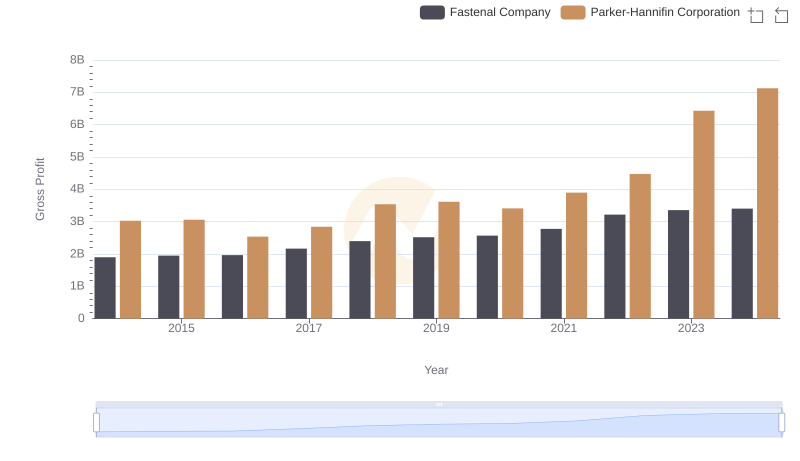

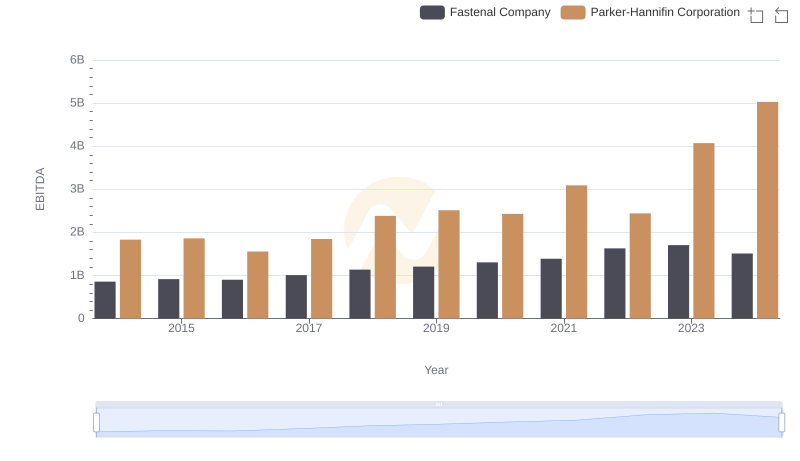

| __timestamp | Fastenal Company | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1110776000 | 1633992000 |

| Thursday, January 1, 2015 | 1121590000 | 1544746000 |

| Friday, January 1, 2016 | 1169470000 | 1359360000 |

| Sunday, January 1, 2017 | 1282800000 | 1453935000 |

| Monday, January 1, 2018 | 1400200000 | 1657152000 |

| Tuesday, January 1, 2019 | 1459400000 | 1543939000 |

| Wednesday, January 1, 2020 | 1427400000 | 1656553000 |

| Friday, January 1, 2021 | 1559800000 | 1527302000 |

| Saturday, January 1, 2022 | 1762200000 | 1627116000 |

| Sunday, January 1, 2023 | 1825800000 | 3354103000 |

| Monday, January 1, 2024 | 1891900000 | 3315177000 |

In pursuit of knowledge

In the ever-evolving landscape of industrial and commercial sectors, effective cost management remains a pivotal strategy for success. Parker-Hannifin Corporation and Fastenal Company, two industry titans, exemplify this through their Selling, General, and Administrative (SG&A) expenses over the past decade. From 2014 to 2024, Parker-Hannifin's SG&A expenses have shown a remarkable increase, peaking in 2023 with a 105% rise compared to 2014. Meanwhile, Fastenal Company has maintained a steady upward trajectory, with a 70% increase over the same period. This trend underscores the importance of strategic financial planning in maintaining competitive advantage. As we look to the future, these insights offer valuable lessons in balancing growth and cost efficiency, crucial for stakeholders and investors alike.

Parker-Hannifin Corporation or Waste Connections, Inc.: Who Manages SG&A Costs Better?

Key Insights on Gross Profit: Parker-Hannifin Corporation vs Fastenal Company

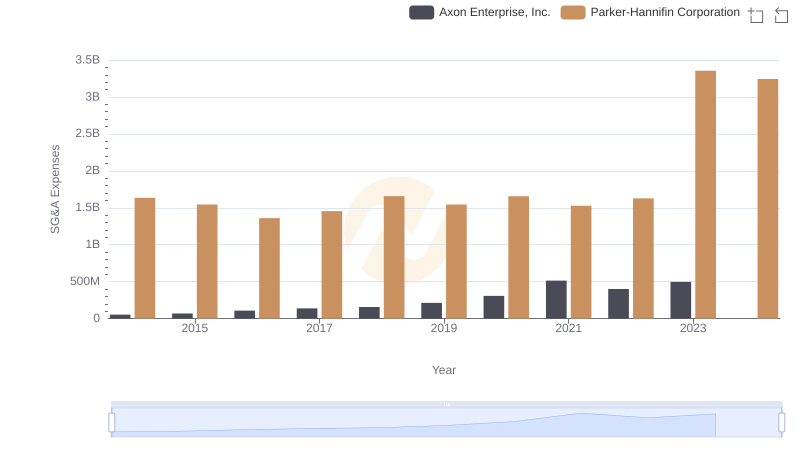

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs Axon Enterprise, Inc.

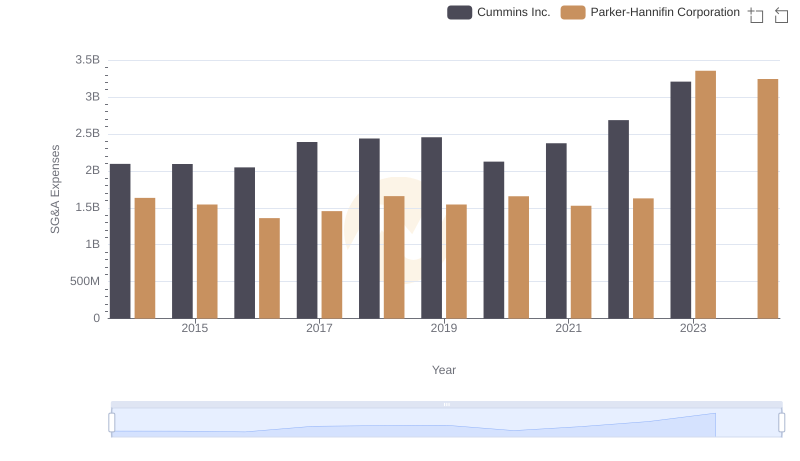

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs Cummins Inc.

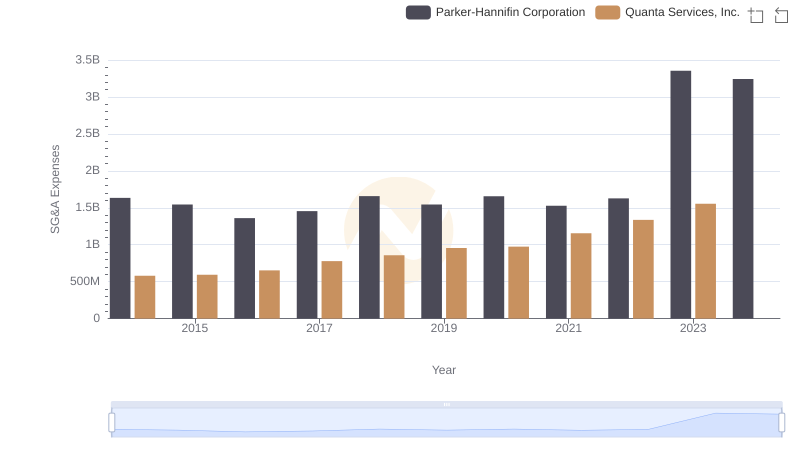

Parker-Hannifin Corporation vs Quanta Services, Inc.: SG&A Expense Trends

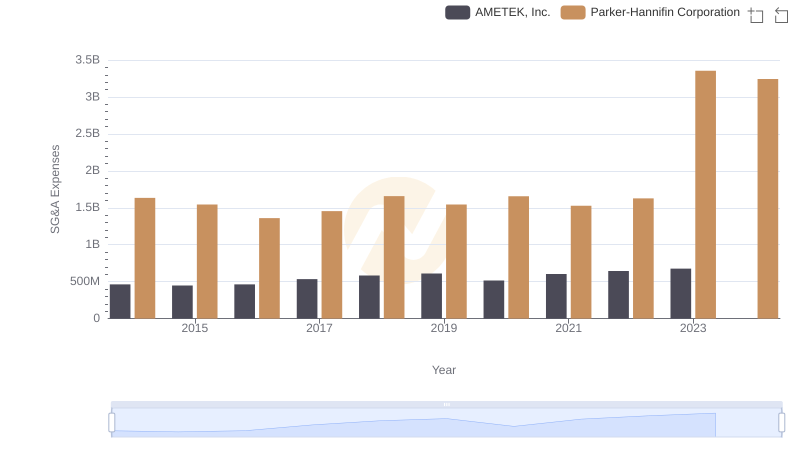

Selling, General, and Administrative Costs: Parker-Hannifin Corporation vs AMETEK, Inc.

Parker-Hannifin Corporation and Fastenal Company: A Detailed Examination of EBITDA Performance

Cost Management Insights: SG&A Expenses for Parker-Hannifin Corporation and Old Dominion Freight Line, Inc.

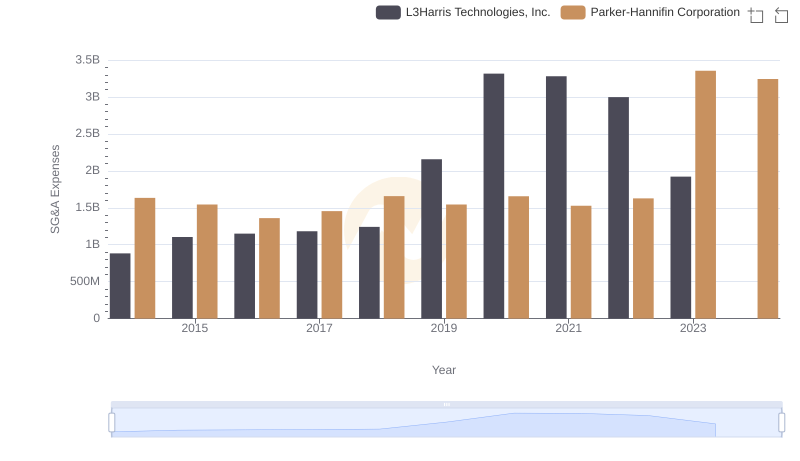

Who Optimizes SG&A Costs Better? Parker-Hannifin Corporation or L3Harris Technologies, Inc.