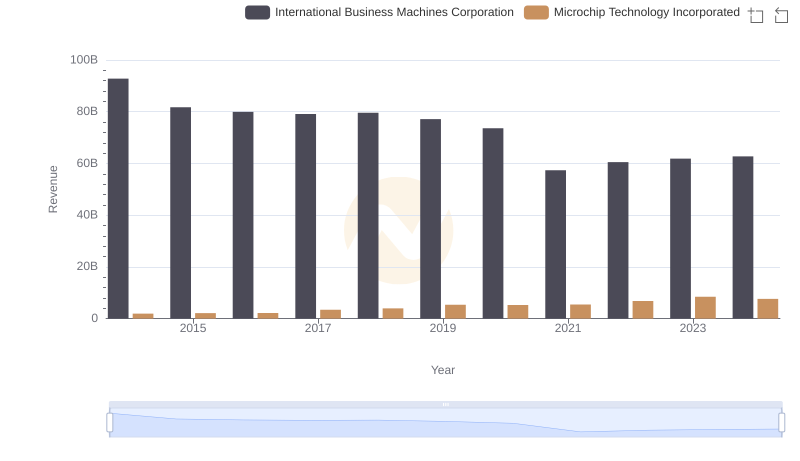

| __timestamp | International Business Machines Corporation | Microchip Technology Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 46386000000 | 802474000 |

| Thursday, January 1, 2015 | 41057000000 | 917472000 |

| Friday, January 1, 2016 | 41403000000 | 967870000 |

| Sunday, January 1, 2017 | 42196000000 | 1650611000 |

| Monday, January 1, 2018 | 42655000000 | 1560100000 |

| Tuesday, January 1, 2019 | 26181000000 | 2418200000 |

| Wednesday, January 1, 2020 | 24314000000 | 2032100000 |

| Friday, January 1, 2021 | 25865000000 | 2059600000 |

| Saturday, January 1, 2022 | 27842000000 | 2371300000 |

| Sunday, January 1, 2023 | 27560000000 | 2740800000 |

| Monday, January 1, 2024 | 27202000000 | 2638700000 |

In pursuit of knowledge

In the ever-evolving tech industry, cost efficiency is a critical metric for success. Over the past decade, International Business Machines Corporation (IBM) and Microchip Technology Incorporated have showcased contrasting trends in their cost of revenue. IBM, a stalwart in the tech world, has seen a significant reduction in its cost of revenue, dropping from approximately $46 billion in 2014 to around $27 billion in 2024. This represents a 41% decrease, highlighting IBM's strategic shift towards more efficient operations.

Conversely, Microchip Technology, a leader in semiconductor solutions, has experienced a steady increase in its cost of revenue, rising from $802 million in 2014 to nearly $2.6 billion in 2024. This 225% increase reflects the company's expansion and growing market presence. As these two giants navigate the complexities of the tech landscape, their financial strategies offer valuable insights into the industry's future.

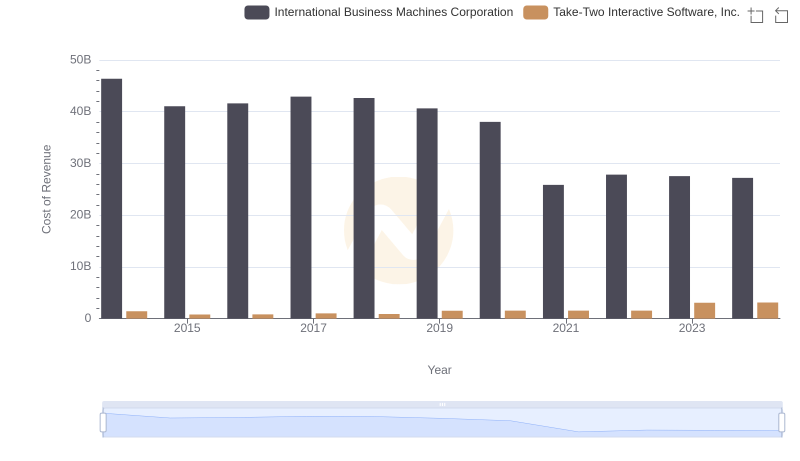

Cost of Revenue: Key Insights for International Business Machines Corporation and Take-Two Interactive Software, Inc.

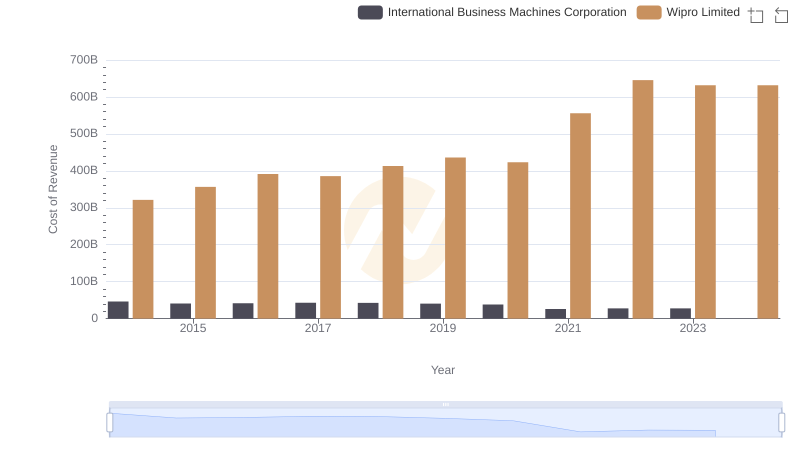

Analyzing Cost of Revenue: International Business Machines Corporation and Wipro Limited

Annual Revenue Comparison: International Business Machines Corporation vs Microchip Technology Incorporated

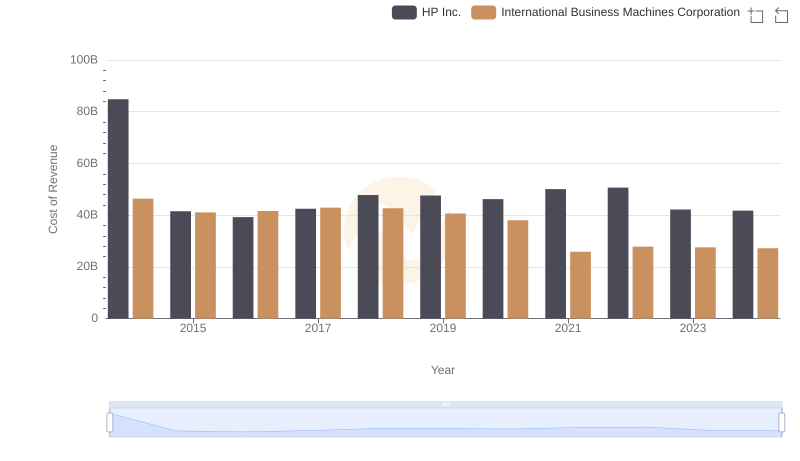

Cost of Revenue: Key Insights for International Business Machines Corporation and HP Inc.

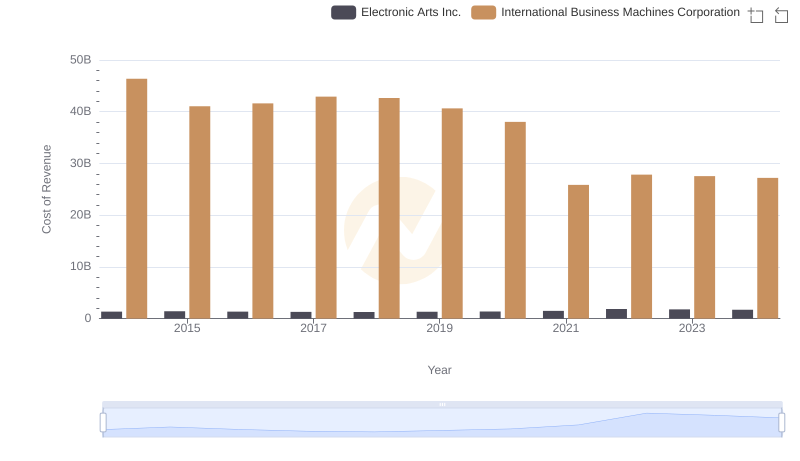

Comparing Cost of Revenue Efficiency: International Business Machines Corporation vs Electronic Arts Inc.

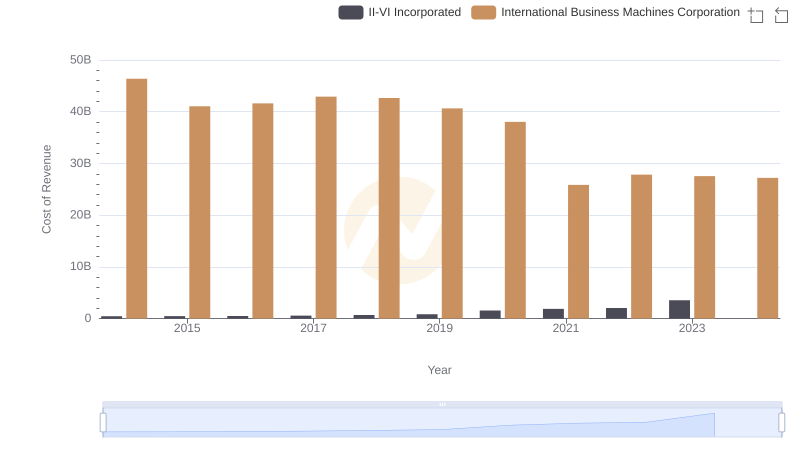

Analyzing Cost of Revenue: International Business Machines Corporation and II-VI Incorporated

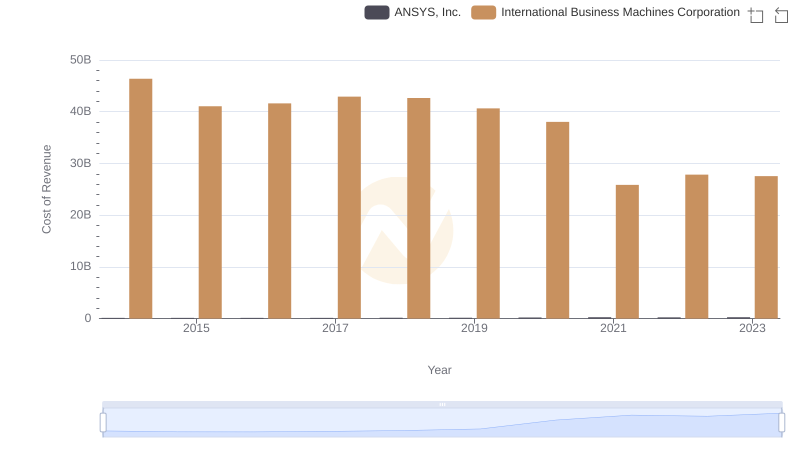

Cost of Revenue: Key Insights for International Business Machines Corporation and ANSYS, Inc.

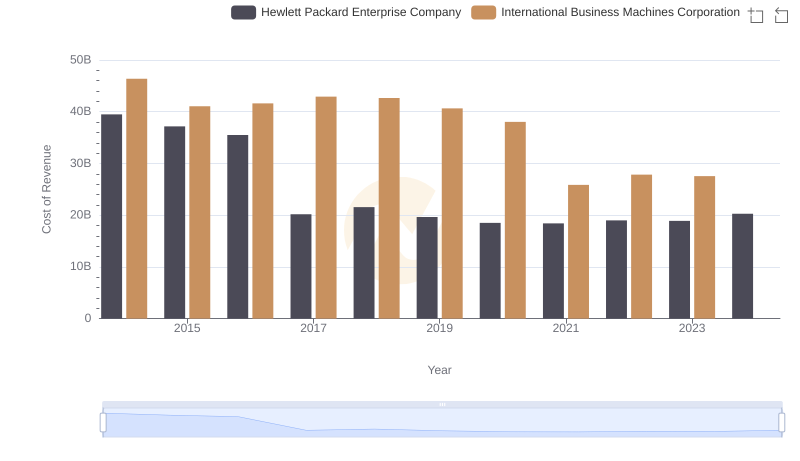

Analyzing Cost of Revenue: International Business Machines Corporation and Hewlett Packard Enterprise Company

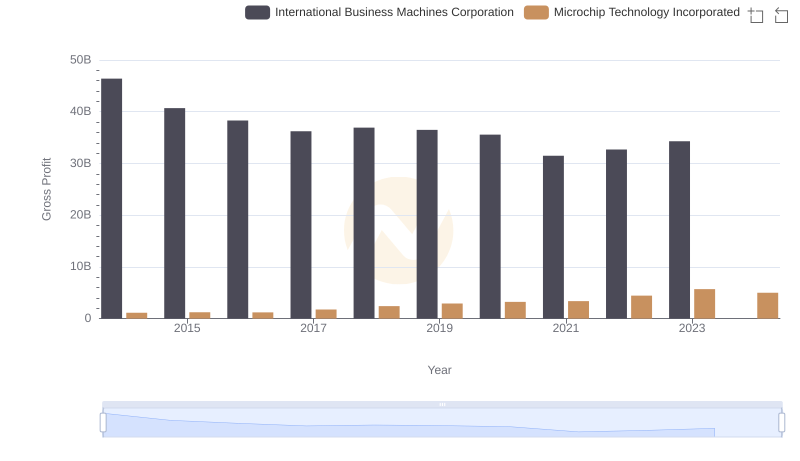

Gross Profit Analysis: Comparing International Business Machines Corporation and Microchip Technology Incorporated

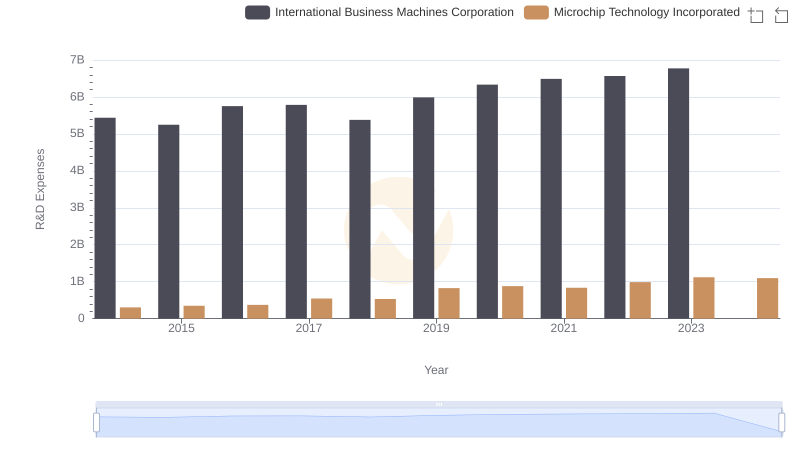

Analyzing R&D Budgets: International Business Machines Corporation vs Microchip Technology Incorporated

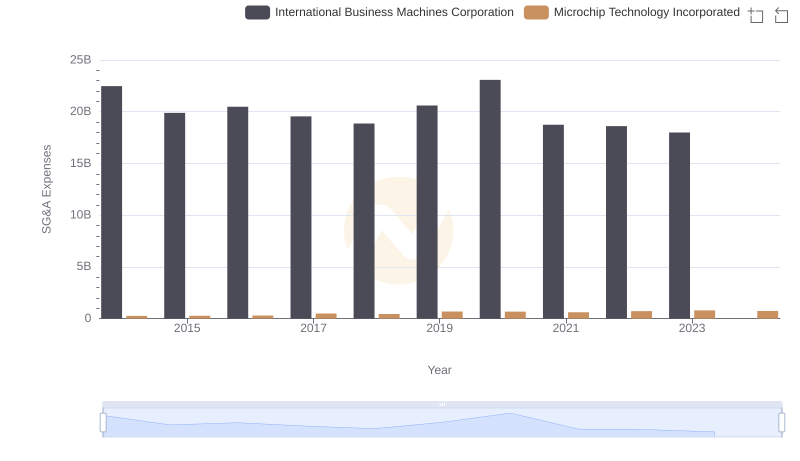

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Microchip Technology Incorporated

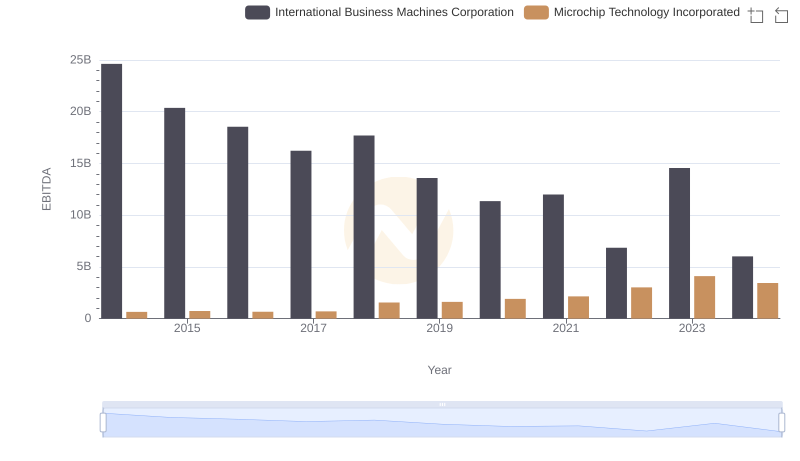

EBITDA Metrics Evaluated: International Business Machines Corporation vs Microchip Technology Incorporated