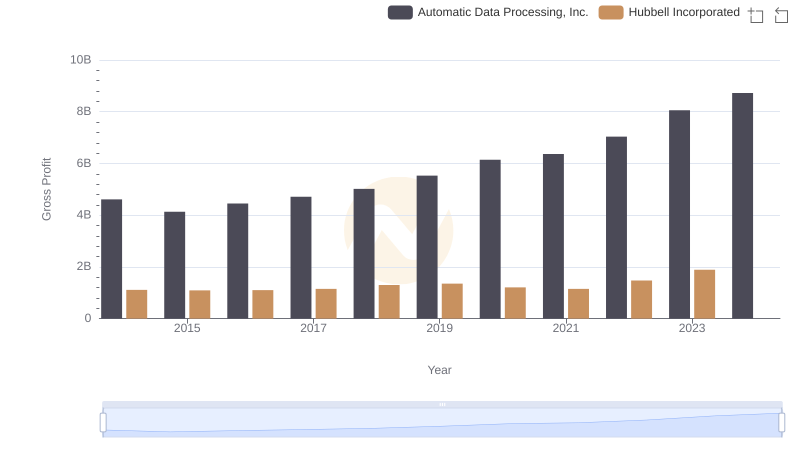

| __timestamp | Automatic Data Processing, Inc. | Hubbell Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 7221400000 | 2250400000 |

| Thursday, January 1, 2015 | 6427600000 | 2298600000 |

| Friday, January 1, 2016 | 6840300000 | 2404500000 |

| Sunday, January 1, 2017 | 7269800000 | 2516900000 |

| Monday, January 1, 2018 | 7842600000 | 3181300000 |

| Tuesday, January 1, 2019 | 8086600000 | 3238300000 |

| Wednesday, January 1, 2020 | 8445100000 | 2976700000 |

| Friday, January 1, 2021 | 8640300000 | 3042600000 |

| Saturday, January 1, 2022 | 9461900000 | 3476300000 |

| Sunday, January 1, 2023 | 9953400000 | 3484800000 |

| Monday, January 1, 2024 | 10476700000 | 3724400000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, understanding cost efficiency is paramount. Automatic Data Processing, Inc. (ADP) and Hubbell Incorporated offer a fascinating study in contrasts. Over the past decade, ADP has consistently demonstrated a robust cost of revenue, peaking at approximately $10.5 billion in 2024, a remarkable 45% increase from 2014. In contrast, Hubbell's cost of revenue has shown a steadier growth, reaching around $3.5 billion in 2023, marking a 55% rise since 2014.

This data, spanning from 2014 to 2024, highlights the strategic financial maneuvers of these industry giants. ADP's aggressive growth trajectory underscores its expansive operational scale, while Hubbell's steady climb reflects a more conservative approach. Notably, the absence of data for Hubbell in 2024 suggests a potential shift or anomaly worth further exploration. As investors and analysts delve into these figures, the narrative of cost efficiency continues to unfold, offering insights into the financial health and strategic direction of these companies.

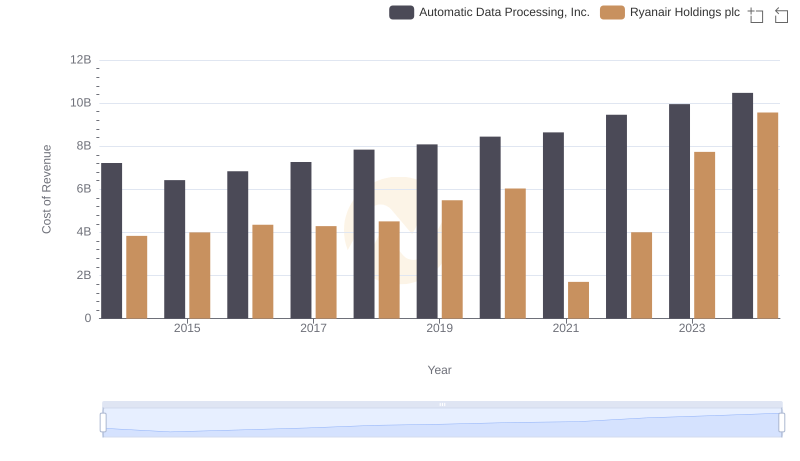

Cost of Revenue Trends: Automatic Data Processing, Inc. vs Ryanair Holdings plc

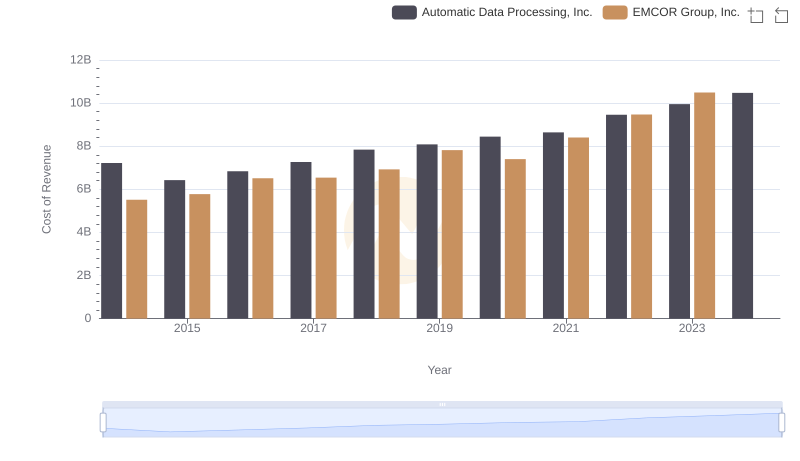

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs EMCOR Group, Inc.

Analyzing Cost of Revenue: Automatic Data Processing, Inc. and Watsco, Inc.

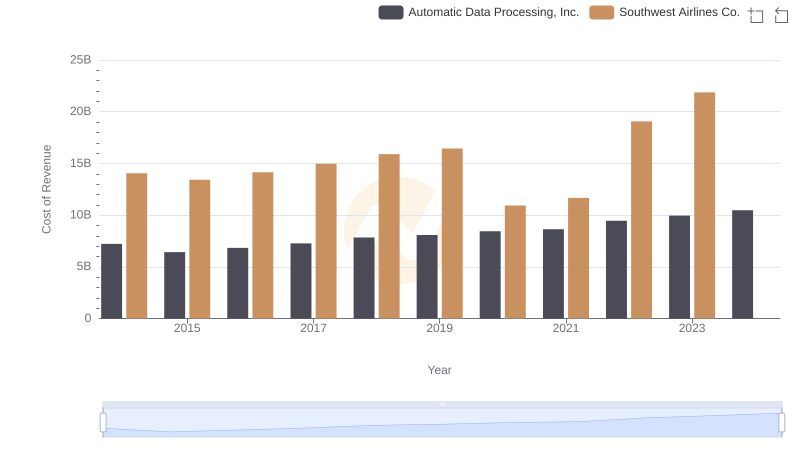

Automatic Data Processing, Inc. vs Southwest Airlines Co.: Efficiency in Cost of Revenue Explored

Gross Profit Comparison: Automatic Data Processing, Inc. and Hubbell Incorporated Trends

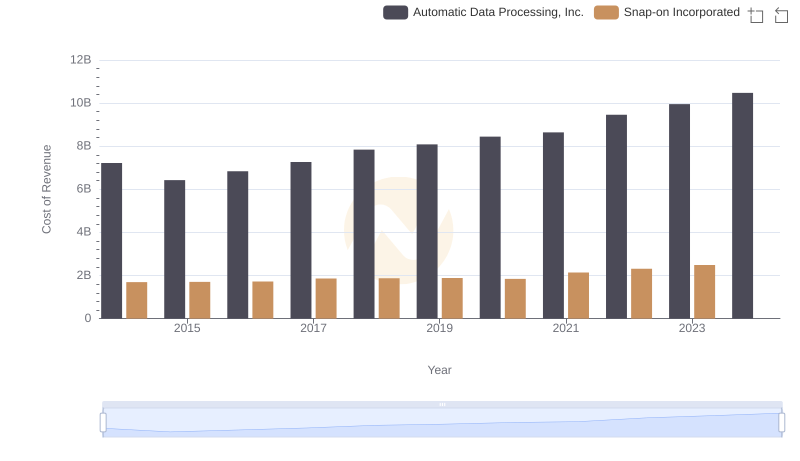

Cost of Revenue: Key Insights for Automatic Data Processing, Inc. and Snap-on Incorporated

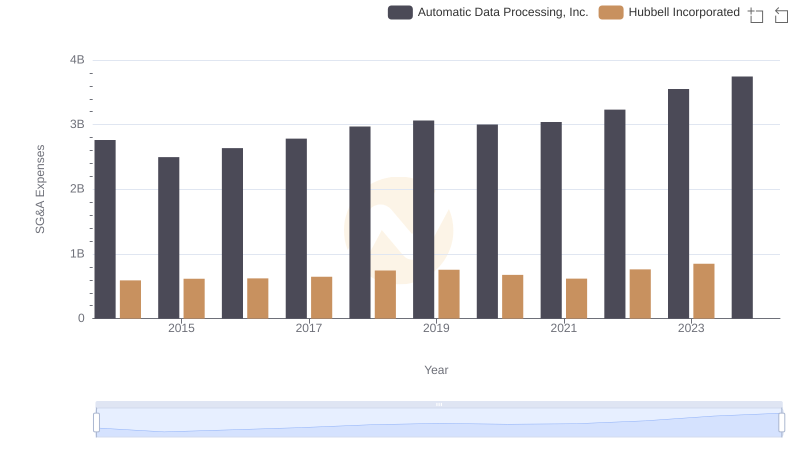

Comparing SG&A Expenses: Automatic Data Processing, Inc. vs Hubbell Incorporated Trends and Insights

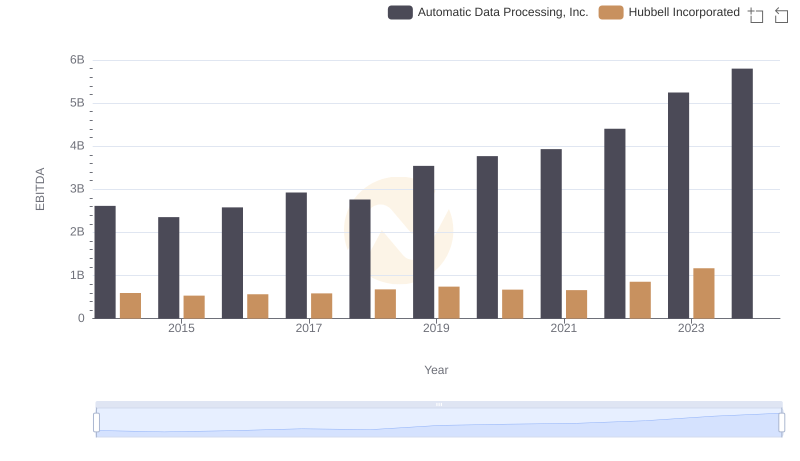

EBITDA Performance Review: Automatic Data Processing, Inc. vs Hubbell Incorporated