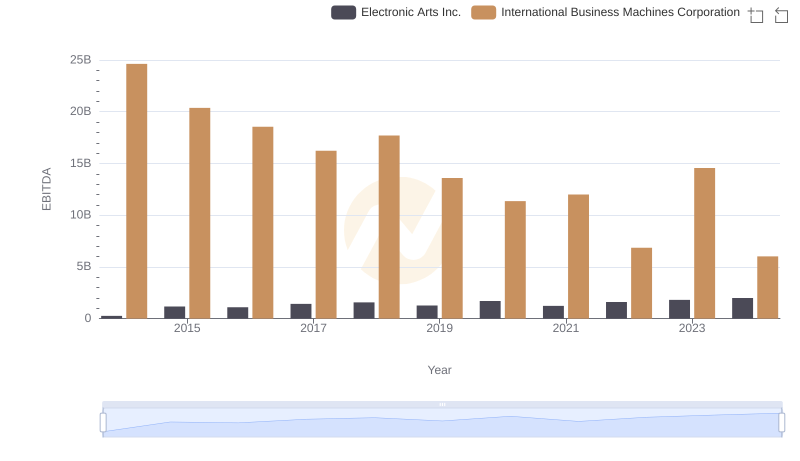

EBITDA Performance Review: International Business Machines Corporation vs Electronic Arts Inc.

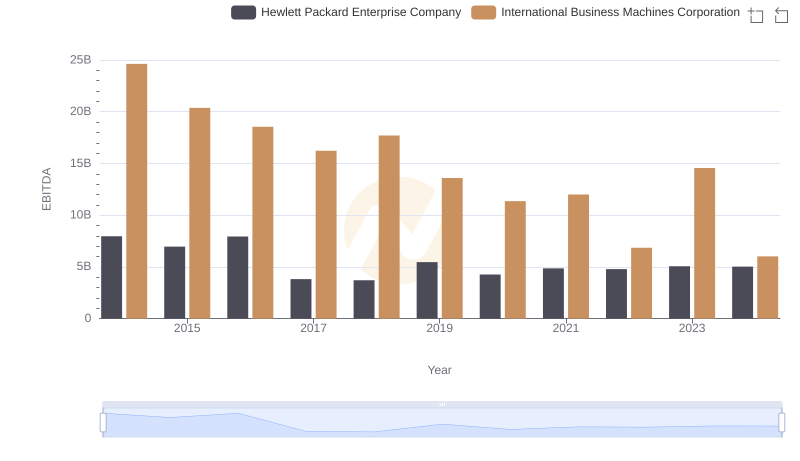

A Side-by-Side Analysis of EBITDA: International Business Machines Corporation and Hewlett Packard Enterprise Company

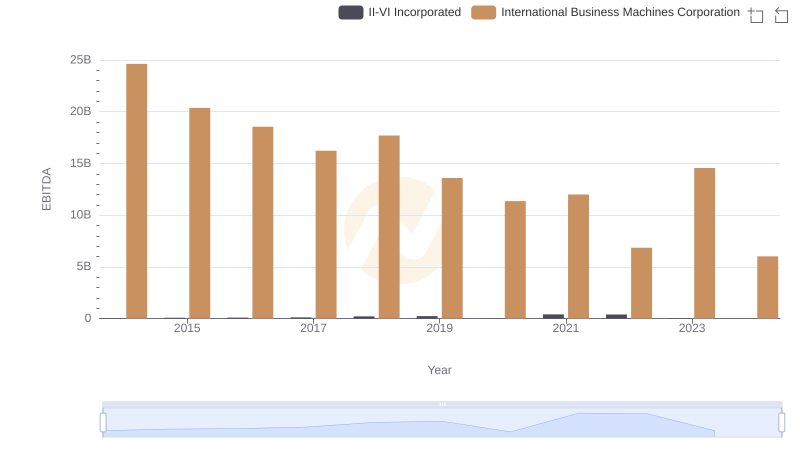

A Professional Review of EBITDA: International Business Machines Corporation Compared to II-VI Incorporated

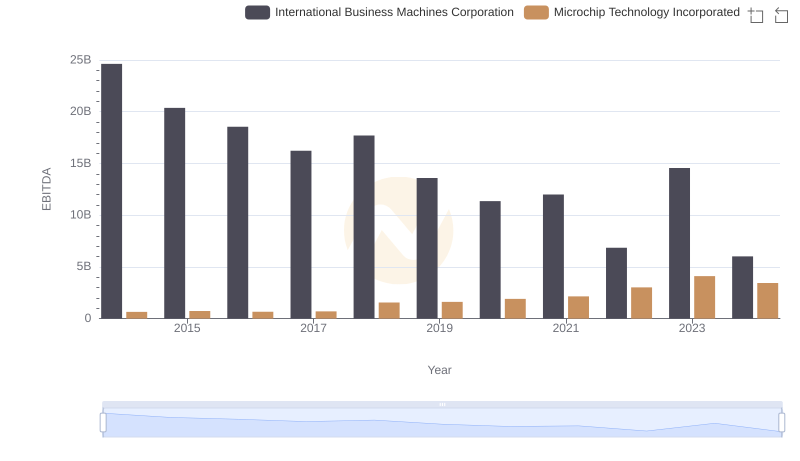

EBITDA Metrics Evaluated: International Business Machines Corporation vs Microchip Technology Incorporated

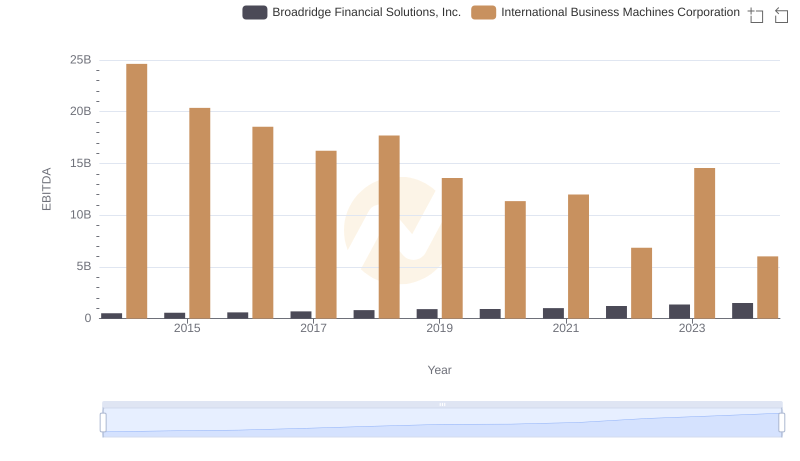

International Business Machines Corporation and Broadridge Financial Solutions, Inc.: A Detailed Examination of EBITDA Performance

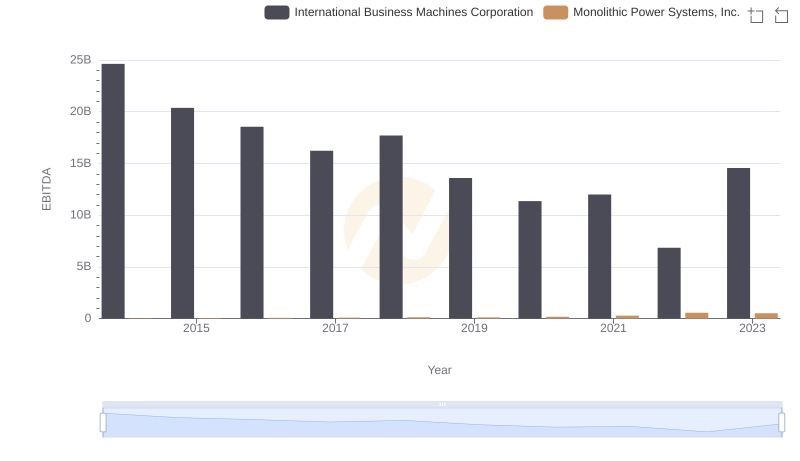

EBITDA Performance Review: International Business Machines Corporation vs Monolithic Power Systems, Inc.

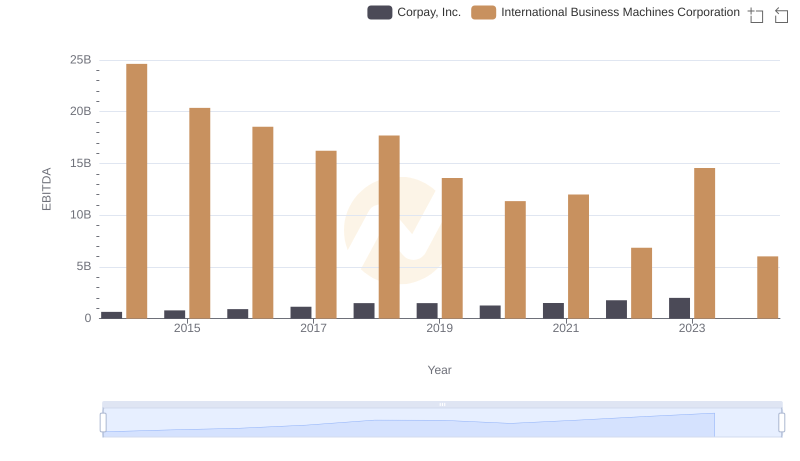

Professional EBITDA Benchmarking: International Business Machines Corporation vs Corpay, Inc.