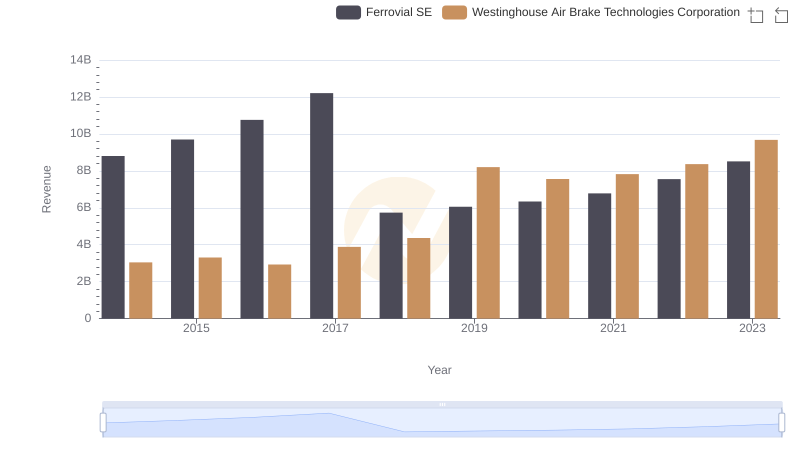

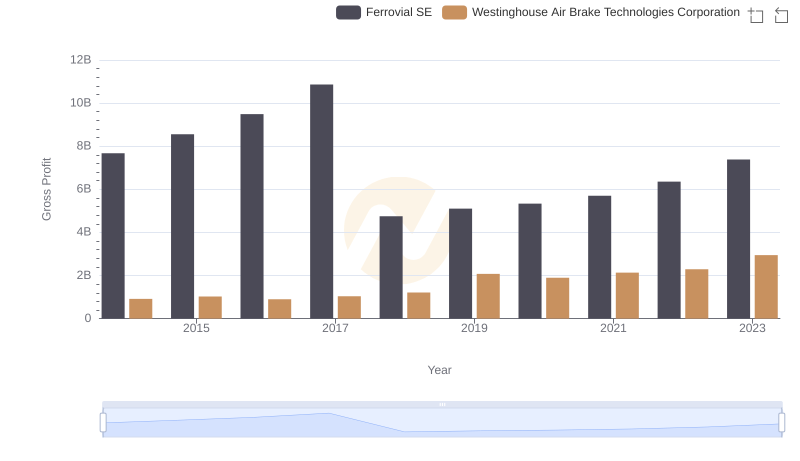

| __timestamp | Ferrovial SE | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1131000000 | 2130920000 |

| Thursday, January 1, 2015 | 1143000000 | 2281845000 |

| Friday, January 1, 2016 | 1267000000 | 2029647000 |

| Sunday, January 1, 2017 | 1345000000 | 2841159000 |

| Monday, January 1, 2018 | 985000000 | 3151816000 |

| Tuesday, January 1, 2019 | 949000000 | 6122400000 |

| Wednesday, January 1, 2020 | 1005000000 | 5657400000 |

| Friday, January 1, 2021 | 1077000000 | 5687000000 |

| Saturday, January 1, 2022 | 1197000000 | 6070000000 |

| Sunday, January 1, 2023 | 1129000000 | 6733000000 |

| Monday, January 1, 2024 | 7021000000 |

Cracking the code

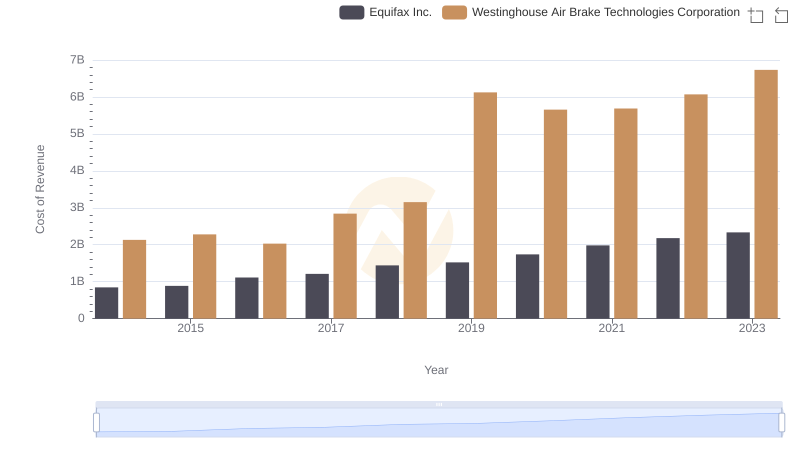

In the ever-evolving landscape of the transportation industry, cost efficiency remains a pivotal factor for success. This analysis delves into the cost of revenue trends for two industry titans: Westinghouse Air Brake Technologies Corporation and Ferrovial SE, from 2014 to 2023. Over this period, Westinghouse Air Brake Technologies Corporation consistently outpaced Ferrovial SE, with its cost of revenue peaking at approximately 6.7 billion in 2023, a staggering 500% increase from its 2014 figure. In contrast, Ferrovial SE maintained a more stable trajectory, with its cost of revenue fluctuating around the 1.1 billion mark, reflecting a modest 6% increase over the same period. This stark contrast highlights Westinghouse's aggressive growth strategy, while Ferrovial's steady approach underscores its focus on maintaining operational efficiency. As the industry continues to evolve, these insights offer a glimpse into the strategic priorities of these two giants.

Westinghouse Air Brake Technologies Corporation vs Ferrovial SE: Annual Revenue Growth Compared

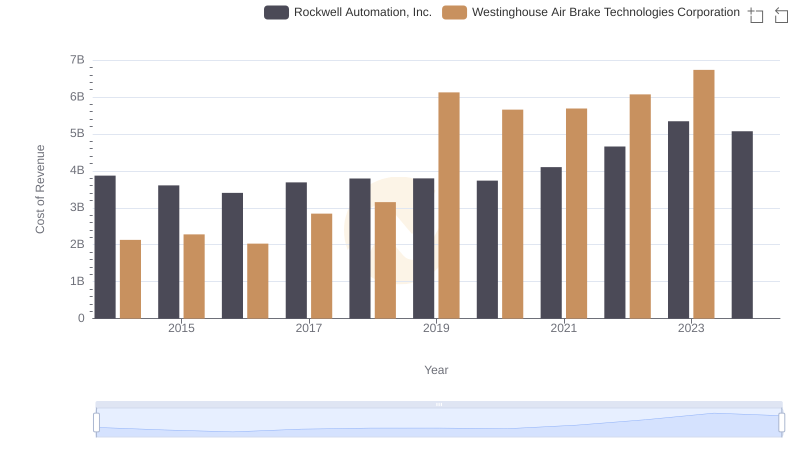

Westinghouse Air Brake Technologies Corporation vs Rockwell Automation, Inc.: Efficiency in Cost of Revenue Explored

Cost of Revenue: Key Insights for Westinghouse Air Brake Technologies Corporation and United Airlines Holdings, Inc.

Westinghouse Air Brake Technologies Corporation vs Equifax Inc.: Efficiency in Cost of Revenue Explored

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Global Payments Inc.

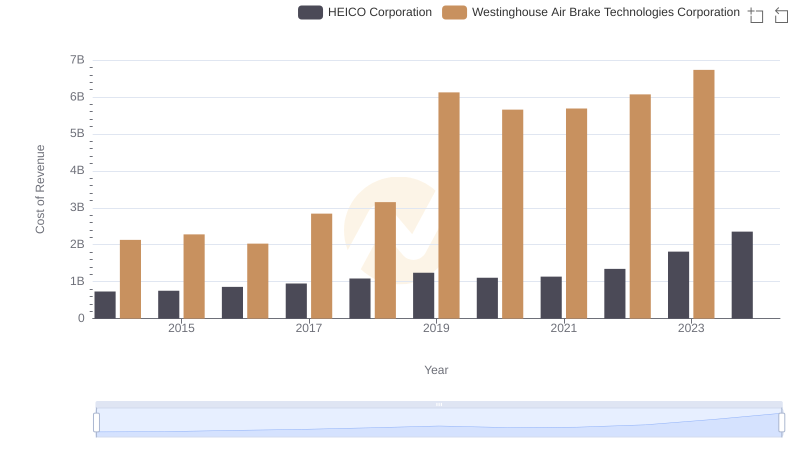

Westinghouse Air Brake Technologies Corporation vs HEICO Corporation: Efficiency in Cost of Revenue Explored

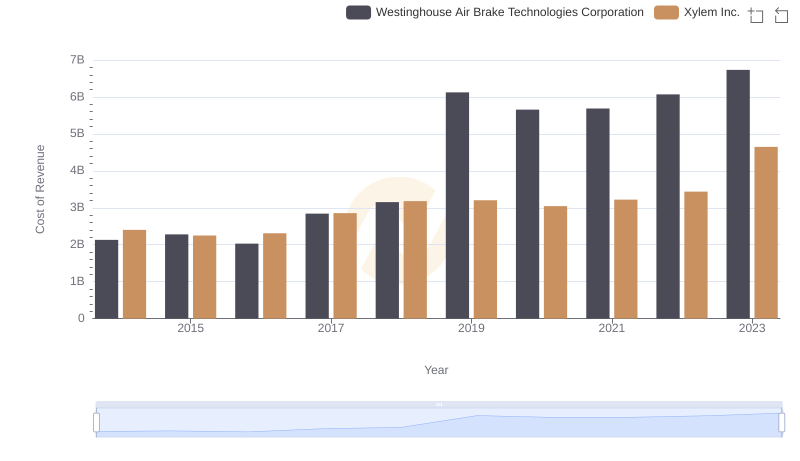

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and Xylem Inc.'s Expenses

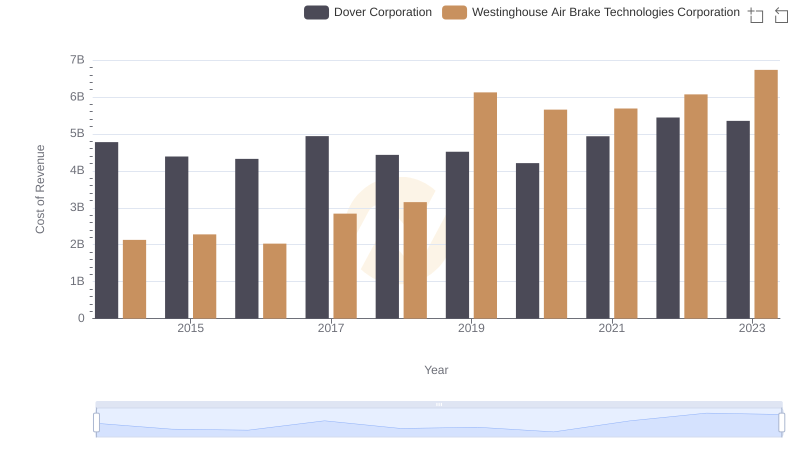

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and Dover Corporation's Expenses

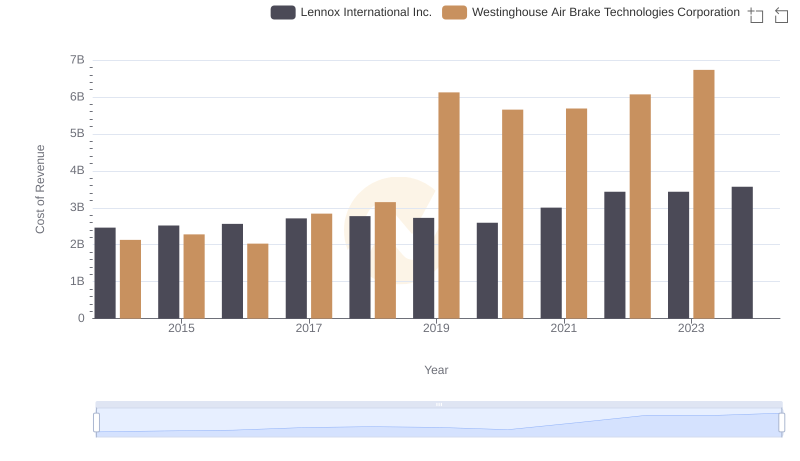

Westinghouse Air Brake Technologies Corporation vs Lennox International Inc.: Efficiency in Cost of Revenue Explored

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Ferrovial SE

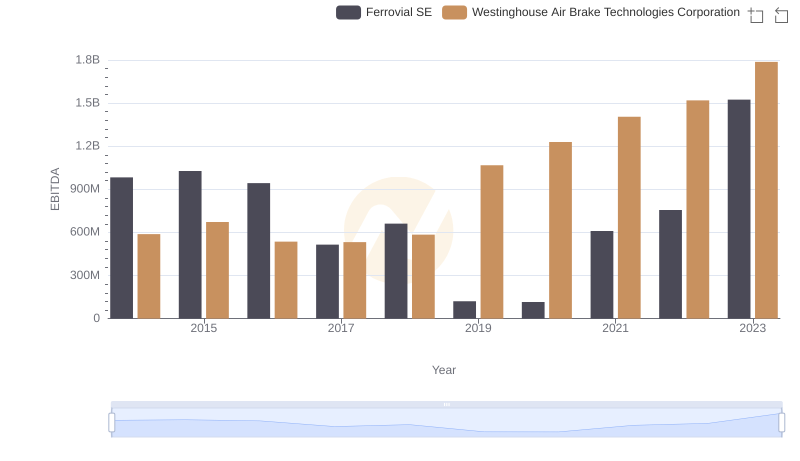

Professional EBITDA Benchmarking: Westinghouse Air Brake Technologies Corporation vs Ferrovial SE