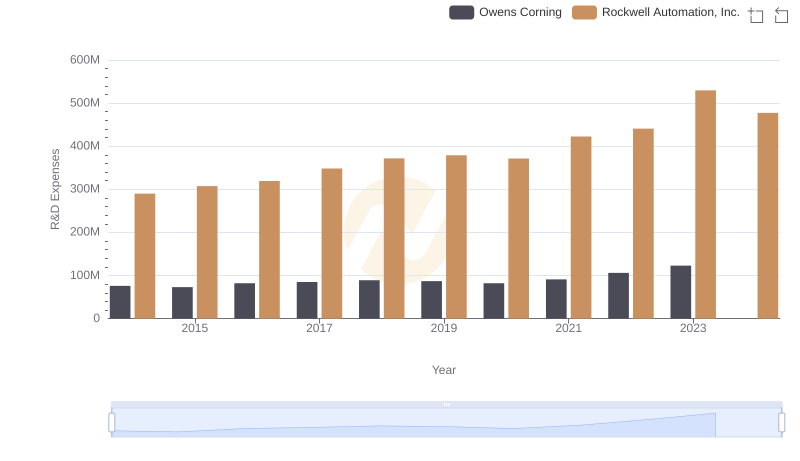

| __timestamp | Avery Dennison Corporation | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 102500000 | 290100000 |

| Thursday, January 1, 2015 | 91900000 | 307300000 |

| Friday, January 1, 2016 | 89700000 | 319300000 |

| Sunday, January 1, 2017 | 93400000 | 348200000 |

| Monday, January 1, 2018 | 98200000 | 371800000 |

| Tuesday, January 1, 2019 | 92600000 | 378900000 |

| Wednesday, January 1, 2020 | 112800000 | 371500000 |

| Friday, January 1, 2021 | 136600000 | 422500000 |

| Saturday, January 1, 2022 | 136100000 | 440900000 |

| Sunday, January 1, 2023 | 135800000 | 529500000 |

| Monday, January 1, 2024 | 0 | 477300000 |

Cracking the code

In the ever-evolving landscape of industrial innovation, research and development (R&D) spending is a critical indicator of a company's commitment to future growth. Over the past decade, Rockwell Automation, Inc. and Avery Dennison Corporation have demonstrated distinct strategies in their R&D allocations.

From 2014 to 2023, Rockwell Automation consistently increased its R&D investment, peaking in 2023 with a 45% rise from its 2014 levels. This upward trend underscores Rockwell's dedication to maintaining its competitive edge in automation technology. In contrast, Avery Dennison's R&D spending exhibited a more modest growth, with a notable 33% increase from 2014 to 2021, before stabilizing in subsequent years.

The data reveals a strategic divergence: while Rockwell Automation aggressively scales its R&D efforts, Avery Dennison opts for a steady, albeit slower, investment pace. This insight into their financial strategies offers a glimpse into their future innovation trajectories.

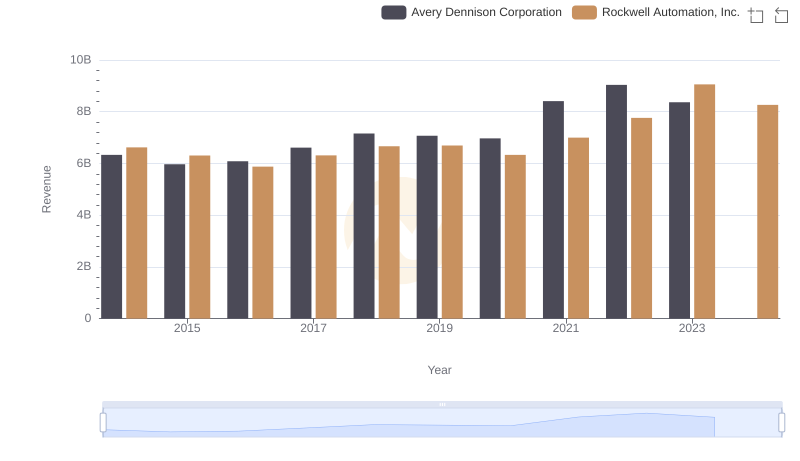

Rockwell Automation, Inc. or Avery Dennison Corporation: Who Leads in Yearly Revenue?

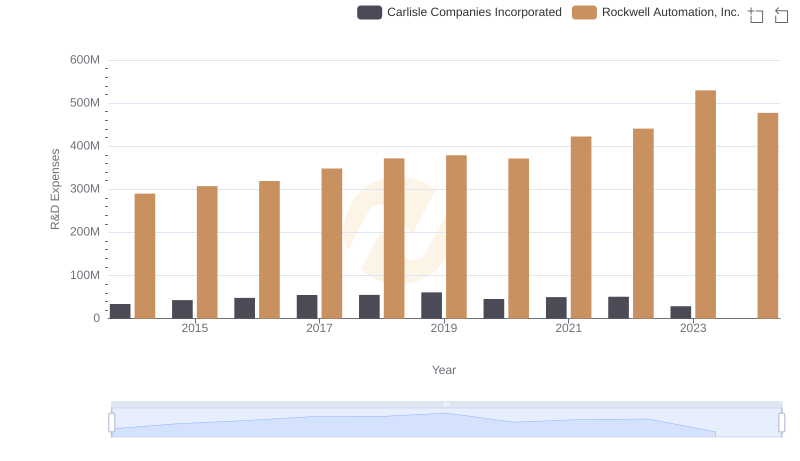

Rockwell Automation, Inc. or Carlisle Companies Incorporated: Who Invests More in Innovation?

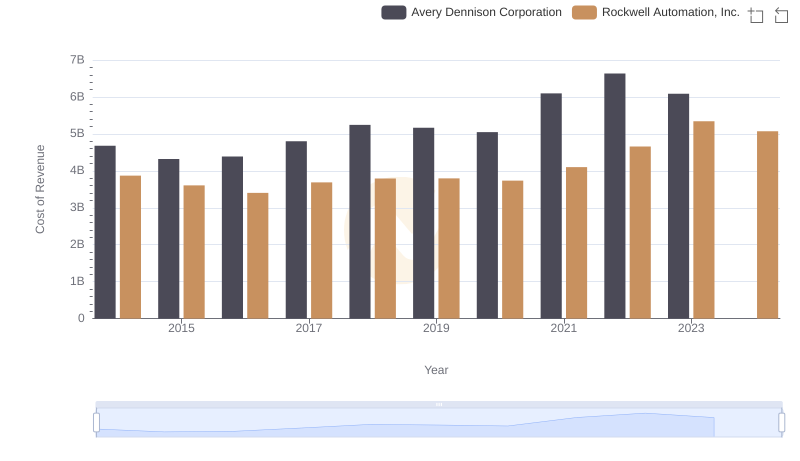

Analyzing Cost of Revenue: Rockwell Automation, Inc. and Avery Dennison Corporation

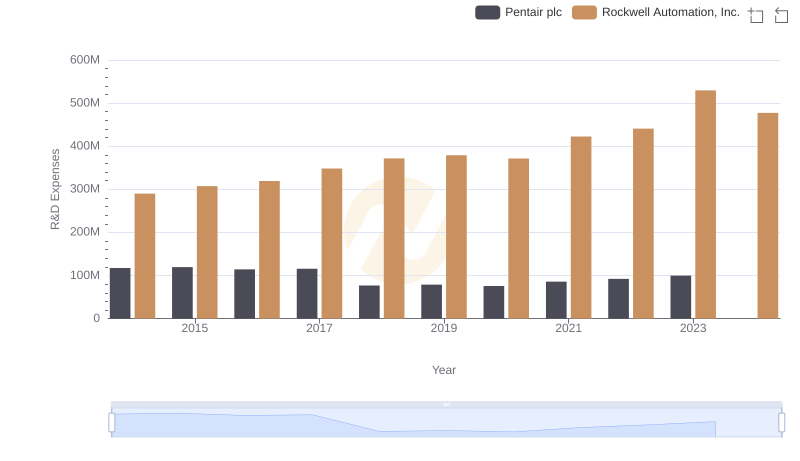

Research and Development: Comparing Key Metrics for Rockwell Automation, Inc. and Pentair plc

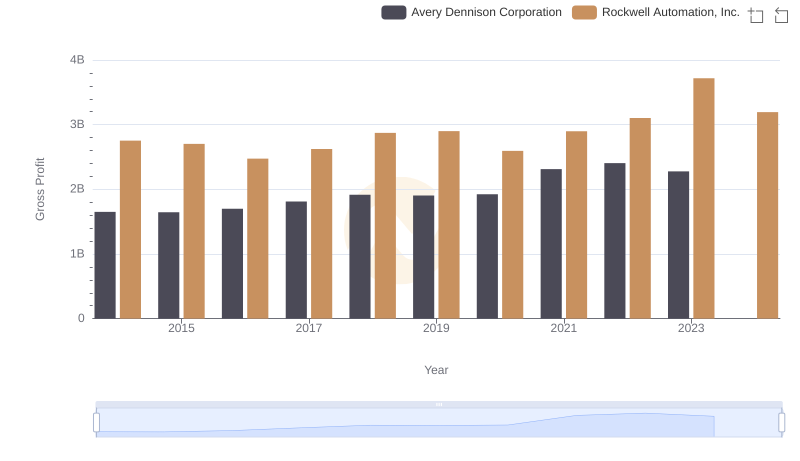

Gross Profit Trends Compared: Rockwell Automation, Inc. vs Avery Dennison Corporation

R&D Spending Showdown: Rockwell Automation, Inc. vs Owens Corning

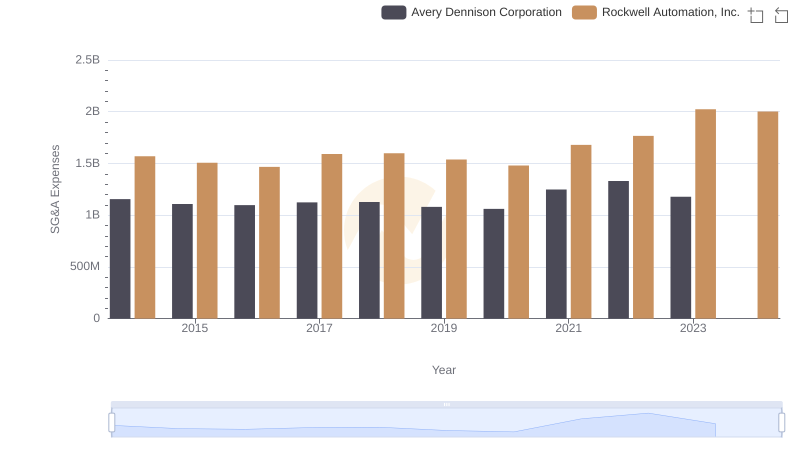

Comparing SG&A Expenses: Rockwell Automation, Inc. vs Avery Dennison Corporation Trends and Insights

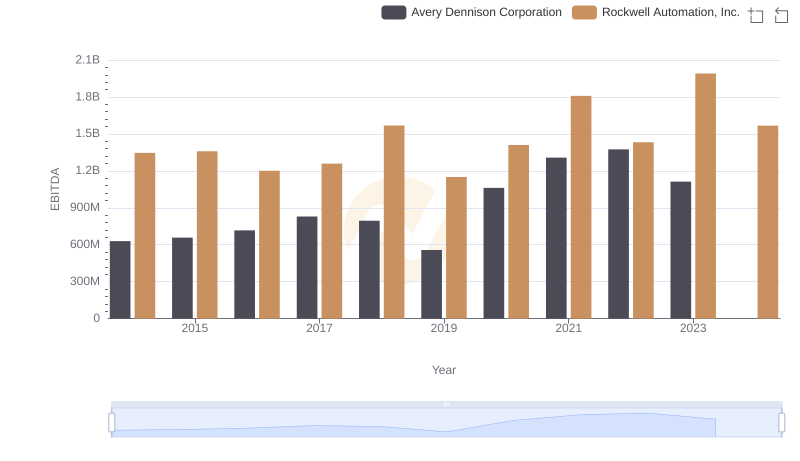

EBITDA Analysis: Evaluating Rockwell Automation, Inc. Against Avery Dennison Corporation

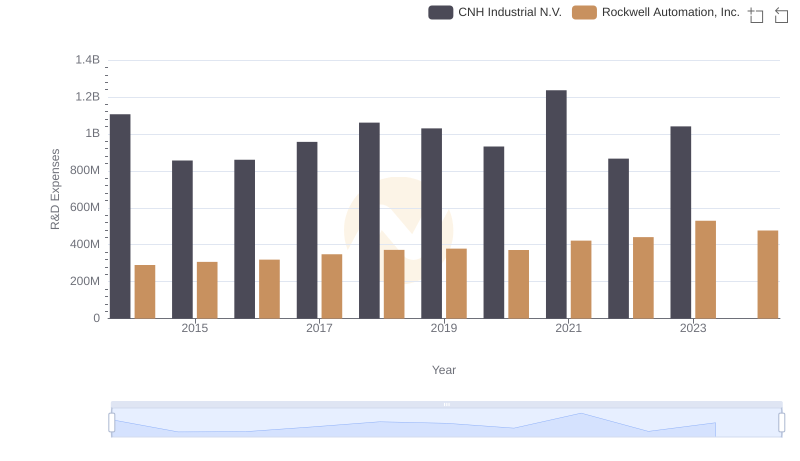

Research and Development Expenses Breakdown: Rockwell Automation, Inc. vs CNH Industrial N.V.

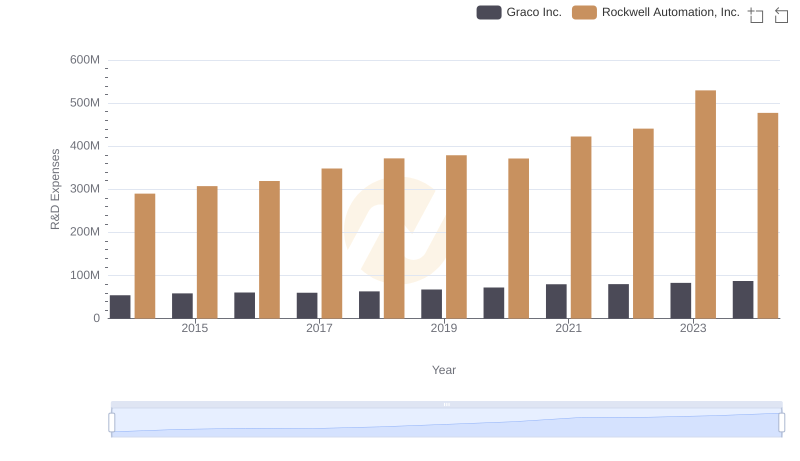

Research and Development Expenses Breakdown: Rockwell Automation, Inc. vs Graco Inc.