| __timestamp | Cintas Corporation | EMCOR Group, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 793811000 | 355858000 |

| Thursday, January 1, 2015 | 877761000 | 362095000 |

| Friday, January 1, 2016 | 933728000 | 395913000 |

| Sunday, January 1, 2017 | 968293000 | 478459000 |

| Monday, January 1, 2018 | 1227852000 | 489954000 |

| Tuesday, January 1, 2019 | 1564228000 | 556055000 |

| Wednesday, January 1, 2020 | 1542737000 | 601449000 |

| Friday, January 1, 2021 | 1773591000 | 646861000 |

| Saturday, January 1, 2022 | 1990046000 | 682399000 |

| Sunday, January 1, 2023 | 2221676000 | 1009017000 |

| Monday, January 1, 2024 | 2523857000 |

Unleashing the power of data

In the competitive landscape of the service industry, Cintas Corporation and EMCOR Group, Inc. have shown remarkable financial trajectories over the past decade. Since 2014, Cintas has consistently outperformed EMCOR in terms of EBITDA, showcasing a robust growth of approximately 218% by 2023. This growth reflects Cintas's strategic expansions and operational efficiencies. In contrast, EMCOR, while experiencing a steady increase, has seen its EBITDA grow by about 184% over the same period, reaching its peak in 2023.

The data highlights a significant leap for Cintas in 2023, with a 12% increase from the previous year, while EMCOR's growth was more modest at 48%. Notably, the data for 2024 is incomplete, leaving room for speculation on future trends. This analysis underscores the dynamic nature of the industry and the importance of strategic financial management.

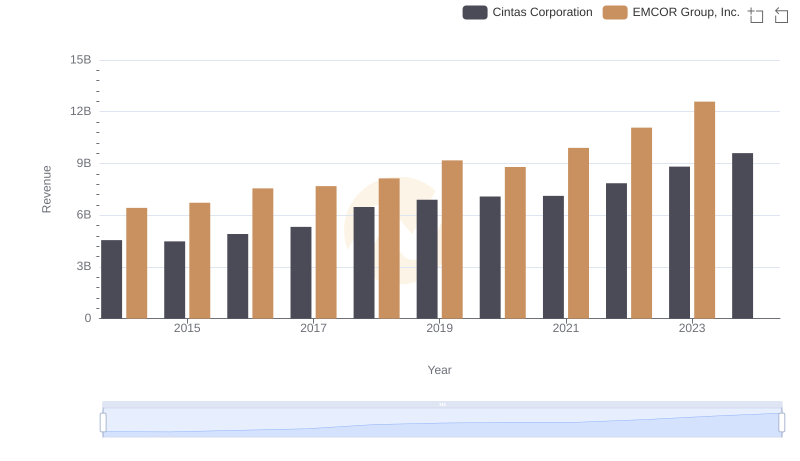

Cintas Corporation or EMCOR Group, Inc.: Who Leads in Yearly Revenue?

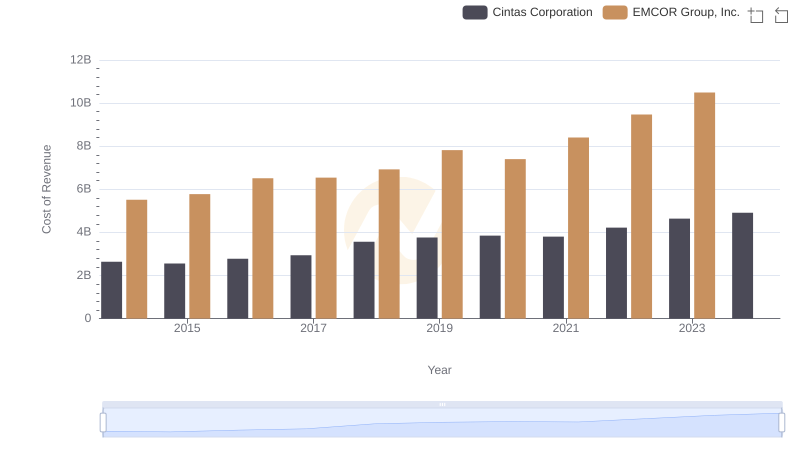

Comparing Cost of Revenue Efficiency: Cintas Corporation vs EMCOR Group, Inc.

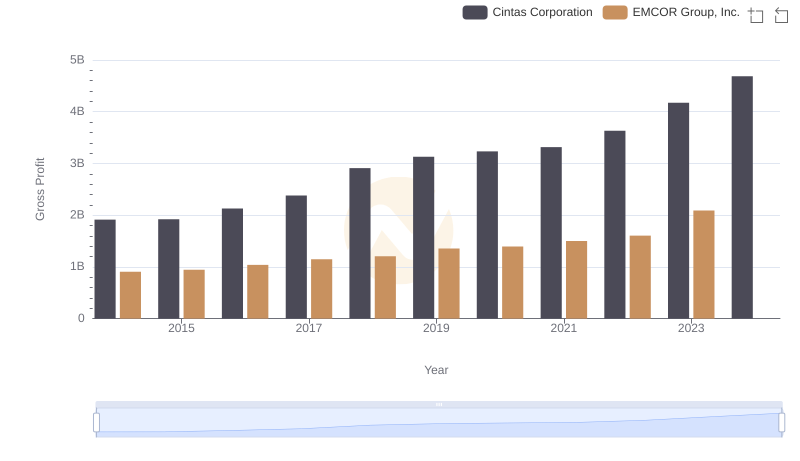

Gross Profit Trends Compared: Cintas Corporation vs EMCOR Group, Inc.

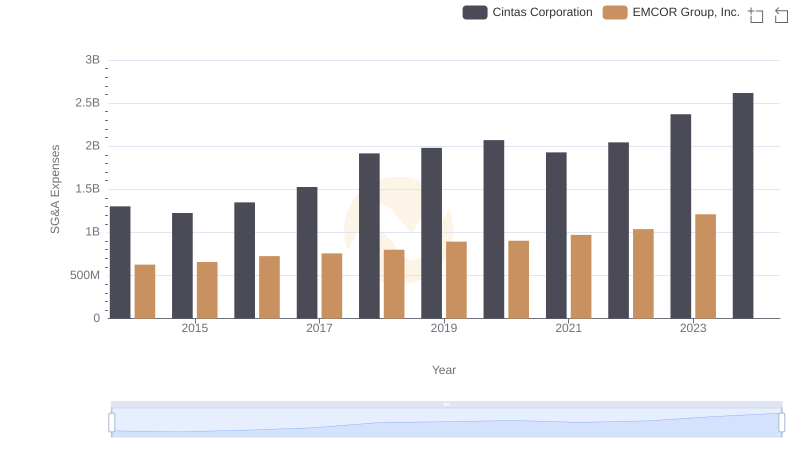

Comparing SG&A Expenses: Cintas Corporation vs EMCOR Group, Inc. Trends and Insights

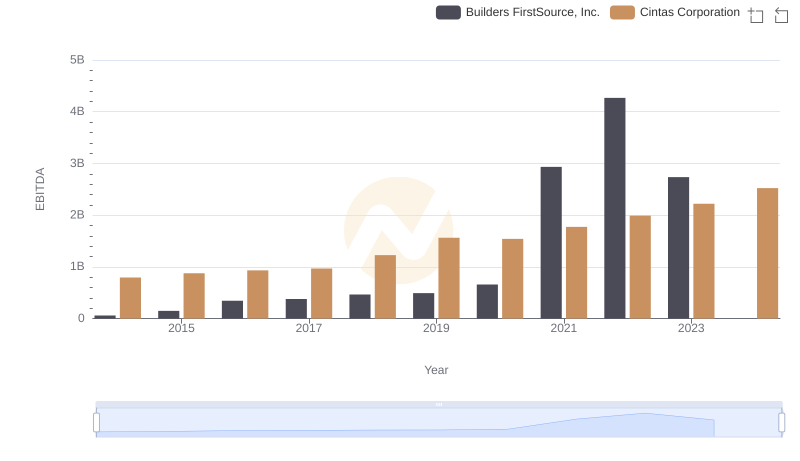

A Side-by-Side Analysis of EBITDA: Cintas Corporation and Builders FirstSource, Inc.

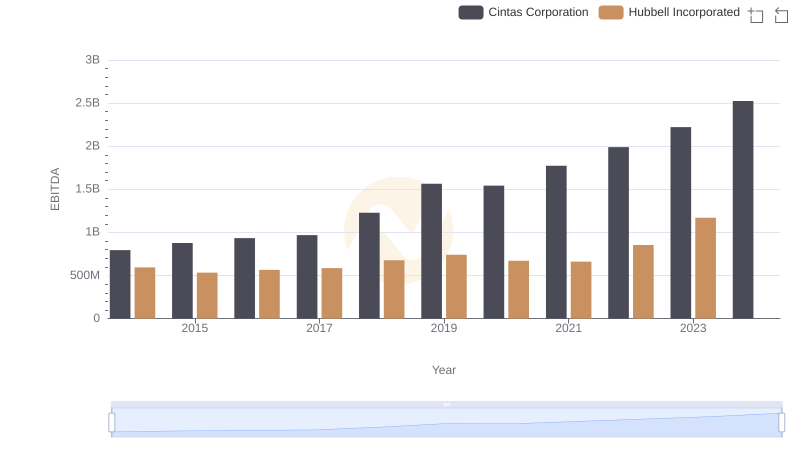

EBITDA Metrics Evaluated: Cintas Corporation vs Hubbell Incorporated

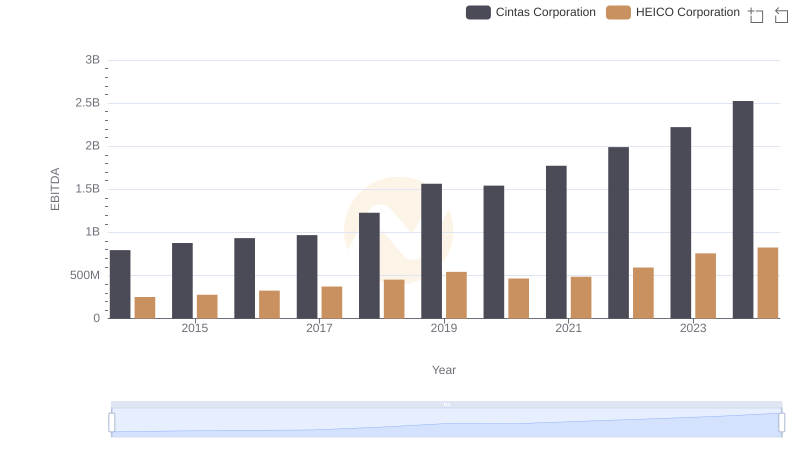

A Professional Review of EBITDA: Cintas Corporation Compared to HEICO Corporation

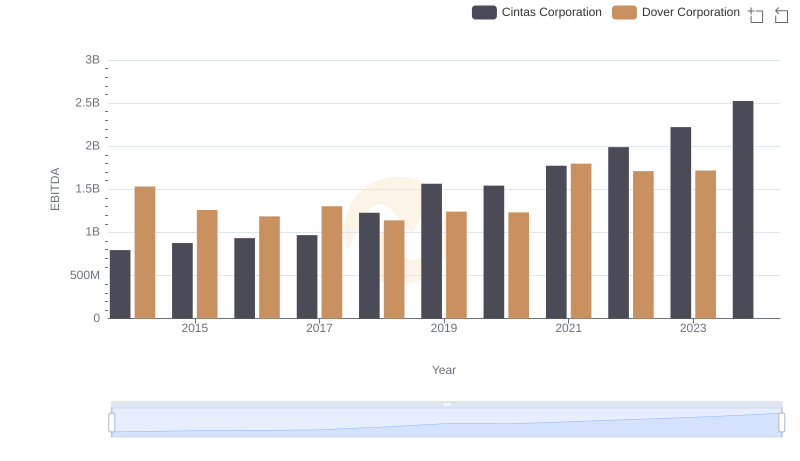

EBITDA Performance Review: Cintas Corporation vs Dover Corporation

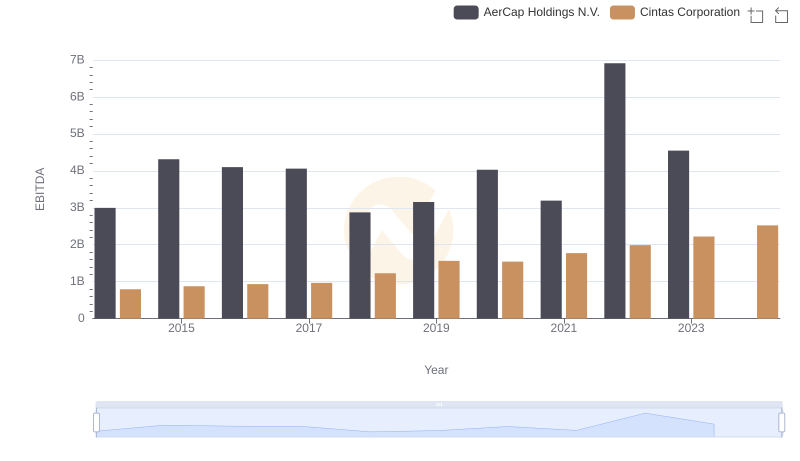

EBITDA Performance Review: Cintas Corporation vs AerCap Holdings N.V.

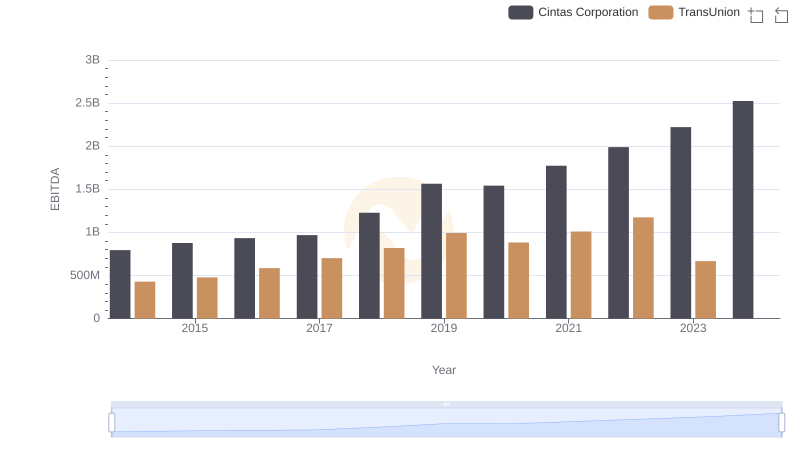

EBITDA Performance Review: Cintas Corporation vs TransUnion

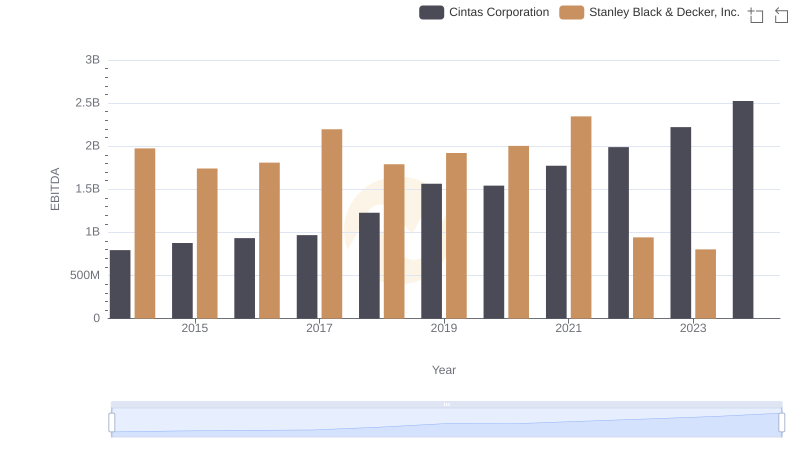

Cintas Corporation vs Stanley Black & Decker, Inc.: In-Depth EBITDA Performance Comparison