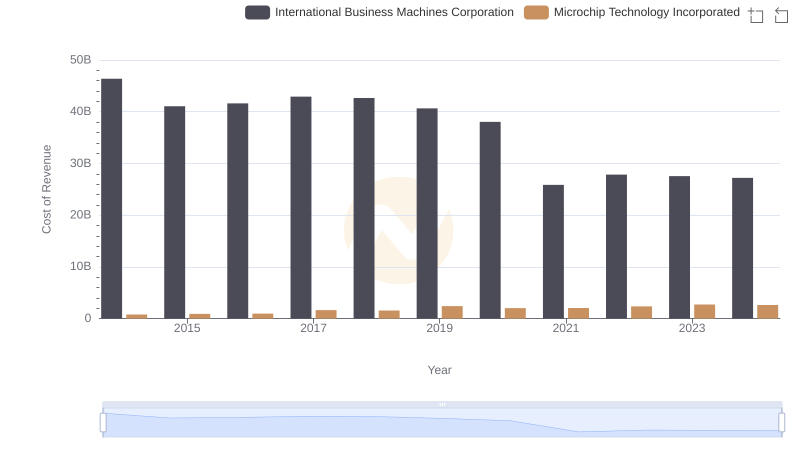

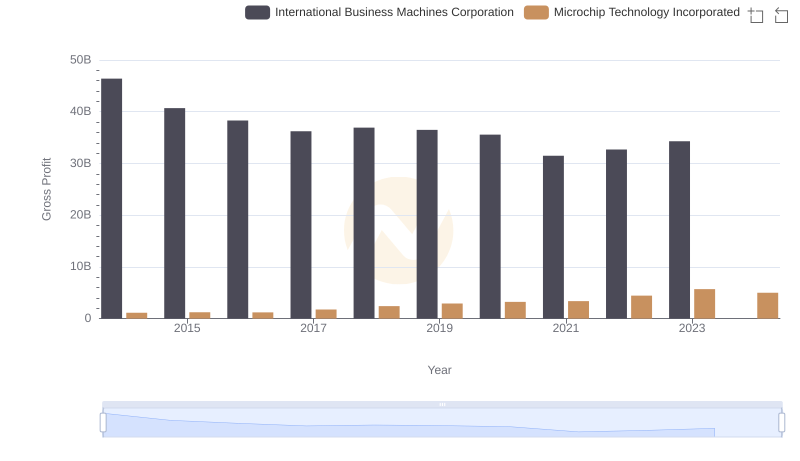

| __timestamp | International Business Machines Corporation | Microchip Technology Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 92793000000 | 1931217000 |

| Thursday, January 1, 2015 | 81742000000 | 2147036000 |

| Friday, January 1, 2016 | 79920000000 | 2173334000 |

| Sunday, January 1, 2017 | 79139000000 | 3407807000 |

| Monday, January 1, 2018 | 79591000000 | 3980800000 |

| Tuesday, January 1, 2019 | 57714000000 | 5349500000 |

| Wednesday, January 1, 2020 | 55179000000 | 5274200000 |

| Friday, January 1, 2021 | 57351000000 | 5438400000 |

| Saturday, January 1, 2022 | 60530000000 | 6820900000 |

| Sunday, January 1, 2023 | 61860000000 | 8438700000 |

| Monday, January 1, 2024 | 62753000000 | 7634400000 |

In pursuit of knowledge

In the ever-evolving landscape of technology, the revenue trajectories of International Business Machines Corporation (IBM) and Microchip Technology Incorporated offer a fascinating glimpse into the industry's shifts over the past decade. From 2014 to 2024, IBM's annual revenue has seen a decline of approximately 32%, dropping from its peak in 2014. This trend reflects the company's strategic pivot from traditional hardware to cloud computing and AI services.

Conversely, Microchip Technology has experienced a robust growth of over 290% in the same period, highlighting its successful expansion in the semiconductor market. By 2023, Microchip's revenue reached its zenith, showcasing the increasing demand for microcontrollers and analog semiconductors.

This comparison underscores the broader industry trend where nimble, specialized firms like Microchip are thriving, while legacy giants like IBM are navigating transformative shifts to maintain their market relevance.

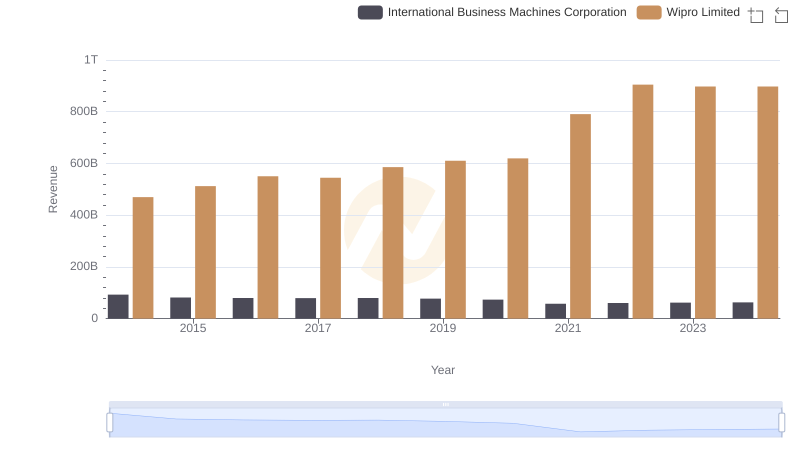

International Business Machines Corporation vs Wipro Limited: Examining Key Revenue Metrics

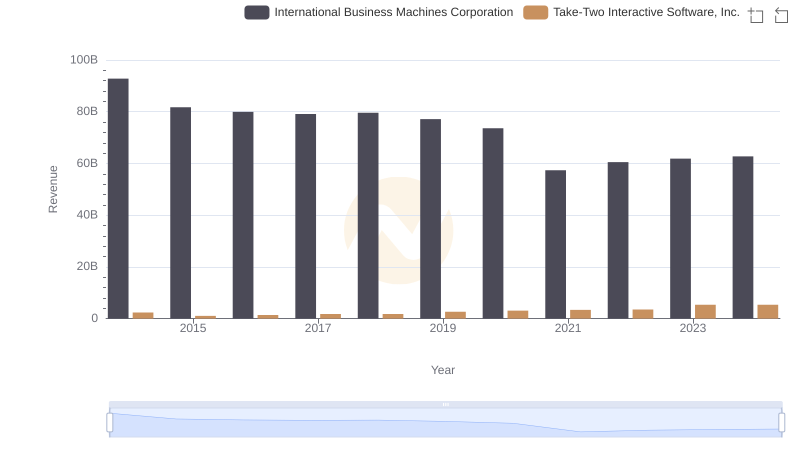

Breaking Down Revenue Trends: International Business Machines Corporation vs Take-Two Interactive Software, Inc.

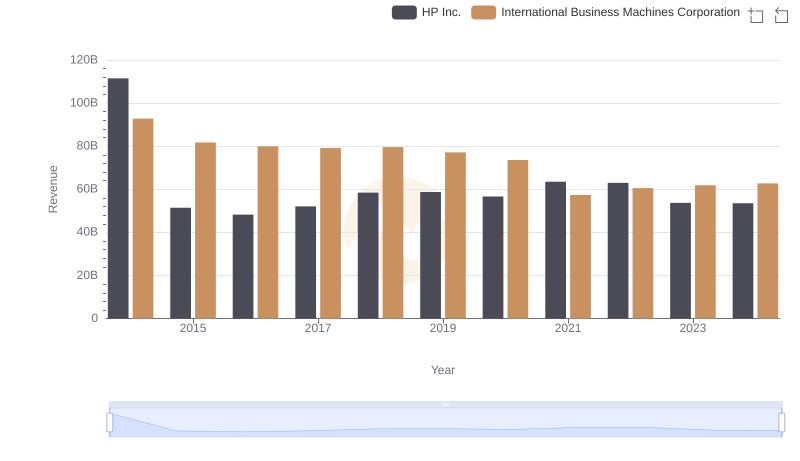

International Business Machines Corporation and HP Inc.: A Comprehensive Revenue Analysis

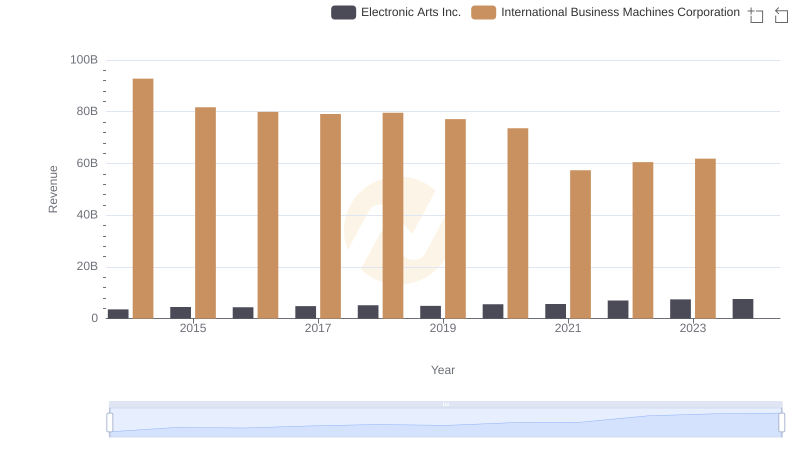

Comparing Revenue Performance: International Business Machines Corporation or Electronic Arts Inc.?

Breaking Down Revenue Trends: International Business Machines Corporation vs II-VI Incorporated

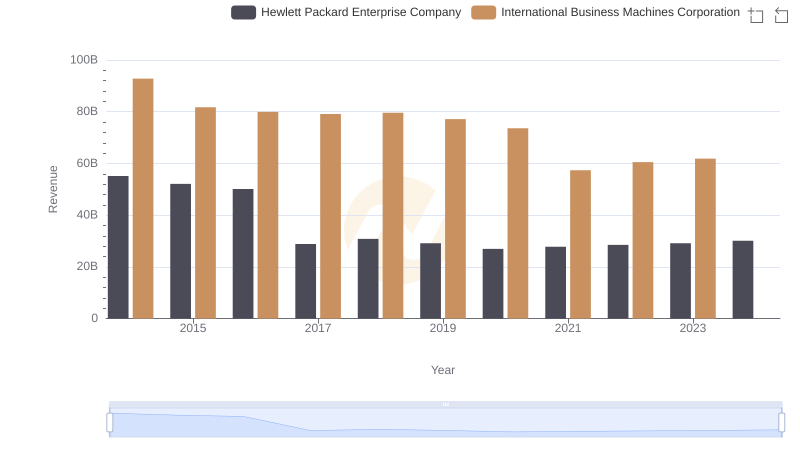

Who Generates More Revenue? International Business Machines Corporation or Hewlett Packard Enterprise Company

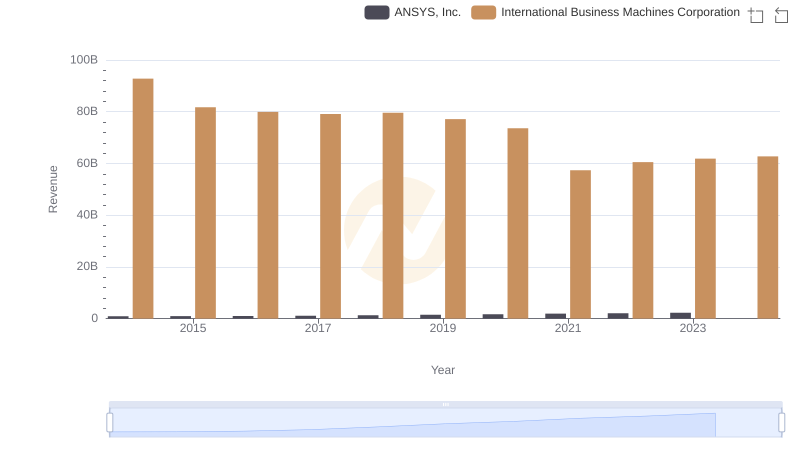

International Business Machines Corporation and ANSYS, Inc.: A Comprehensive Revenue Analysis

Comparing Cost of Revenue Efficiency: International Business Machines Corporation vs Microchip Technology Incorporated

Gross Profit Analysis: Comparing International Business Machines Corporation and Microchip Technology Incorporated

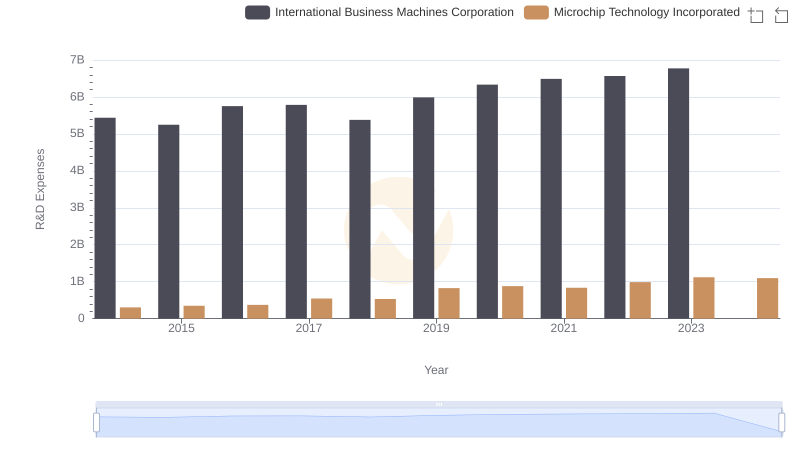

Analyzing R&D Budgets: International Business Machines Corporation vs Microchip Technology Incorporated

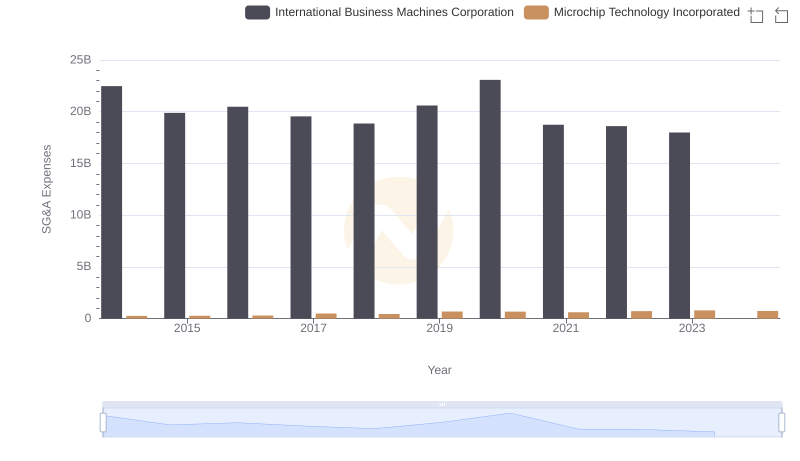

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Microchip Technology Incorporated

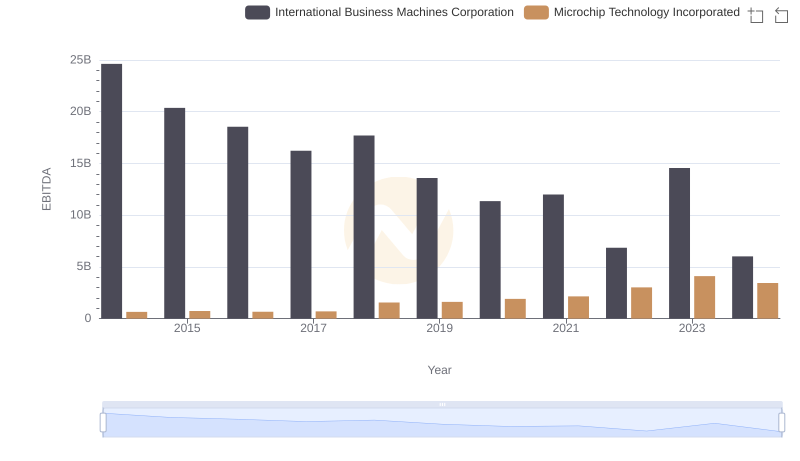

EBITDA Metrics Evaluated: International Business Machines Corporation vs Microchip Technology Incorporated