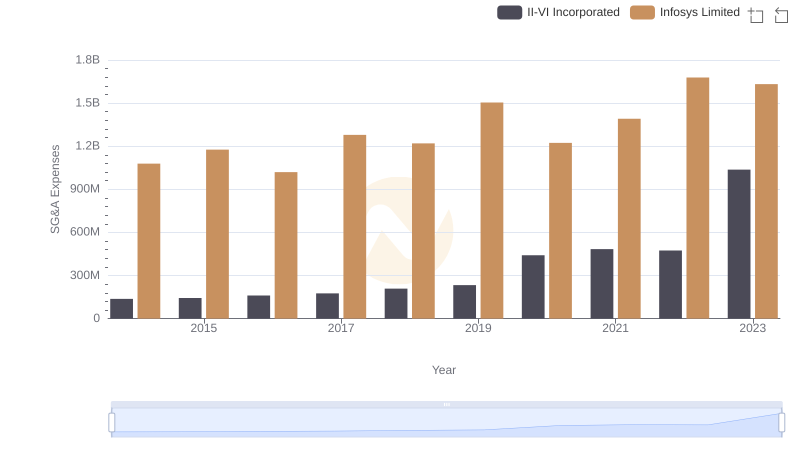

| __timestamp | II-VI Incorporated | Infosys Limited |

|---|---|---|

| Wednesday, January 1, 2014 | 103218000 | 2258000000 |

| Thursday, January 1, 2015 | 136058000 | 2590000000 |

| Friday, January 1, 2016 | 149699000 | 2765000000 |

| Sunday, January 1, 2017 | 189234000 | 2936000000 |

| Monday, January 1, 2018 | 221316000 | 2984000000 |

| Tuesday, January 1, 2019 | 243595000 | 3053000000 |

| Wednesday, January 1, 2020 | 246363000 | 4053342784 |

| Friday, January 1, 2021 | 682558000 | 4116000000 |

| Saturday, January 1, 2022 | 689840000 | 4707334610 |

| Sunday, January 1, 2023 | 613001000 | 4206000000 |

| Monday, January 1, 2024 | 682936000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of global business, understanding a company's financial health is crucial. EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, serves as a key indicator of operational performance. This analysis delves into the EBITDA trends of two industry giants: Infosys Limited and II-VI Incorporated, from 2014 to 2023.

Infosys Limited, a leader in IT services, consistently outperformed II-VI Incorporated, a prominent player in the manufacturing sector. Over the decade, Infosys's EBITDA grew by approximately 86%, peaking in 2022 with a staggering 4.7 billion. In contrast, II-VI Incorporated experienced a more volatile journey, with a notable peak in 2021, reaching 412 million, before a sharp decline in 2023.

This comparison highlights the resilience and growth trajectory of Infosys, while II-VI's fluctuations underscore the challenges faced in the manufacturing industry.

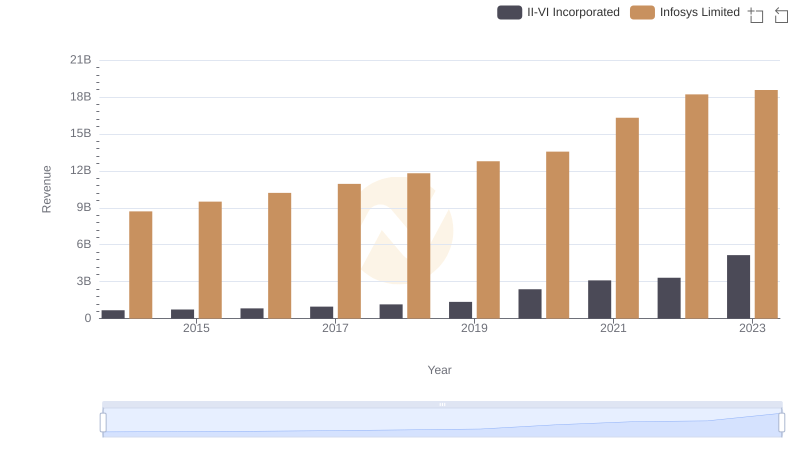

Comparing Revenue Performance: Infosys Limited or II-VI Incorporated?

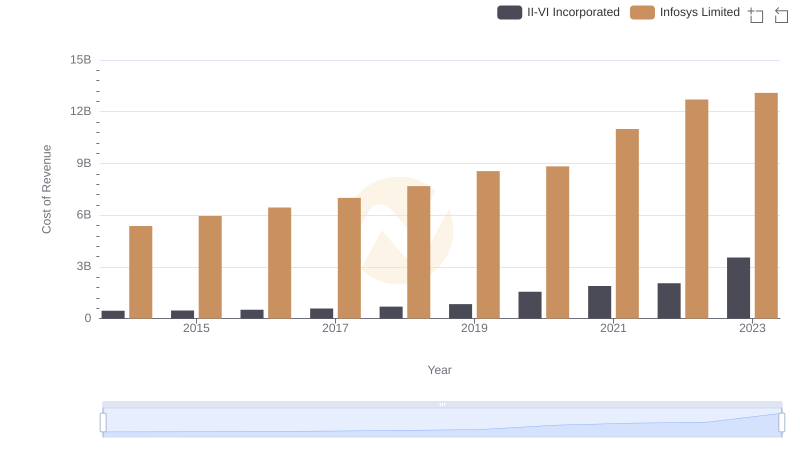

Analyzing Cost of Revenue: Infosys Limited and II-VI Incorporated

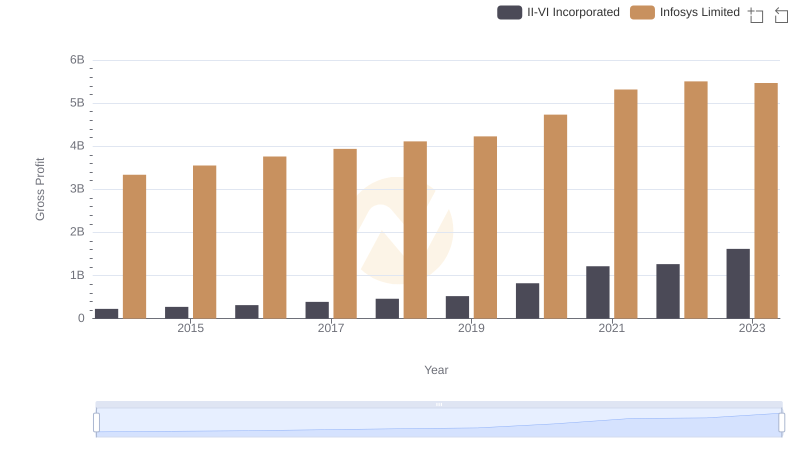

Key Insights on Gross Profit: Infosys Limited vs II-VI Incorporated

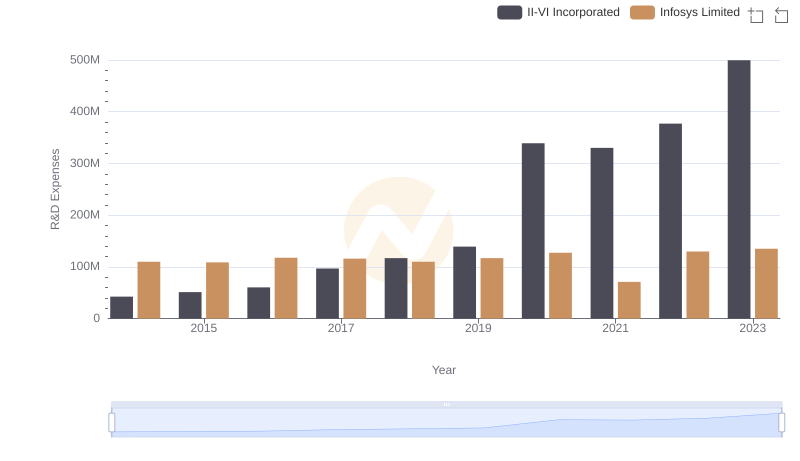

Comparing Innovation Spending: Infosys Limited and II-VI Incorporated

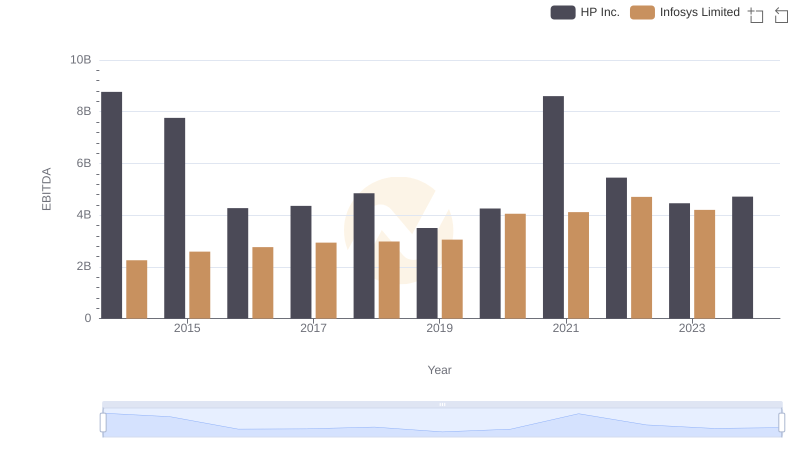

Infosys Limited and HP Inc.: A Detailed Examination of EBITDA Performance

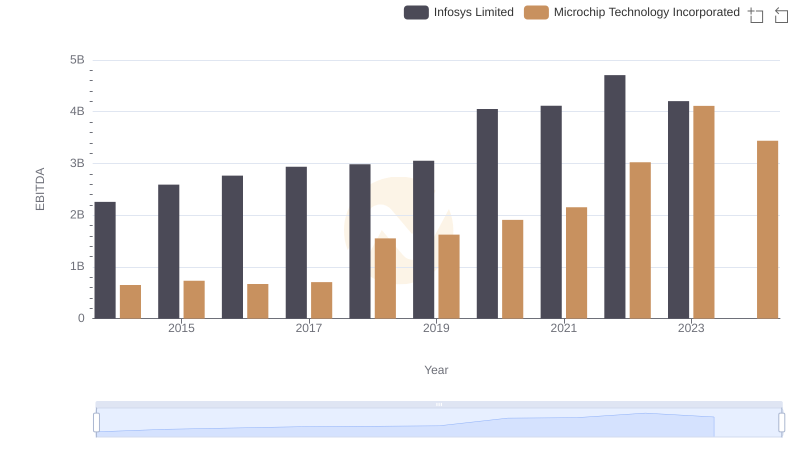

EBITDA Performance Review: Infosys Limited vs Microchip Technology Incorporated

Cost Management Insights: SG&A Expenses for Infosys Limited and II-VI Incorporated

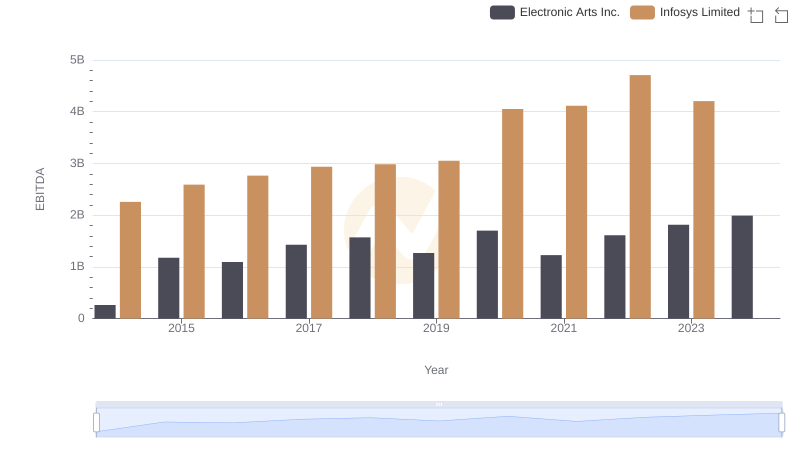

A Side-by-Side Analysis of EBITDA: Infosys Limited and Electronic Arts Inc.

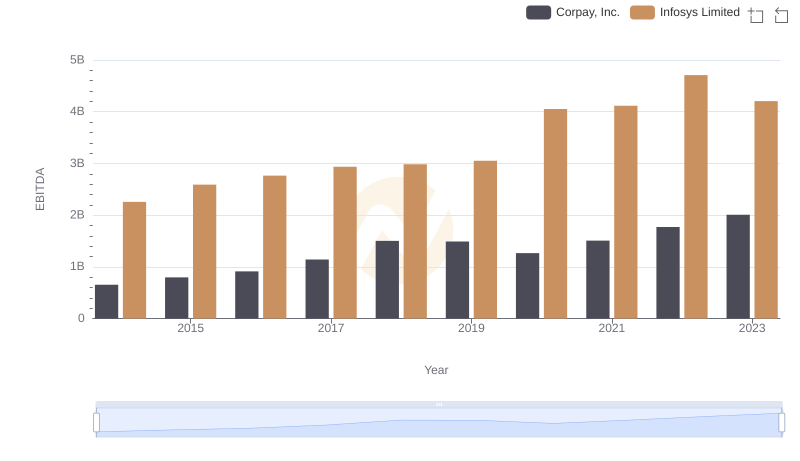

Infosys Limited and Corpay, Inc.: A Detailed Examination of EBITDA Performance

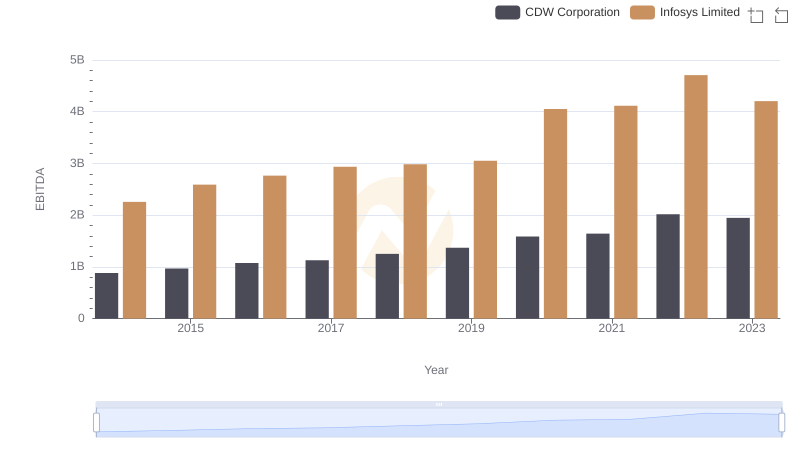

EBITDA Performance Review: Infosys Limited vs CDW Corporation

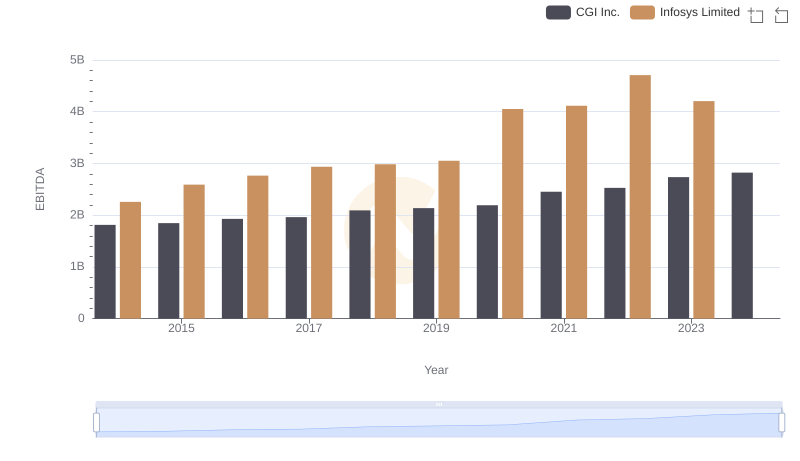

A Professional Review of EBITDA: Infosys Limited Compared to CGI Inc.

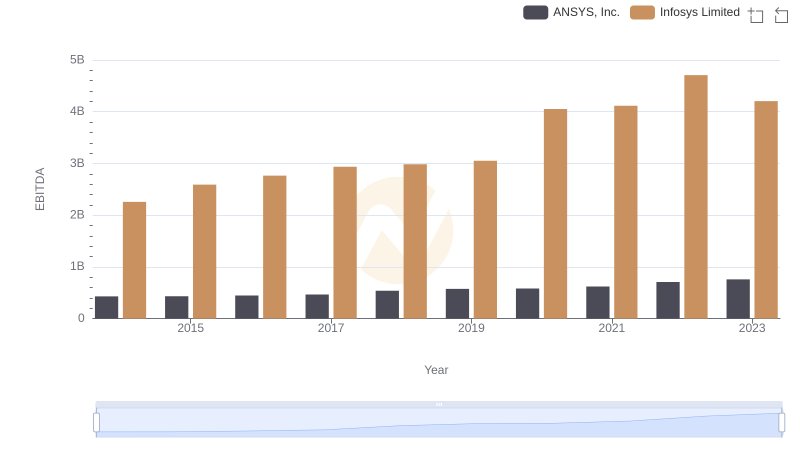

EBITDA Performance Review: Infosys Limited vs ANSYS, Inc.