| __timestamp | Thomson Reuters Corporation | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 4289000000 | 1757000000 |

| Thursday, January 1, 2015 | 3151000000 | 1835000000 |

| Friday, January 1, 2016 | 2999000000 | 2311000000 |

| Sunday, January 1, 2017 | 1495930891 | 1982500000 |

| Monday, January 1, 2018 | 1345686008 | 2242400000 |

| Tuesday, January 1, 2019 | 1913474675 | 1931200000 |

| Wednesday, January 1, 2020 | 2757000000 | 1831900000 |

| Friday, January 1, 2021 | 1994296441 | 2319200000 |

| Saturday, January 1, 2022 | 3010000000 | 2715500000 |

| Sunday, January 1, 2023 | 2950000000 | 3149900000 |

| Monday, January 1, 2024 | 3859600000 |

Infusing magic into the data realm

In the ever-evolving landscape of global business, understanding the financial health of industry giants is crucial. This analysis delves into the EBITDA performance of Trane Technologies plc and Thomson Reuters Corporation from 2014 to 2023. Over this period, Thomson Reuters experienced a notable decline of approximately 31% in EBITDA, from a peak in 2014 to a low in 2018, before rebounding by 2022. In contrast, Trane Technologies demonstrated a steady growth trajectory, with a remarkable 79% increase in EBITDA, culminating in 2023. This divergence highlights the resilience and strategic adaptability of Trane Technologies in a competitive market. As businesses navigate economic uncertainties, these insights offer a window into the financial strategies that drive success.

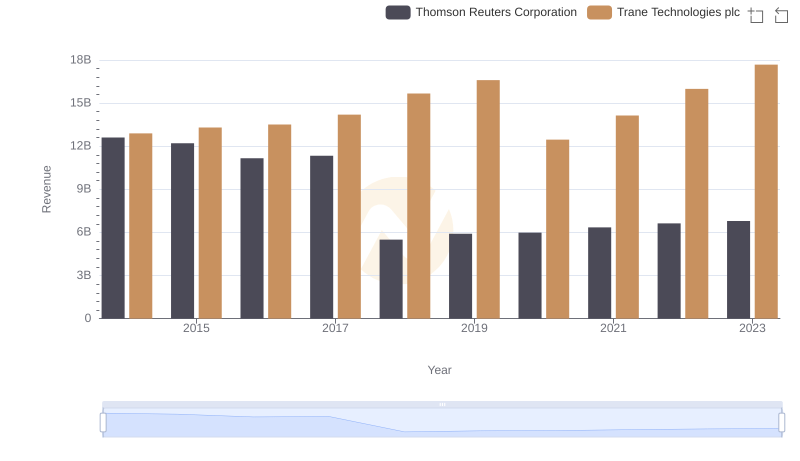

Annual Revenue Comparison: Trane Technologies plc vs Thomson Reuters Corporation

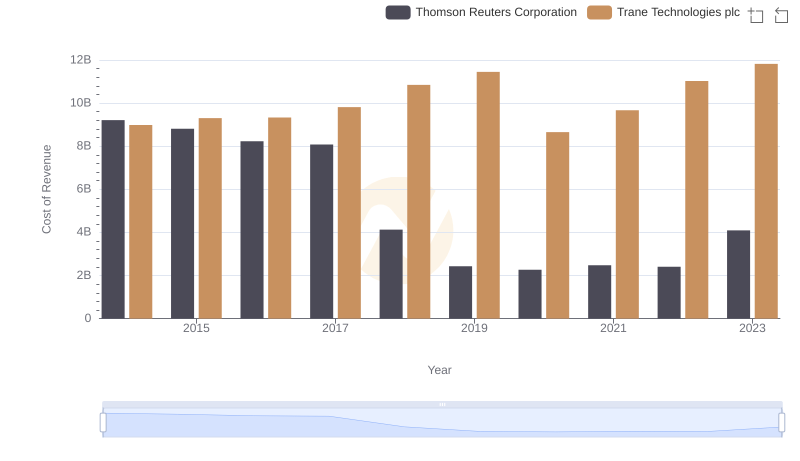

Cost of Revenue Comparison: Trane Technologies plc vs Thomson Reuters Corporation

Key Insights on Gross Profit: Trane Technologies plc vs Thomson Reuters Corporation

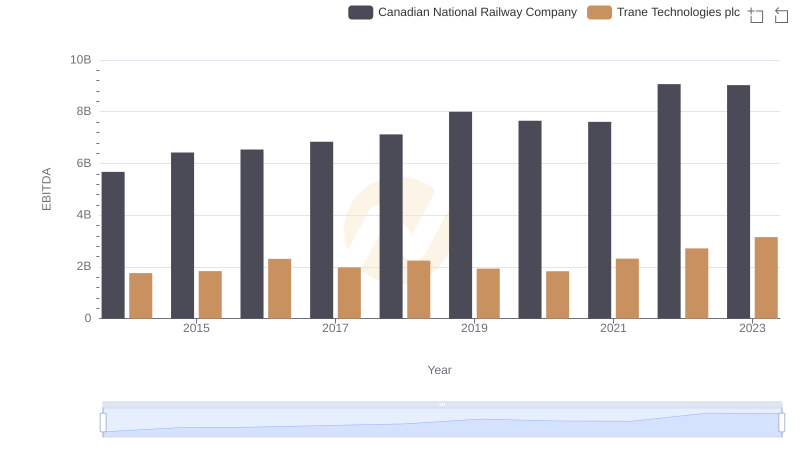

A Professional Review of EBITDA: Trane Technologies plc Compared to Canadian National Railway Company

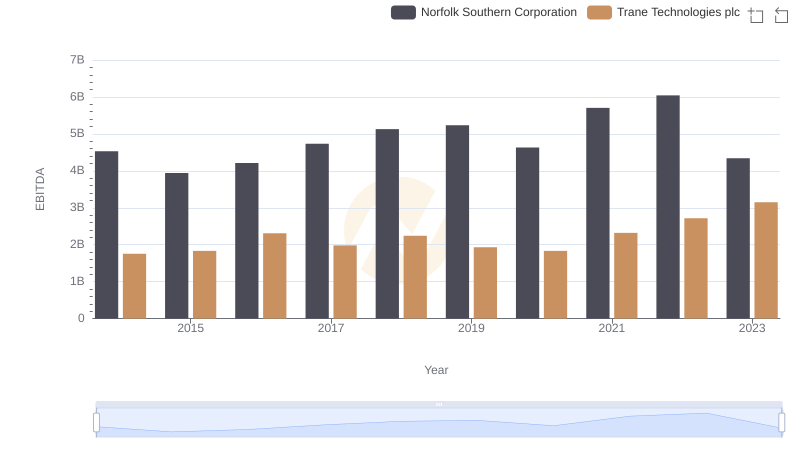

EBITDA Analysis: Evaluating Trane Technologies plc Against Norfolk Southern Corporation

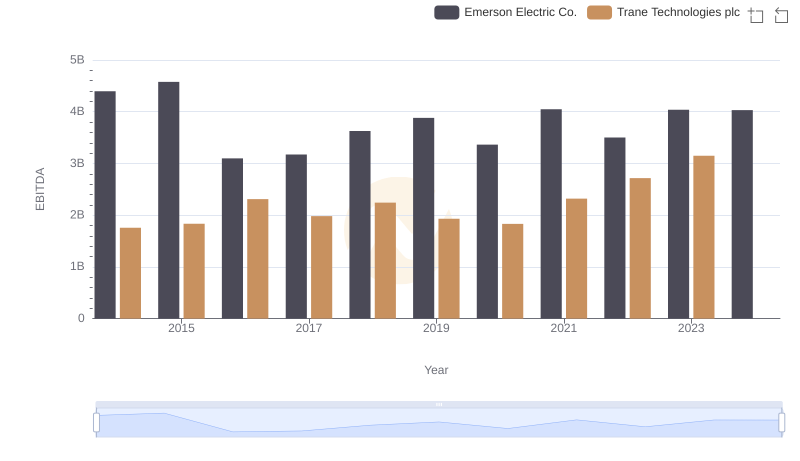

Comparative EBITDA Analysis: Trane Technologies plc vs Emerson Electric Co.

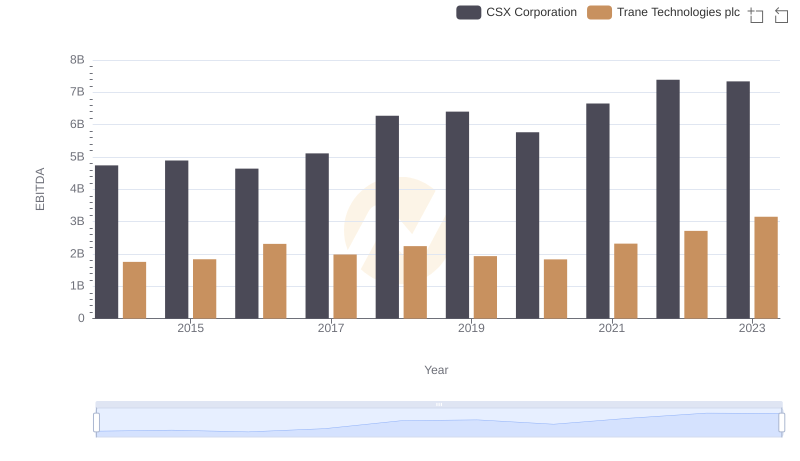

EBITDA Performance Review: Trane Technologies plc vs CSX Corporation

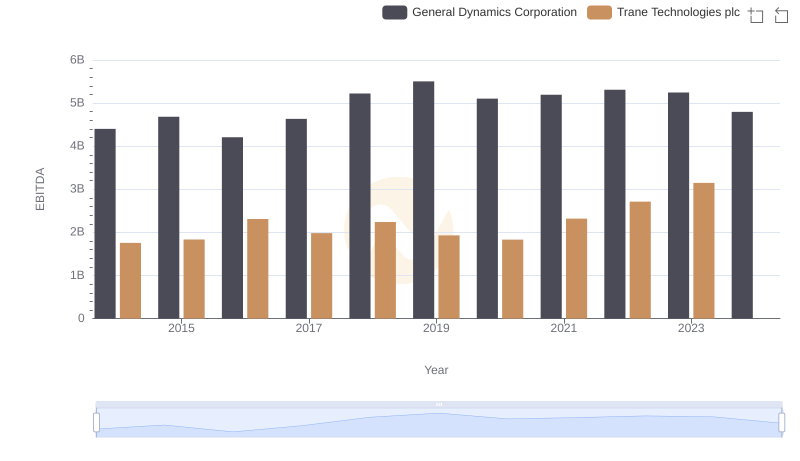

Professional EBITDA Benchmarking: Trane Technologies plc vs General Dynamics Corporation

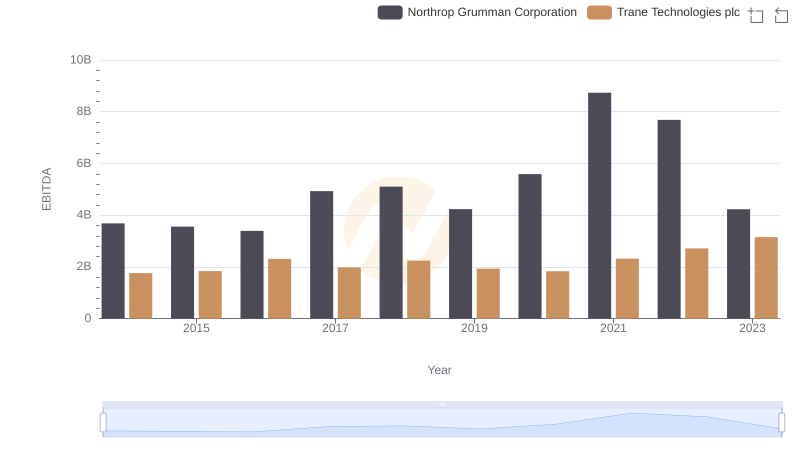

Trane Technologies plc and Northrop Grumman Corporation: A Detailed Examination of EBITDA Performance