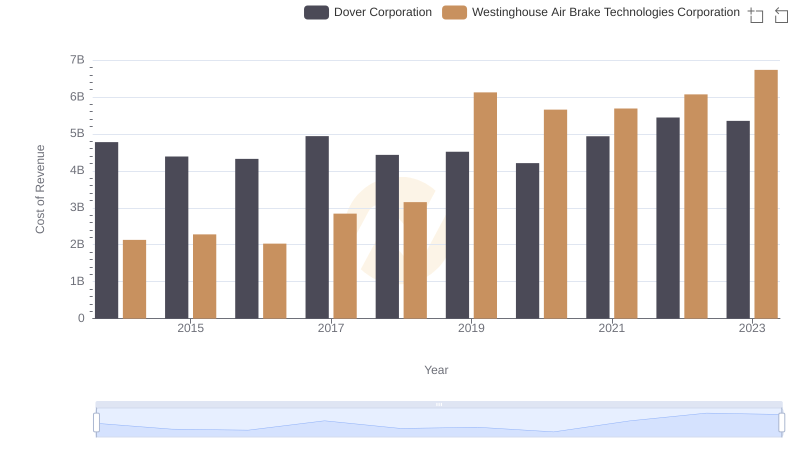

| __timestamp | Equifax Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 844700000 | 2130920000 |

| Thursday, January 1, 2015 | 887400000 | 2281845000 |

| Friday, January 1, 2016 | 1113400000 | 2029647000 |

| Sunday, January 1, 2017 | 1210700000 | 2841159000 |

| Monday, January 1, 2018 | 1440400000 | 3151816000 |

| Tuesday, January 1, 2019 | 1521700000 | 6122400000 |

| Wednesday, January 1, 2020 | 1737400000 | 5657400000 |

| Friday, January 1, 2021 | 1980900000 | 5687000000 |

| Saturday, January 1, 2022 | 2177200000 | 6070000000 |

| Sunday, January 1, 2023 | 2335100000 | 6733000000 |

| Monday, January 1, 2024 | 0 | 7021000000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, understanding cost efficiency is paramount. This analysis delves into the cost of revenue trends for Westinghouse Air Brake Technologies Corporation and Equifax Inc. from 2014 to 2023. Over this period, Westinghouse consistently outpaced Equifax, with its cost of revenue peaking at approximately $6.73 billion in 2023, a staggering 188% increase from 2014. In contrast, Equifax's cost of revenue grew by 176%, reaching around $2.34 billion in 2023.

This comparative analysis highlights the strategic financial maneuvers of these industry giants, offering valuable insights for investors and analysts alike.

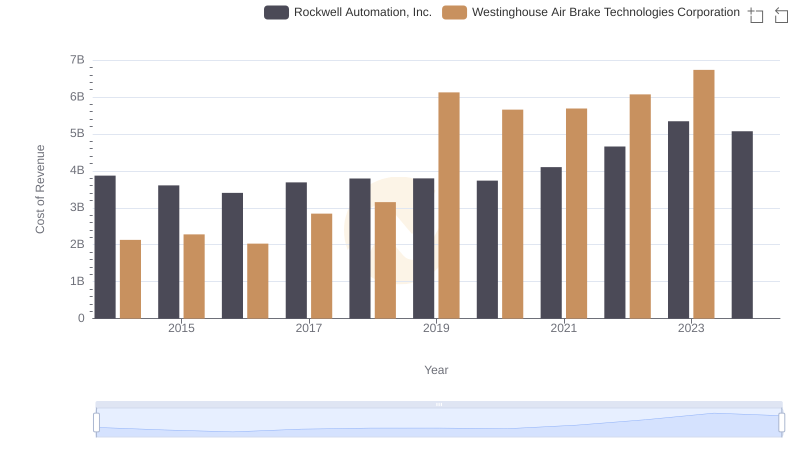

Westinghouse Air Brake Technologies Corporation vs Rockwell Automation, Inc.: Efficiency in Cost of Revenue Explored

Cost of Revenue: Key Insights for Westinghouse Air Brake Technologies Corporation and United Airlines Holdings, Inc.

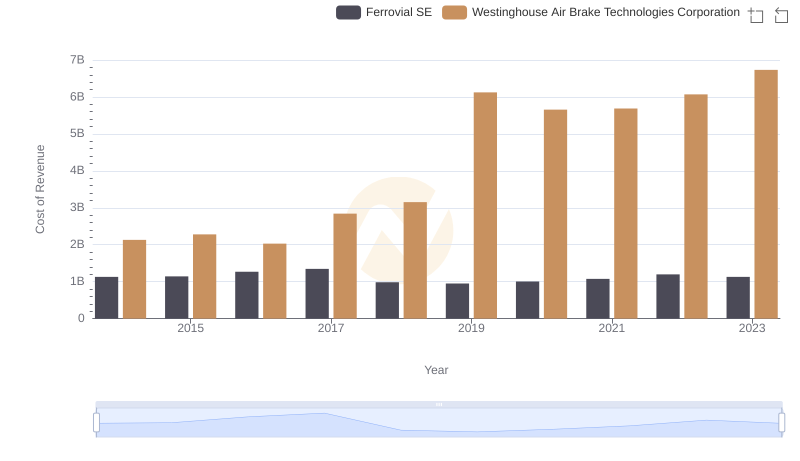

Comparing Cost of Revenue Efficiency: Westinghouse Air Brake Technologies Corporation vs Ferrovial SE

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Global Payments Inc.

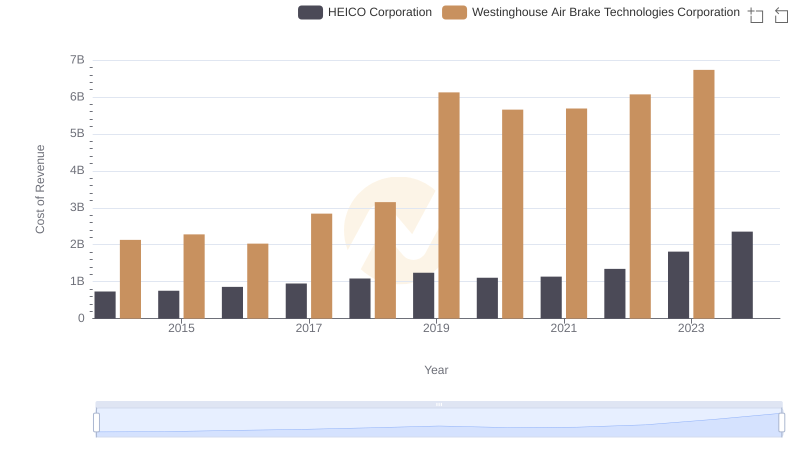

Westinghouse Air Brake Technologies Corporation vs HEICO Corporation: Efficiency in Cost of Revenue Explored

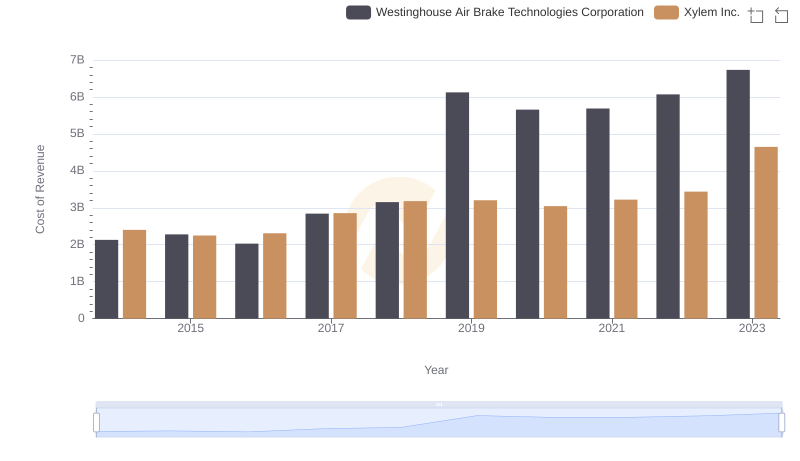

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and Xylem Inc.'s Expenses

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and Dover Corporation's Expenses

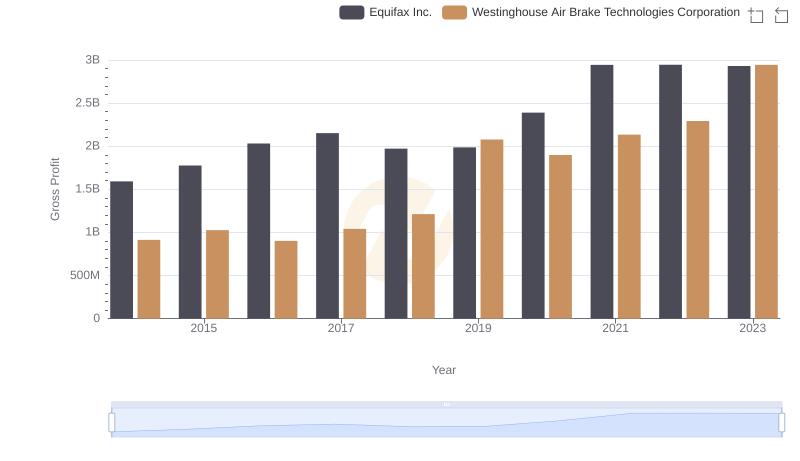

Westinghouse Air Brake Technologies Corporation vs Equifax Inc.: A Gross Profit Performance Breakdown

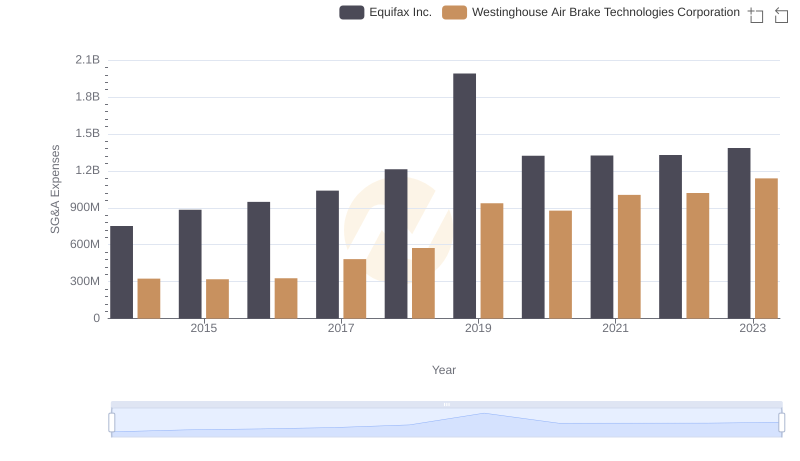

Breaking Down SG&A Expenses: Westinghouse Air Brake Technologies Corporation vs Equifax Inc.

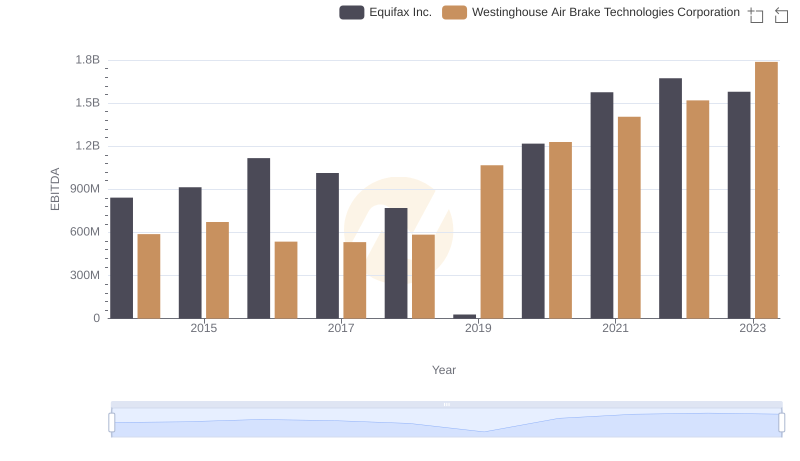

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Equifax Inc.