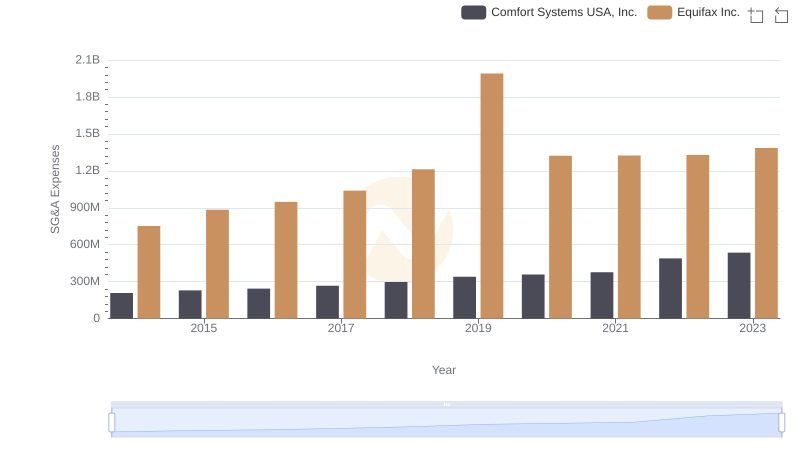

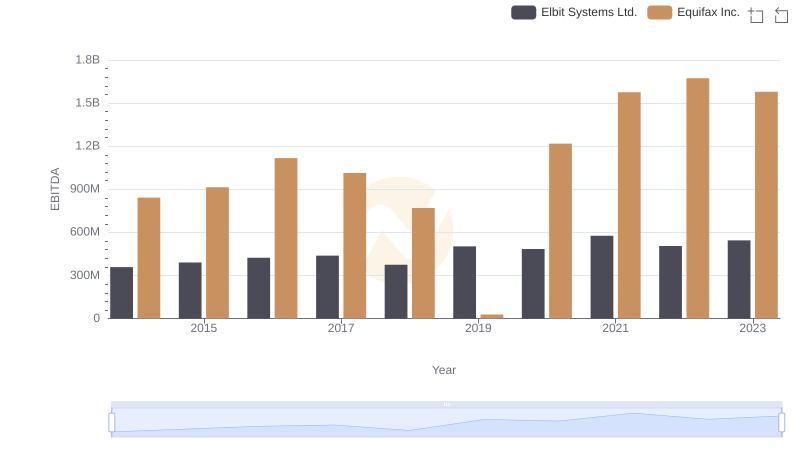

| __timestamp | Elbit Systems Ltd. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 356171000 | 751700000 |

| Thursday, January 1, 2015 | 385059000 | 884300000 |

| Friday, January 1, 2016 | 422390000 | 948200000 |

| Sunday, January 1, 2017 | 413560000 | 1039100000 |

| Monday, January 1, 2018 | 441362000 | 1213300000 |

| Tuesday, January 1, 2019 | 516149000 | 1990200000 |

| Wednesday, January 1, 2020 | 514638000 | 1322500000 |

| Friday, January 1, 2021 | 559113000 | 1324600000 |

| Saturday, January 1, 2022 | 639067000 | 1328900000 |

| Sunday, January 1, 2023 | 696022000 | 1385700000 |

| Monday, January 1, 2024 | 1450500000 |

Cracking the code

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial. Over the past decade, Equifax Inc. and Elbit Systems Ltd. have demonstrated contrasting trends in their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2023, Equifax's SG&A expenses surged by approximately 84%, peaking in 2019. This reflects a strategic expansion and investment in operational capabilities. In contrast, Elbit Systems Ltd. experienced a steady increase of around 95% in the same period, indicating a consistent growth strategy. Notably, Equifax's expenses were consistently higher, averaging 2.5 times those of Elbit Systems. This disparity highlights differing business models and market strategies. As we delve into these financial narratives, it becomes evident that operational costs are not just numbers but a reflection of corporate priorities and market positioning.

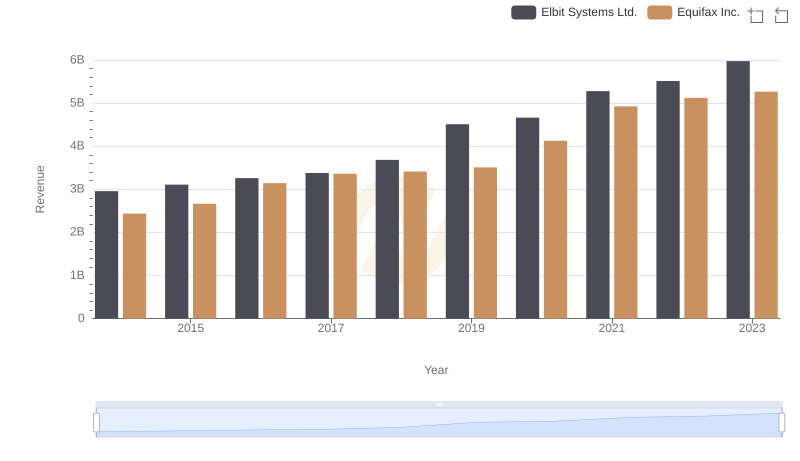

Equifax Inc. or Elbit Systems Ltd.: Who Leads in Yearly Revenue?

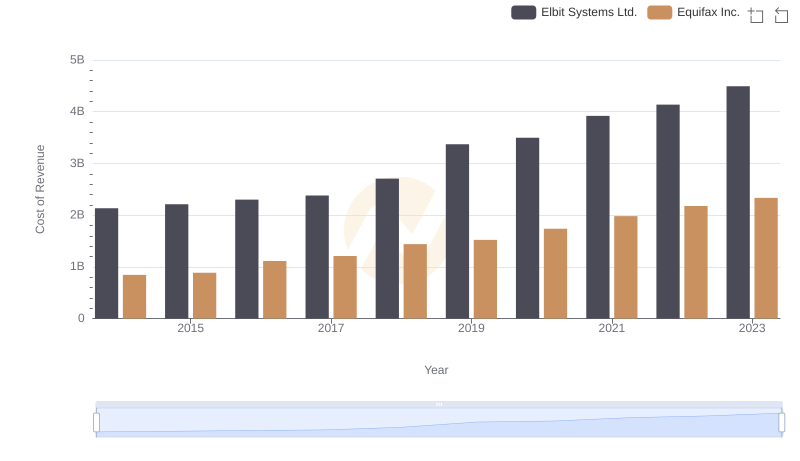

Cost of Revenue Comparison: Equifax Inc. vs Elbit Systems Ltd.

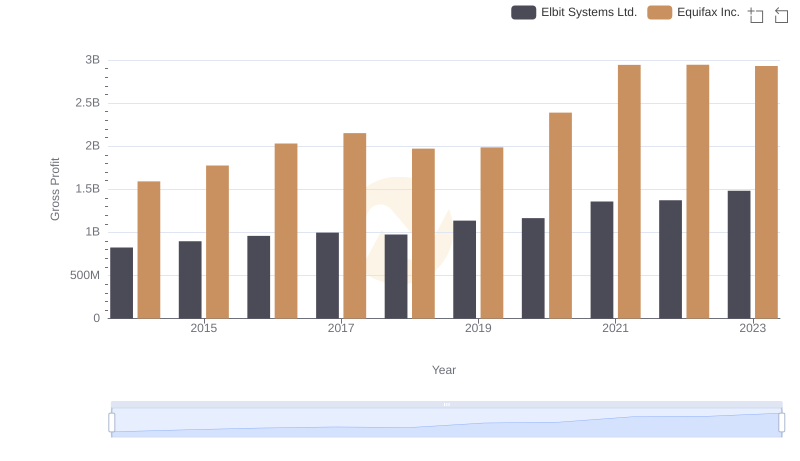

Gross Profit Analysis: Comparing Equifax Inc. and Elbit Systems Ltd.

Equifax Inc. or Comfort Systems USA, Inc.: Who Manages SG&A Costs Better?

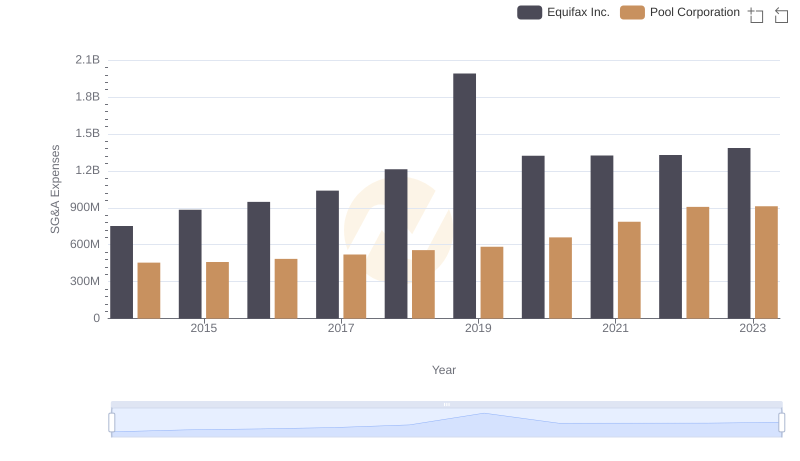

Comparing SG&A Expenses: Equifax Inc. vs Pool Corporation Trends and Insights

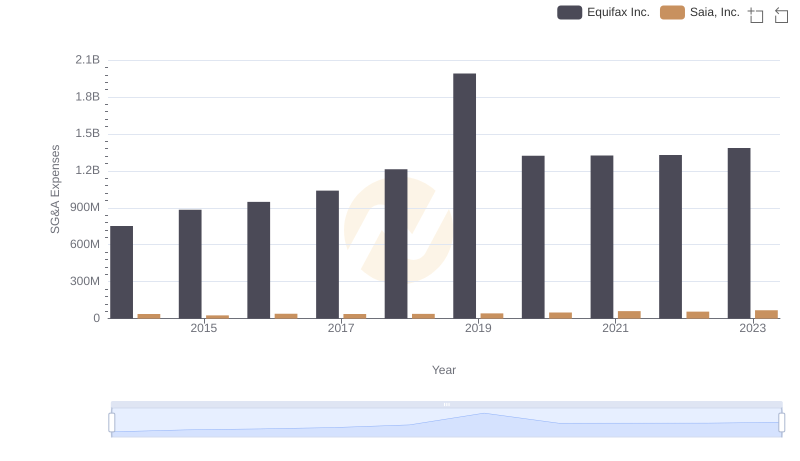

Operational Costs Compared: SG&A Analysis of Equifax Inc. and Saia, Inc.

Equifax Inc. or Curtiss-Wright Corporation: Who Manages SG&A Costs Better?

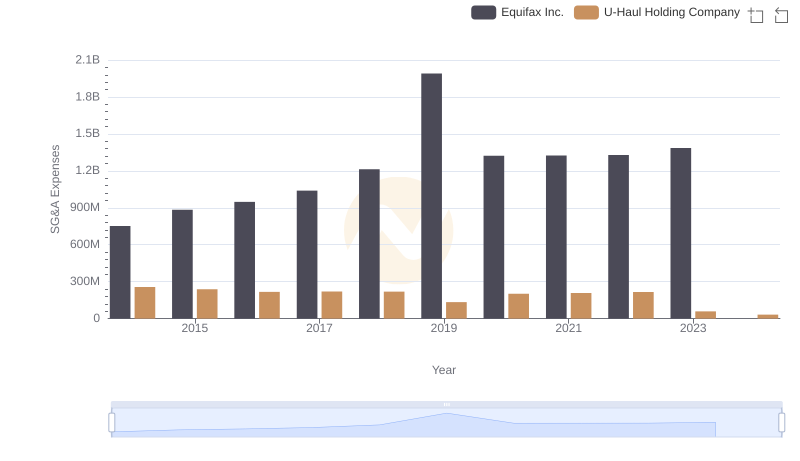

Selling, General, and Administrative Costs: Equifax Inc. vs U-Haul Holding Company

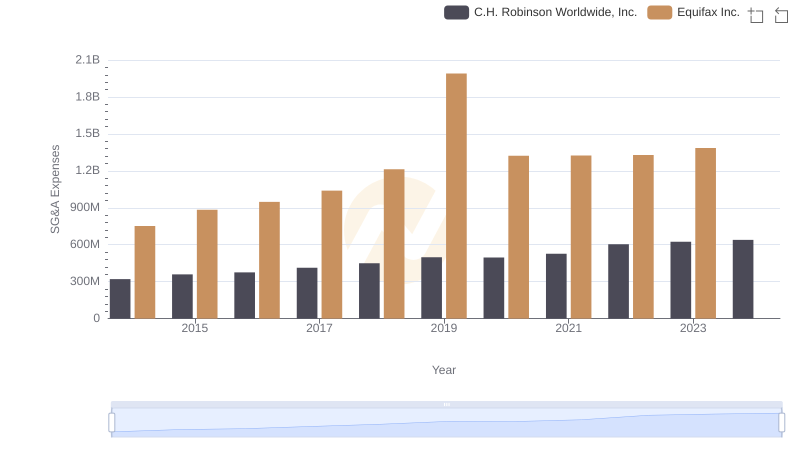

Breaking Down SG&A Expenses: Equifax Inc. vs C.H. Robinson Worldwide, Inc.

Comparative EBITDA Analysis: Equifax Inc. vs Elbit Systems Ltd.