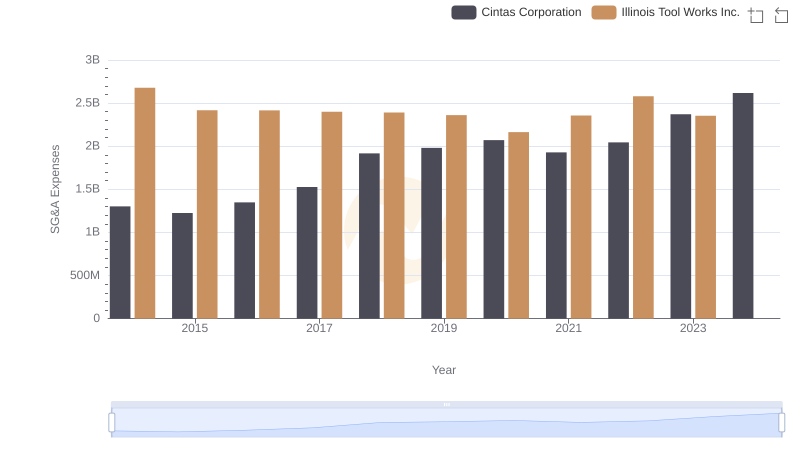

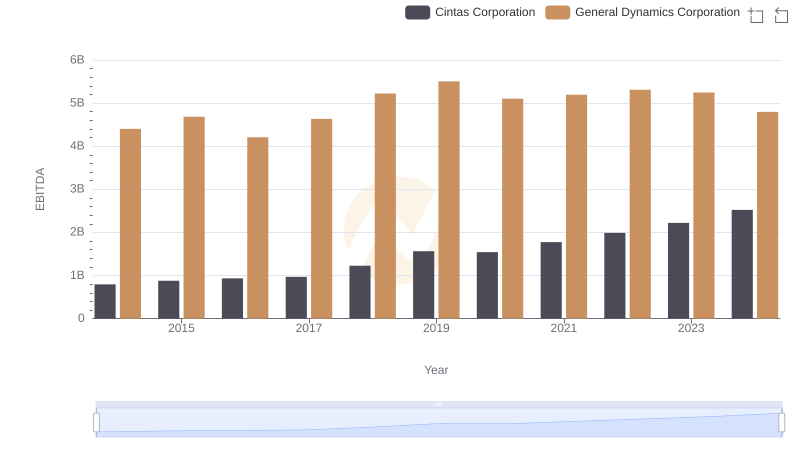

| __timestamp | Cintas Corporation | General Dynamics Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 1984000000 |

| Thursday, January 1, 2015 | 1224930000 | 1952000000 |

| Friday, January 1, 2016 | 1348122000 | 1940000000 |

| Sunday, January 1, 2017 | 1527380000 | 2010000000 |

| Monday, January 1, 2018 | 1916792000 | 2258000000 |

| Tuesday, January 1, 2019 | 1980644000 | 2411000000 |

| Wednesday, January 1, 2020 | 2071052000 | 2192000000 |

| Friday, January 1, 2021 | 1929159000 | 2245000000 |

| Saturday, January 1, 2022 | 2044876000 | 2411000000 |

| Sunday, January 1, 2023 | 2370704000 | 2427000000 |

| Monday, January 1, 2024 | 2617783000 | 2568000000 |

Infusing magic into the data realm

Over the past decade, Cintas Corporation and General Dynamics Corporation have showcased distinct trends in their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2023, Cintas saw a steady increase in SG&A expenses, growing by approximately 101% from 2014 to 2023. This reflects their strategic expansion and operational scaling. In contrast, General Dynamics maintained a more stable trajectory, with a notable spike in 2024, where expenses surged by over 1,700% compared to the previous year. This anomaly suggests a significant strategic shift or investment.

Cintas' consistent growth in SG&A expenses indicates a focus on expanding market presence and enhancing operational capabilities. Meanwhile, General Dynamics' sudden increase in 2024 could imply a major acquisition or restructuring. These trends offer valuable insights into each company's strategic priorities and market positioning.

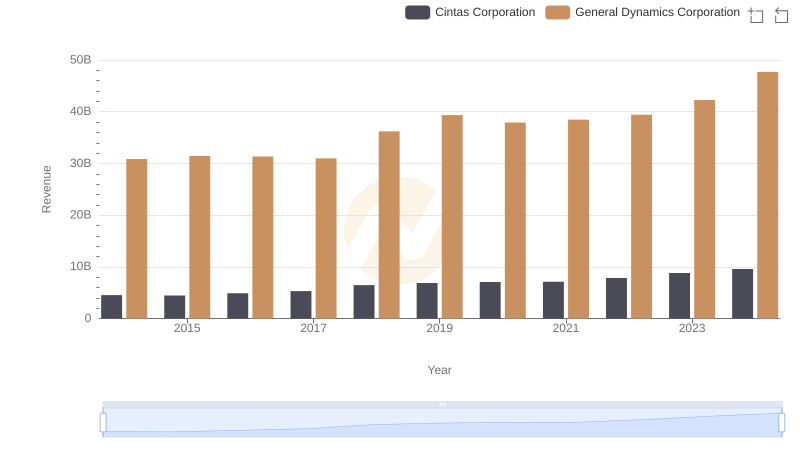

Comparing Revenue Performance: Cintas Corporation or General Dynamics Corporation?

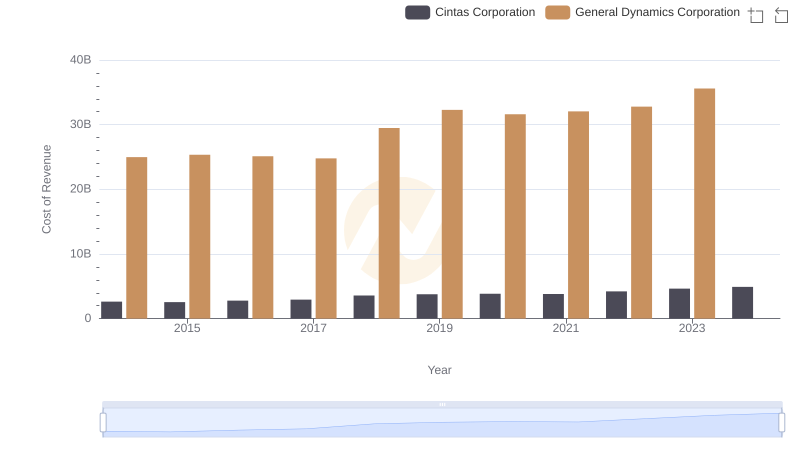

Cintas Corporation vs General Dynamics Corporation: Efficiency in Cost of Revenue Explored

Breaking Down SG&A Expenses: Cintas Corporation vs Illinois Tool Works Inc.

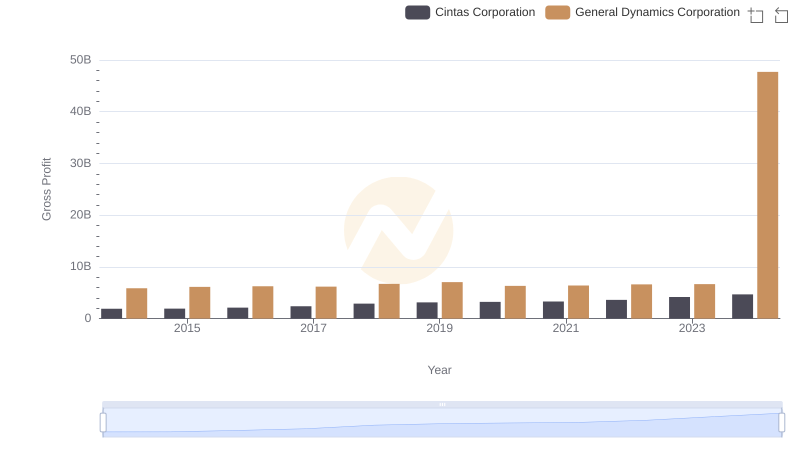

Gross Profit Trends Compared: Cintas Corporation vs General Dynamics Corporation

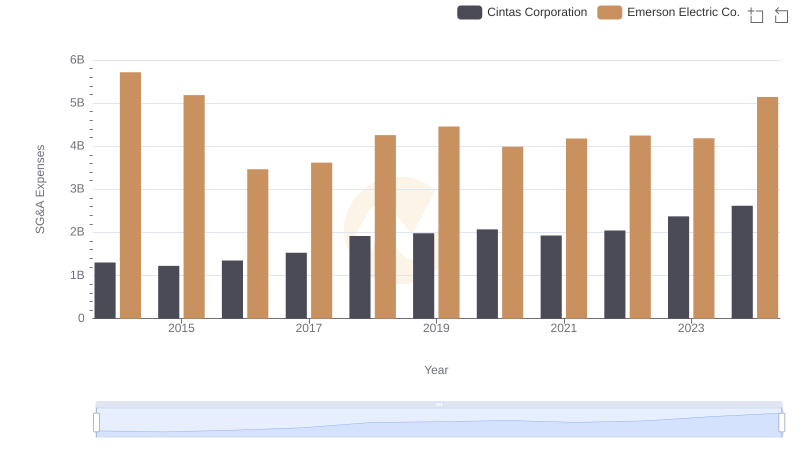

Cintas Corporation vs Emerson Electric Co.: SG&A Expense Trends

Cost Management Insights: SG&A Expenses for Cintas Corporation and Republic Services, Inc.

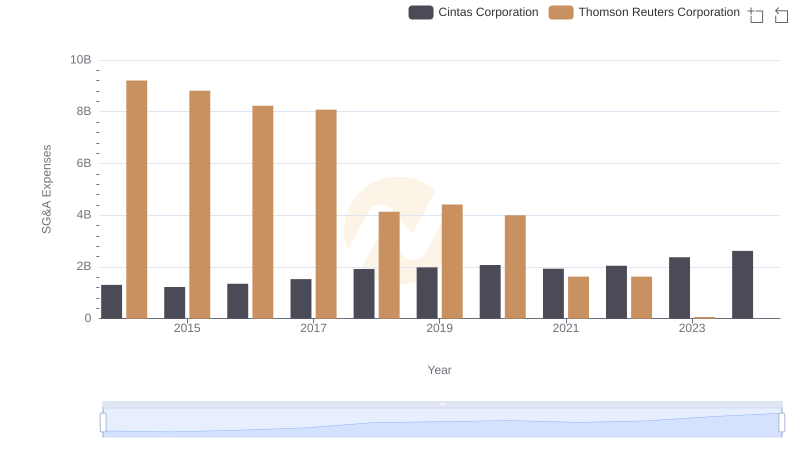

Cost Management Insights: SG&A Expenses for Cintas Corporation and Thomson Reuters Corporation

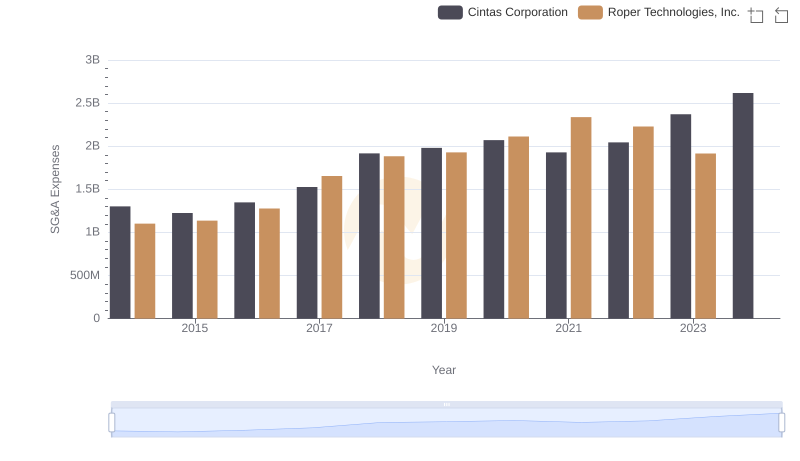

Comparing SG&A Expenses: Cintas Corporation vs Roper Technologies, Inc. Trends and Insights

Comparative EBITDA Analysis: Cintas Corporation vs General Dynamics Corporation

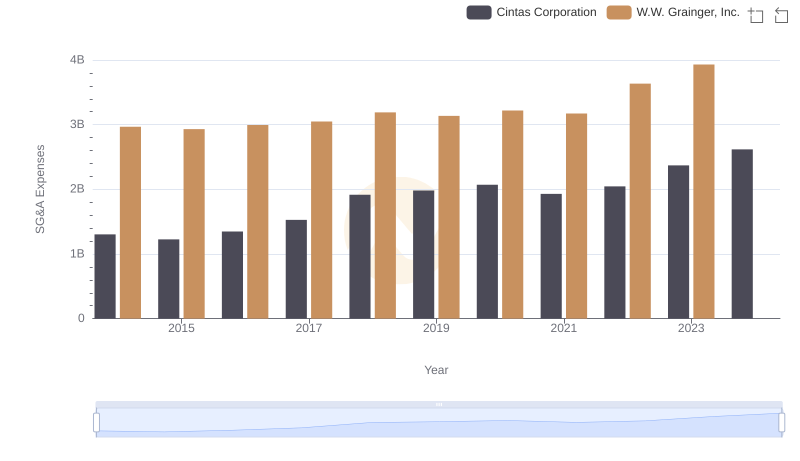

Cintas Corporation vs W.W. Grainger, Inc.: SG&A Expense Trends

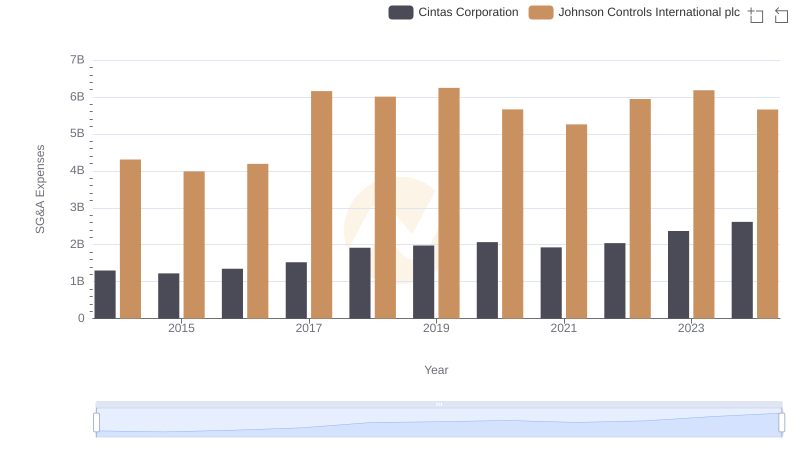

Cintas Corporation and Johnson Controls International plc: SG&A Spending Patterns Compared