| __timestamp | Electronic Arts Inc. | Infosys Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 1090000000 | 1079000000 |

| Thursday, January 1, 2015 | 1033000000 | 1176000000 |

| Friday, January 1, 2016 | 1028000000 | 1020000000 |

| Sunday, January 1, 2017 | 1112000000 | 1279000000 |

| Monday, January 1, 2018 | 1110000000 | 1220000000 |

| Tuesday, January 1, 2019 | 1162000000 | 1504000000 |

| Wednesday, January 1, 2020 | 1137000000 | 1223000000 |

| Friday, January 1, 2021 | 1281000000 | 1391000000 |

| Saturday, January 1, 2022 | 1634000000 | 1678000000 |

| Sunday, January 1, 2023 | 1705000000 | 1632000000 |

| Monday, January 1, 2024 | 1710000000 |

Unleashing the power of data

In the ever-evolving landscape of global business, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. This analysis delves into the SG&A cost management of two industry giants: Infosys Limited, a leader in IT services, and Electronic Arts Inc., a titan in the gaming industry, from 2014 to 2023.

Over the past decade, Infosys and Electronic Arts have shown distinct strategies in managing their SG&A expenses. Infosys, with a mean SG&A expense of approximately $1.32 billion, has seen a steady increase, peaking in 2022. Meanwhile, Electronic Arts, with a slightly lower mean of $1.27 billion, experienced a significant rise in 2023, reaching its highest at $1.71 billion.

While both companies have shown growth in SG&A expenses, Infosys's consistent management reflects a stable approach, whereas Electronic Arts's recent surge suggests a strategic shift. Understanding these trends can offer valuable insights into their operational efficiencies and future financial strategies.

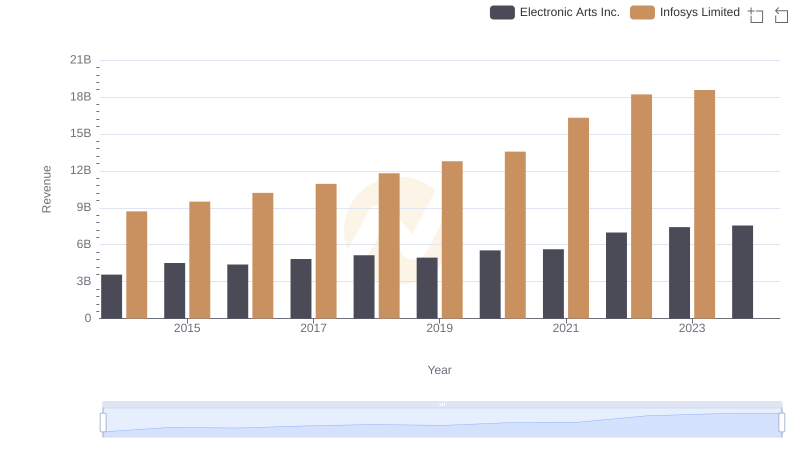

Infosys Limited vs Electronic Arts Inc.: Annual Revenue Growth Compared

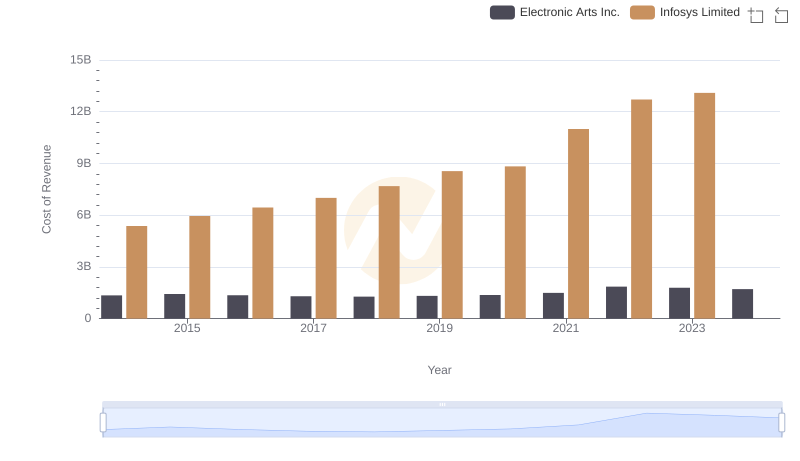

Analyzing Cost of Revenue: Infosys Limited and Electronic Arts Inc.

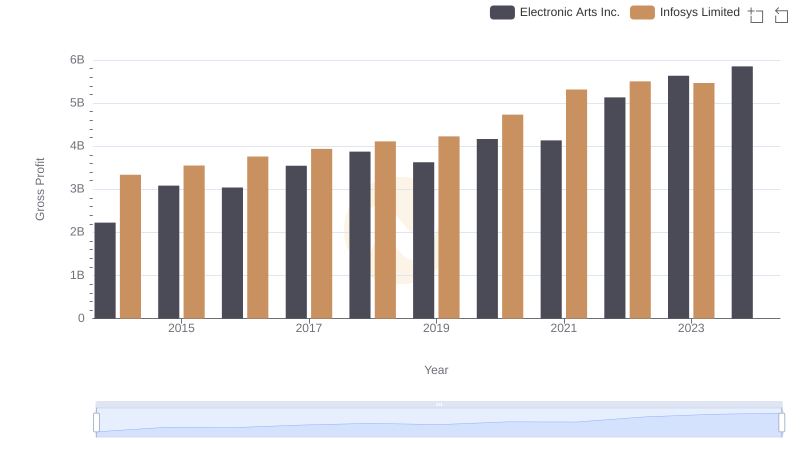

Who Generates Higher Gross Profit? Infosys Limited or Electronic Arts Inc.

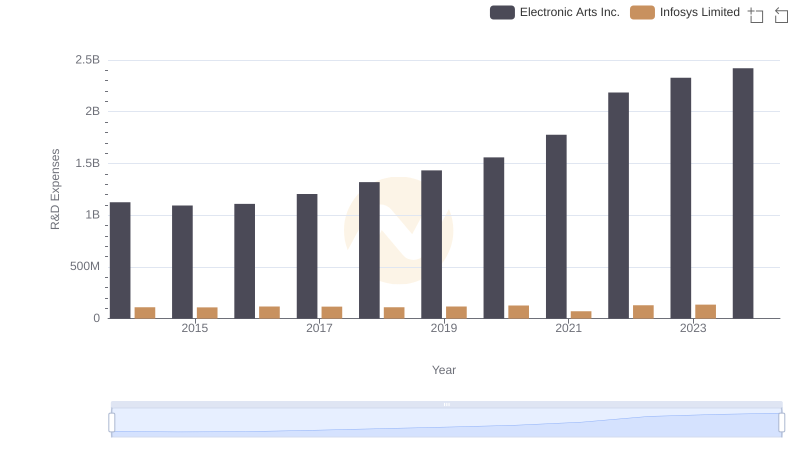

Comparing Innovation Spending: Infosys Limited and Electronic Arts Inc.

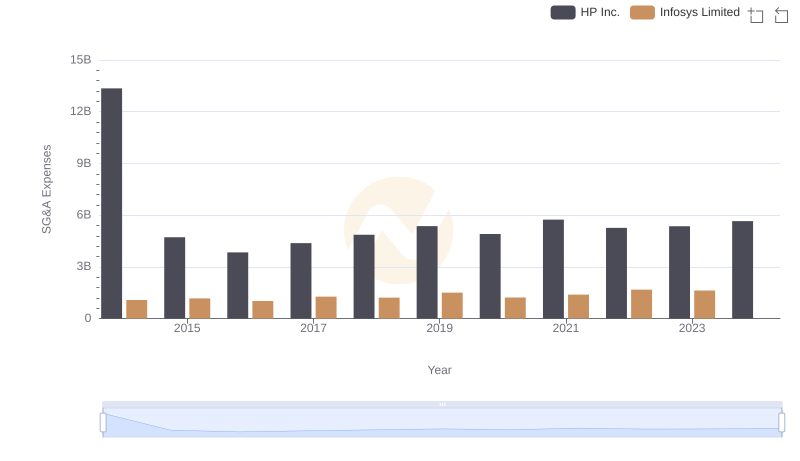

Infosys Limited and HP Inc.: SG&A Spending Patterns Compared

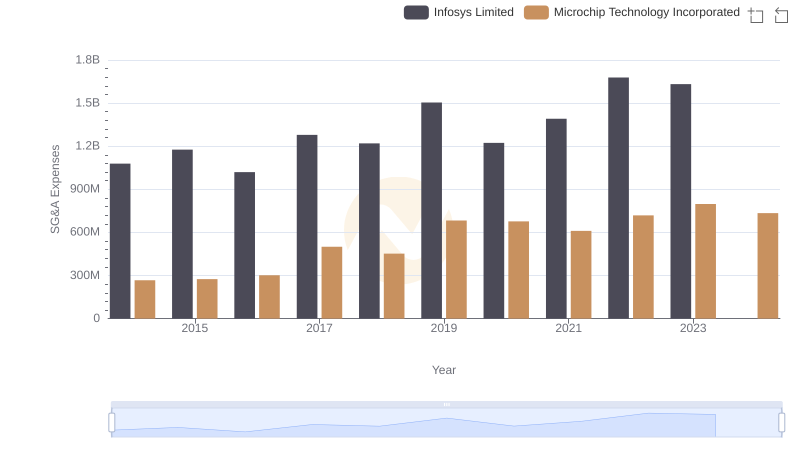

Comparing SG&A Expenses: Infosys Limited vs Microchip Technology Incorporated Trends and Insights

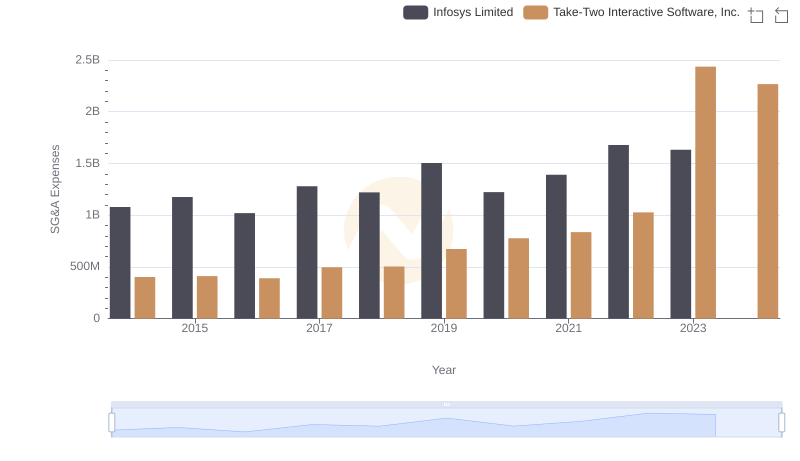

Who Optimizes SG&A Costs Better? Infosys Limited or Take-Two Interactive Software, Inc.

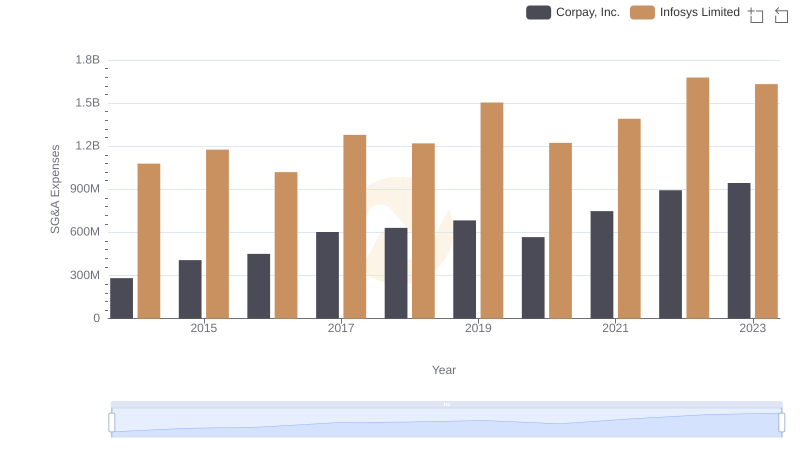

Comparing SG&A Expenses: Infosys Limited vs Corpay, Inc. Trends and Insights

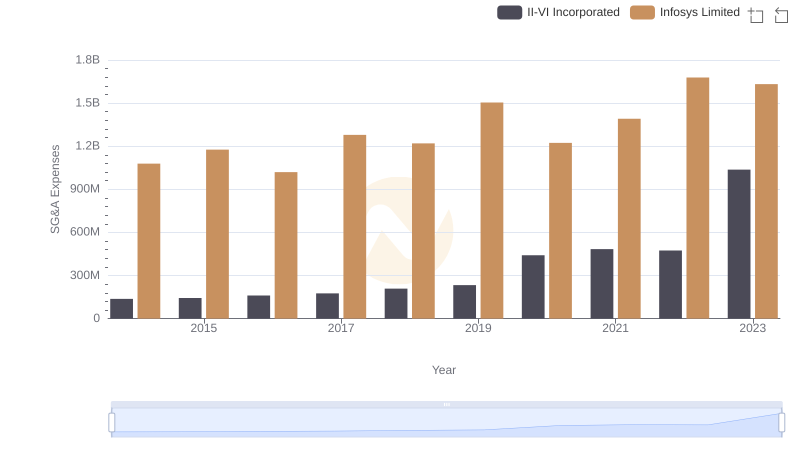

Cost Management Insights: SG&A Expenses for Infosys Limited and II-VI Incorporated

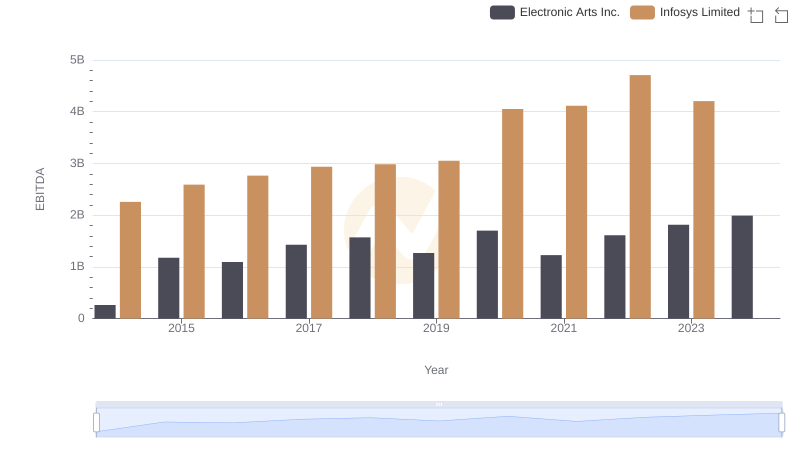

A Side-by-Side Analysis of EBITDA: Infosys Limited and Electronic Arts Inc.

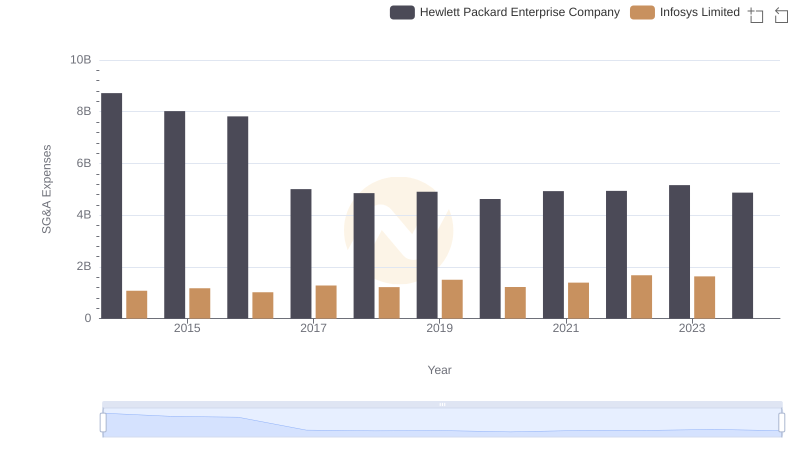

Who Optimizes SG&A Costs Better? Infosys Limited or Hewlett Packard Enterprise Company

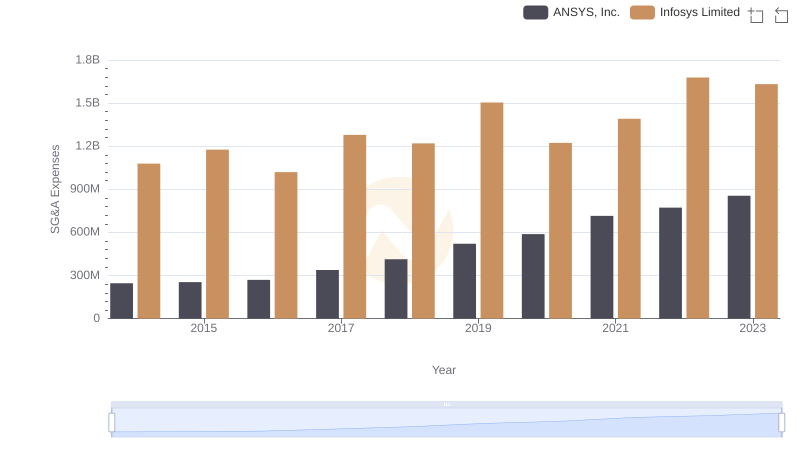

Comparing SG&A Expenses: Infosys Limited vs ANSYS, Inc. Trends and Insights