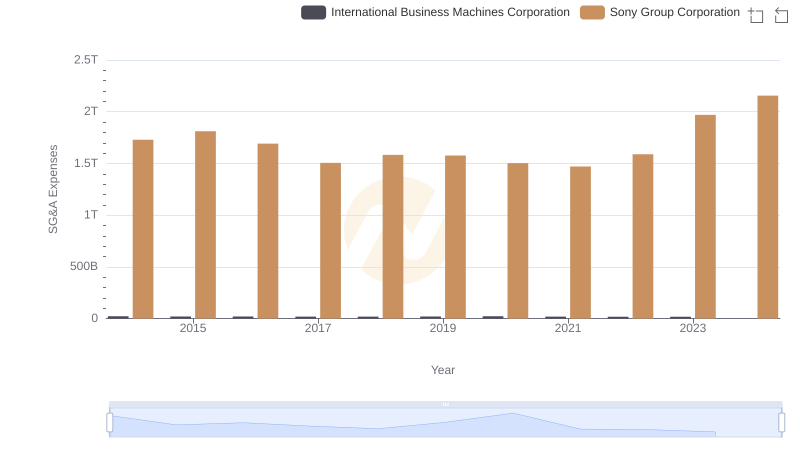

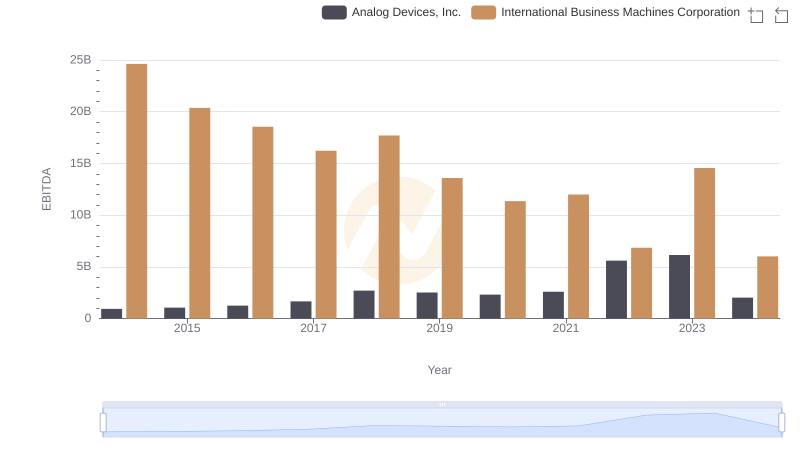

| __timestamp | Analog Devices, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 454676000 | 22472000000 |

| Thursday, January 1, 2015 | 478972000 | 19894000000 |

| Friday, January 1, 2016 | 461438000 | 20279000000 |

| Sunday, January 1, 2017 | 691046000 | 19680000000 |

| Monday, January 1, 2018 | 695937000 | 19366000000 |

| Tuesday, January 1, 2019 | 648094000 | 18724000000 |

| Wednesday, January 1, 2020 | 659923000 | 20561000000 |

| Friday, January 1, 2021 | 915418000 | 18745000000 |

| Saturday, January 1, 2022 | 1266175000 | 17483000000 |

| Sunday, January 1, 2023 | 1273584000 | 17997000000 |

| Monday, January 1, 2024 | 1068640000 | 29536000000 |

Unleashing the power of data

In the ever-evolving landscape of technology, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, International Business Machines Corporation (IBM) and Analog Devices, Inc. (ADI) have showcased contrasting trends in their SG&A expenditures. From 2014 to 2023, IBM's SG&A expenses have fluctuated, peaking in 2024 with a 48% increase from its lowest point in 2023. Meanwhile, ADI has demonstrated a steady rise, with a notable 180% increase from 2014 to 2023. This divergence highlights IBM's strategic shifts and ADI's consistent growth trajectory. As the tech industry continues to expand, these insights offer a glimpse into how these giants manage their operational costs, reflecting broader market dynamics and strategic priorities.

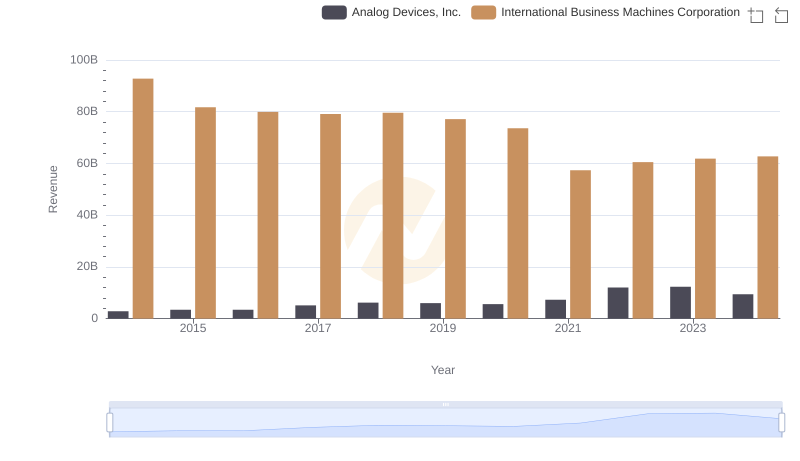

International Business Machines Corporation vs Analog Devices, Inc.: Examining Key Revenue Metrics

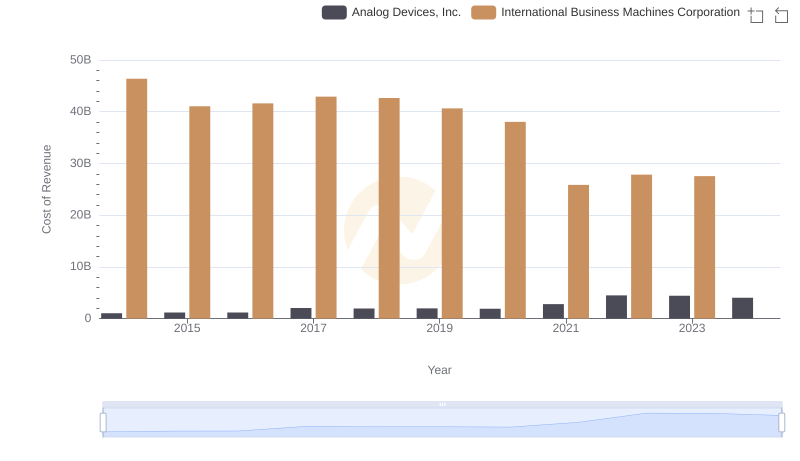

Comparing Cost of Revenue Efficiency: International Business Machines Corporation vs Analog Devices, Inc.

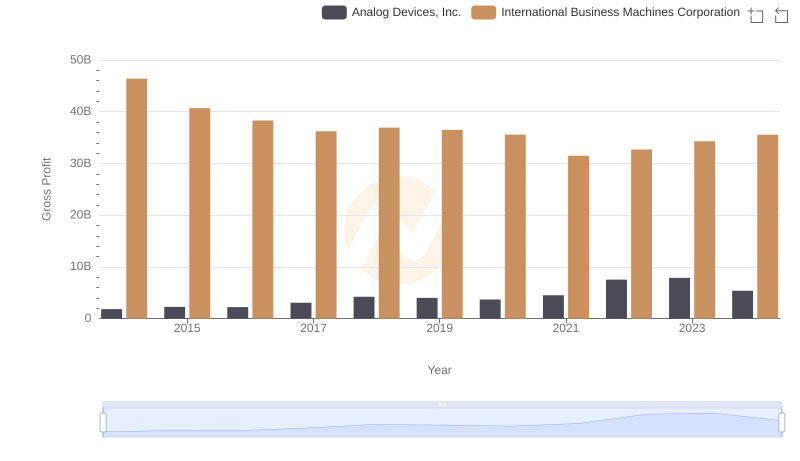

Who Generates Higher Gross Profit? International Business Machines Corporation or Analog Devices, Inc.

Who Optimizes SG&A Costs Better? International Business Machines Corporation or Sony Group Corporation

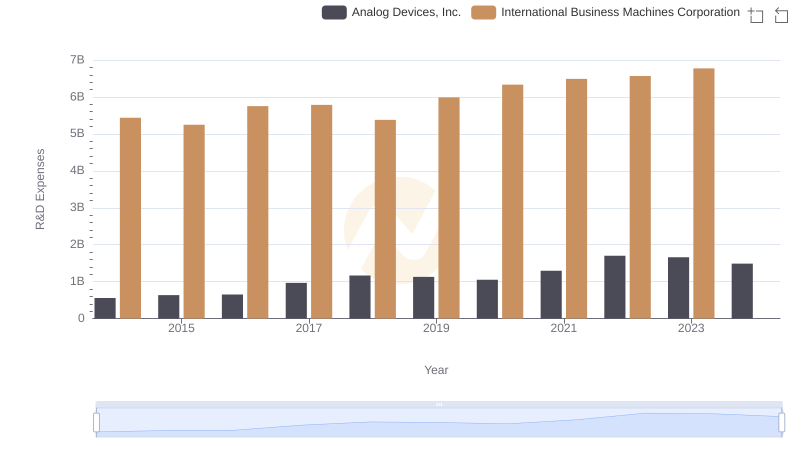

Research and Development Investment: International Business Machines Corporation vs Analog Devices, Inc.

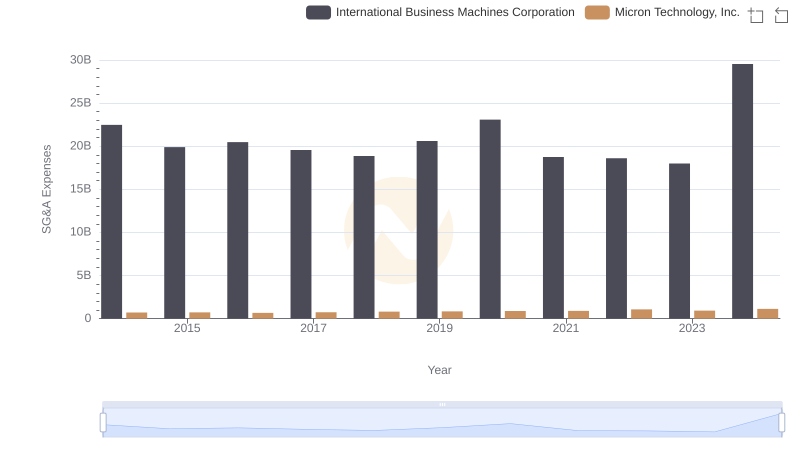

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Micron Technology, Inc.

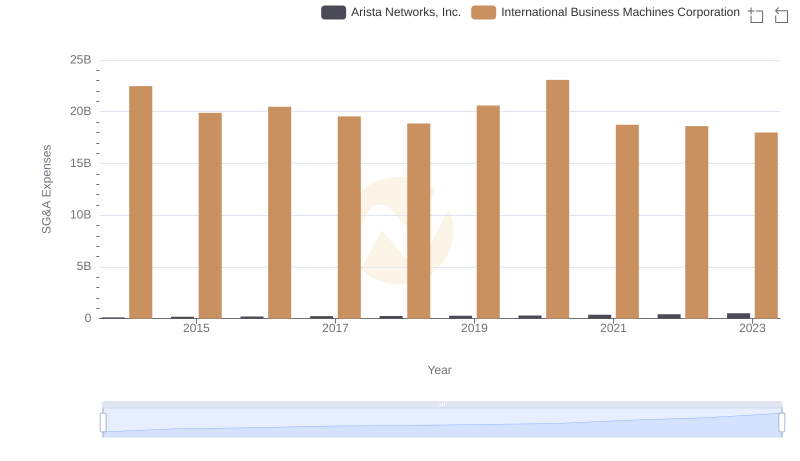

Comparing SG&A Expenses: International Business Machines Corporation vs Arista Networks, Inc. Trends and Insights

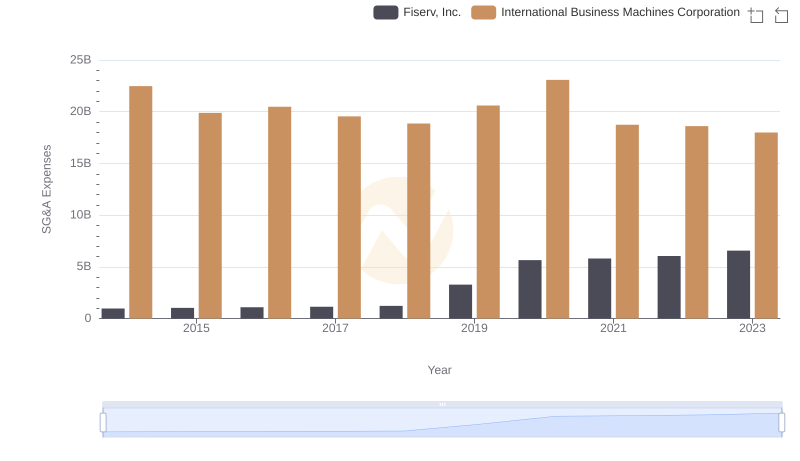

Comparing SG&A Expenses: International Business Machines Corporation vs Fiserv, Inc. Trends and Insights

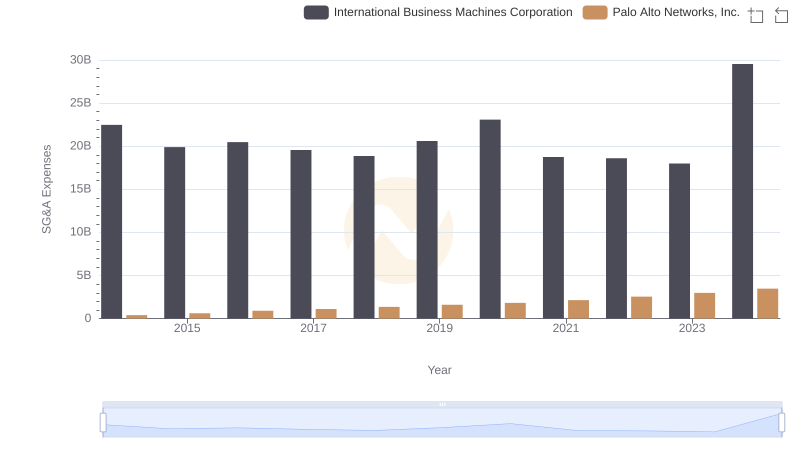

Breaking Down SG&A Expenses: International Business Machines Corporation vs Palo Alto Networks, Inc.

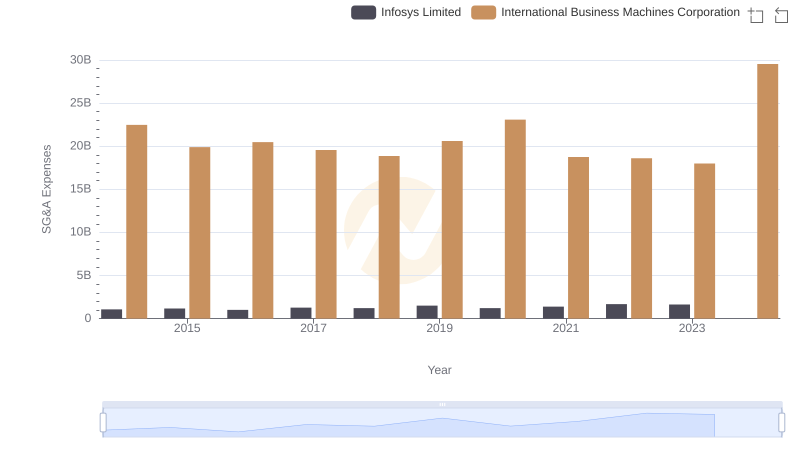

SG&A Efficiency Analysis: Comparing International Business Machines Corporation and Infosys Limited

EBITDA Analysis: Evaluating International Business Machines Corporation Against Analog Devices, Inc.