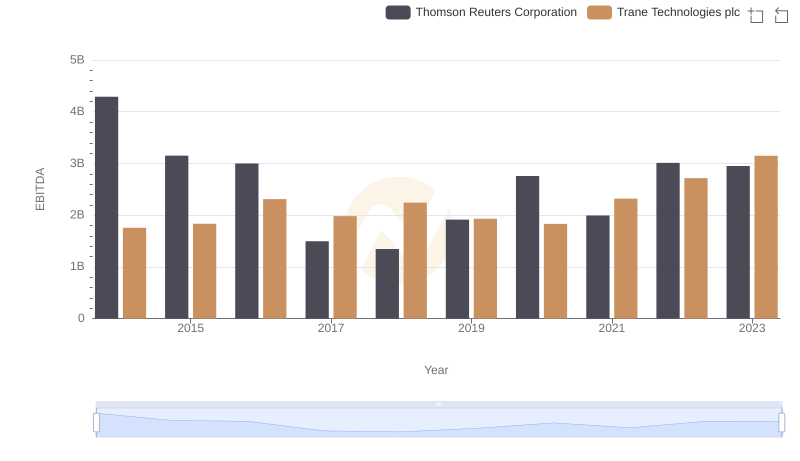

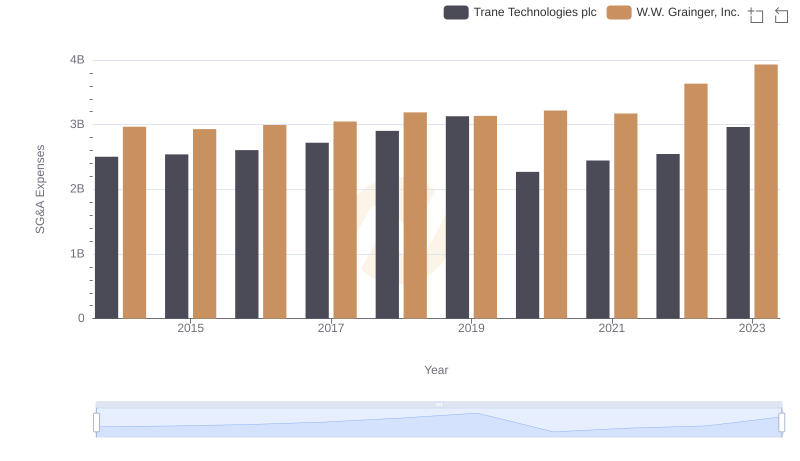

| __timestamp | Trane Technologies plc | W.W. Grainger, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1757000000 | 1552805000 |

| Thursday, January 1, 2015 | 1835000000 | 1512243000 |

| Friday, January 1, 2016 | 2311000000 | 1334247000 |

| Sunday, January 1, 2017 | 1982500000 | 1284000000 |

| Monday, January 1, 2018 | 2242400000 | 1423000000 |

| Tuesday, January 1, 2019 | 1931200000 | 1516000000 |

| Wednesday, January 1, 2020 | 1831900000 | 1216000000 |

| Friday, January 1, 2021 | 2319200000 | 1738000000 |

| Saturday, January 1, 2022 | 2715500000 | 2404000000 |

| Sunday, January 1, 2023 | 3149900000 | 2807000000 |

| Monday, January 1, 2024 | 3859600000 | 2637000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of industrial giants, Trane Technologies plc and W.W. Grainger, Inc. have showcased remarkable EBITDA growth over the past decade. From 2014 to 2023, Trane Technologies has seen its EBITDA soar by approximately 79%, reaching a peak in 2023. This growth trajectory highlights the company's strategic initiatives and operational efficiencies.

Conversely, W.W. Grainger, Inc. has also demonstrated robust growth, with its EBITDA increasing by about 81% over the same period. The company's focus on supply chain optimization and customer-centric solutions has been pivotal in driving this upward trend.

Both companies have navigated economic fluctuations and market challenges, yet their consistent EBITDA growth underscores their resilience and adaptability. As we look to the future, these metrics provide a compelling narrative of industrial innovation and financial prowess.

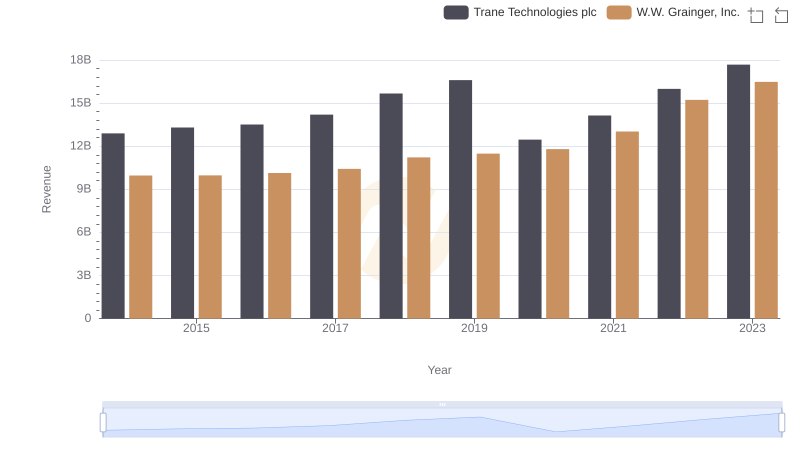

Annual Revenue Comparison: Trane Technologies plc vs W.W. Grainger, Inc.

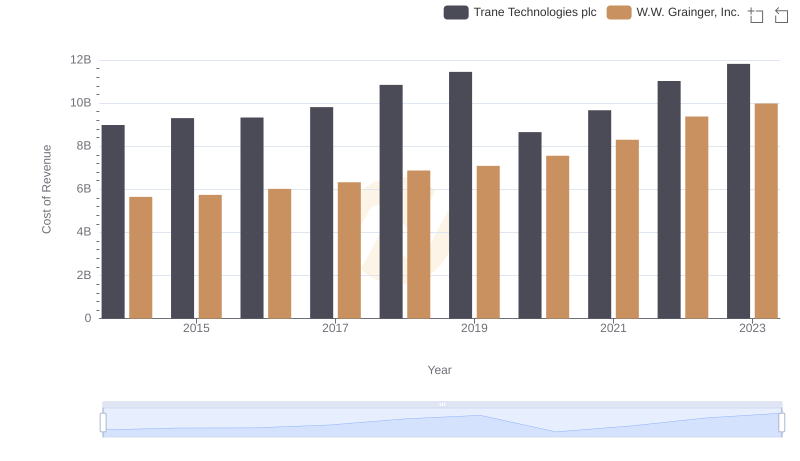

Cost Insights: Breaking Down Trane Technologies plc and W.W. Grainger, Inc.'s Expenses

A Side-by-Side Analysis of EBITDA: Trane Technologies plc and Thomson Reuters Corporation

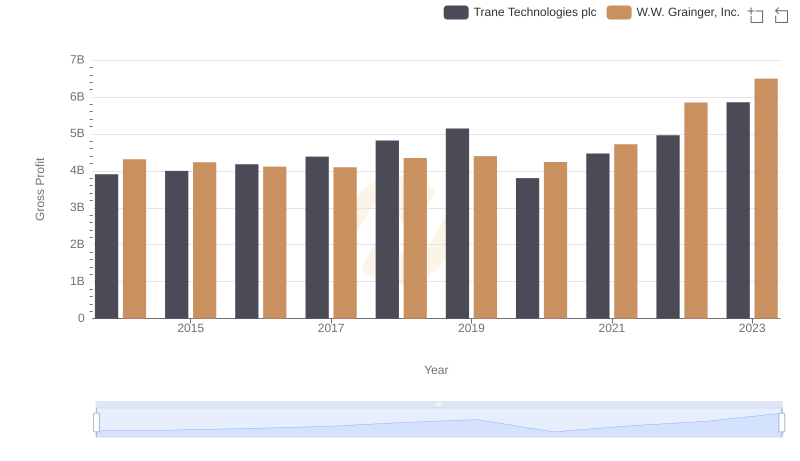

Gross Profit Comparison: Trane Technologies plc and W.W. Grainger, Inc. Trends

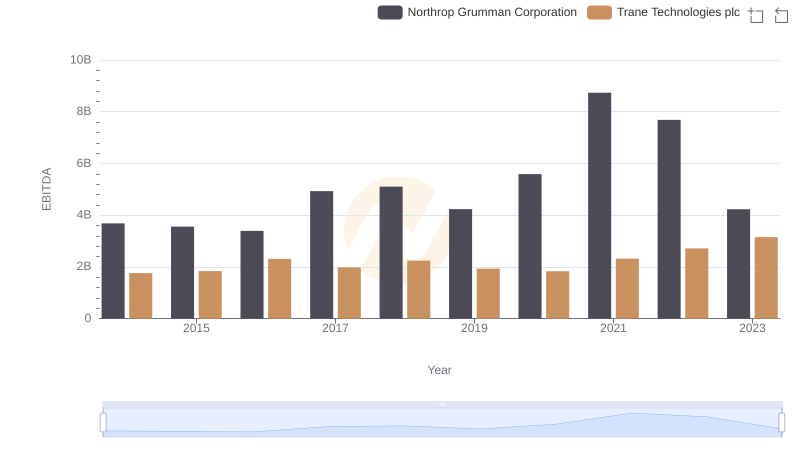

Trane Technologies plc and Northrop Grumman Corporation: A Detailed Examination of EBITDA Performance

Who Optimizes SG&A Costs Better? Trane Technologies plc or W.W. Grainger, Inc.

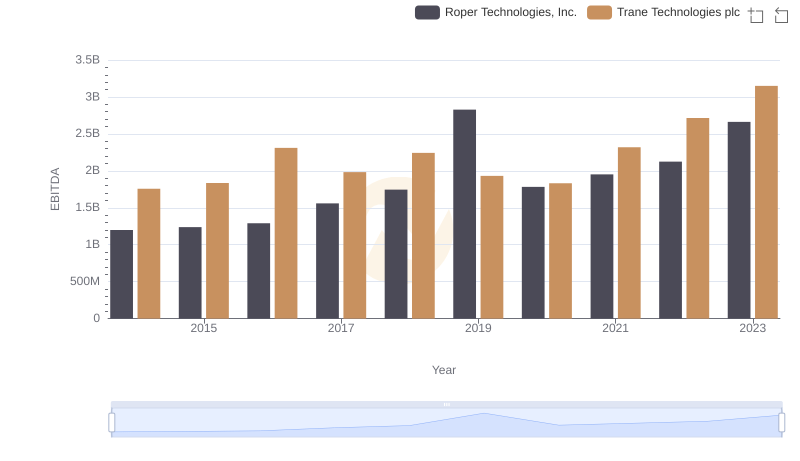

A Side-by-Side Analysis of EBITDA: Trane Technologies plc and Roper Technologies, Inc.

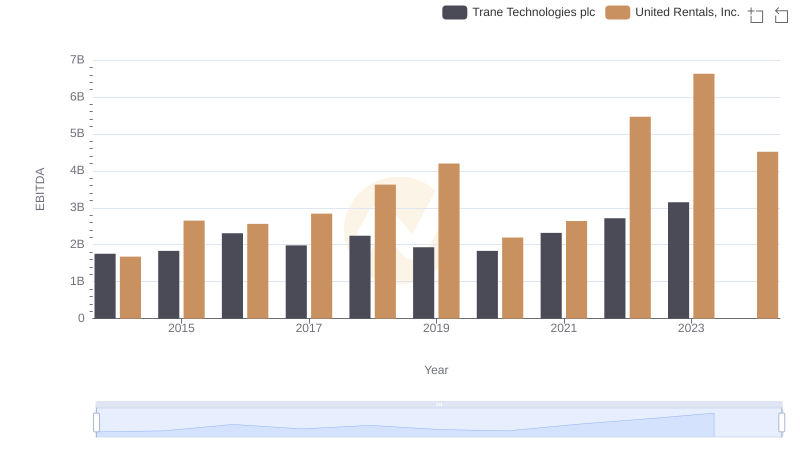

Comparative EBITDA Analysis: Trane Technologies plc vs United Rentals, Inc.

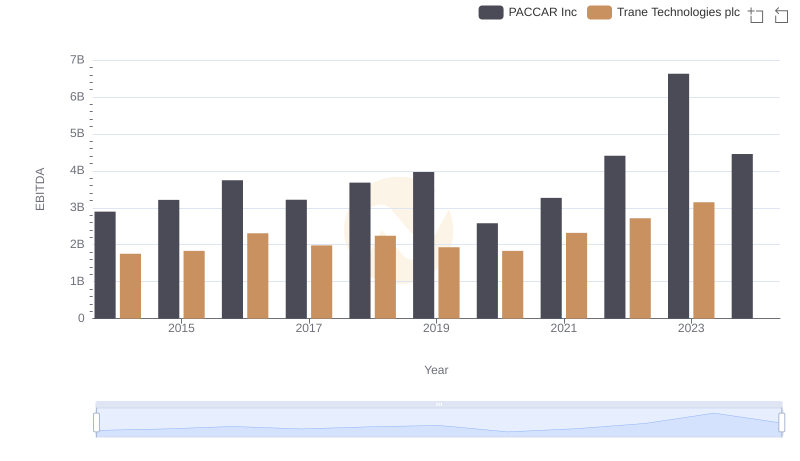

Trane Technologies plc vs PACCAR Inc: In-Depth EBITDA Performance Comparison

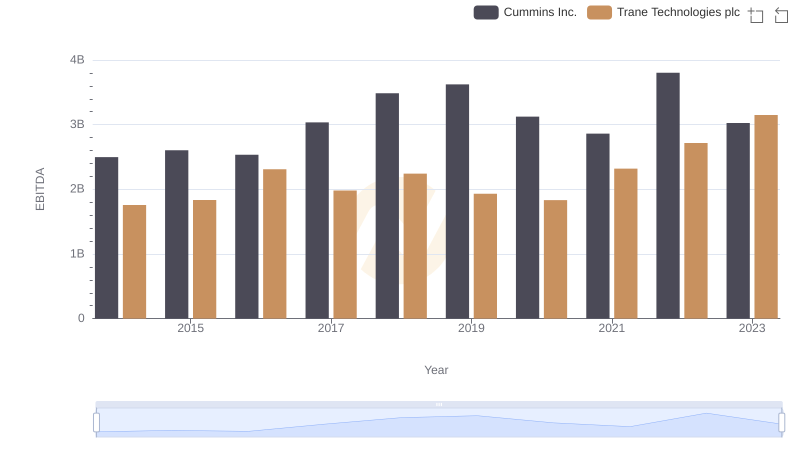

A Side-by-Side Analysis of EBITDA: Trane Technologies plc and Cummins Inc.