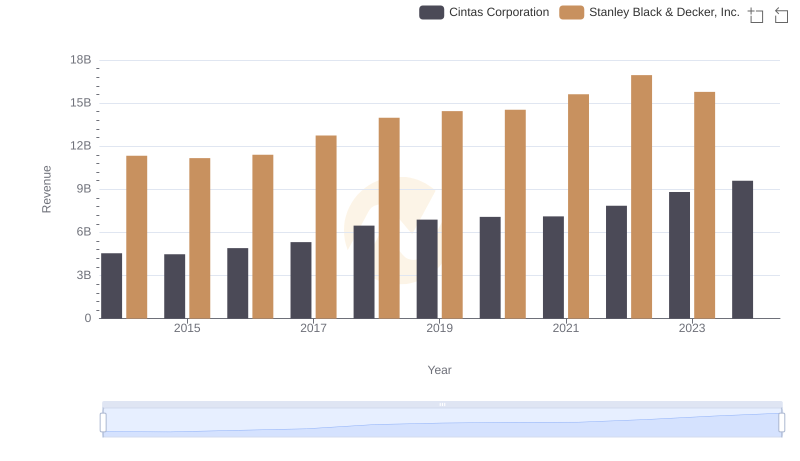

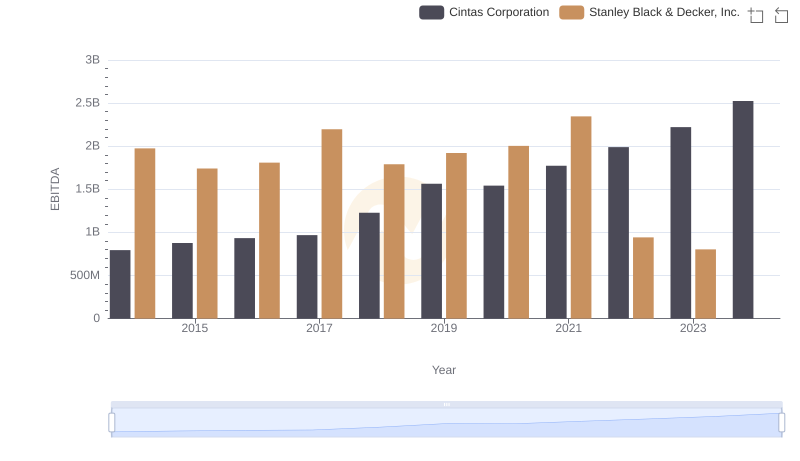

| __timestamp | Cintas Corporation | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 793811000 | 1975400000 |

| Thursday, January 1, 2015 | 877761000 | 1741900000 |

| Friday, January 1, 2016 | 933728000 | 1810200000 |

| Sunday, January 1, 2017 | 968293000 | 2196000000 |

| Monday, January 1, 2018 | 1227852000 | 1791200000 |

| Tuesday, January 1, 2019 | 1564228000 | 1920600000 |

| Wednesday, January 1, 2020 | 1542737000 | 2004200000 |

| Friday, January 1, 2021 | 1773591000 | 2345500000 |

| Saturday, January 1, 2022 | 1990046000 | 942800000 |

| Sunday, January 1, 2023 | 2221676000 | 802700000 |

| Monday, January 1, 2024 | 2523857000 | 286300000 |

Unleashing insights

In the world of corporate finance, EBITDA serves as a crucial indicator of a company's operational performance. From 2014 to 2023, Cintas Corporation and Stanley Black & Decker, Inc. have showcased intriguing trends in their EBITDA figures. Cintas Corporation has demonstrated a remarkable growth trajectory, with its EBITDA increasing by approximately 218% over the decade. In contrast, Stanley Black & Decker, Inc. experienced a decline of around 59% in the same period, with a notable drop in 2022 and 2023.

This comparison highlights the dynamic nature of corporate performance and the importance of strategic financial management.

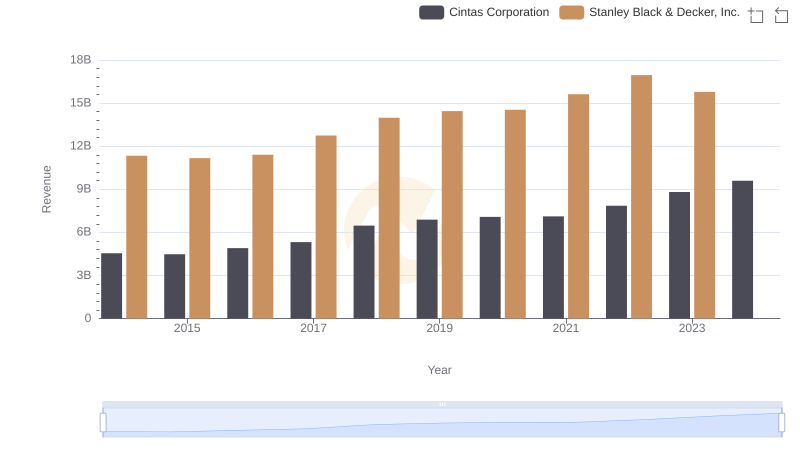

Cintas Corporation or Stanley Black & Decker, Inc.: Who Leads in Yearly Revenue?

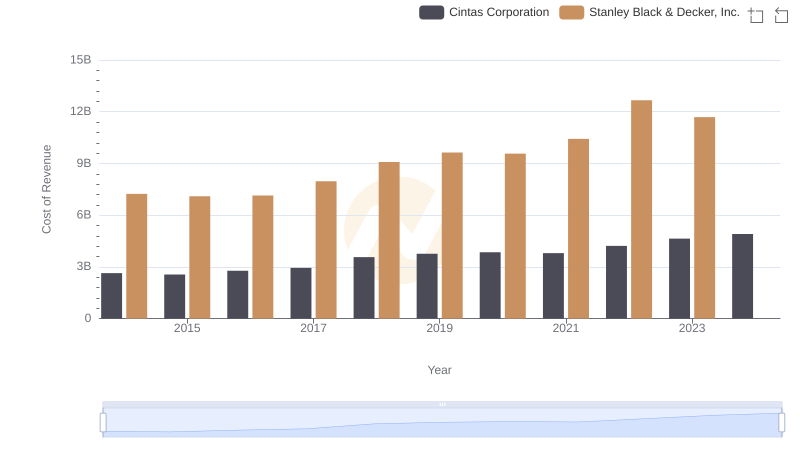

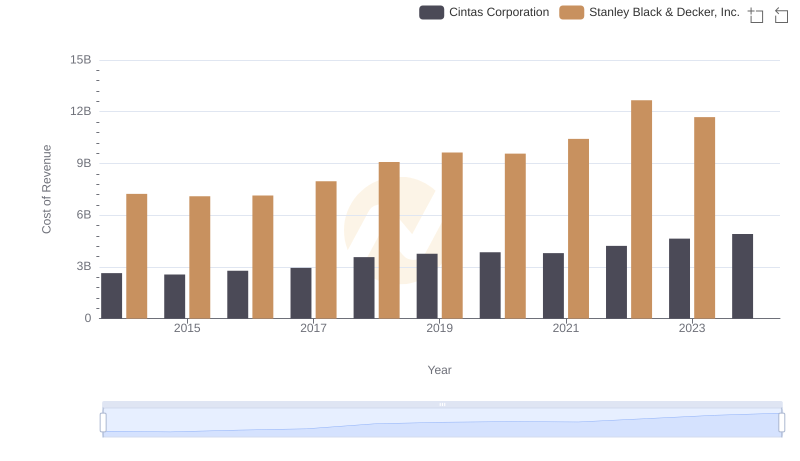

Cost of Revenue: Key Insights for Cintas Corporation and Stanley Black & Decker, Inc.

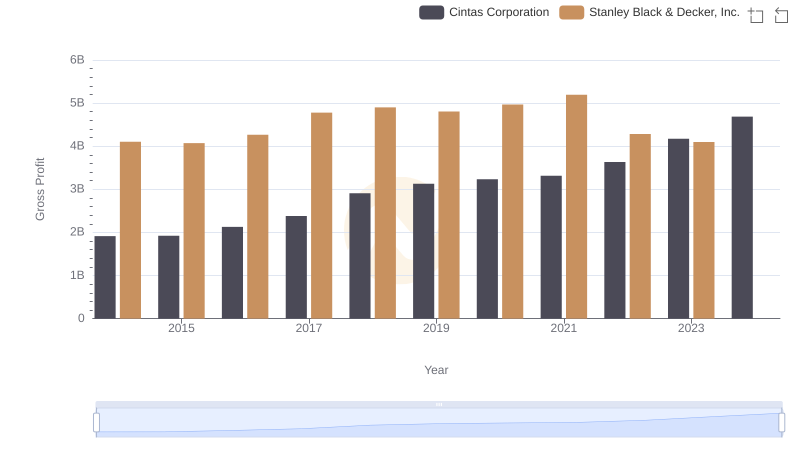

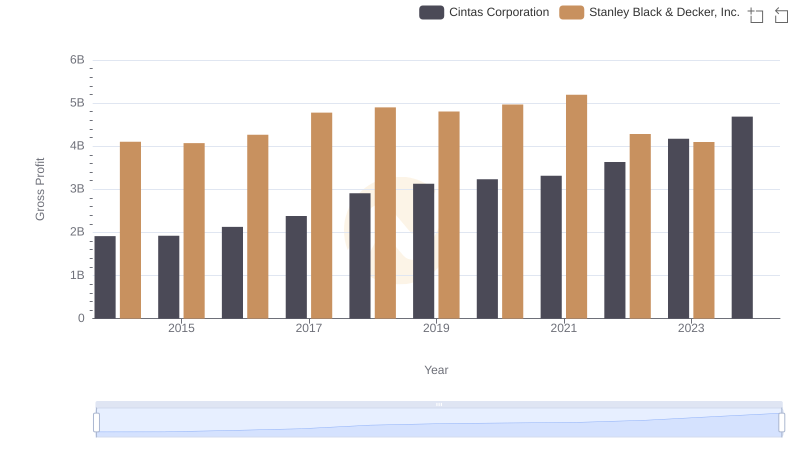

Key Insights on Gross Profit: Cintas Corporation vs Stanley Black & Decker, Inc.

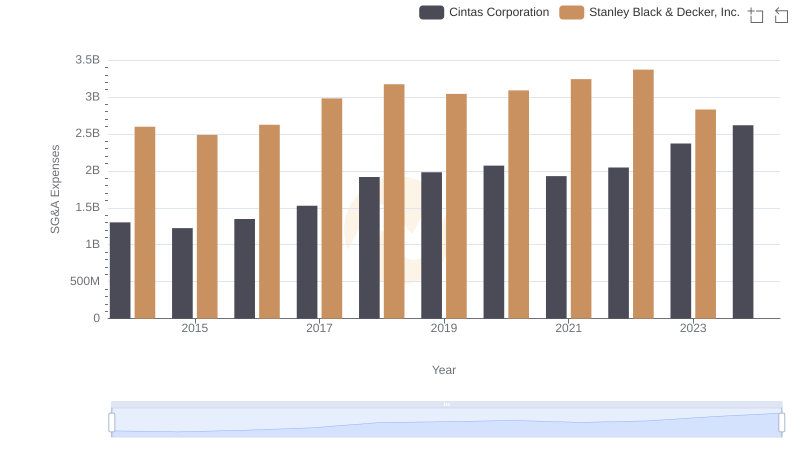

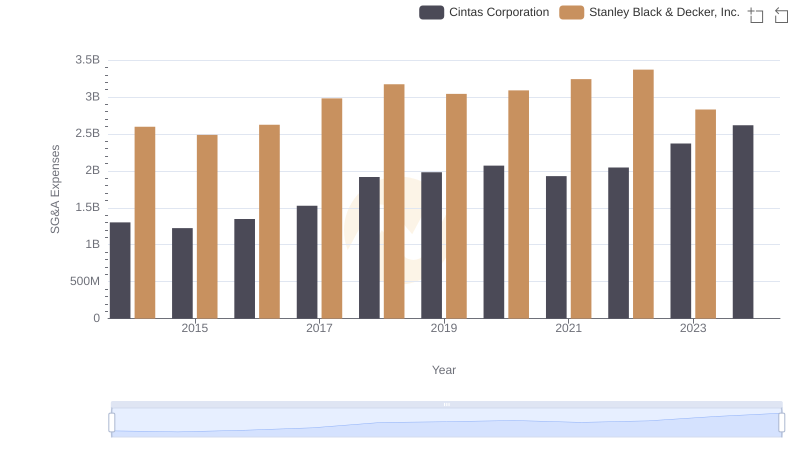

Operational Costs Compared: SG&A Analysis of Cintas Corporation and Stanley Black & Decker, Inc.

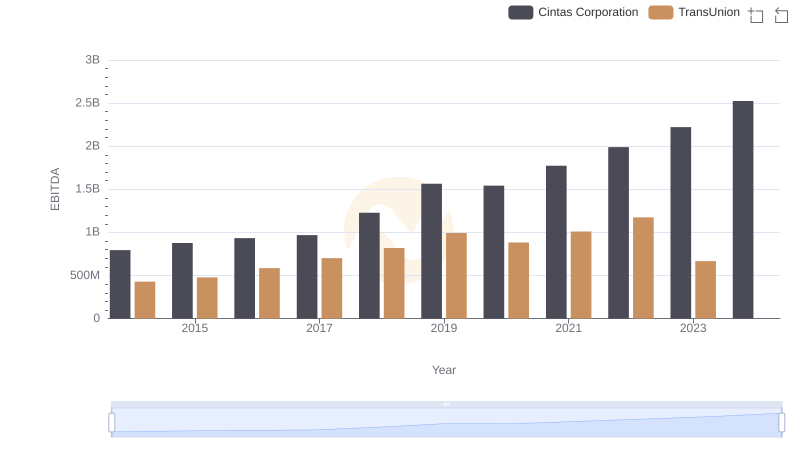

EBITDA Performance Review: Cintas Corporation vs TransUnion

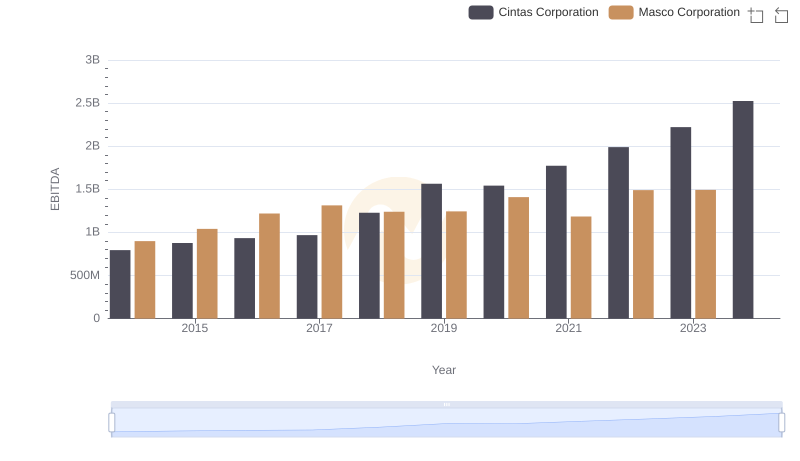

Cintas Corporation and Masco Corporation: A Detailed Examination of EBITDA Performance

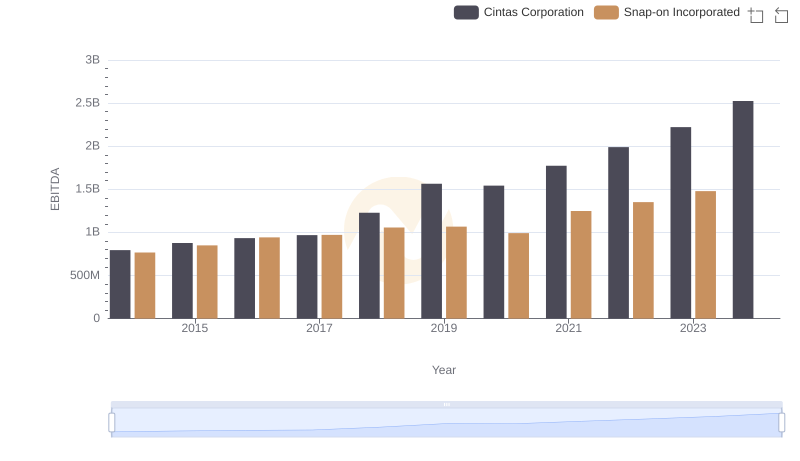

EBITDA Metrics Evaluated: Cintas Corporation vs Snap-on Incorporated

Breaking Down Revenue Trends: Cintas Corporation vs Stanley Black & Decker, Inc.

Analyzing Cost of Revenue: Cintas Corporation and Stanley Black & Decker, Inc.

Key Insights on Gross Profit: Cintas Corporation vs Stanley Black & Decker, Inc.

Cintas Corporation or Stanley Black & Decker, Inc.: Who Manages SG&A Costs Better?

Comprehensive EBITDA Comparison: Cintas Corporation vs Stanley Black & Decker, Inc.