| __timestamp | Rockwell Automation, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3869600000 | 2130920000 |

| Thursday, January 1, 2015 | 3604800000 | 2281845000 |

| Friday, January 1, 2016 | 3404000000 | 2029647000 |

| Sunday, January 1, 2017 | 3687100000 | 2841159000 |

| Monday, January 1, 2018 | 3793800000 | 3151816000 |

| Tuesday, January 1, 2019 | 3794700000 | 6122400000 |

| Wednesday, January 1, 2020 | 3734600000 | 5657400000 |

| Friday, January 1, 2021 | 4099700000 | 5687000000 |

| Saturday, January 1, 2022 | 4658400000 | 6070000000 |

| Sunday, January 1, 2023 | 5341000000 | 6733000000 |

| Monday, January 1, 2024 | 5070800000 | 7021000000 |

Igniting the spark of knowledge

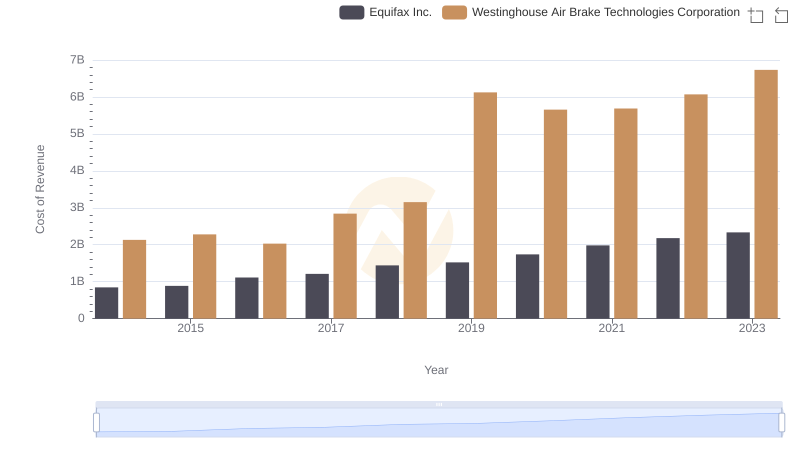

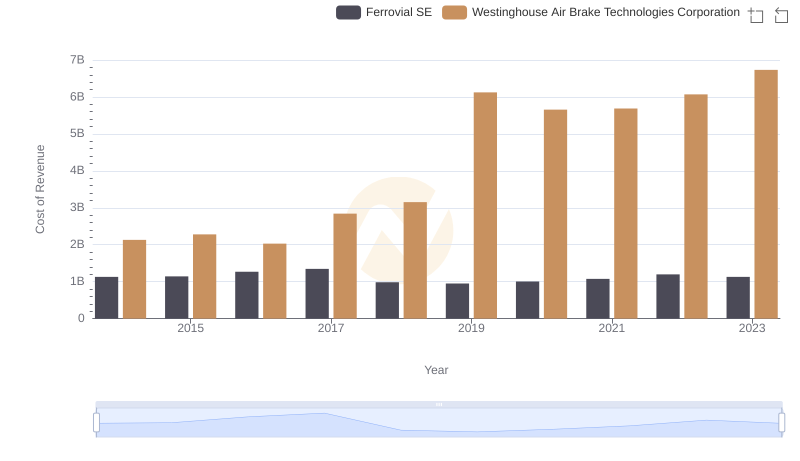

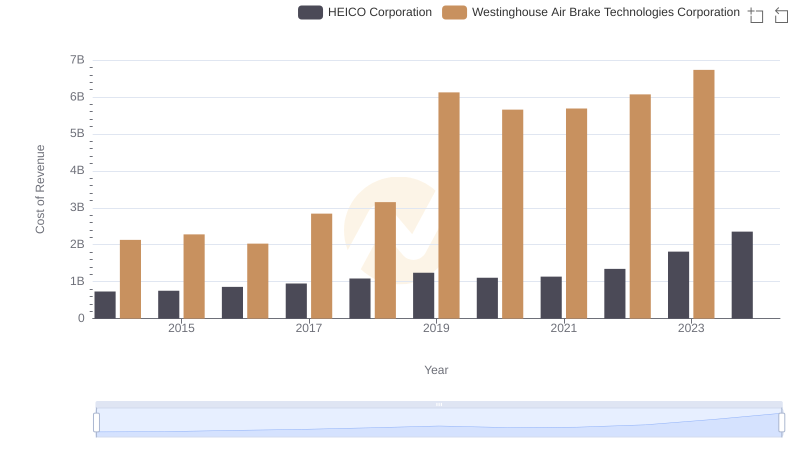

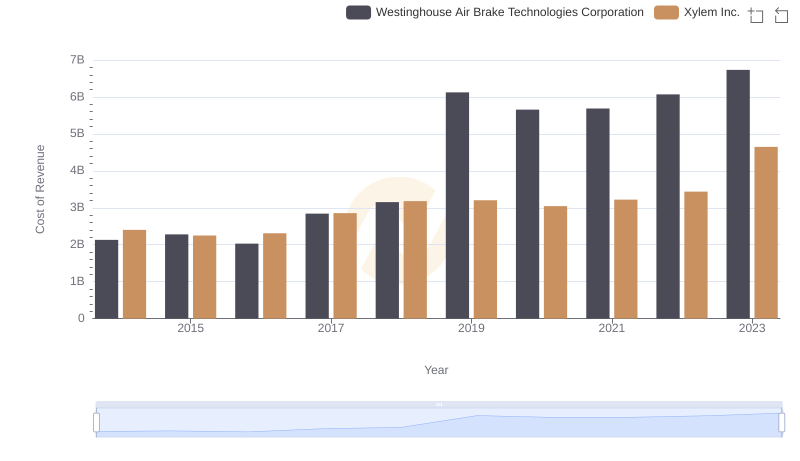

In the competitive landscape of industrial automation, cost efficiency is a critical metric. Over the past decade, Rockwell Automation, Inc. and Westinghouse Air Brake Technologies Corporation have showcased distinct trends in their cost of revenue. From 2014 to 2023, Rockwell Automation's cost of revenue increased by approximately 38%, peaking in 2023. Meanwhile, Westinghouse Air Brake Technologies saw a dramatic rise of over 215% from 2014 to 2023, highlighting a significant shift in their operational dynamics.

These trends underscore the evolving strategies of these industrial leaders, with Rockwell focusing on steady growth and Westinghouse adapting to rapid changes in market demands.

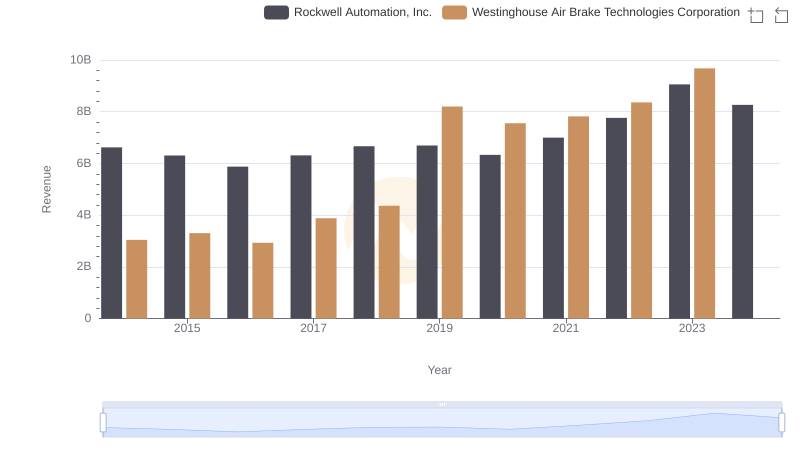

Westinghouse Air Brake Technologies Corporation vs Rockwell Automation, Inc.: Examining Key Revenue Metrics

Cost of Revenue: Key Insights for Westinghouse Air Brake Technologies Corporation and United Airlines Holdings, Inc.

Westinghouse Air Brake Technologies Corporation vs Equifax Inc.: Efficiency in Cost of Revenue Explored

Comparing Cost of Revenue Efficiency: Westinghouse Air Brake Technologies Corporation vs Ferrovial SE

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs Global Payments Inc.

Westinghouse Air Brake Technologies Corporation vs HEICO Corporation: Efficiency in Cost of Revenue Explored

Cost Insights: Breaking Down Westinghouse Air Brake Technologies Corporation and Xylem Inc.'s Expenses

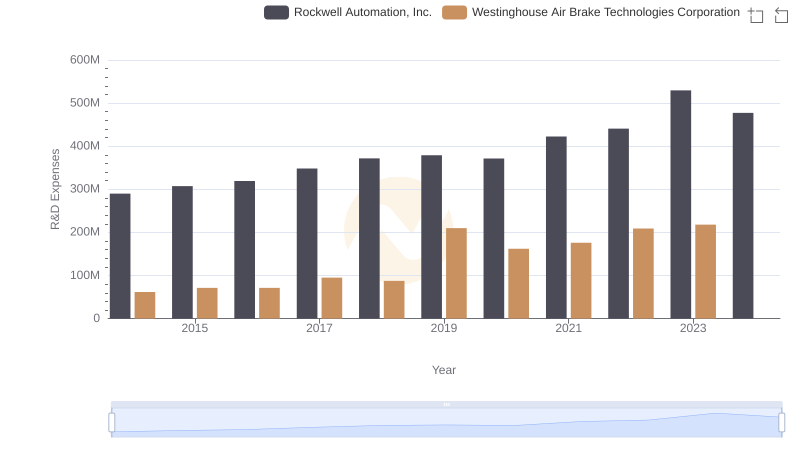

Westinghouse Air Brake Technologies Corporation vs Rockwell Automation, Inc.: Strategic Focus on R&D Spending

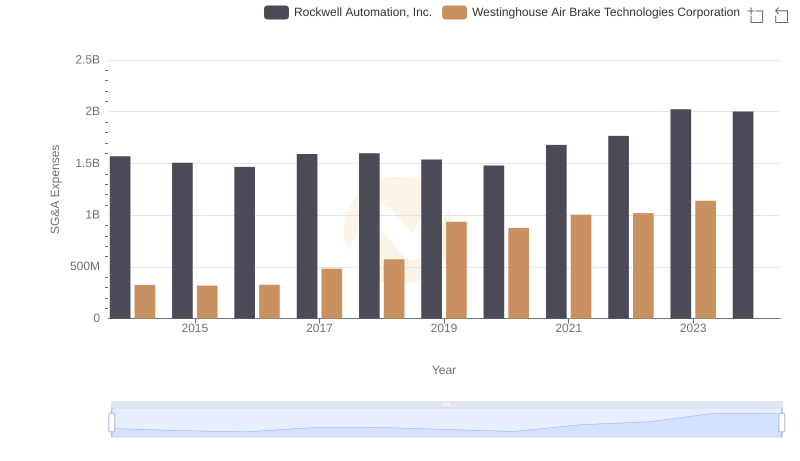

Westinghouse Air Brake Technologies Corporation and Rockwell Automation, Inc.: SG&A Spending Patterns Compared

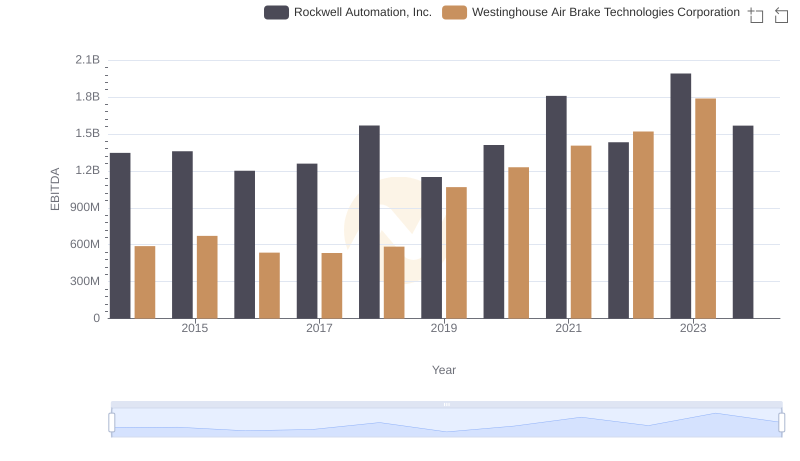

Westinghouse Air Brake Technologies Corporation and Rockwell Automation, Inc.: A Detailed Examination of EBITDA Performance