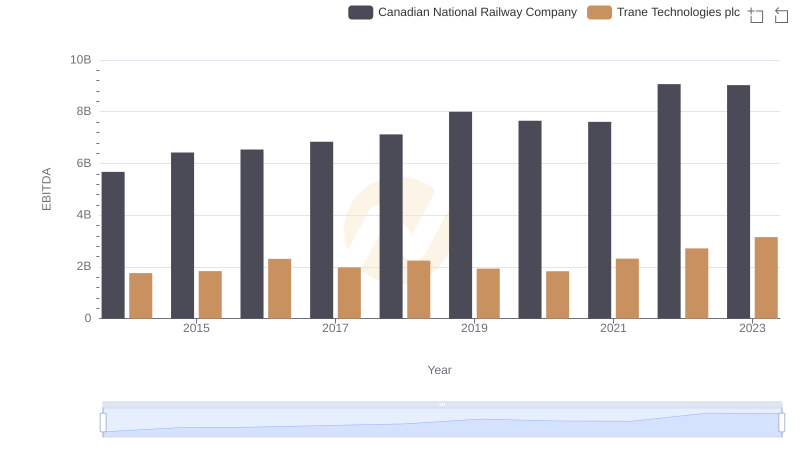

| __timestamp | Northrop Grumman Corporation | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 3681000000 | 1757000000 |

| Thursday, January 1, 2015 | 3558000000 | 1835000000 |

| Friday, January 1, 2016 | 3394000000 | 2311000000 |

| Sunday, January 1, 2017 | 4928000000 | 1982500000 |

| Monday, January 1, 2018 | 5104000000 | 2242400000 |

| Tuesday, January 1, 2019 | 4234000000 | 1931200000 |

| Wednesday, January 1, 2020 | 5588000000 | 1831900000 |

| Friday, January 1, 2021 | 8734000000 | 2319200000 |

| Saturday, January 1, 2022 | 7684000000 | 2715500000 |

| Sunday, January 1, 2023 | 4229000000 | 3149900000 |

| Monday, January 1, 2024 | 4370000000 | 3859600000 |

Cracking the code

In the ever-evolving landscape of global business, understanding the financial health of industry giants is crucial. This analysis delves into the EBITDA performance of Trane Technologies plc and Northrop Grumman Corporation from 2014 to 2023. Over this period, Northrop Grumman demonstrated a robust growth trajectory, peaking in 2021 with an EBITDA increase of approximately 150% from its 2014 figures. However, by 2023, their EBITDA saw a significant decline, dropping by over 50% from the 2021 high.

Conversely, Trane Technologies exhibited a steady upward trend, culminating in a 79% increase in EBITDA by 2023 compared to 2014. This consistent growth underscores Trane's resilience and strategic prowess in navigating market challenges. As these two corporations continue to evolve, their financial narratives offer valuable insights into their operational strategies and market positioning.

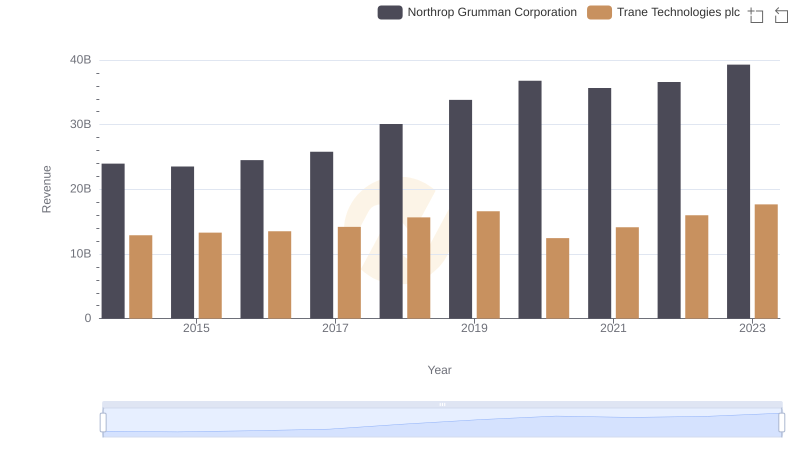

Breaking Down Revenue Trends: Trane Technologies plc vs Northrop Grumman Corporation

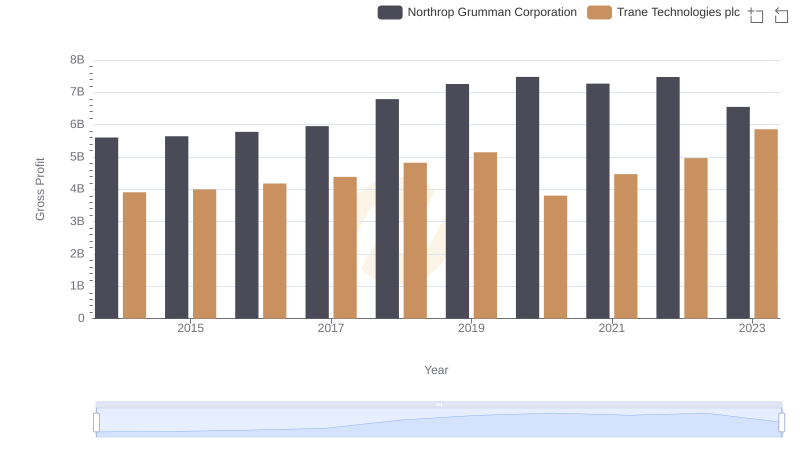

Trane Technologies plc and Northrop Grumman Corporation: A Detailed Gross Profit Analysis

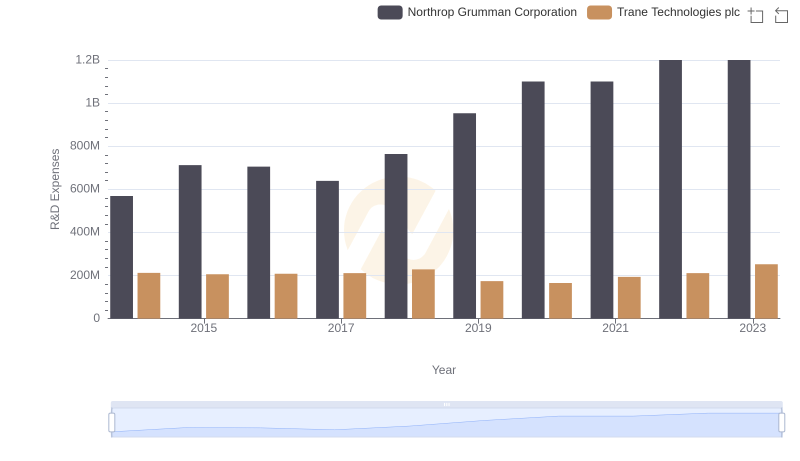

Who Prioritizes Innovation? R&D Spending Compared for Trane Technologies plc and Northrop Grumman Corporation

A Professional Review of EBITDA: Trane Technologies plc Compared to Canadian National Railway Company

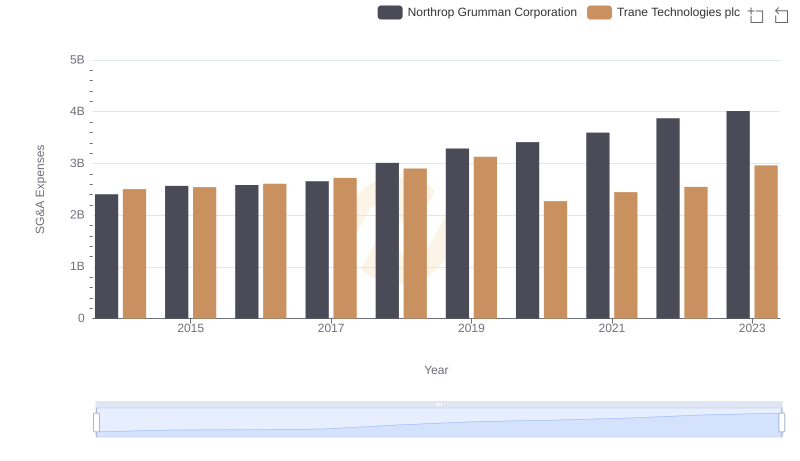

Trane Technologies plc vs Northrop Grumman Corporation: SG&A Expense Trends

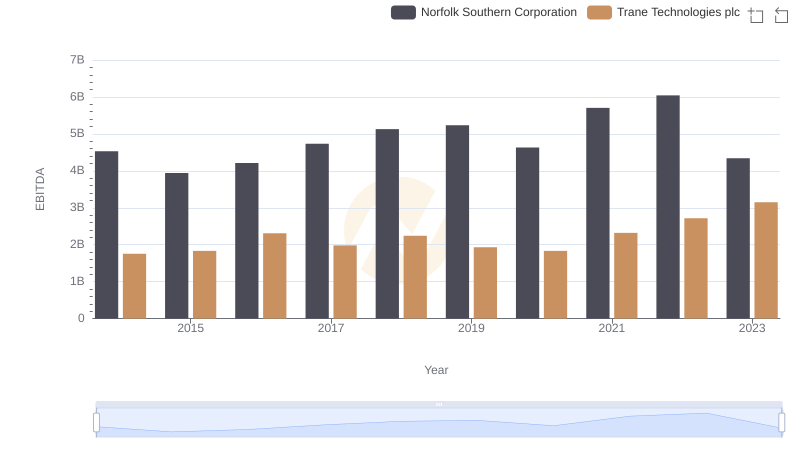

EBITDA Analysis: Evaluating Trane Technologies plc Against Norfolk Southern Corporation

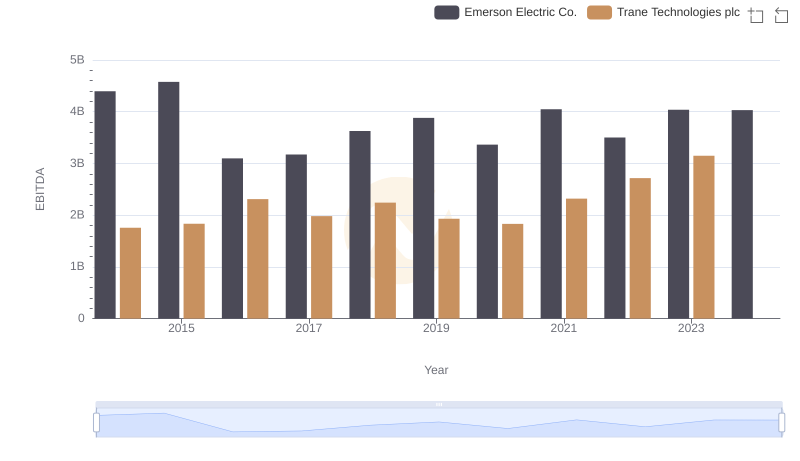

Comparative EBITDA Analysis: Trane Technologies plc vs Emerson Electric Co.

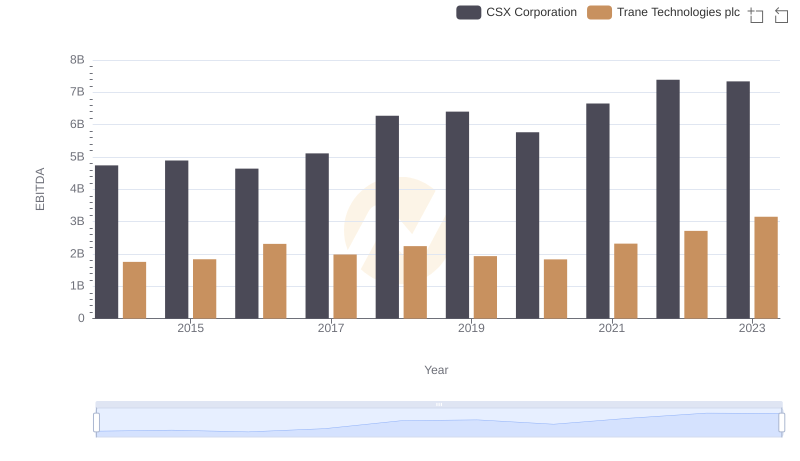

EBITDA Performance Review: Trane Technologies plc vs CSX Corporation

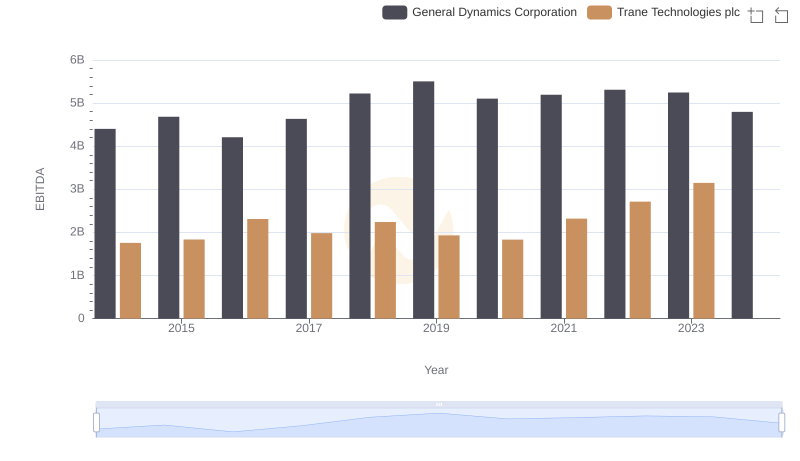

Professional EBITDA Benchmarking: Trane Technologies plc vs General Dynamics Corporation

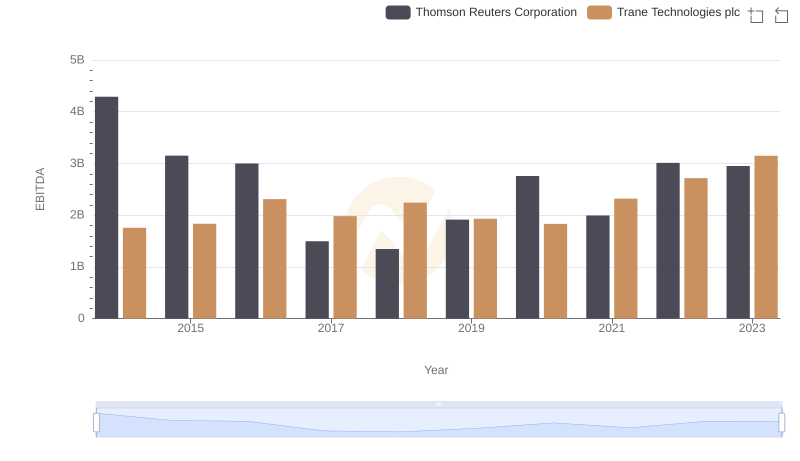

A Side-by-Side Analysis of EBITDA: Trane Technologies plc and Thomson Reuters Corporation