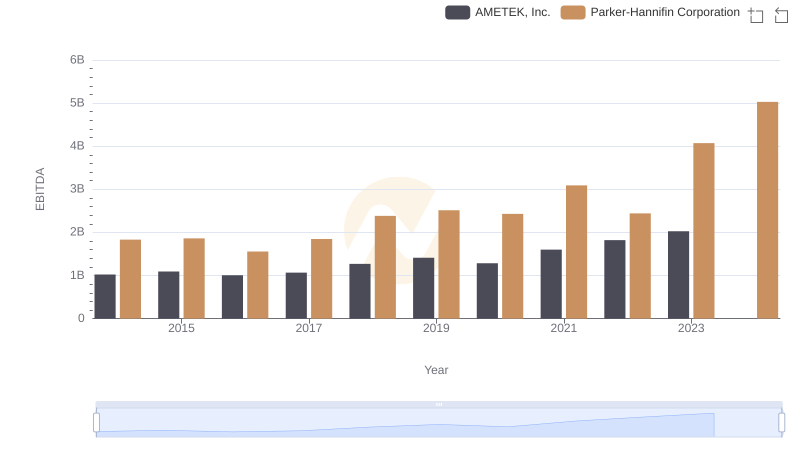

| __timestamp | AMETEK, Inc. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 462637000 | 1633992000 |

| Thursday, January 1, 2015 | 448592000 | 1544746000 |

| Friday, January 1, 2016 | 462970000 | 1359360000 |

| Sunday, January 1, 2017 | 533645000 | 1453935000 |

| Monday, January 1, 2018 | 584022000 | 1657152000 |

| Tuesday, January 1, 2019 | 610280000 | 1543939000 |

| Wednesday, January 1, 2020 | 515630000 | 1656553000 |

| Friday, January 1, 2021 | 603944000 | 1527302000 |

| Saturday, January 1, 2022 | 644577000 | 1627116000 |

| Sunday, January 1, 2023 | 677006000 | 3354103000 |

| Monday, January 1, 2024 | 696905000 | 3315177000 |

Data in motion

In the competitive landscape of industrial manufacturing, Parker-Hannifin Corporation and AMETEK, Inc. have long been titans. Over the past decade, their Selling, General, and Administrative (SG&A) expenses have revealed intriguing trends. From 2014 to 2023, Parker-Hannifin's SG&A costs surged by over 100%, peaking in 2023 with a notable increase to $3.35 billion. In contrast, AMETEK's expenses grew more modestly, with a 46% rise, reaching $677 million in 2023. This divergence highlights Parker-Hannifin's aggressive expansion and operational strategies, while AMETEK maintains a more conservative approach. The data for 2024 is incomplete, leaving room for speculation on future trajectories. As these industry leaders navigate economic challenges, their SG&A strategies will be pivotal in shaping their competitive edge.

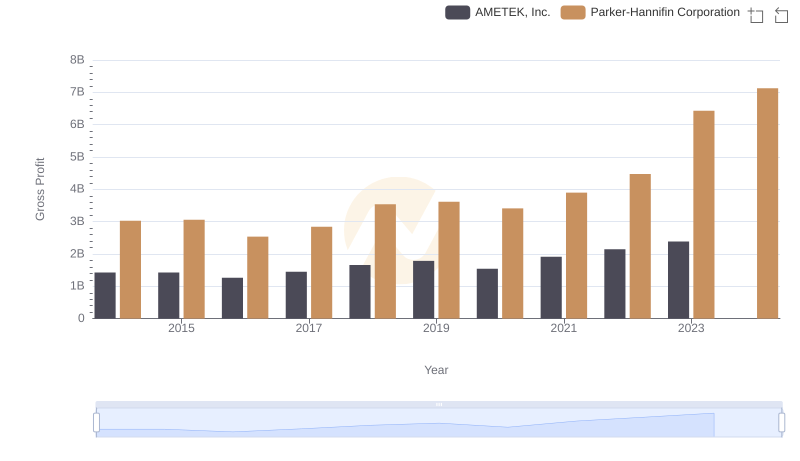

Key Insights on Gross Profit: Parker-Hannifin Corporation vs AMETEK, Inc.

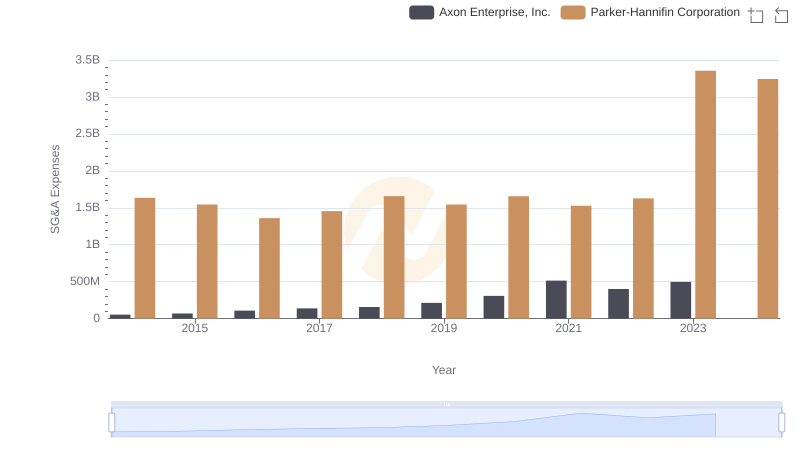

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs Axon Enterprise, Inc.

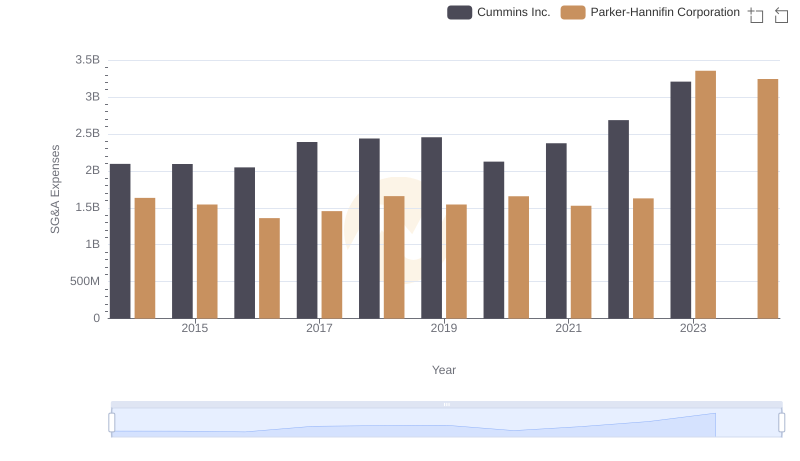

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs Cummins Inc.

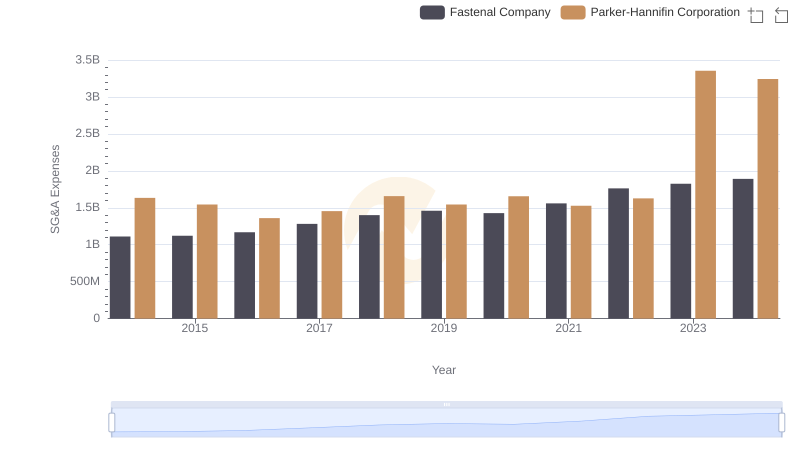

Cost Management Insights: SG&A Expenses for Parker-Hannifin Corporation and Fastenal Company

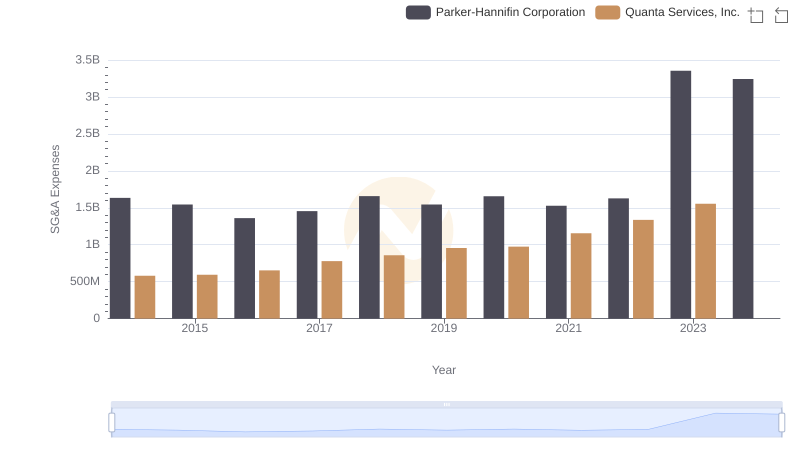

Parker-Hannifin Corporation vs Quanta Services, Inc.: SG&A Expense Trends

Cost Management Insights: SG&A Expenses for Parker-Hannifin Corporation and Old Dominion Freight Line, Inc.

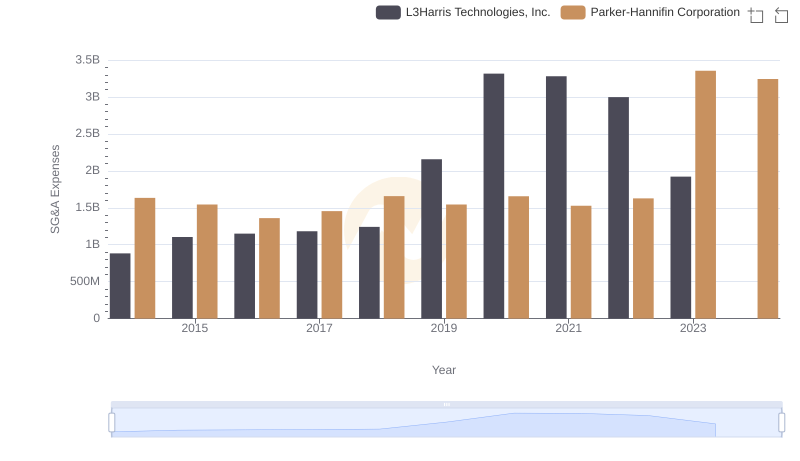

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or L3Harris Technologies, Inc.

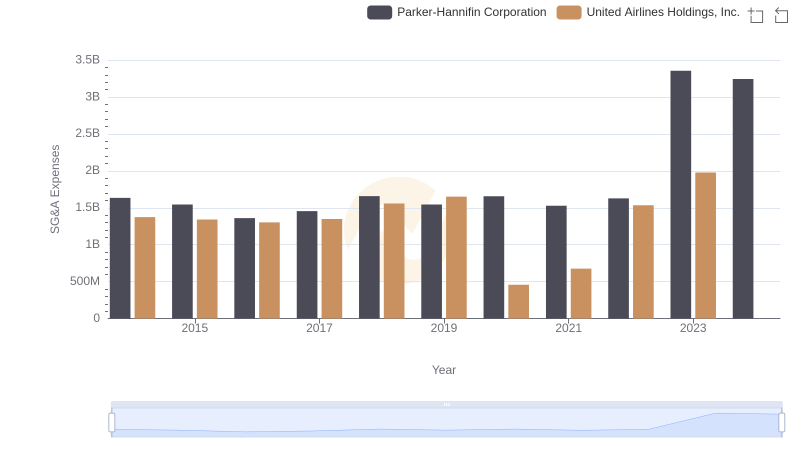

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs United Airlines Holdings, Inc.

Parker-Hannifin Corporation and AMETEK, Inc.: A Detailed Examination of EBITDA Performance