| __timestamp | Infosys Limited | NXP Semiconductors N.V. |

|---|---|---|

| Wednesday, January 1, 2014 | 1079000000 | 838000000 |

| Thursday, January 1, 2015 | 1176000000 | 922000000 |

| Friday, January 1, 2016 | 1020000000 | 1141000000 |

| Sunday, January 1, 2017 | 1279000000 | 1090000000 |

| Monday, January 1, 2018 | 1220000000 | 993000000 |

| Tuesday, January 1, 2019 | 1504000000 | 924000000 |

| Wednesday, January 1, 2020 | 1223000000 | 879000000 |

| Friday, January 1, 2021 | 1391000000 | 956000000 |

| Saturday, January 1, 2022 | 1678000000 | 1066000000 |

| Sunday, January 1, 2023 | 1632000000 | 1159000000 |

Unlocking the unknown

In the ever-evolving landscape of global technology, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. This analysis compares Infosys Limited and NXP Semiconductors N.V. over a decade, from 2014 to 2023. Infosys, a leader in IT services, consistently outpaced NXP in SG&A spending, peaking at approximately 1.68 billion in 2022. Meanwhile, NXP, a semiconductor powerhouse, maintained a more conservative approach, with its highest SG&A expenses reaching around 1.16 billion in 2023.

Despite Infosys's higher absolute spending, both companies showed a similar upward trend, with Infosys's SG&A expenses growing by about 51% and NXP's by 38% over the period. This reflects their strategic investments in operational efficiency and market expansion. As these tech titans continue to innovate, their SG&A strategies will remain pivotal in shaping their competitive edge.

Revenue Insights: Infosys Limited and NXP Semiconductors N.V. Performance Compared

Analyzing Cost of Revenue: Infosys Limited and NXP Semiconductors N.V.

Gross Profit Analysis: Comparing Infosys Limited and NXP Semiconductors N.V.

Research and Development Investment: Infosys Limited vs NXP Semiconductors N.V.

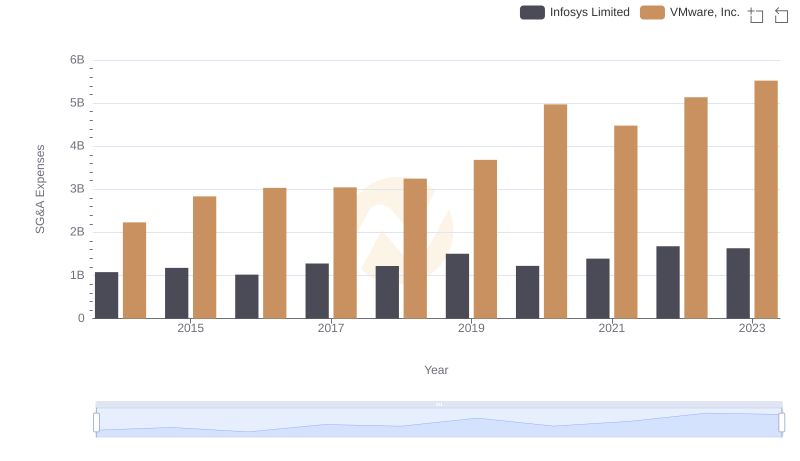

SG&A Efficiency Analysis: Comparing Infosys Limited and VMware, Inc.

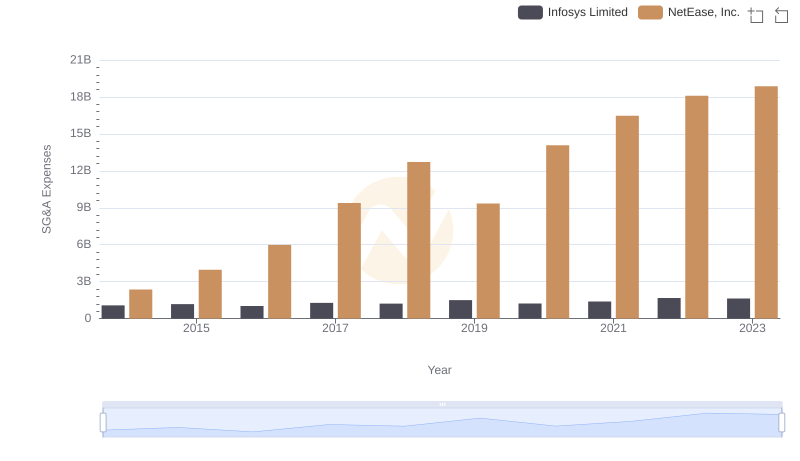

Cost Management Insights: SG&A Expenses for Infosys Limited and NetEase, Inc.

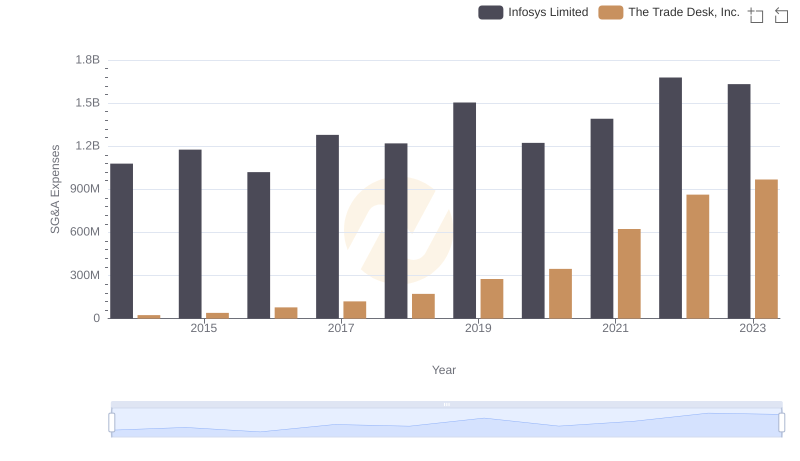

Selling, General, and Administrative Costs: Infosys Limited vs The Trade Desk, Inc.

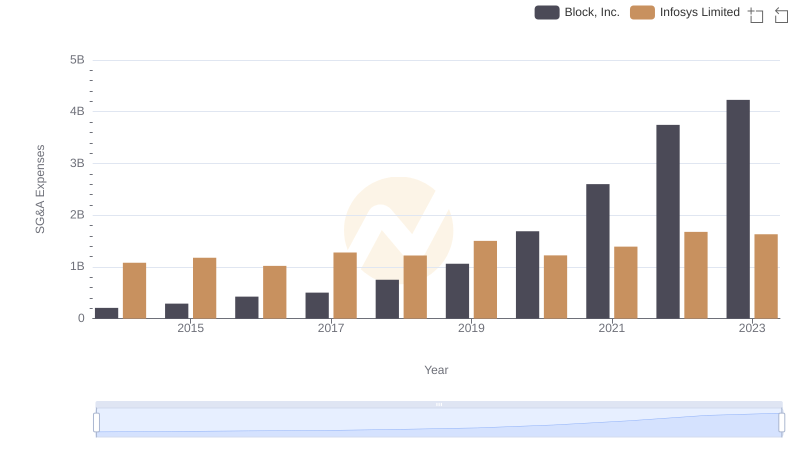

Infosys Limited vs Block, Inc.: SG&A Expense Trends

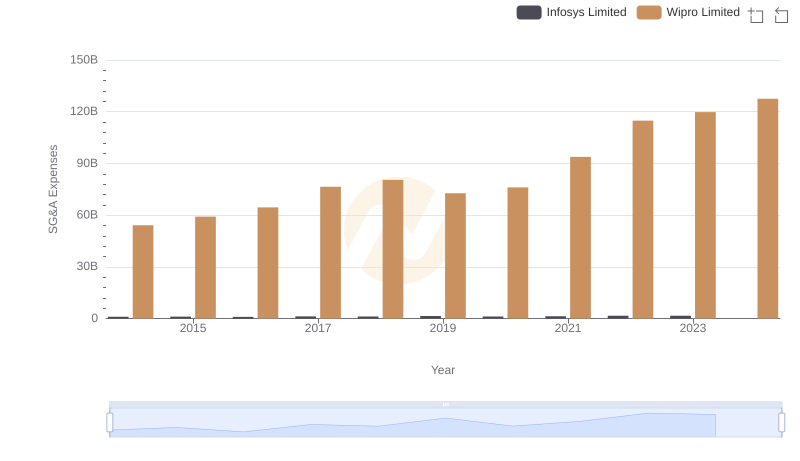

Cost Management Insights: SG&A Expenses for Infosys Limited and Wipro Limited

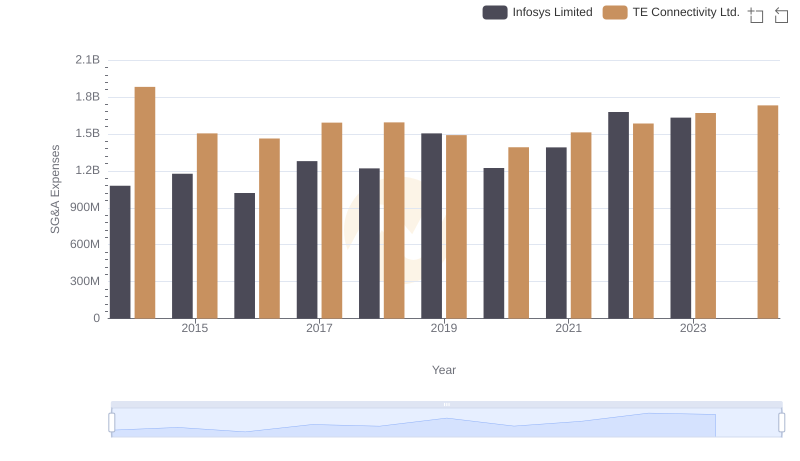

Breaking Down SG&A Expenses: Infosys Limited vs TE Connectivity Ltd.

EBITDA Metrics Evaluated: Infosys Limited vs NXP Semiconductors N.V.

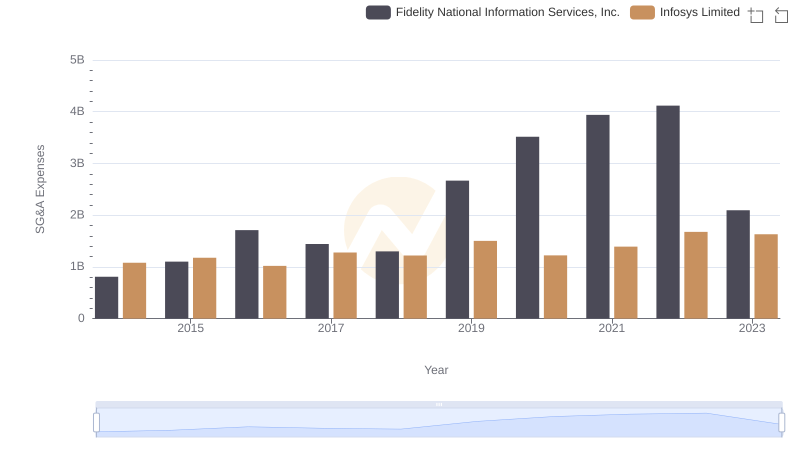

Operational Costs Compared: SG&A Analysis of Infosys Limited and Fidelity National Information Services, Inc.