| __timestamp | Cintas Corporation | Ryanair Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 2637426000 | 3838100000 |

| Thursday, January 1, 2015 | 2555549000 | 3999600000 |

| Friday, January 1, 2016 | 2775588000 | 4355900000 |

| Sunday, January 1, 2017 | 2943086000 | 4294000000 |

| Monday, January 1, 2018 | 3568109000 | 4512300000 |

| Tuesday, January 1, 2019 | 3763715000 | 5492800000 |

| Wednesday, January 1, 2020 | 3851372000 | 6039900000 |

| Friday, January 1, 2021 | 3801689000 | 1702700000 |

| Saturday, January 1, 2022 | 4222213000 | 4009800000 |

| Sunday, January 1, 2023 | 4642401000 | 7735000000 |

| Monday, January 1, 2024 | 4910199000 | 9566400000 |

Data in motion

In the ever-evolving landscape of corporate expenses, understanding the cost dynamics of industry leaders like Cintas Corporation and Ryanair Holdings plc offers valuable insights. Over the past decade, Cintas has seen a steady increase in its cost of revenue, growing by approximately 86% from 2014 to 2024. This reflects its strategic expansion and operational scaling. Meanwhile, Ryanair's cost of revenue has surged by nearly 150% in the same period, highlighting its aggressive growth strategy and the challenges of operating in the competitive airline industry.

These trends underscore the importance of strategic cost management in maintaining competitive advantage.

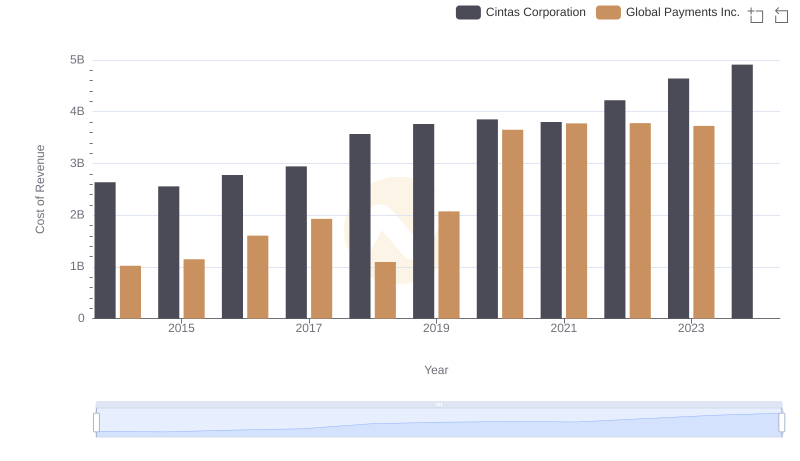

Comparing Cost of Revenue Efficiency: Cintas Corporation vs Global Payments Inc.

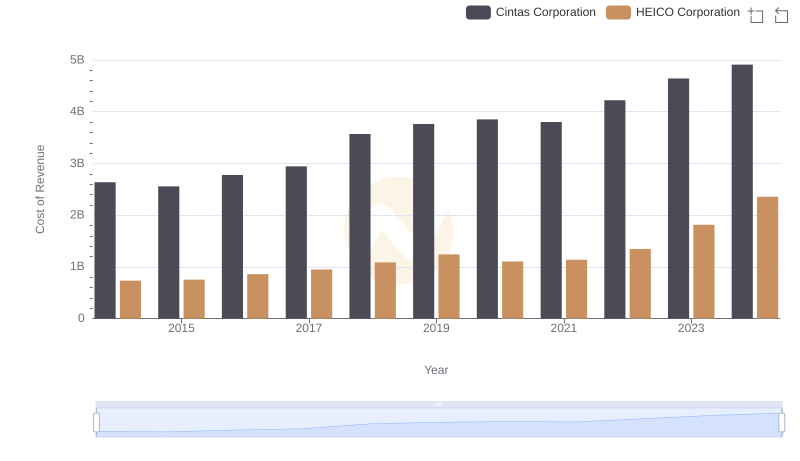

Cintas Corporation vs HEICO Corporation: Efficiency in Cost of Revenue Explored

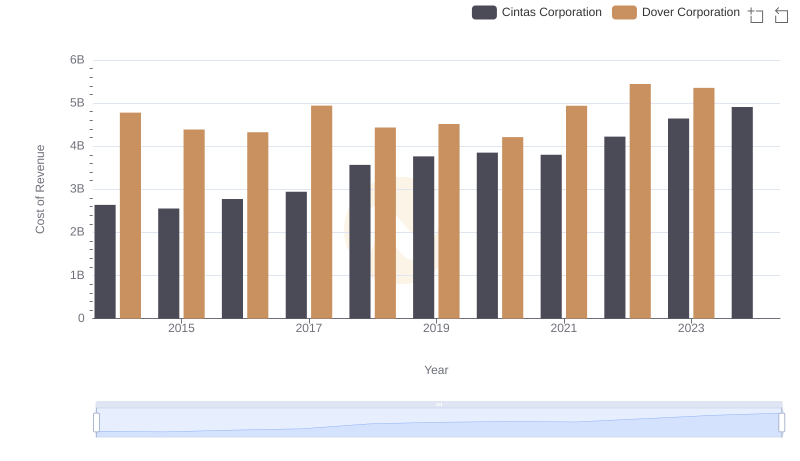

Cost of Revenue Trends: Cintas Corporation vs Dover Corporation

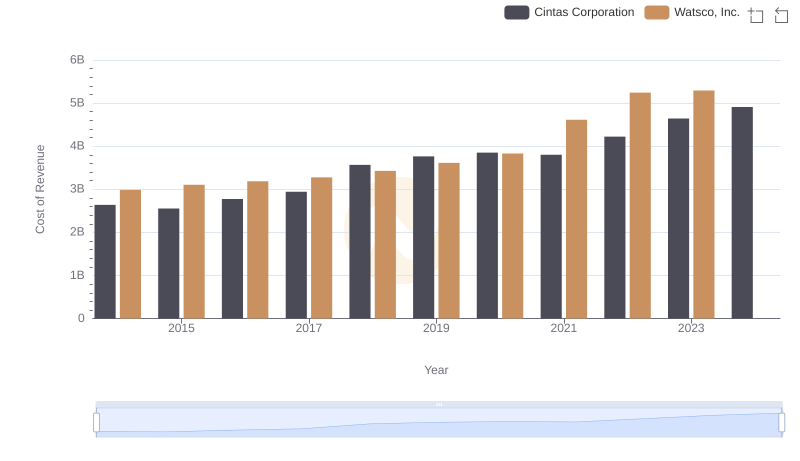

Cost of Revenue: Key Insights for Cintas Corporation and Watsco, Inc.

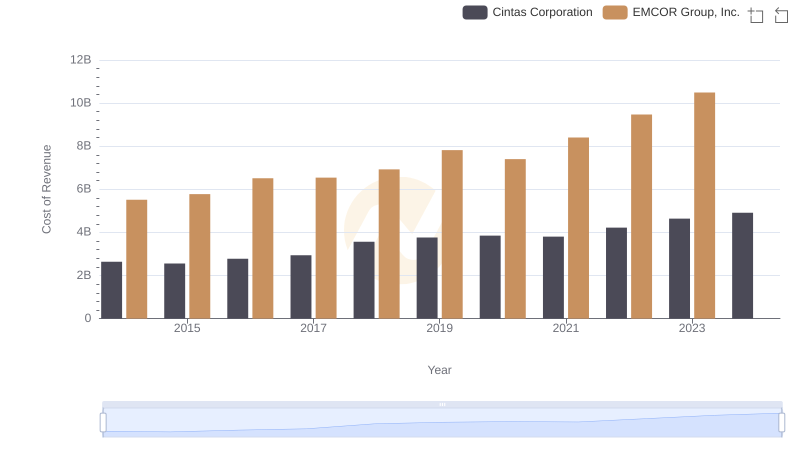

Comparing Cost of Revenue Efficiency: Cintas Corporation vs EMCOR Group, Inc.

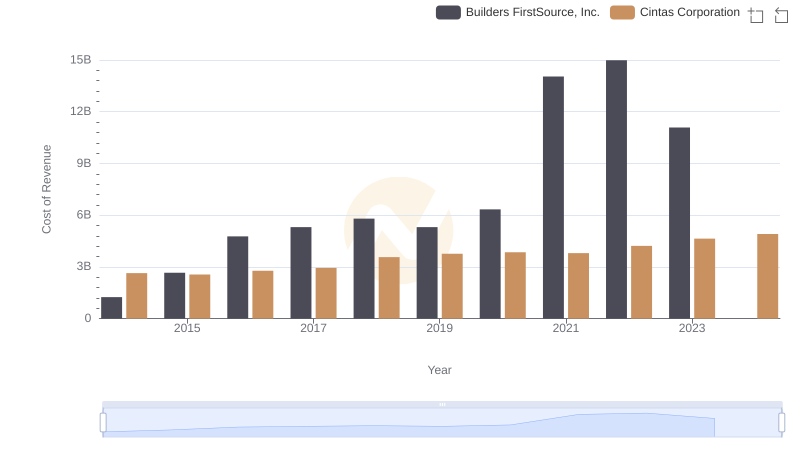

Comparing Cost of Revenue Efficiency: Cintas Corporation vs Builders FirstSource, Inc.

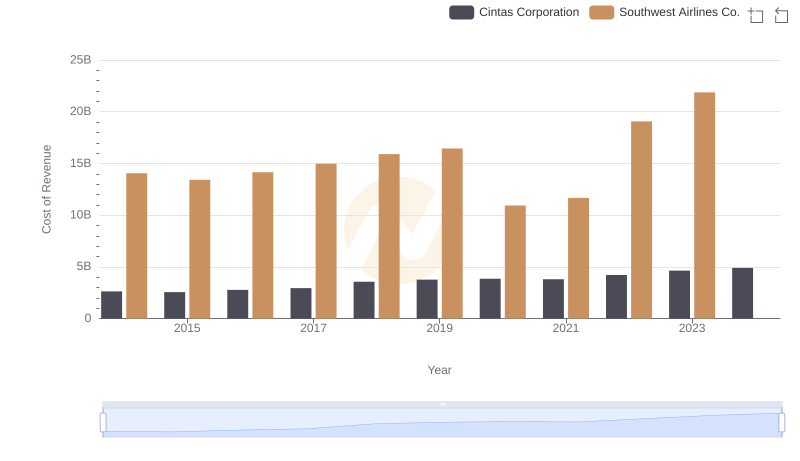

Comparing Cost of Revenue Efficiency: Cintas Corporation vs Southwest Airlines Co.

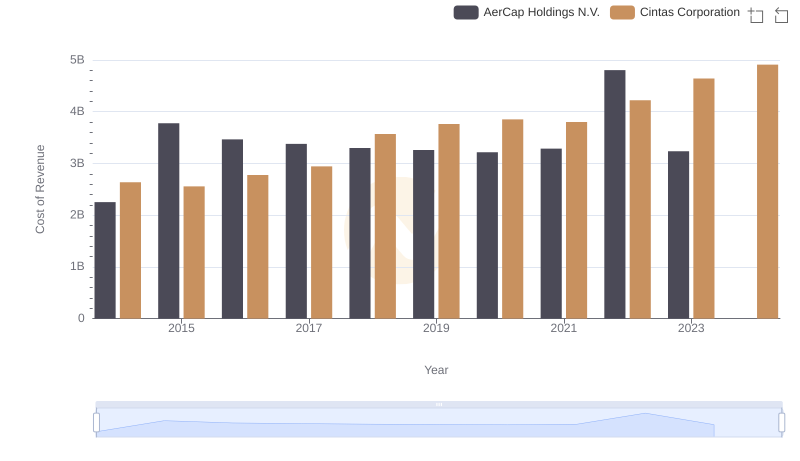

Cost of Revenue Trends: Cintas Corporation vs AerCap Holdings N.V.

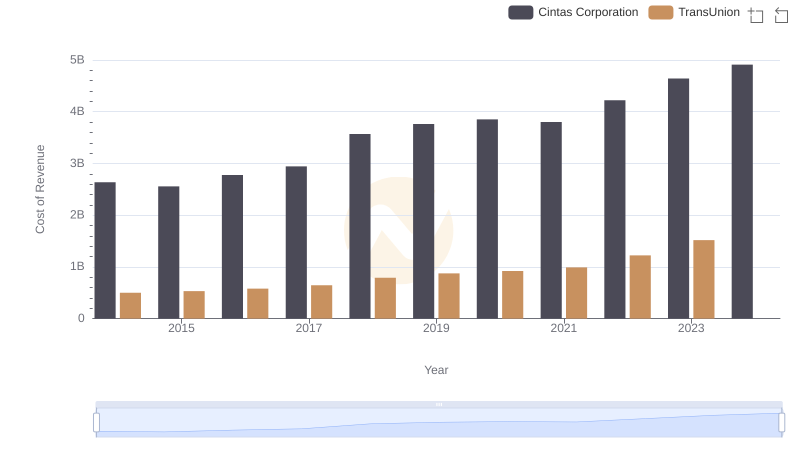

Cost of Revenue Trends: Cintas Corporation vs TransUnion

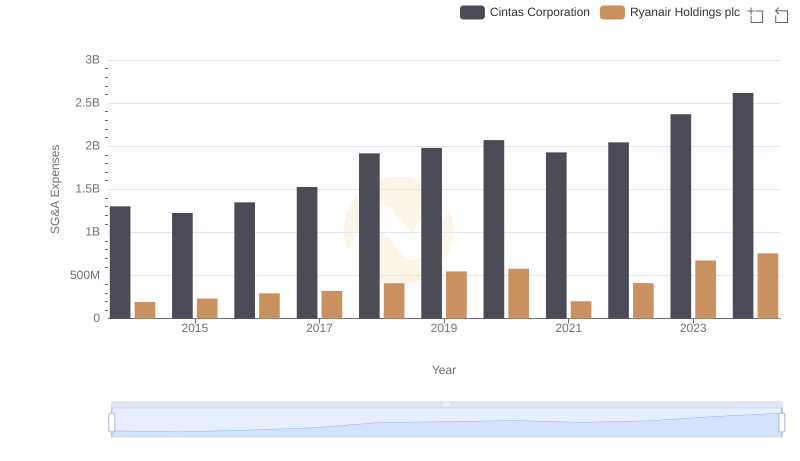

Comparing SG&A Expenses: Cintas Corporation vs Ryanair Holdings plc Trends and Insights