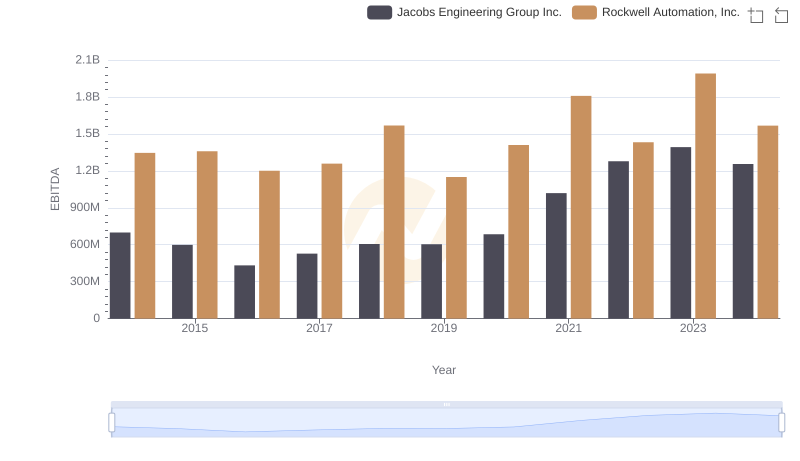

| __timestamp | Avery Dennison Corporation | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 629200000 | 1346000000 |

| Thursday, January 1, 2015 | 657700000 | 1359100000 |

| Friday, January 1, 2016 | 717000000 | 1200700000 |

| Sunday, January 1, 2017 | 829400000 | 1258400000 |

| Monday, January 1, 2018 | 794300000 | 1568400000 |

| Tuesday, January 1, 2019 | 557500000 | 1150200000 |

| Wednesday, January 1, 2020 | 1062000000 | 1410200000 |

| Friday, January 1, 2021 | 1306900000 | 1808300000 |

| Saturday, January 1, 2022 | 1374100000 | 1432100000 |

| Sunday, January 1, 2023 | 1112100000 | 1990700000 |

| Monday, January 1, 2024 | 1382700000 | 1567500000 |

Infusing magic into the data realm

In the ever-evolving landscape of industrial automation and materials science, Rockwell Automation and Avery Dennison stand as titans. Over the past decade, Rockwell Automation has consistently outperformed Avery Dennison in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2023, Rockwell Automation's EBITDA surged by approximately 48%, peaking in 2023. In contrast, Avery Dennison experienced a more modest growth of around 77% during the same period, with a notable dip in 2019. The year 2020 marked a significant recovery for Avery Dennison, with a 90% increase in EBITDA compared to the previous year. However, 2024 data for Avery Dennison remains elusive, leaving room for speculation. This analysis underscores the resilience and strategic prowess of these industry leaders, offering valuable insights for investors and stakeholders alike.

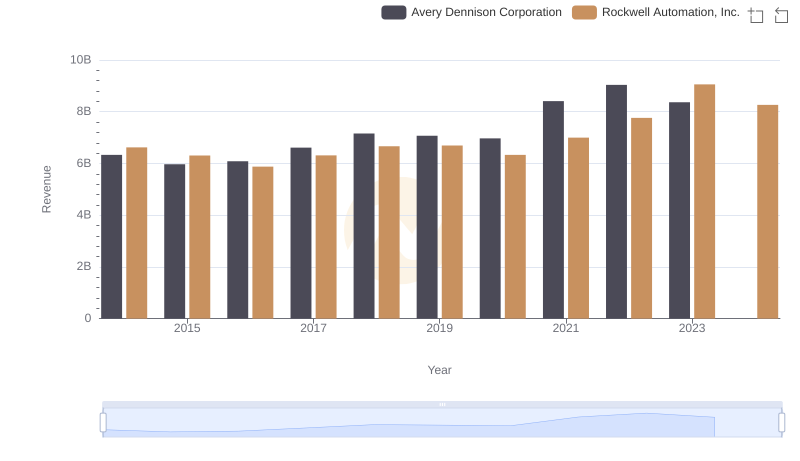

Rockwell Automation, Inc. or Avery Dennison Corporation: Who Leads in Yearly Revenue?

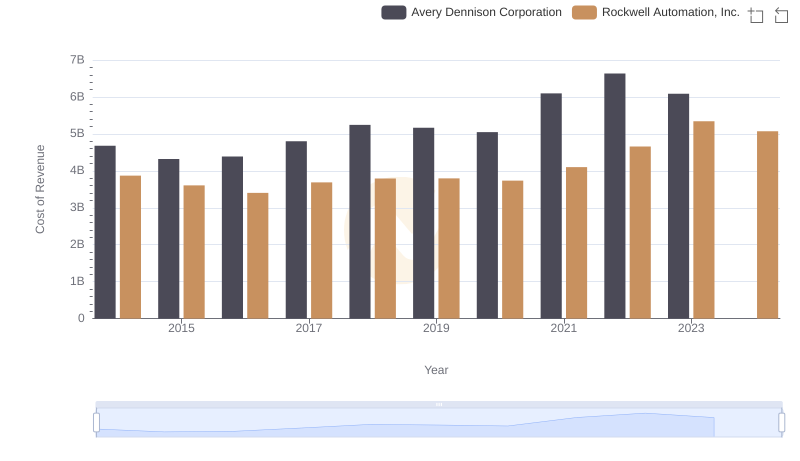

Analyzing Cost of Revenue: Rockwell Automation, Inc. and Avery Dennison Corporation

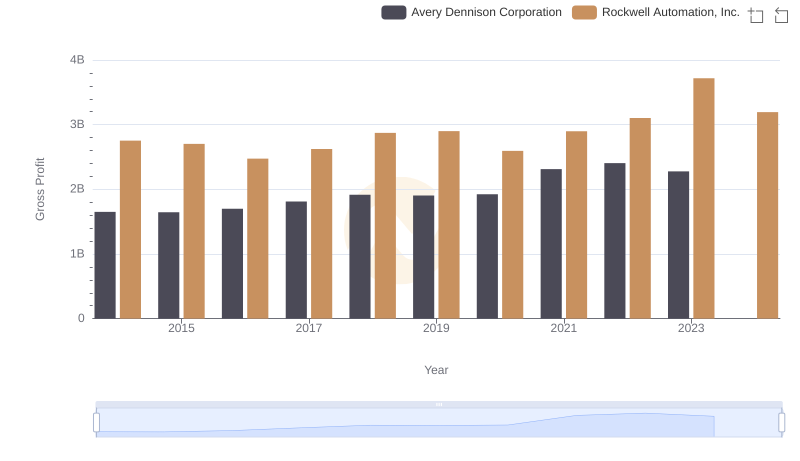

Gross Profit Trends Compared: Rockwell Automation, Inc. vs Avery Dennison Corporation

Rockwell Automation, Inc. vs Jacobs Engineering Group Inc.: In-Depth EBITDA Performance Comparison

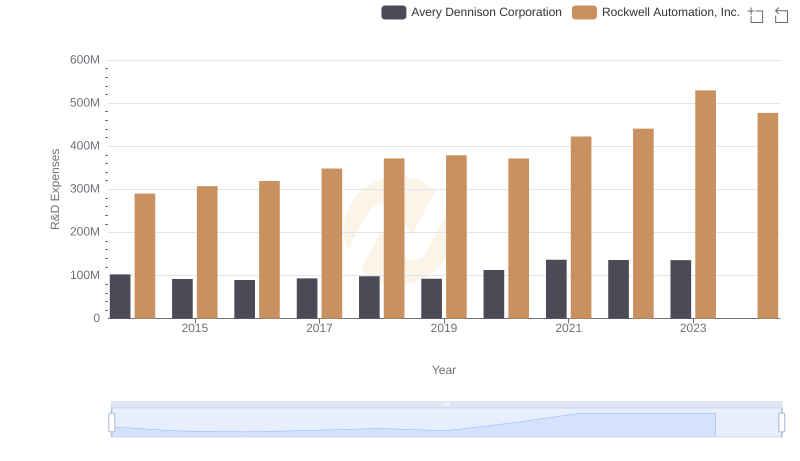

R&D Insights: How Rockwell Automation, Inc. and Avery Dennison Corporation Allocate Funds

Comprehensive EBITDA Comparison: Rockwell Automation, Inc. vs XPO Logistics, Inc.

A Professional Review of EBITDA: Rockwell Automation, Inc. Compared to Expeditors International of Washington, Inc.

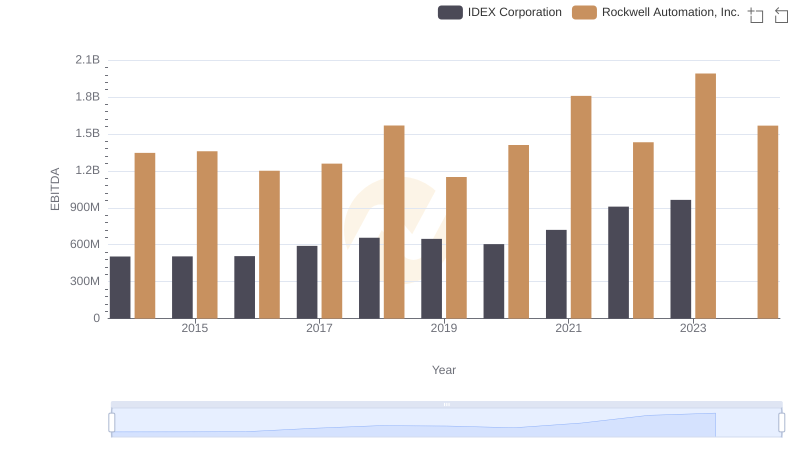

Rockwell Automation, Inc. vs IDEX Corporation: In-Depth EBITDA Performance Comparison

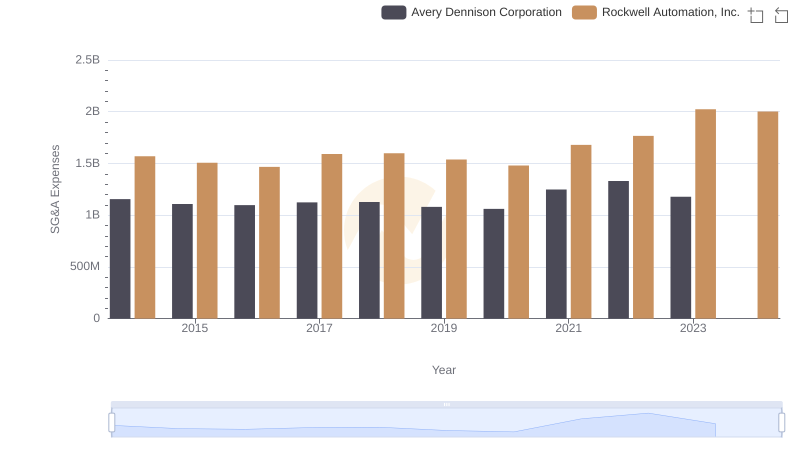

Comparing SG&A Expenses: Rockwell Automation, Inc. vs Avery Dennison Corporation Trends and Insights

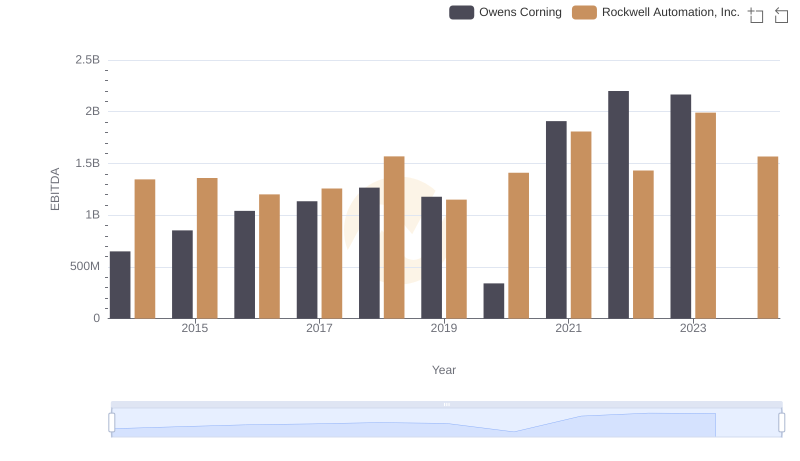

EBITDA Analysis: Evaluating Rockwell Automation, Inc. Against Owens Corning

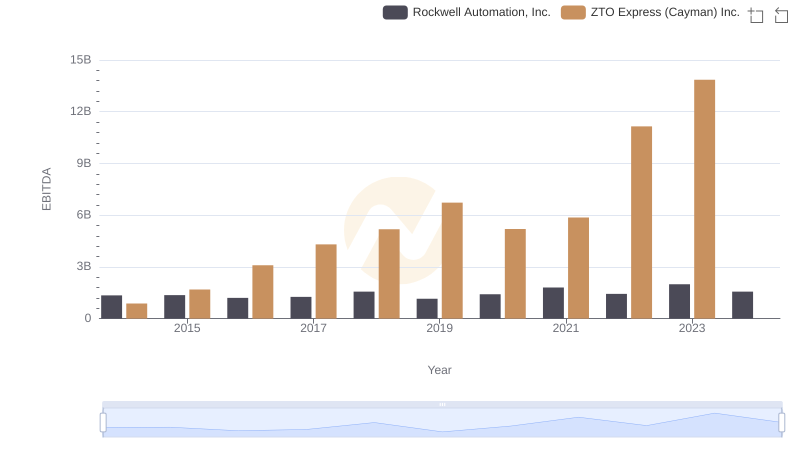

EBITDA Performance Review: Rockwell Automation, Inc. vs ZTO Express (Cayman) Inc.

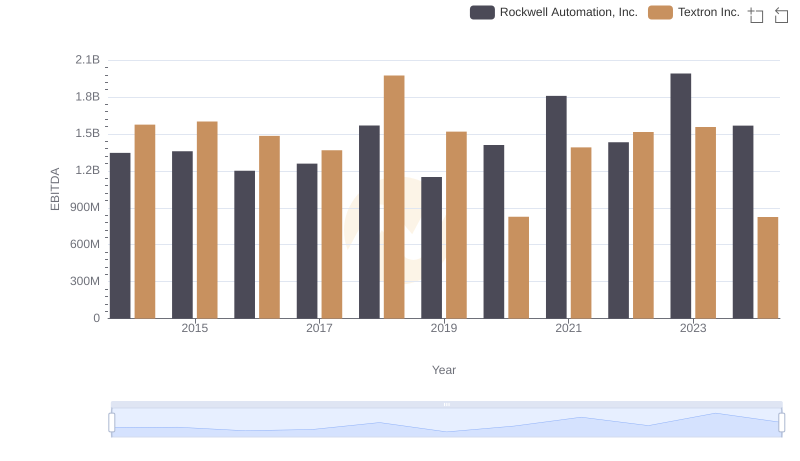

A Side-by-Side Analysis of EBITDA: Rockwell Automation, Inc. and Textron Inc.