| __timestamp | Infosys Limited | Take-Two Interactive Software, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1079000000 | 402370000 |

| Thursday, January 1, 2015 | 1176000000 | 410434000 |

| Friday, January 1, 2016 | 1020000000 | 390761000 |

| Sunday, January 1, 2017 | 1279000000 | 496862000 |

| Monday, January 1, 2018 | 1220000000 | 503920000 |

| Tuesday, January 1, 2019 | 1504000000 | 672634000 |

| Wednesday, January 1, 2020 | 1223000000 | 776659000 |

| Friday, January 1, 2021 | 1391000000 | 835668000 |

| Saturday, January 1, 2022 | 1678000000 | 1027284000 |

| Sunday, January 1, 2023 | 1632000000 | 2435700000 |

| Monday, January 1, 2024 | 2266300000 |

Unleashing insights

In the competitive world of business, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. This analysis compares Infosys Limited and Take-Two Interactive Software, Inc. over a decade, from 2014 to 2023. Infosys, a global leader in IT services, consistently maintained its SG&A expenses, with a notable increase of around 51% from 2014 to 2023. In contrast, Take-Two Interactive, a major player in the gaming industry, saw a staggering 505% rise in SG&A costs during the same period.

While Infosys's expenses peaked in 2022, Take-Two's costs surged dramatically in 2023, reaching their highest point. This suggests that Infosys has been more effective in optimizing its SG&A costs over the years. However, the absence of data for Infosys in 2024 leaves room for speculation on future trends. Understanding these dynamics is essential for investors and industry analysts alike.

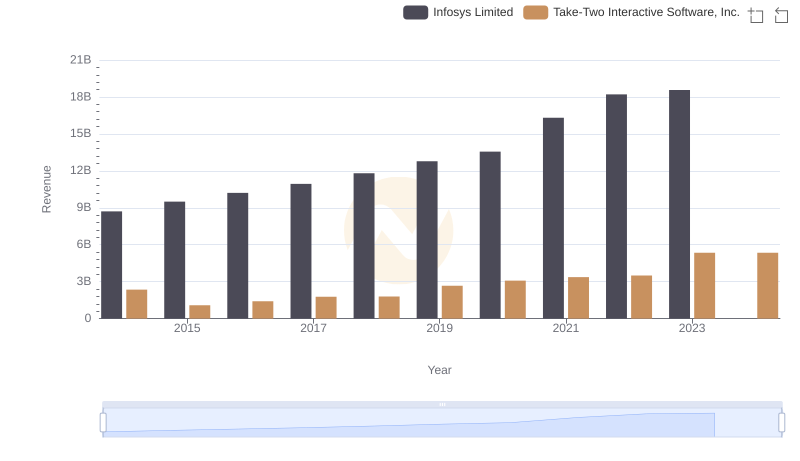

Infosys Limited vs Take-Two Interactive Software, Inc.: Examining Key Revenue Metrics

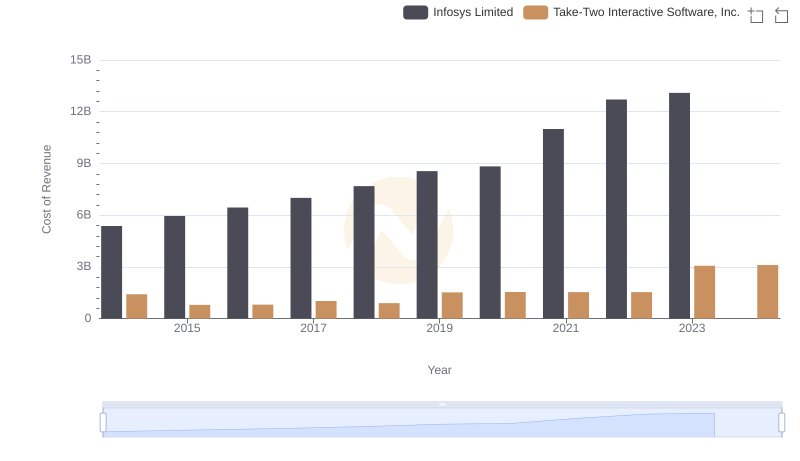

Analyzing Cost of Revenue: Infosys Limited and Take-Two Interactive Software, Inc.

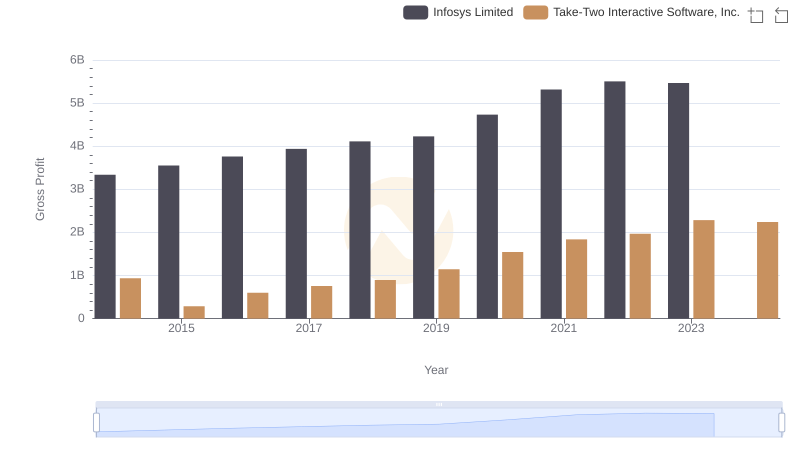

Gross Profit Trends Compared: Infosys Limited vs Take-Two Interactive Software, Inc.

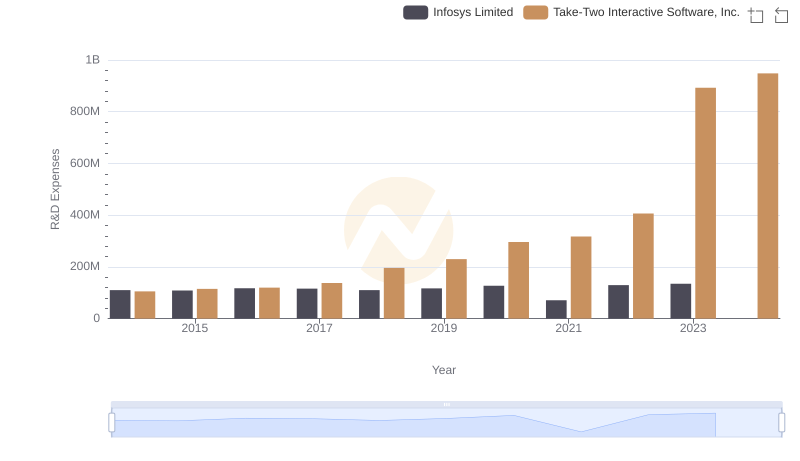

Infosys Limited or Take-Two Interactive Software, Inc.: Who Invests More in Innovation?

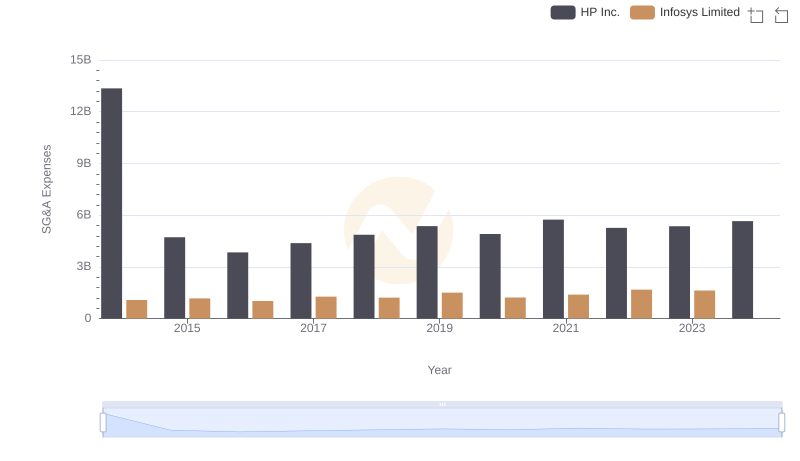

Infosys Limited and HP Inc.: SG&A Spending Patterns Compared

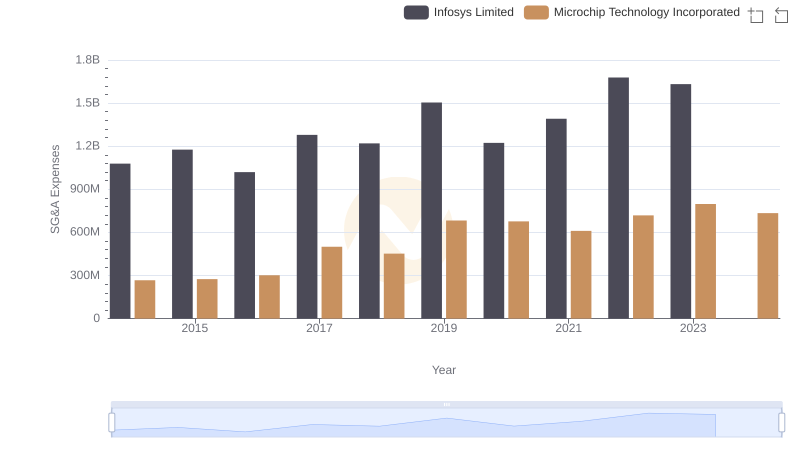

Comparing SG&A Expenses: Infosys Limited vs Microchip Technology Incorporated Trends and Insights

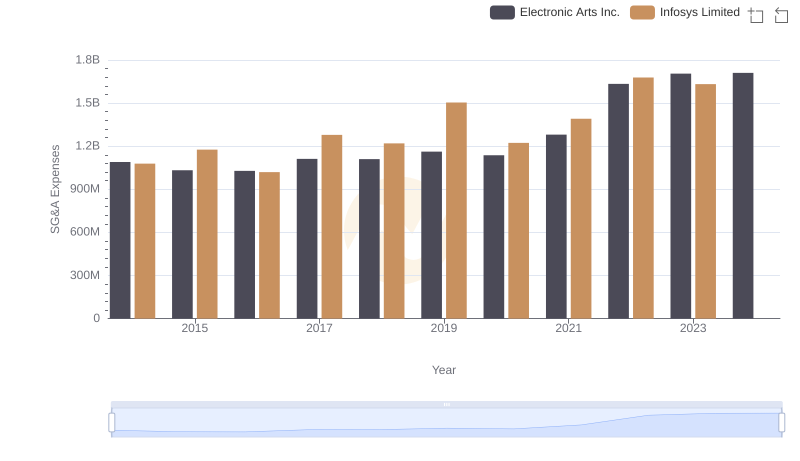

Infosys Limited or Electronic Arts Inc.: Who Manages SG&A Costs Better?

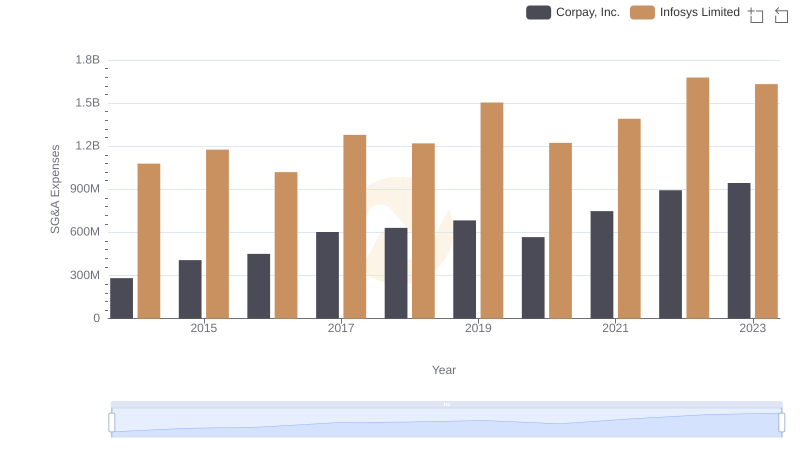

Comparing SG&A Expenses: Infosys Limited vs Corpay, Inc. Trends and Insights

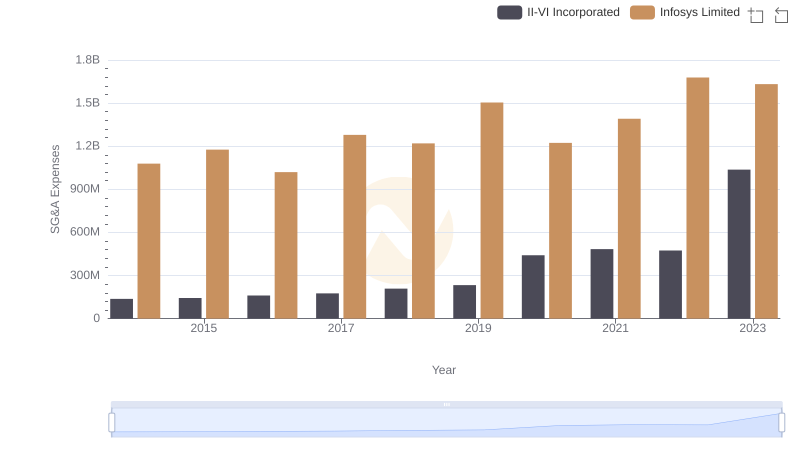

Cost Management Insights: SG&A Expenses for Infosys Limited and II-VI Incorporated

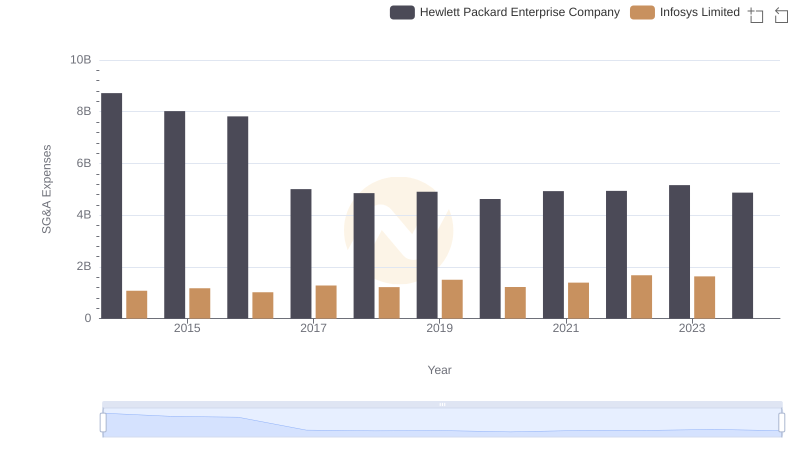

Who Optimizes SG&A Costs Better? Infosys Limited or Hewlett Packard Enterprise Company

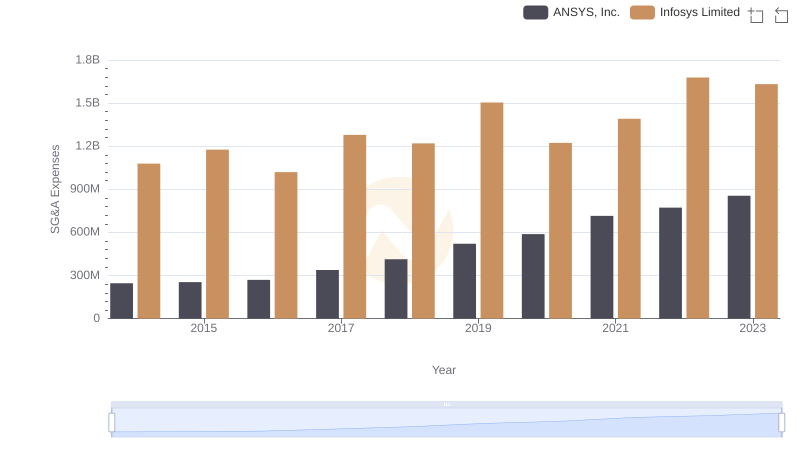

Comparing SG&A Expenses: Infosys Limited vs ANSYS, Inc. Trends and Insights

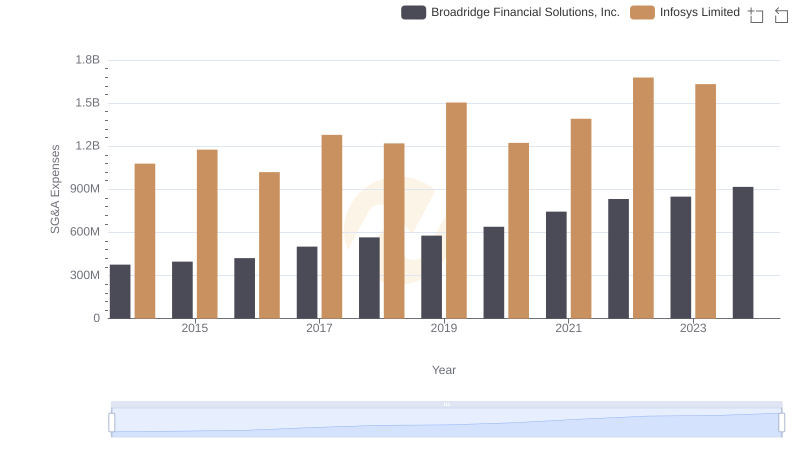

Comparing SG&A Expenses: Infosys Limited vs Broadridge Financial Solutions, Inc. Trends and Insights