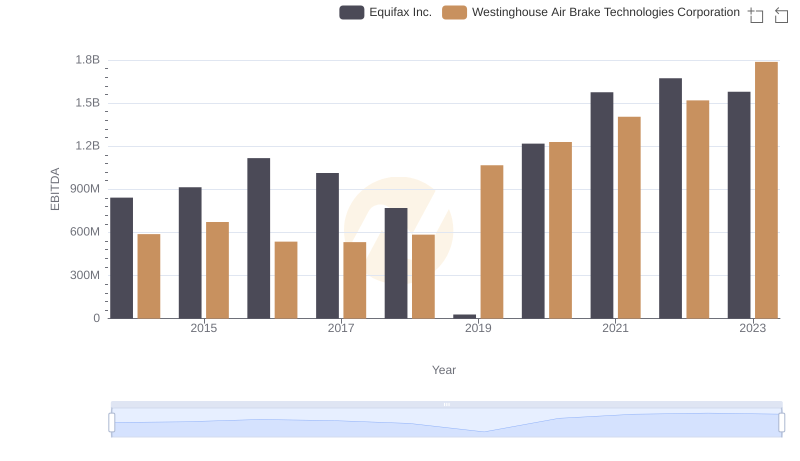

| __timestamp | Ferrovial SE | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 983000000 | 588370000 |

| Thursday, January 1, 2015 | 1027000000 | 672301000 |

| Friday, January 1, 2016 | 943000000 | 535893000 |

| Sunday, January 1, 2017 | 515000000 | 532795000 |

| Monday, January 1, 2018 | 661000000 | 584199000 |

| Tuesday, January 1, 2019 | 121000000 | 1067300000 |

| Wednesday, January 1, 2020 | 116000000 | 1229400000 |

| Friday, January 1, 2021 | 610000000 | 1405000000 |

| Saturday, January 1, 2022 | 756000000 | 1519000000 |

| Sunday, January 1, 2023 | 1524000000 | 1787000000 |

| Monday, January 1, 2024 | 1609000000 |

Igniting the spark of knowledge

In the competitive landscape of global transportation and infrastructure, Westinghouse Air Brake Technologies Corporation (WAB) and Ferrovial SE have emerged as key players. Over the past decade, from 2014 to 2023, these companies have demonstrated significant shifts in their EBITDA, a crucial indicator of financial health and operational efficiency.

Westinghouse Air Brake Technologies Corporation has shown a robust growth trajectory, with its EBITDA increasing by approximately 200% from 2014 to 2023. In contrast, Ferrovial SE experienced a more volatile journey, with a notable dip in 2019 and 2020, but rebounding strongly by 2023 with a 56% increase from its 2014 figures.

The data highlights the resilience and strategic adaptability of these corporations in navigating economic challenges. As the industry evolves, monitoring such financial metrics will be essential for stakeholders and investors aiming to make informed decisions.

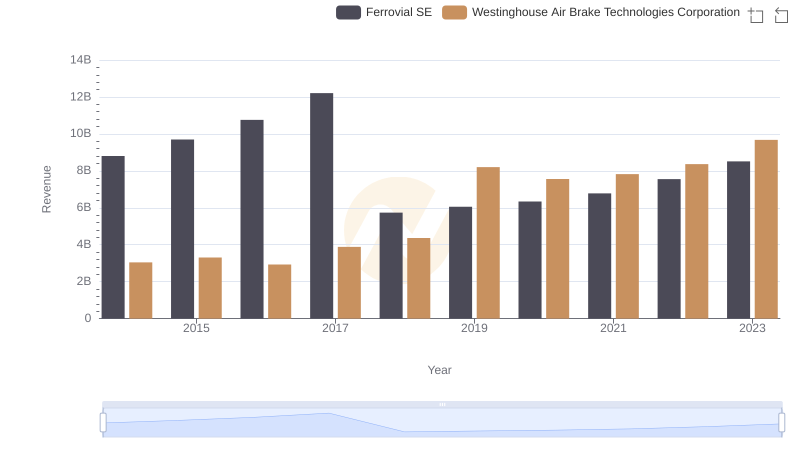

Westinghouse Air Brake Technologies Corporation vs Ferrovial SE: Annual Revenue Growth Compared

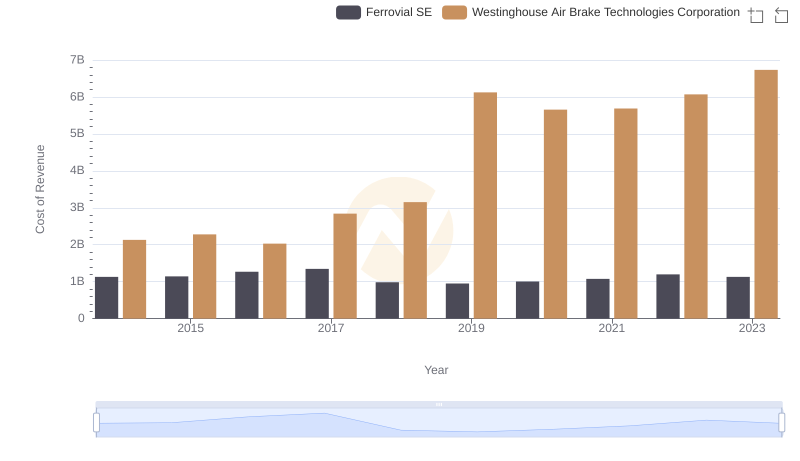

Comparing Cost of Revenue Efficiency: Westinghouse Air Brake Technologies Corporation vs Ferrovial SE

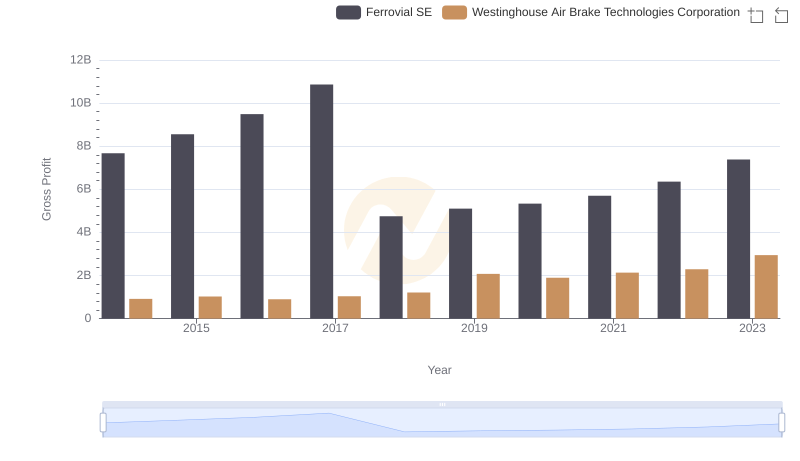

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Ferrovial SE

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Equifax Inc.

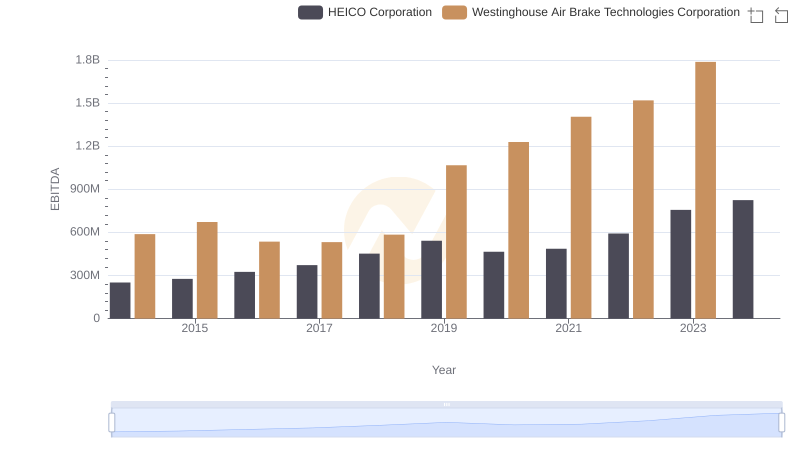

EBITDA Metrics Evaluated: Westinghouse Air Brake Technologies Corporation vs HEICO Corporation

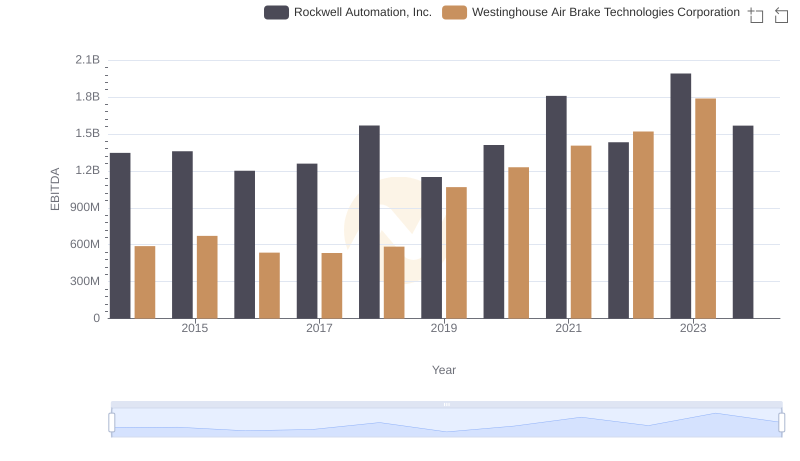

Westinghouse Air Brake Technologies Corporation and Rockwell Automation, Inc.: A Detailed Examination of EBITDA Performance

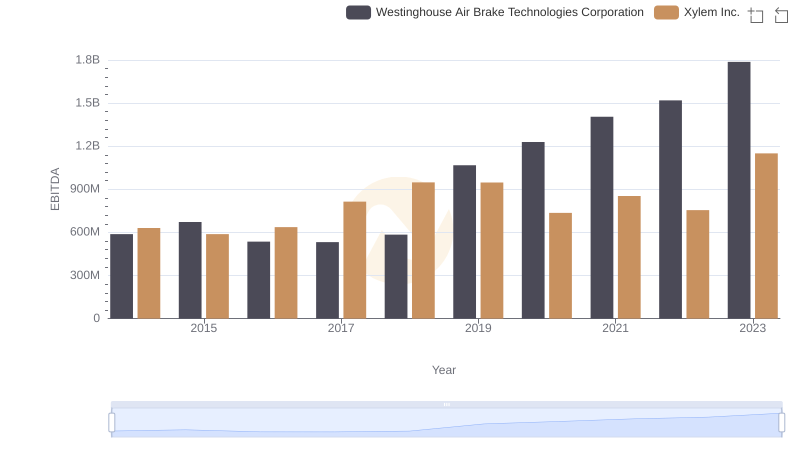

A Professional Review of EBITDA: Westinghouse Air Brake Technologies Corporation Compared to Xylem Inc.

Comparative EBITDA Analysis: Westinghouse Air Brake Technologies Corporation vs Dover Corporation

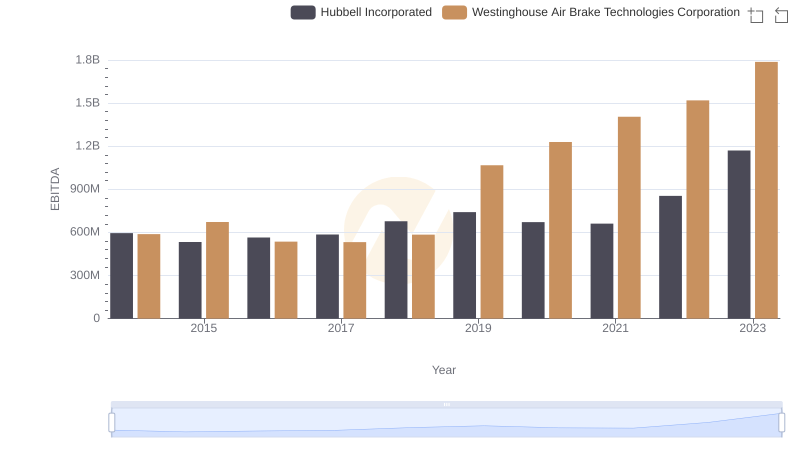

EBITDA Analysis: Evaluating Westinghouse Air Brake Technologies Corporation Against Hubbell Incorporated

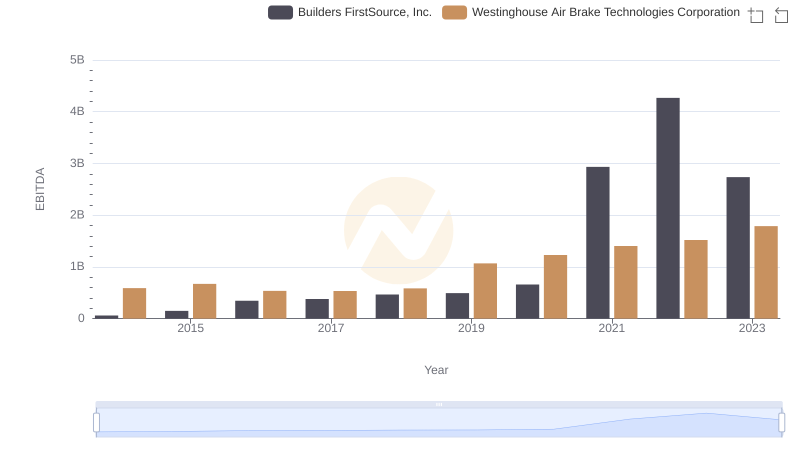

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Builders FirstSource, Inc.

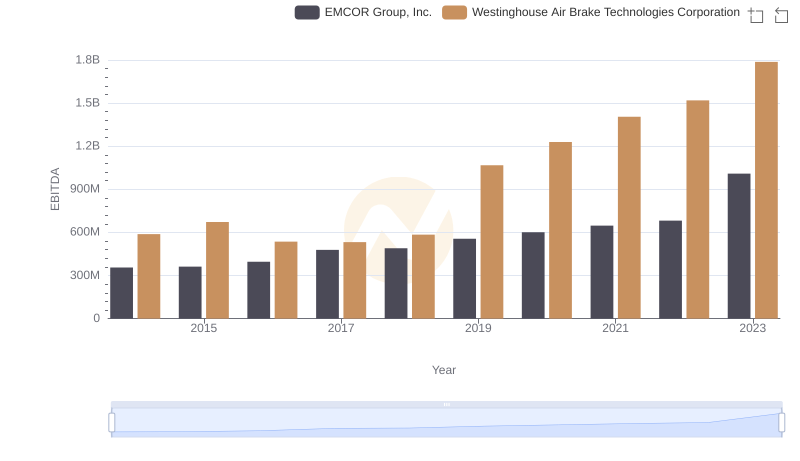

Professional EBITDA Benchmarking: Westinghouse Air Brake Technologies Corporation vs EMCOR Group, Inc.