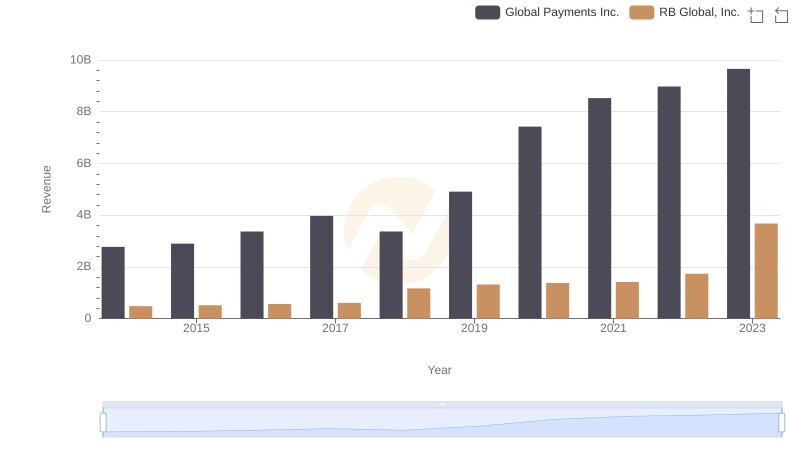

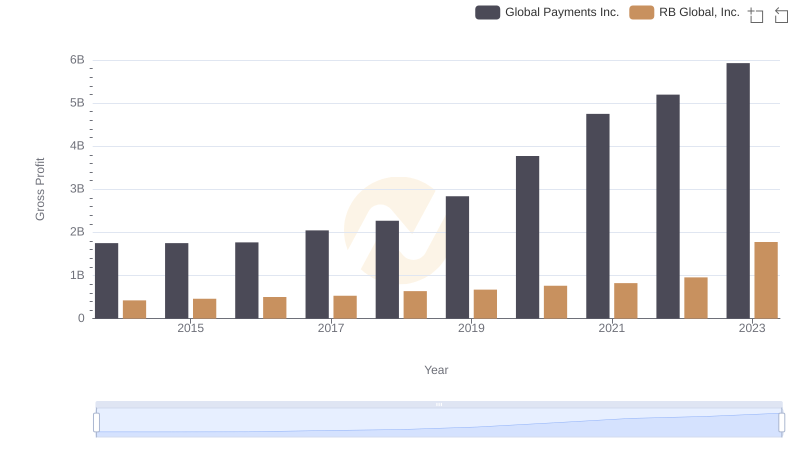

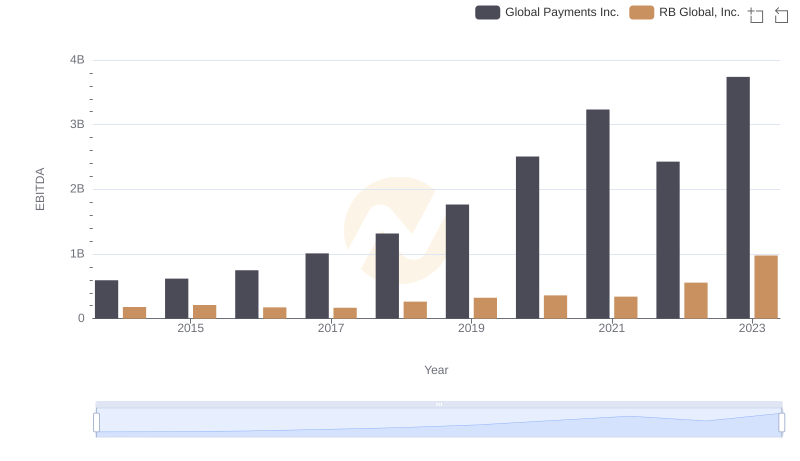

| __timestamp | Global Payments Inc. | RB Global, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1295014000 | 248220000 |

| Thursday, January 1, 2015 | 1325567000 | 254990000 |

| Friday, January 1, 2016 | 1411096000 | 283529000 |

| Sunday, January 1, 2017 | 1488258000 | 323270000 |

| Monday, January 1, 2018 | 1534297000 | 382676000 |

| Tuesday, January 1, 2019 | 2046672000 | 382389000 |

| Wednesday, January 1, 2020 | 2878878000 | 417523000 |

| Friday, January 1, 2021 | 3391161000 | 464599000 |

| Saturday, January 1, 2022 | 3524578000 | 539933000 |

| Sunday, January 1, 2023 | 4073768000 | 743700000 |

| Monday, January 1, 2024 | 4285307000 | 773900000 |

Unveiling the hidden dimensions of data

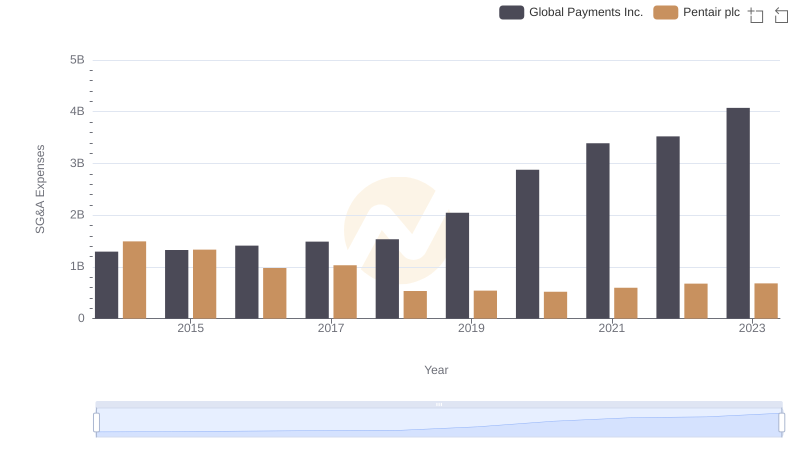

In the ever-evolving landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. Over the past decade, Global Payments Inc. and RB Global, Inc. have demonstrated contrasting trajectories in their SG&A expenditures.

From 2014 to 2023, Global Payments Inc. saw a staggering 214% increase in SG&A expenses, reflecting its aggressive expansion and strategic investments. In contrast, RB Global, Inc. experienced a more modest 200% rise, indicating a steady yet cautious approach to growth.

By 2023, Global Payments Inc.'s SG&A expenses were nearly six times higher than those of RB Global, Inc., highlighting differing operational scales and market strategies. This data underscores the importance of cost management in achieving sustainable growth and competitive advantage in the financial sector.

Comparing Revenue Performance: Global Payments Inc. or RB Global, Inc.?

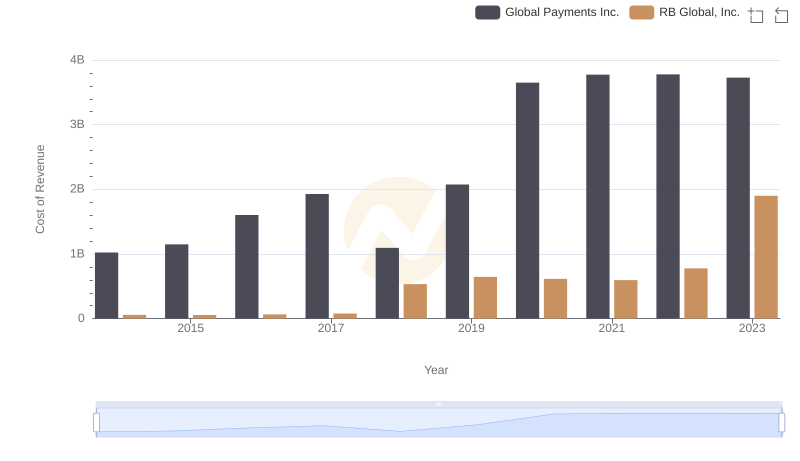

Cost of Revenue: Key Insights for Global Payments Inc. and RB Global, Inc.

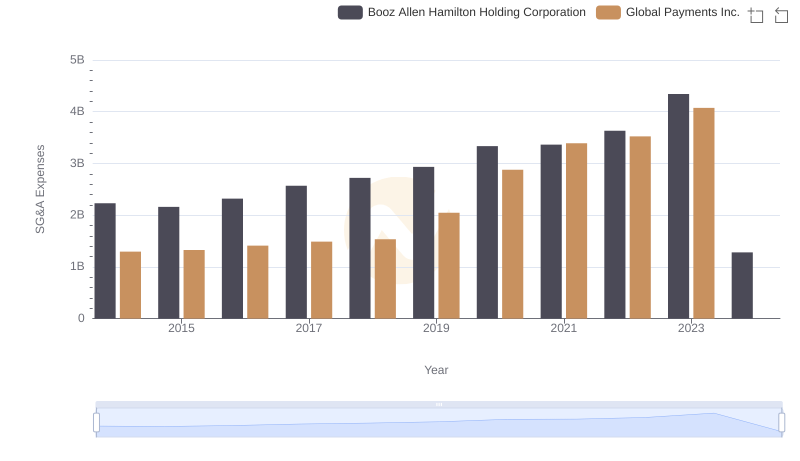

Who Optimizes SG&A Costs Better? Global Payments Inc. or Booz Allen Hamilton Holding Corporation

Selling, General, and Administrative Costs: Global Payments Inc. vs Pentair plc

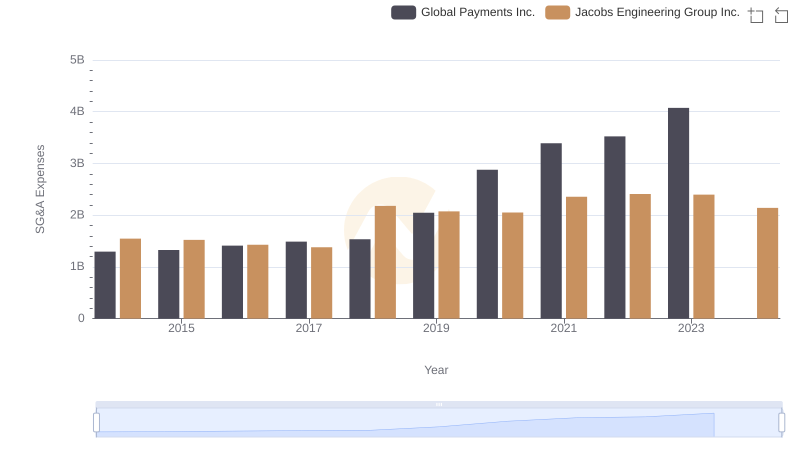

Cost Management Insights: SG&A Expenses for Global Payments Inc. and Jacobs Engineering Group Inc.

Gross Profit Comparison: Global Payments Inc. and RB Global, Inc. Trends

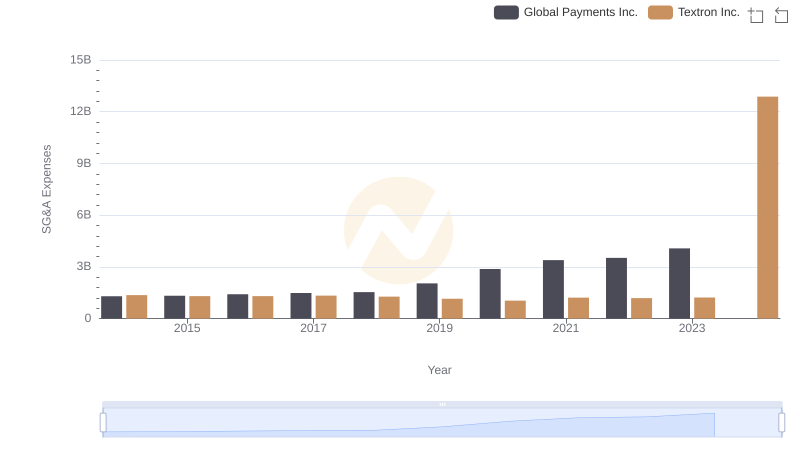

Cost Management Insights: SG&A Expenses for Global Payments Inc. and Textron Inc.

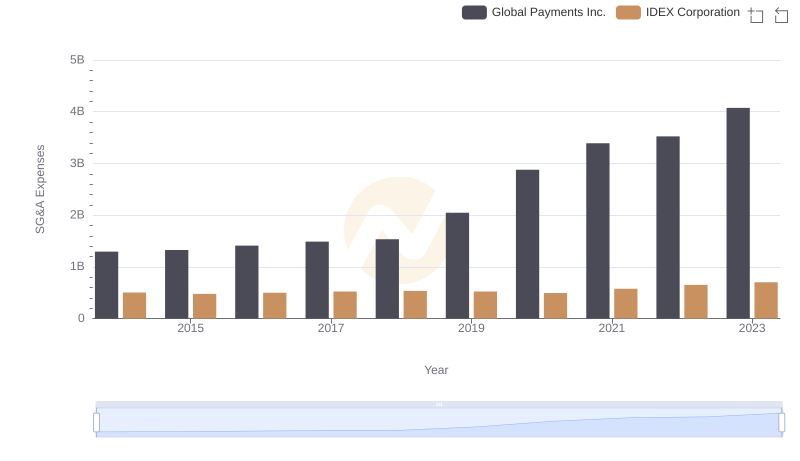

Who Optimizes SG&A Costs Better? Global Payments Inc. or IDEX Corporation

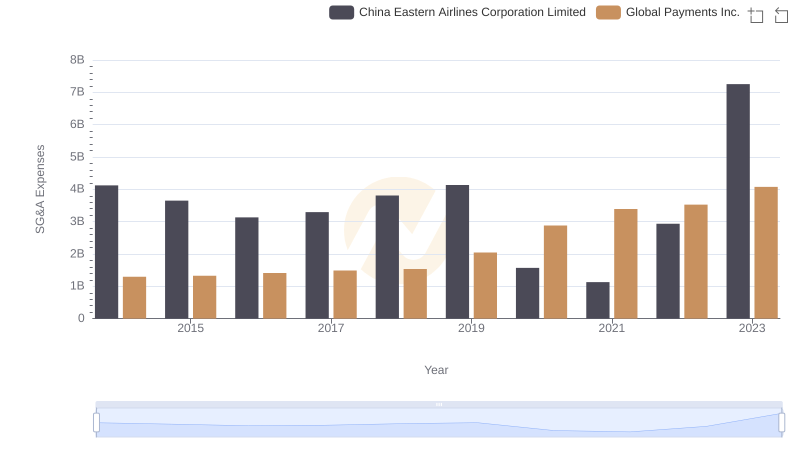

Global Payments Inc. vs China Eastern Airlines Corporation Limited: SG&A Expense Trends

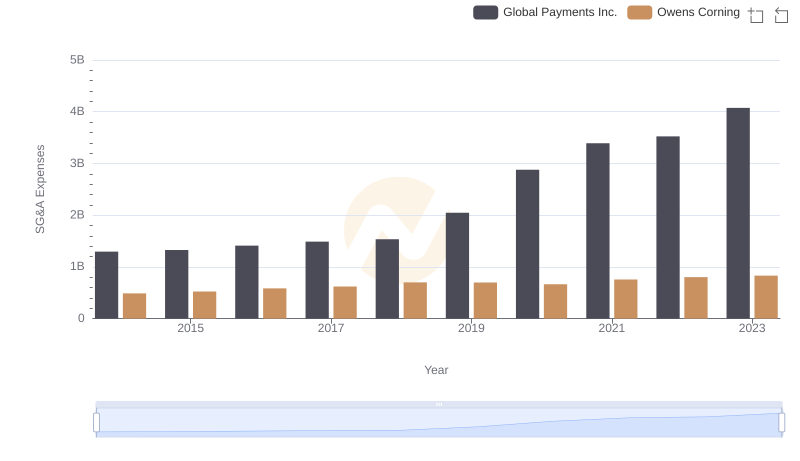

Global Payments Inc. and Owens Corning: SG&A Spending Patterns Compared

Comprehensive EBITDA Comparison: Global Payments Inc. vs RB Global, Inc.

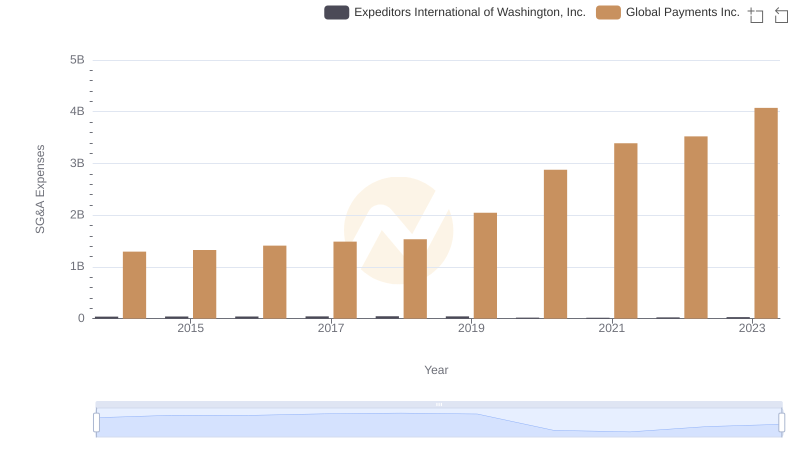

Breaking Down SG&A Expenses: Global Payments Inc. vs Expeditors International of Washington, Inc.