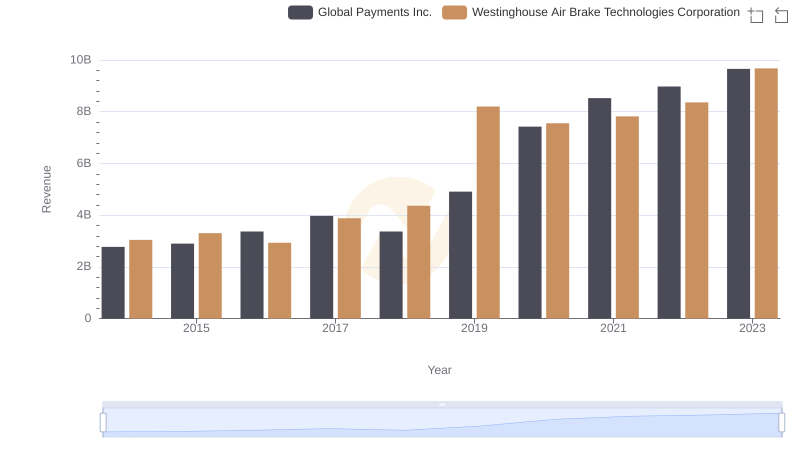

| __timestamp | Global Payments Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1022107000 | 2130920000 |

| Thursday, January 1, 2015 | 1147639000 | 2281845000 |

| Friday, January 1, 2016 | 1603532000 | 2029647000 |

| Sunday, January 1, 2017 | 1928037000 | 2841159000 |

| Monday, January 1, 2018 | 1095014000 | 3151816000 |

| Tuesday, January 1, 2019 | 2073803000 | 6122400000 |

| Wednesday, January 1, 2020 | 3650727000 | 5657400000 |

| Friday, January 1, 2021 | 3773725000 | 5687000000 |

| Saturday, January 1, 2022 | 3778617000 | 6070000000 |

| Sunday, January 1, 2023 | 3727521000 | 6733000000 |

| Monday, January 1, 2024 | 3760116000 | 7021000000 |

In pursuit of knowledge

In the ever-evolving landscape of the industrial and financial sectors, understanding cost dynamics is crucial. Westinghouse Air Brake Technologies Corporation, a leader in rail technology, and Global Payments Inc., a titan in payment technology, have shown distinct cost of revenue trends from 2014 to 2023.

Over the past decade, Westinghouse's cost of revenue has surged by approximately 216%, peaking in 2023. This growth reflects the company's expanding operations and increased production costs, aligning with its strategic focus on innovation and market expansion.

Conversely, Global Payments Inc. experienced a 265% increase in cost of revenue, with a notable spike in 2020. This rise underscores the company's aggressive acquisition strategy and the growing demand for digital payment solutions.

These trends highlight the contrasting strategies and market responses of these industry giants, offering valuable insights for investors and analysts alike.

Westinghouse Air Brake Technologies Corporation or Global Payments Inc.: Who Leads in Yearly Revenue?

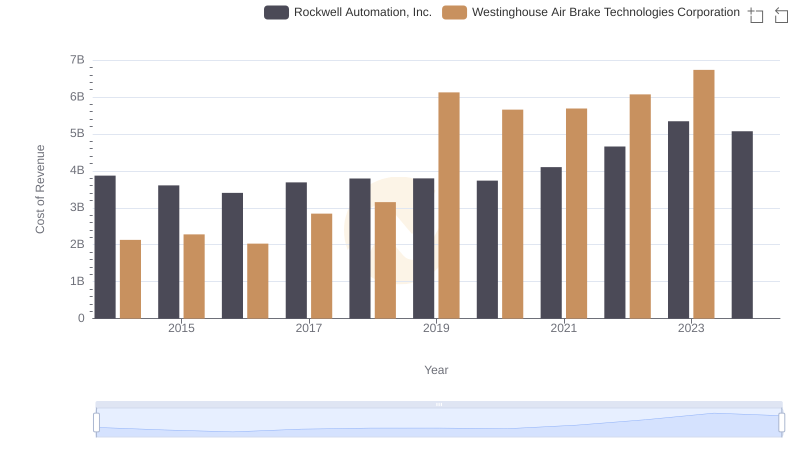

Westinghouse Air Brake Technologies Corporation vs Rockwell Automation, Inc.: Efficiency in Cost of Revenue Explored

Cost of Revenue: Key Insights for Westinghouse Air Brake Technologies Corporation and United Airlines Holdings, Inc.

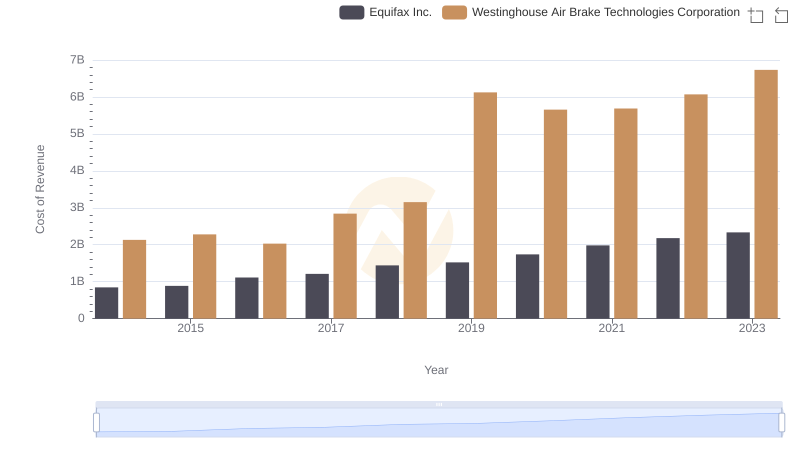

Westinghouse Air Brake Technologies Corporation vs Equifax Inc.: Efficiency in Cost of Revenue Explored

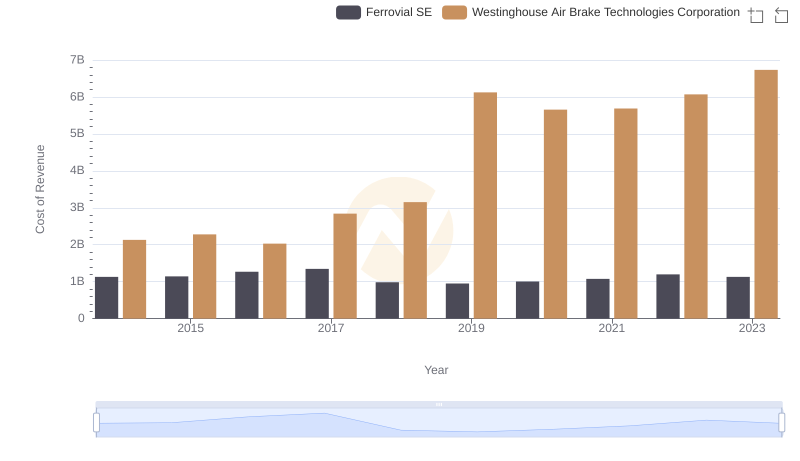

Comparing Cost of Revenue Efficiency: Westinghouse Air Brake Technologies Corporation vs Ferrovial SE

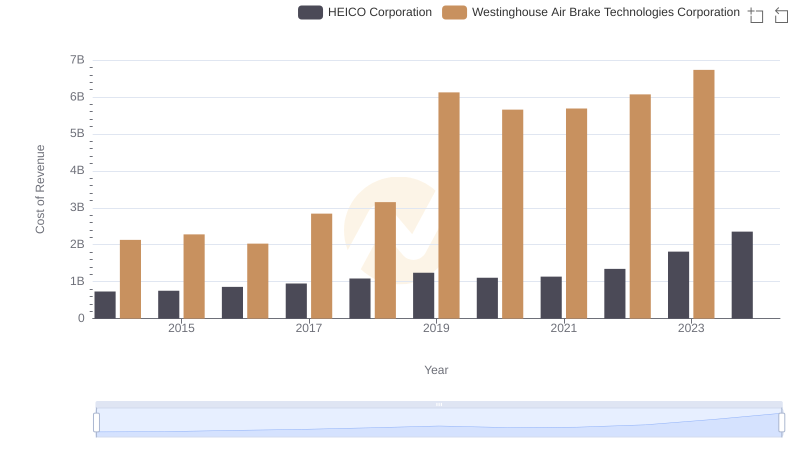

Westinghouse Air Brake Technologies Corporation vs HEICO Corporation: Efficiency in Cost of Revenue Explored

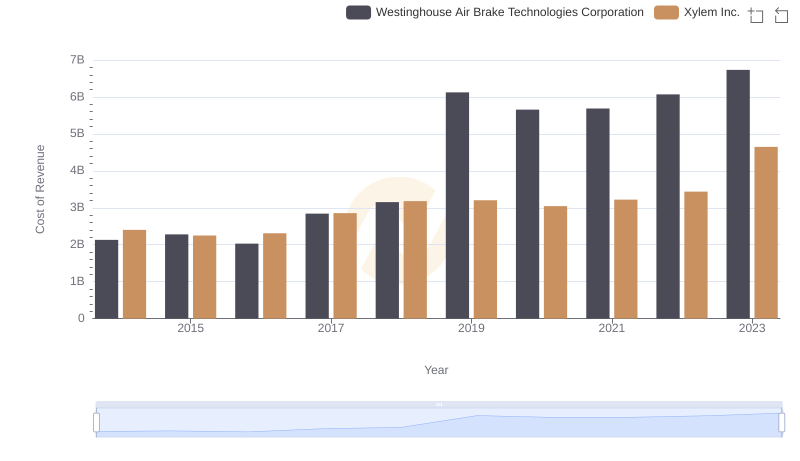

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and Xylem Inc.'s Expenses

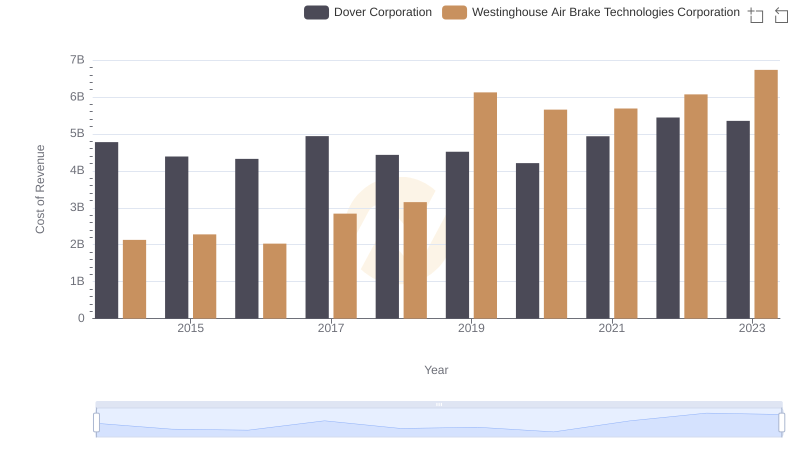

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and Dover Corporation's Expenses