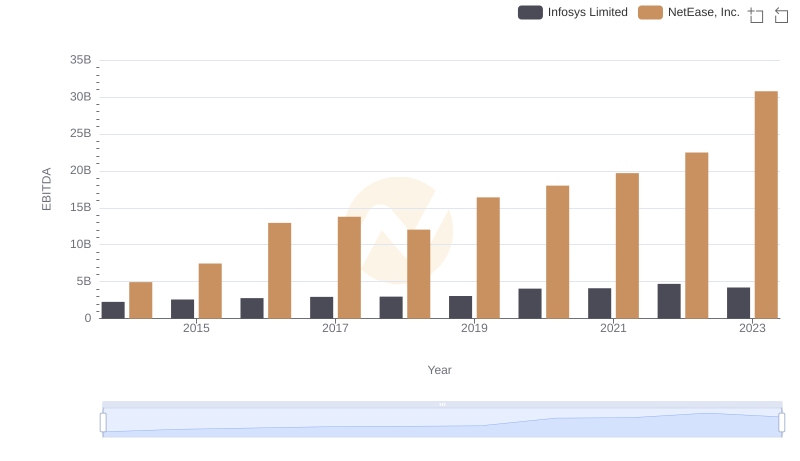

| __timestamp | Infosys Limited | NetEase, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1079000000 | 2362667000 |

| Thursday, January 1, 2015 | 1176000000 | 3972624000 |

| Friday, January 1, 2016 | 1020000000 | 5987969000 |

| Sunday, January 1, 2017 | 1279000000 | 9387454000 |

| Monday, January 1, 2018 | 1220000000 | 12718007000 |

| Tuesday, January 1, 2019 | 1504000000 | 9351425000 |

| Wednesday, January 1, 2020 | 1223000000 | 14075615000 |

| Friday, January 1, 2021 | 1391000000 | 16477740000 |

| Saturday, January 1, 2022 | 1678000000 | 18098519000 |

| Sunday, January 1, 2023 | 1632000000 | 18869340000 |

Cracking the code

In the ever-evolving landscape of global business, effective cost management is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry titans: Infosys Limited and NetEase, Inc., from 2014 to 2023. Over this period, Infosys Limited's SG&A expenses have shown a steady increase, peaking at approximately 1.68 billion in 2022, reflecting a growth of around 56% from 2014. Meanwhile, NetEase, Inc. has experienced a more dramatic rise, with expenses surging by nearly 700%, reaching close to 18.87 billion in 2023. This stark contrast highlights differing strategic approaches to cost management and expansion. As businesses navigate the complexities of the modern economy, understanding these trends offers valuable insights into the financial strategies of leading corporations.

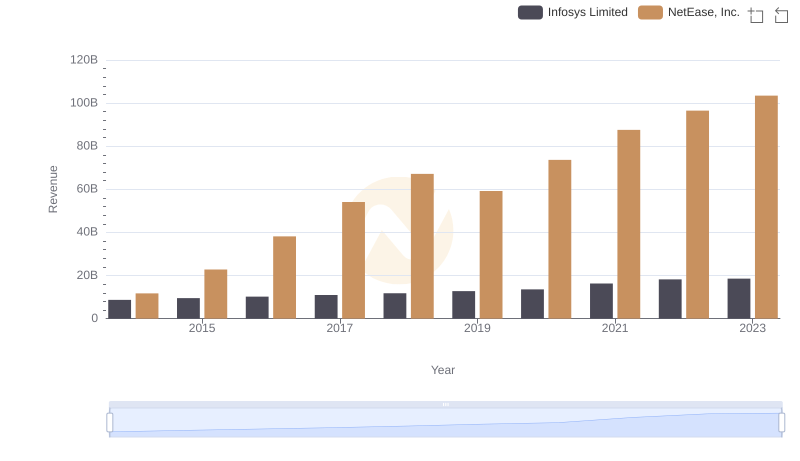

Infosys Limited vs NetEase, Inc.: Examining Key Revenue Metrics

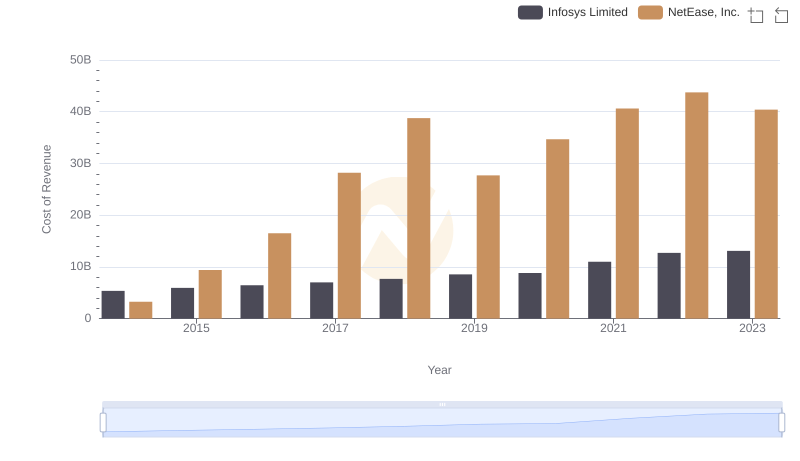

Cost of Revenue Trends: Infosys Limited vs NetEase, Inc.

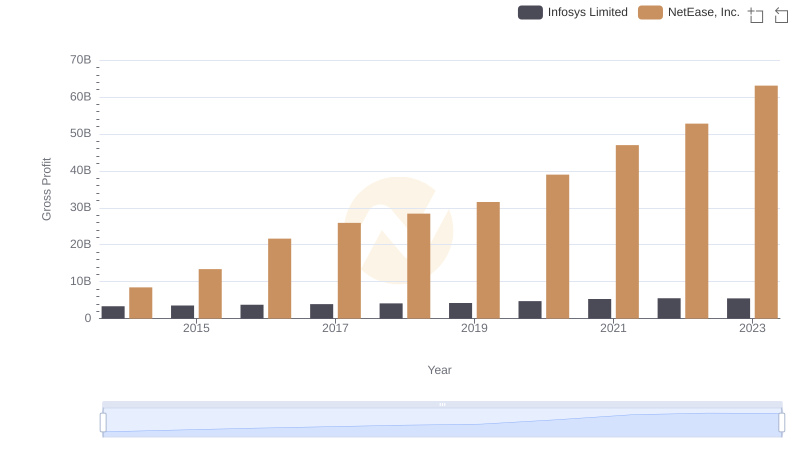

Gross Profit Comparison: Infosys Limited and NetEase, Inc. Trends

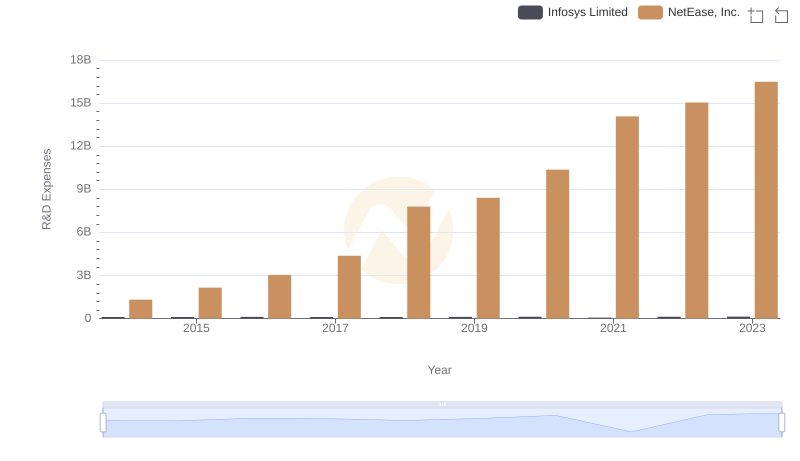

Infosys Limited or NetEase, Inc.: Who Invests More in Innovation?

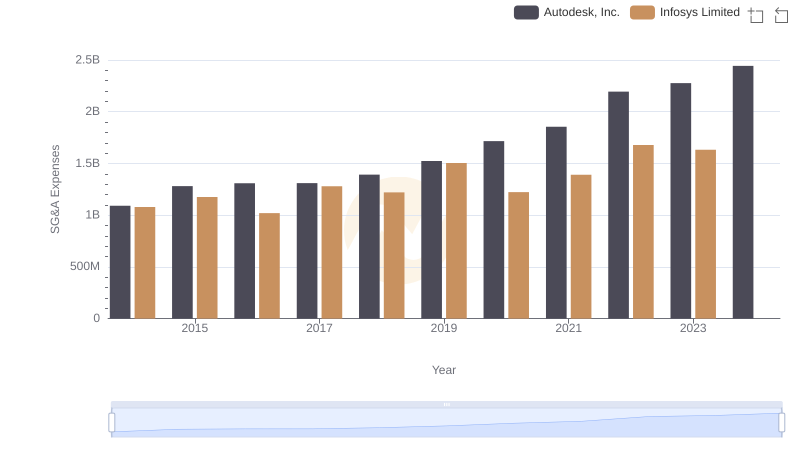

Infosys Limited and Autodesk, Inc.: SG&A Spending Patterns Compared

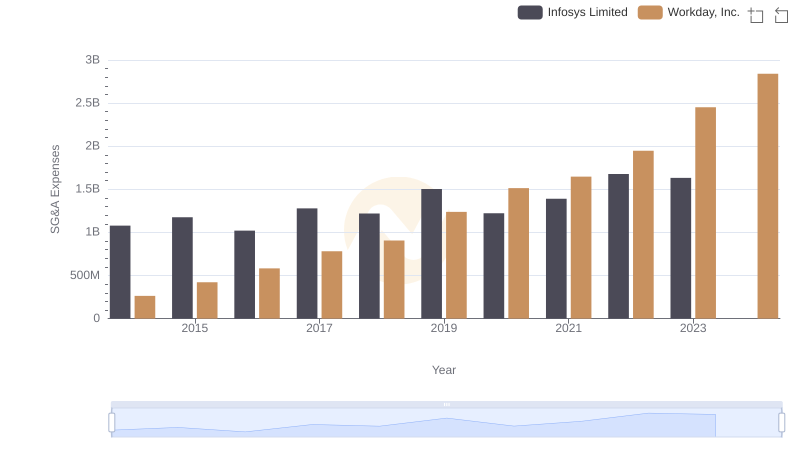

Operational Costs Compared: SG&A Analysis of Infosys Limited and Workday, Inc.

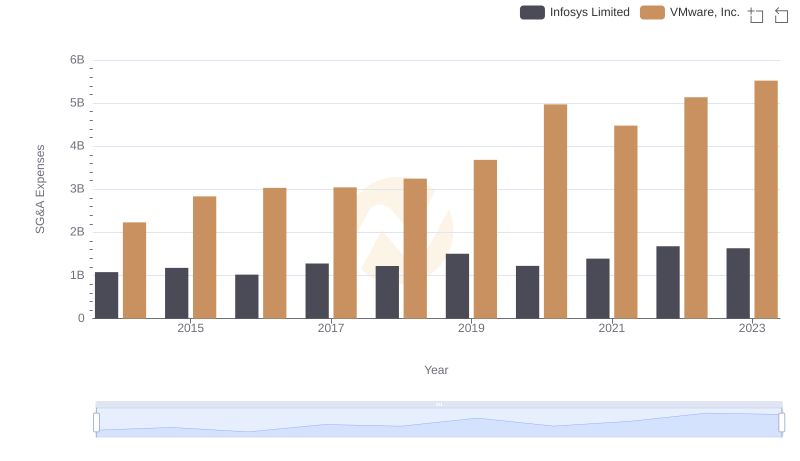

SG&A Efficiency Analysis: Comparing Infosys Limited and VMware, Inc.

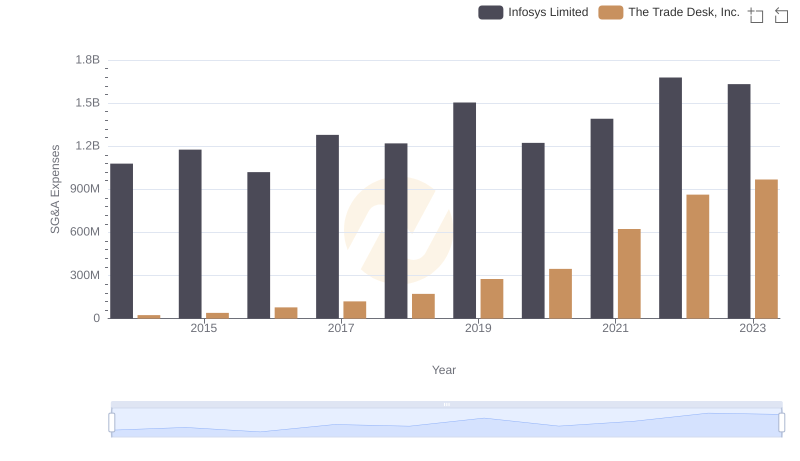

Selling, General, and Administrative Costs: Infosys Limited vs The Trade Desk, Inc.

SG&A Efficiency Analysis: Comparing Infosys Limited and NXP Semiconductors N.V.

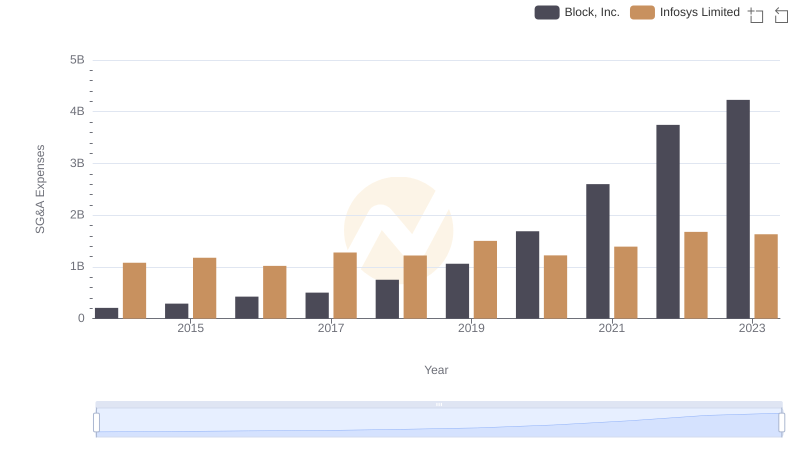

Infosys Limited vs Block, Inc.: SG&A Expense Trends

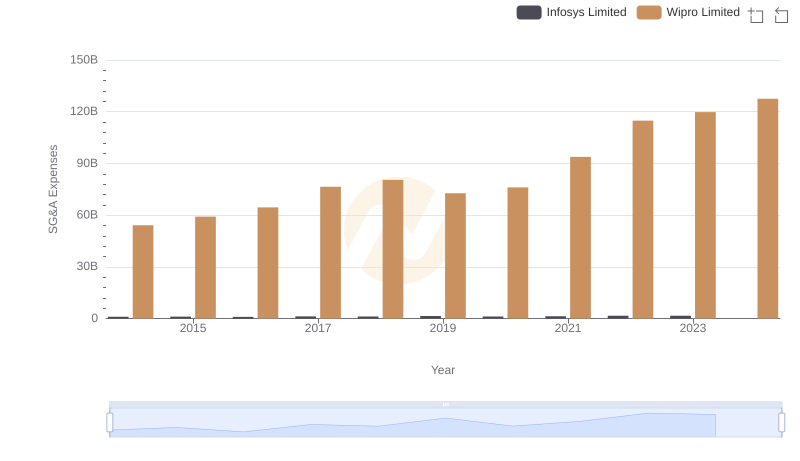

Cost Management Insights: SG&A Expenses for Infosys Limited and Wipro Limited

A Side-by-Side Analysis of EBITDA: Infosys Limited and NetEase, Inc.