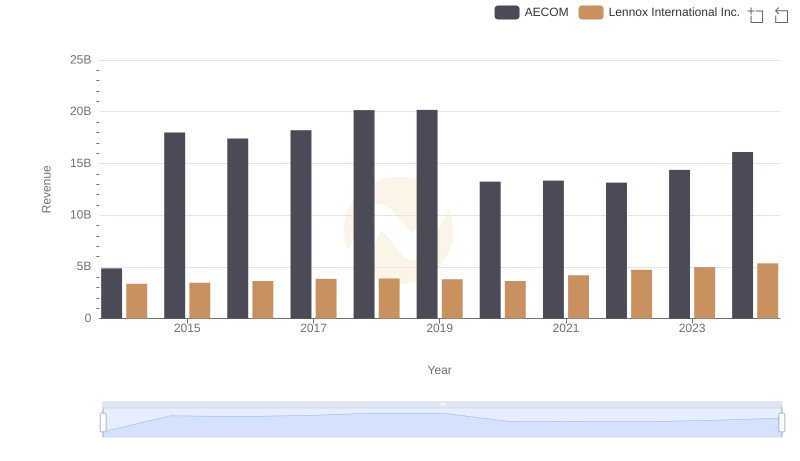

| __timestamp | AECOM | Lennox International Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 4452451000 | 2464100000 |

| Thursday, January 1, 2015 | 17454692000 | 2520000000 |

| Friday, January 1, 2016 | 16768001000 | 2565100000 |

| Sunday, January 1, 2017 | 17519682000 | 2714400000 |

| Monday, January 1, 2018 | 19504863000 | 2772700000 |

| Tuesday, January 1, 2019 | 19359884000 | 2727400000 |

| Wednesday, January 1, 2020 | 12530416000 | 2594000000 |

| Friday, January 1, 2021 | 12542431000 | 3005700000 |

| Saturday, January 1, 2022 | 12300208000 | 3433700000 |

| Sunday, January 1, 2023 | 13432996000 | 3434100000 |

| Monday, January 1, 2024 | 15021157000 | 3569400000 |

Unleashing insights

In the ever-evolving landscape of industrial giants, AECOM and Lennox International Inc. have showcased intriguing cost of revenue trends over the past decade. From 2014 to 2024, AECOM's cost of revenue has seen a significant fluctuation, peaking in 2018 with a 33% increase from 2014, before experiencing a dip in 2020. Meanwhile, Lennox International Inc. has demonstrated a steady upward trajectory, with a notable 45% rise in cost of revenue from 2014 to 2024.

These trends underscore the dynamic nature of cost management strategies in the industrial sector, offering valuable insights for investors and analysts alike.

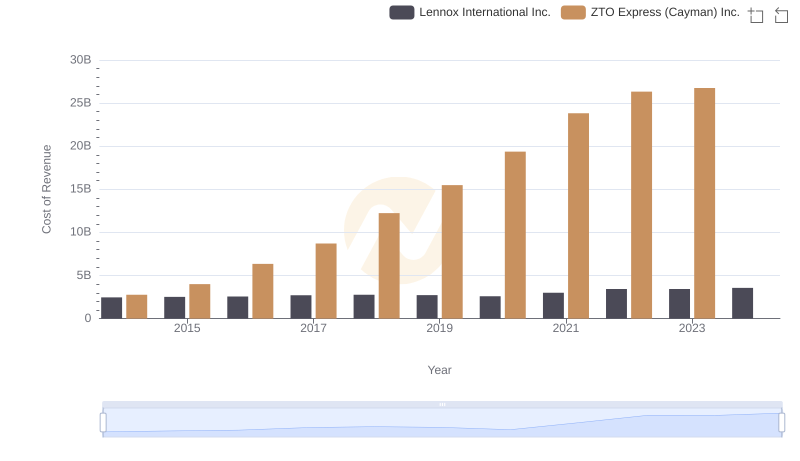

Lennox International Inc. vs ZTO Express (Cayman) Inc.: Efficiency in Cost of Revenue Explored

Lennox International Inc. vs AECOM: Examining Key Revenue Metrics

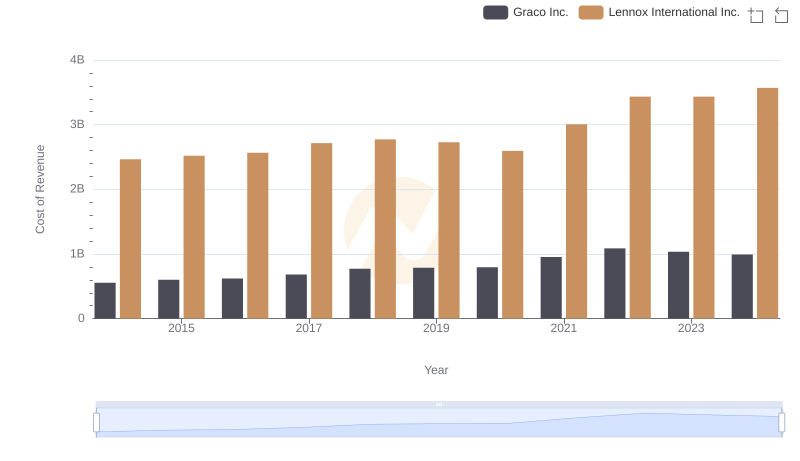

Cost of Revenue Comparison: Lennox International Inc. vs Graco Inc.

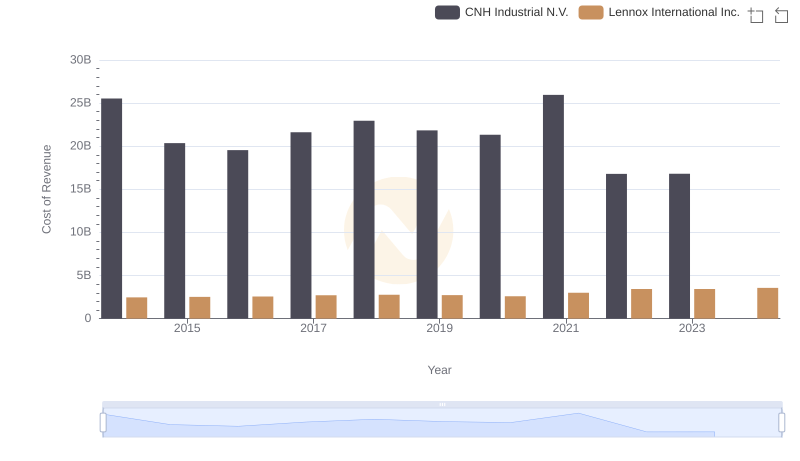

Cost of Revenue Trends: Lennox International Inc. vs CNH Industrial N.V.

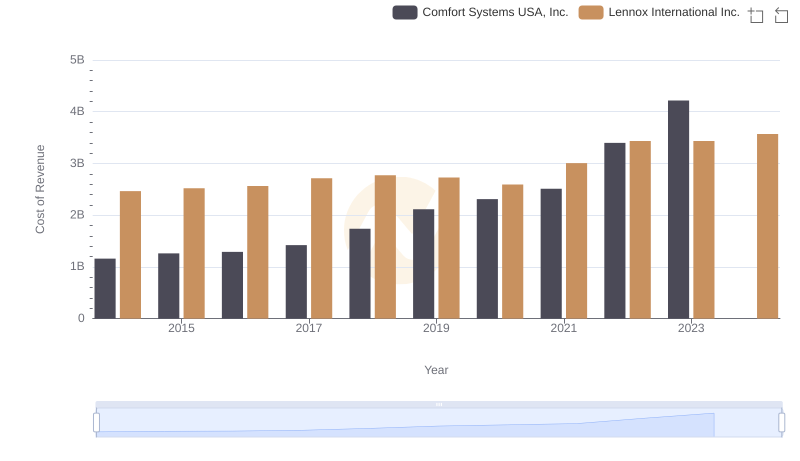

Cost of Revenue Trends: Lennox International Inc. vs Comfort Systems USA, Inc.

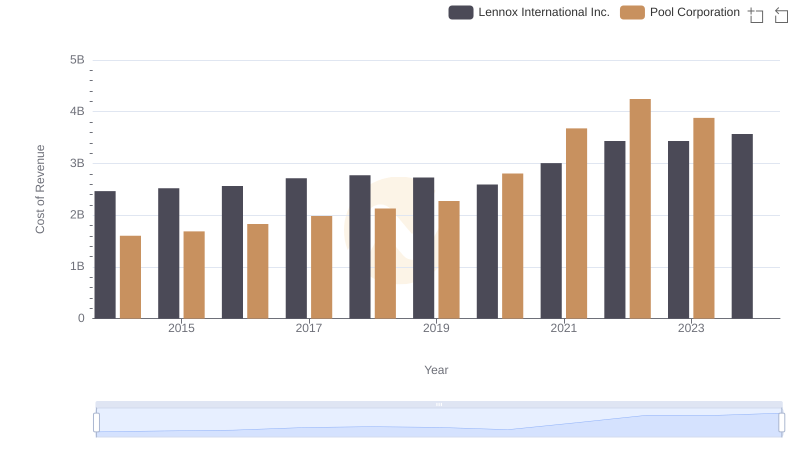

Comparing Cost of Revenue Efficiency: Lennox International Inc. vs Pool Corporation

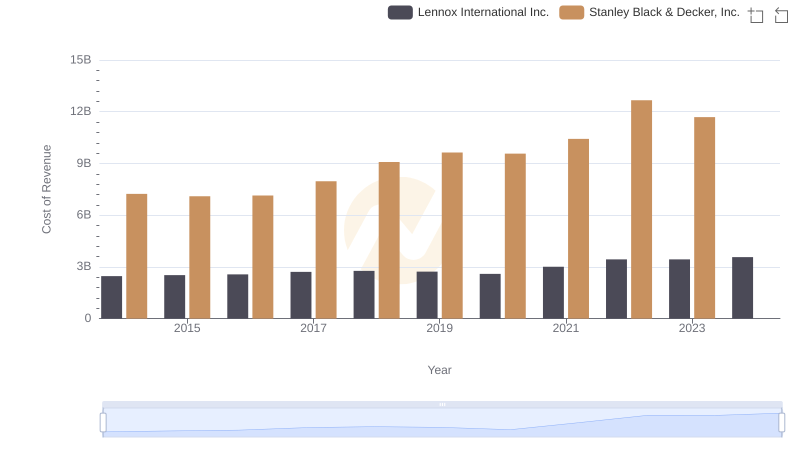

Analyzing Cost of Revenue: Lennox International Inc. and Stanley Black & Decker, Inc.

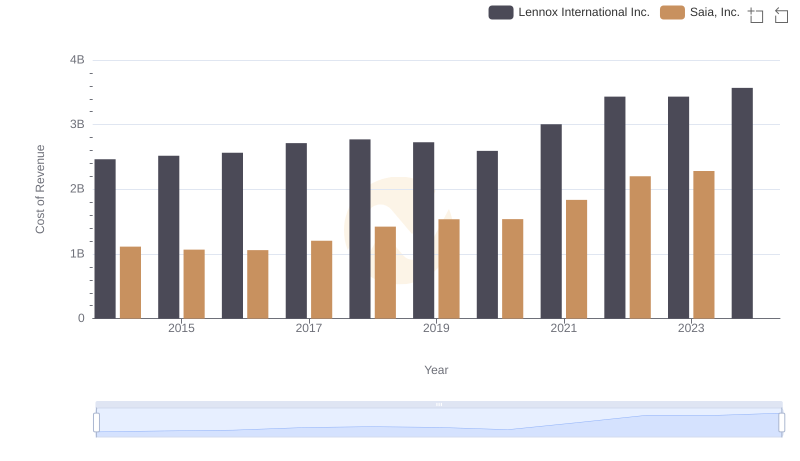

Cost Insights: Breaking Down Lennox International Inc. and Saia, Inc.'s Expenses

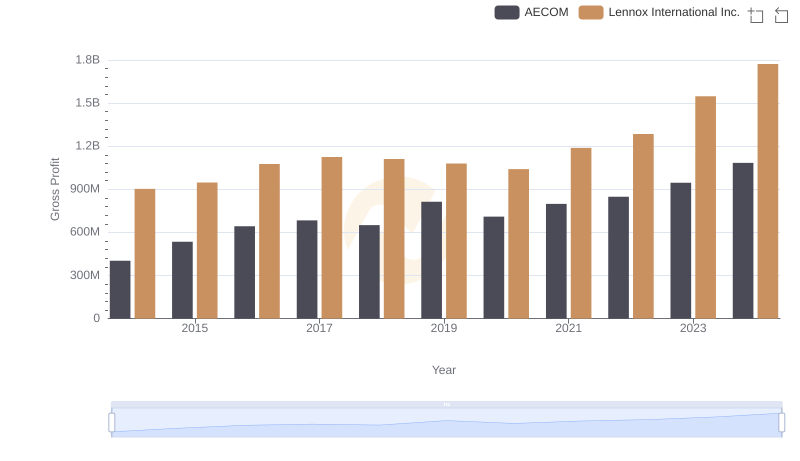

Lennox International Inc. vs AECOM: A Gross Profit Performance Breakdown

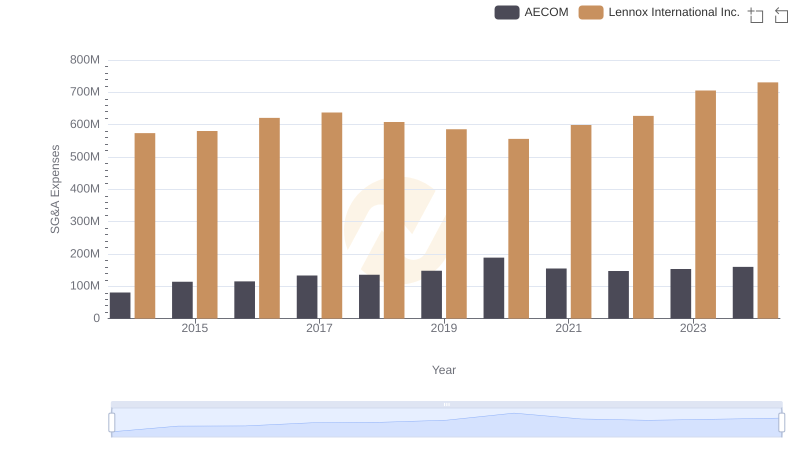

Who Optimizes SG&A Costs Better? Lennox International Inc. or AECOM

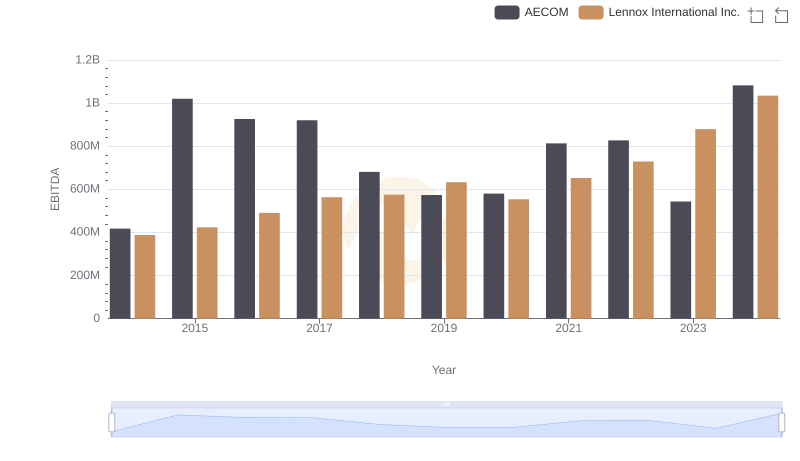

EBITDA Analysis: Evaluating Lennox International Inc. Against AECOM