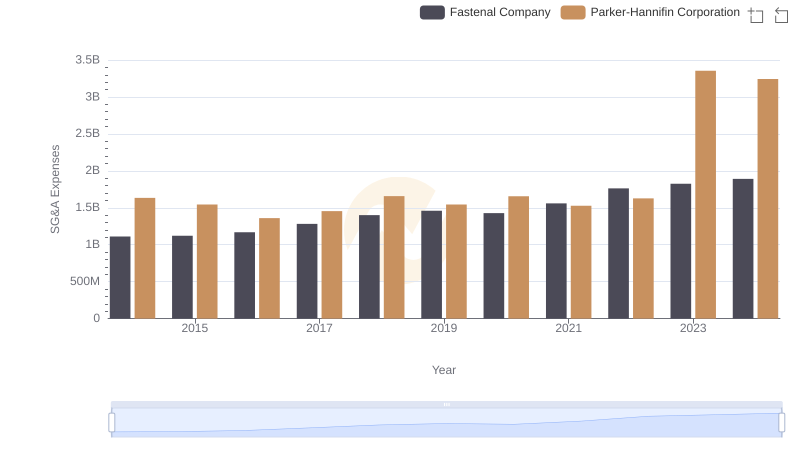

| __timestamp | Old Dominion Freight Line, Inc. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 144817000 | 1633992000 |

| Thursday, January 1, 2015 | 153589000 | 1544746000 |

| Friday, January 1, 2016 | 152391000 | 1359360000 |

| Sunday, January 1, 2017 | 177205000 | 1453935000 |

| Monday, January 1, 2018 | 194368000 | 1657152000 |

| Tuesday, January 1, 2019 | 206125000 | 1543939000 |

| Wednesday, January 1, 2020 | 184185000 | 1656553000 |

| Friday, January 1, 2021 | 223757000 | 1527302000 |

| Saturday, January 1, 2022 | 258883000 | 1627116000 |

| Sunday, January 1, 2023 | 281053000 | 3354103000 |

| Monday, January 1, 2024 | 3315177000 |

Unleashing insights

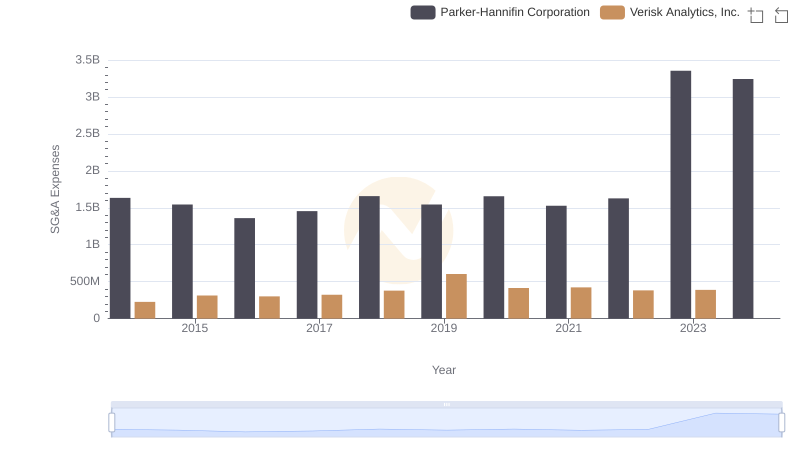

In the ever-evolving landscape of corporate finance, effective cost management is crucial. Parker-Hannifin Corporation and Old Dominion Freight Line, Inc. exemplify this through their Selling, General, and Administrative (SG&A) expenses over the past decade. From 2014 to 2023, Parker-Hannifin's SG&A expenses have shown a steady increase, peaking in 2023 with a remarkable 105% rise from 2014. Meanwhile, Old Dominion Freight Line, Inc. has experienced a 94% increase in the same period, highlighting their strategic cost management.

Interestingly, 2023 marked a significant year for Parker-Hannifin, with expenses soaring to over double their 2022 figures, indicating a potential strategic shift or investment. Old Dominion, while showing consistent growth, has maintained a more stable trajectory. This data underscores the importance of strategic financial planning in maintaining competitive advantage in the industrial and logistics sectors.

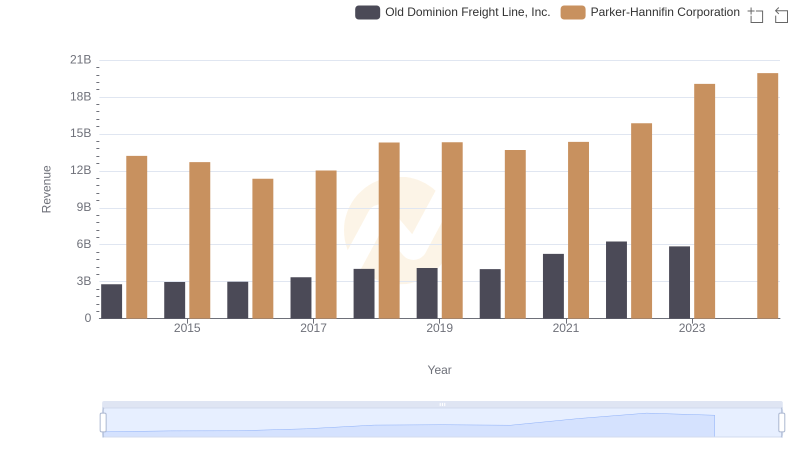

Breaking Down Revenue Trends: Parker-Hannifin Corporation vs Old Dominion Freight Line, Inc.

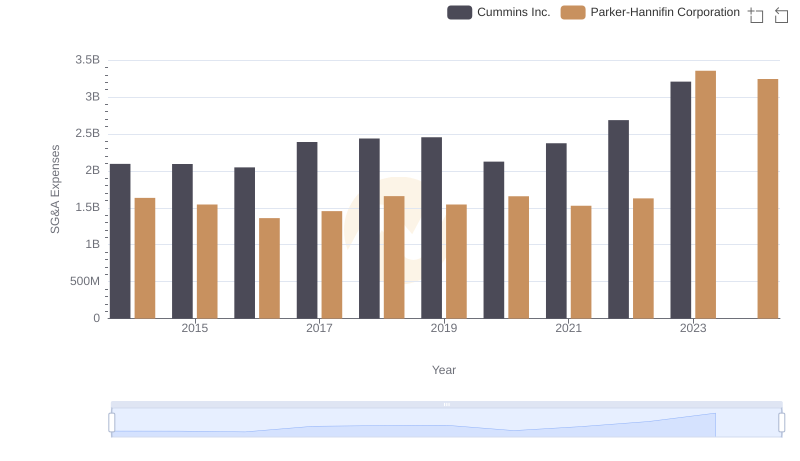

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs Cummins Inc.

Cost Management Insights: SG&A Expenses for Parker-Hannifin Corporation and Fastenal Company

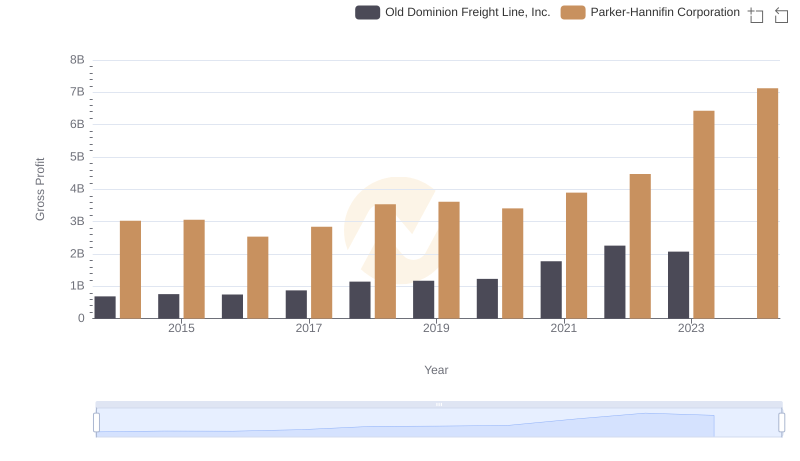

Parker-Hannifin Corporation vs Old Dominion Freight Line, Inc.: A Gross Profit Performance Breakdown

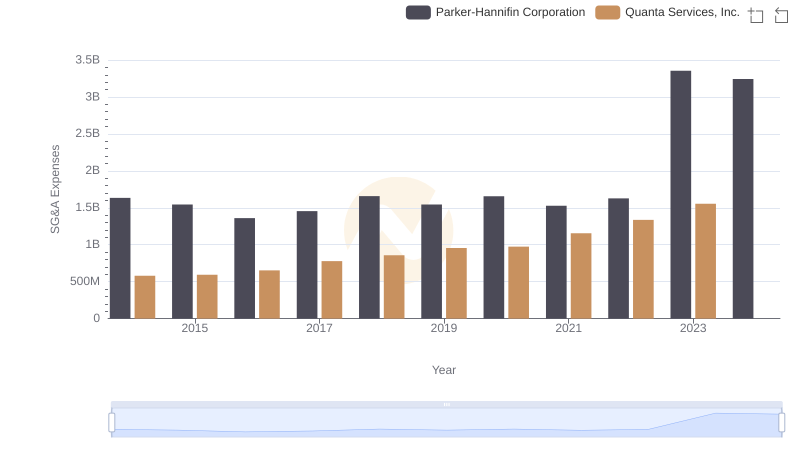

Parker-Hannifin Corporation vs Quanta Services, Inc.: SG&A Expense Trends

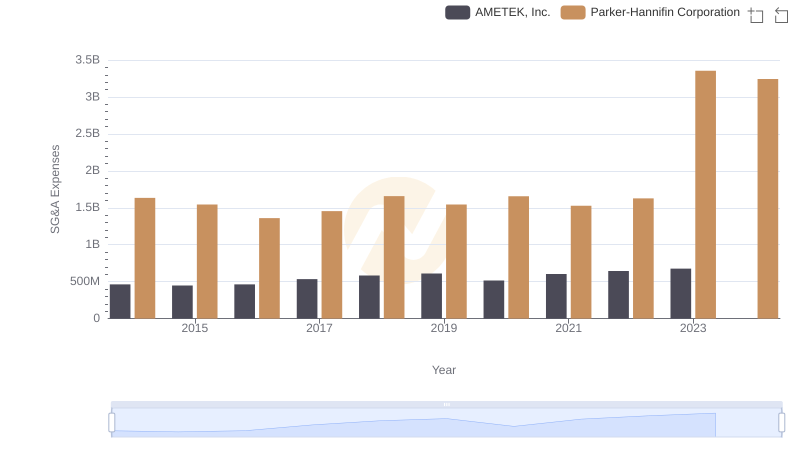

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs AMETEK, Inc.

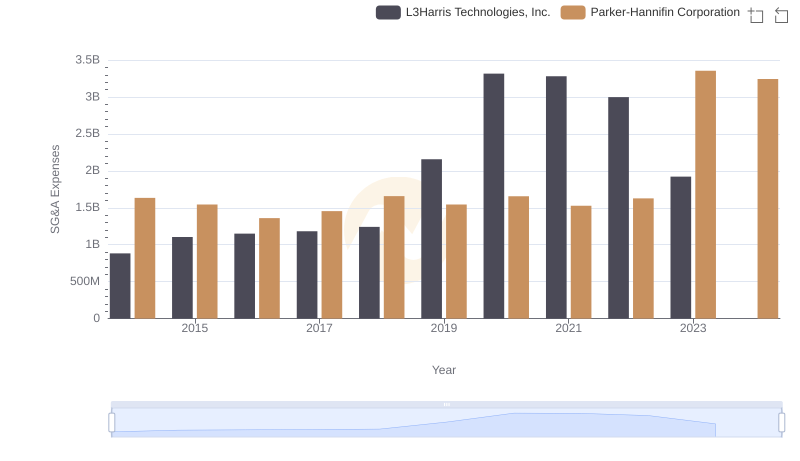

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or L3Harris Technologies, Inc.

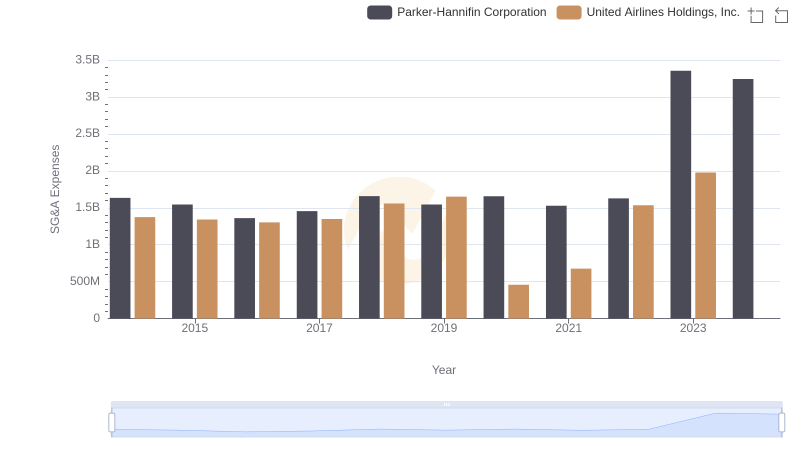

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs United Airlines Holdings, Inc.

Comparing SG&A Expenses: Parker-Hannifin Corporation vs Verisk Analytics, Inc. Trends and Insights