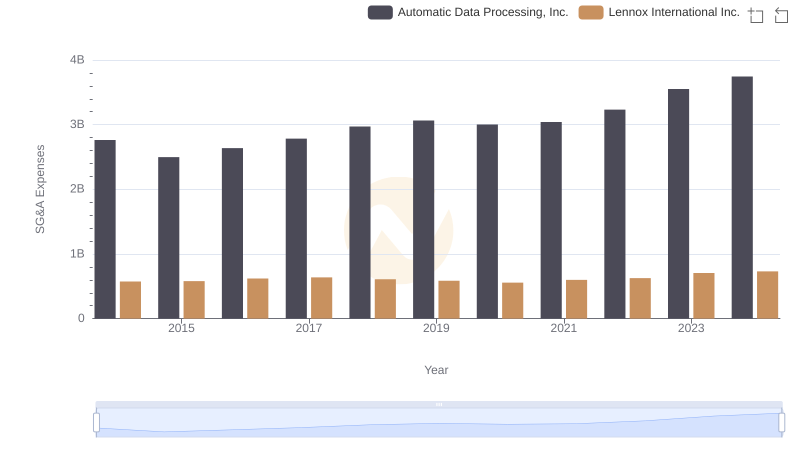

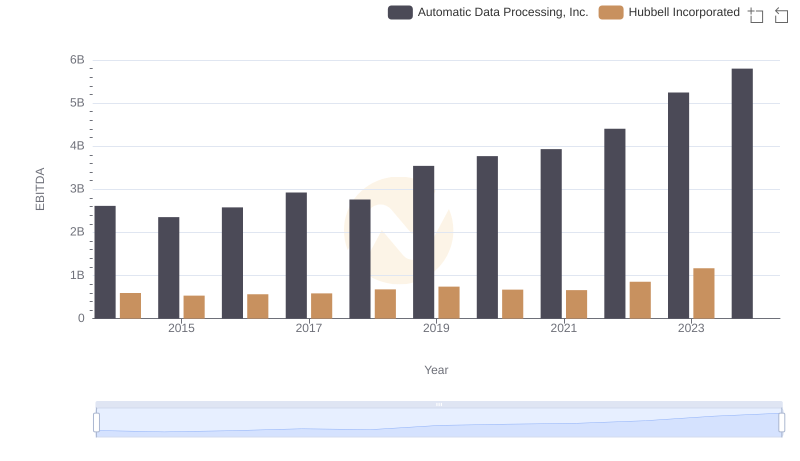

| __timestamp | Automatic Data Processing, Inc. | Hubbell Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 2762400000 | 591600000 |

| Thursday, January 1, 2015 | 2496900000 | 617200000 |

| Friday, January 1, 2016 | 2637000000 | 622900000 |

| Sunday, January 1, 2017 | 2783200000 | 648200000 |

| Monday, January 1, 2018 | 2971500000 | 743500000 |

| Tuesday, January 1, 2019 | 3064200000 | 756100000 |

| Wednesday, January 1, 2020 | 3003000000 | 676300000 |

| Friday, January 1, 2021 | 3040500000 | 619200000 |

| Saturday, January 1, 2022 | 3233200000 | 762500000 |

| Sunday, January 1, 2023 | 3551400000 | 848600000 |

| Monday, January 1, 2024 | 3778900000 | 812500000 |

Infusing magic into the data realm

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a crucial indicator of a company's operational efficiency. This article delves into the SG&A trends of two industry giants: Automatic Data Processing, Inc. (ADP) and Hubbell Incorporated, from 2014 to 2023.

Over the past decade, ADP has consistently outpaced Hubbell in SG&A expenses, reflecting its expansive operational scale. In 2014, ADP's SG&A expenses were approximately 4.7 times higher than Hubbell's. By 2023, this ratio increased to over 4.2 times, with ADP's expenses growing by 29% compared to Hubbell's 43% increase.

While 2024 data for Hubbell is unavailable, ADP's continued growth suggests a robust financial strategy. As businesses navigate economic challenges, understanding these trends offers valuable insights into corporate financial health.

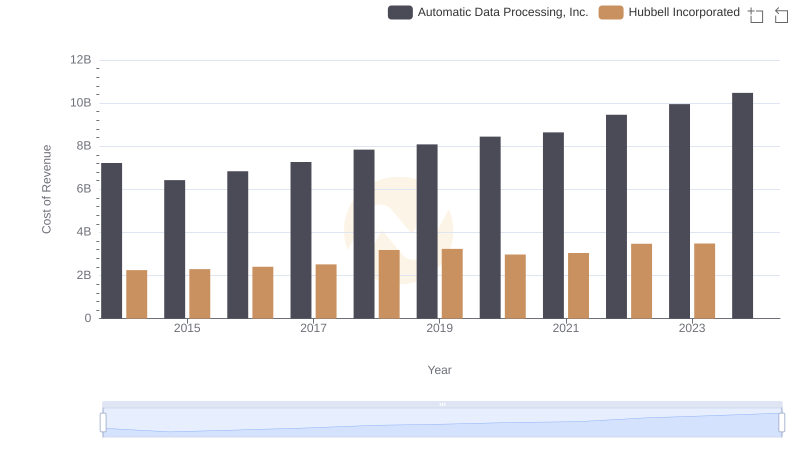

Comparing Cost of Revenue Efficiency: Automatic Data Processing, Inc. vs Hubbell Incorporated

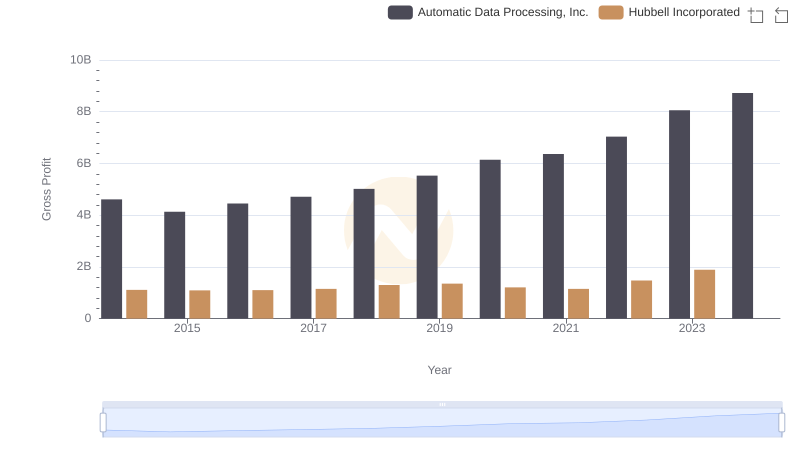

Gross Profit Comparison: Automatic Data Processing, Inc. and Hubbell Incorporated Trends

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Lennox International Inc.

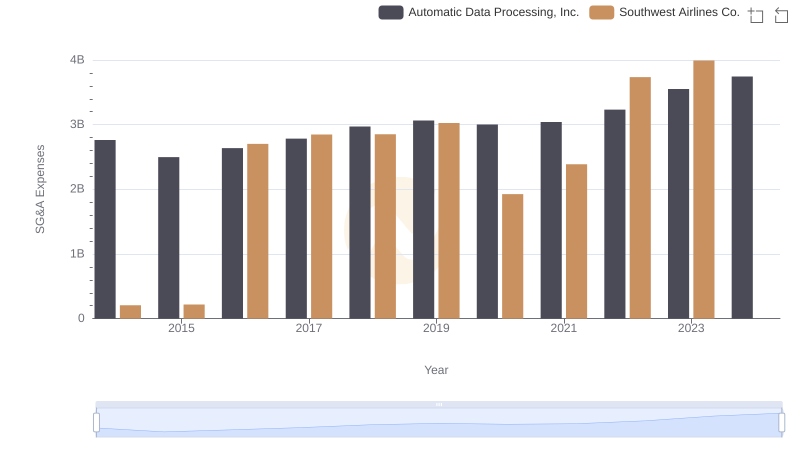

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Southwest Airlines Co.

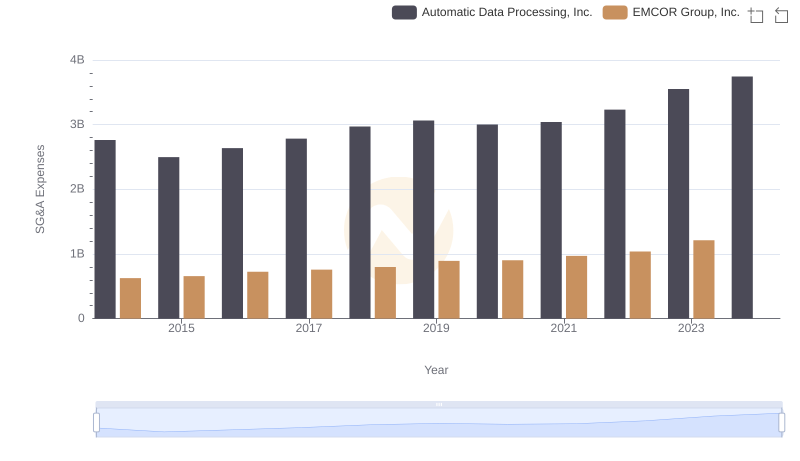

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs EMCOR Group, Inc.

Breaking Down SG&A Expenses: Automatic Data Processing, Inc. vs AerCap Holdings N.V.

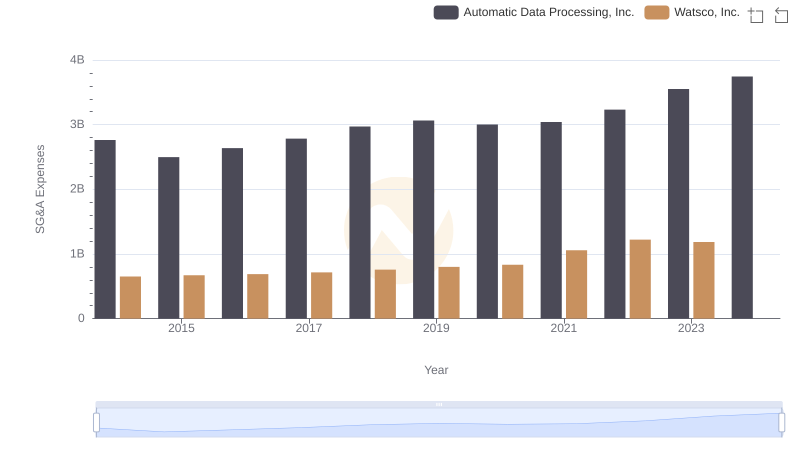

Who Optimizes SG&A Costs Better? Automatic Data Processing, Inc. or Watsco, Inc.

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Snap-on Incorporated

EBITDA Performance Review: Automatic Data Processing, Inc. vs Hubbell Incorporated