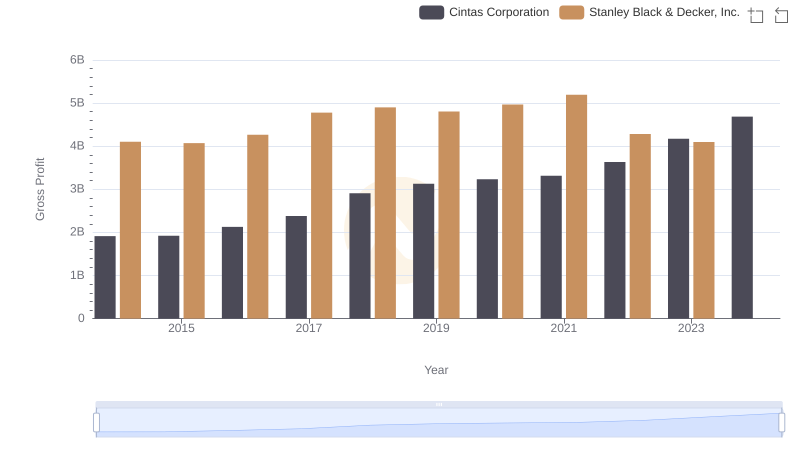

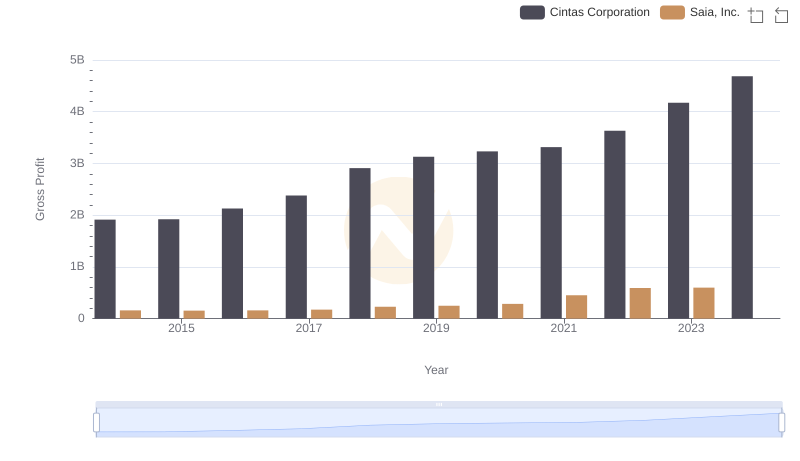

| __timestamp | Cintas Corporation | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1914386000 | 4102700000 |

| Thursday, January 1, 2015 | 1921337000 | 4072000000 |

| Friday, January 1, 2016 | 2129870000 | 4267200000 |

| Sunday, January 1, 2017 | 2380295000 | 4778000000 |

| Monday, January 1, 2018 | 2908523000 | 4901900000 |

| Tuesday, January 1, 2019 | 3128588000 | 4805500000 |

| Wednesday, January 1, 2020 | 3233748000 | 4967900000 |

| Friday, January 1, 2021 | 3314651000 | 5194200000 |

| Saturday, January 1, 2022 | 3632246000 | 4284100000 |

| Sunday, January 1, 2023 | 4173368000 | 4098000000 |

| Monday, January 1, 2024 | 4686416000 | 4514400000 |

Unveiling the hidden dimensions of data

In the competitive landscape of American industry, Cintas Corporation and Stanley Black & Decker, Inc. have long been titans. Over the past decade, these companies have showcased their prowess in generating substantial gross profits. From 2014 to 2023, Cintas Corporation's gross profit surged by an impressive 145%, reflecting its robust growth strategy and market adaptability. In contrast, Stanley Black & Decker, Inc. experienced a more modest increase of around 0.5% during the same period, highlighting a stable yet less dynamic trajectory.

The year 2023 marked a pivotal moment, with Cintas Corporation achieving a gross profit of approximately $4.17 billion, surpassing Stanley Black & Decker's $4.10 billion. This shift underscores Cintas's strategic advancements and market penetration. However, data for 2024 remains incomplete for Stanley Black & Decker, leaving room for speculation on future trends. As these industry leaders continue to evolve, their financial narratives offer valuable insights into the broader economic landscape.

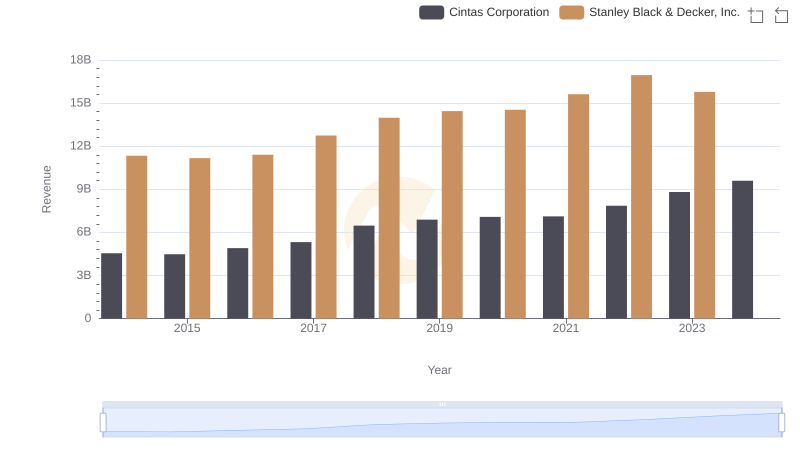

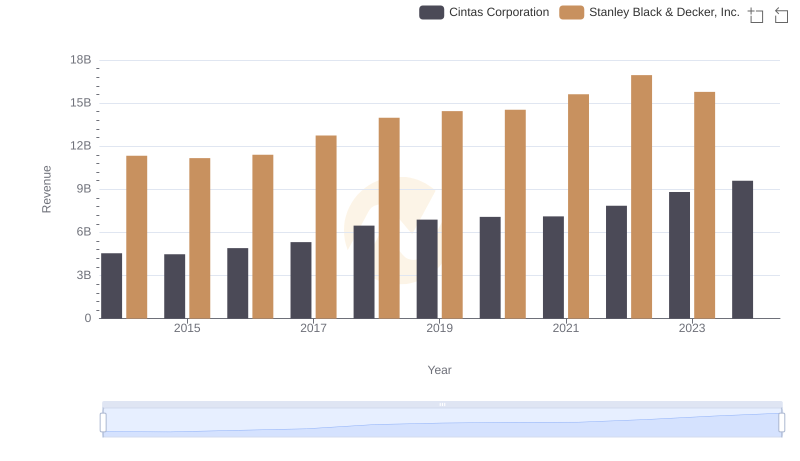

Cintas Corporation or Stanley Black & Decker, Inc.: Who Leads in Yearly Revenue?

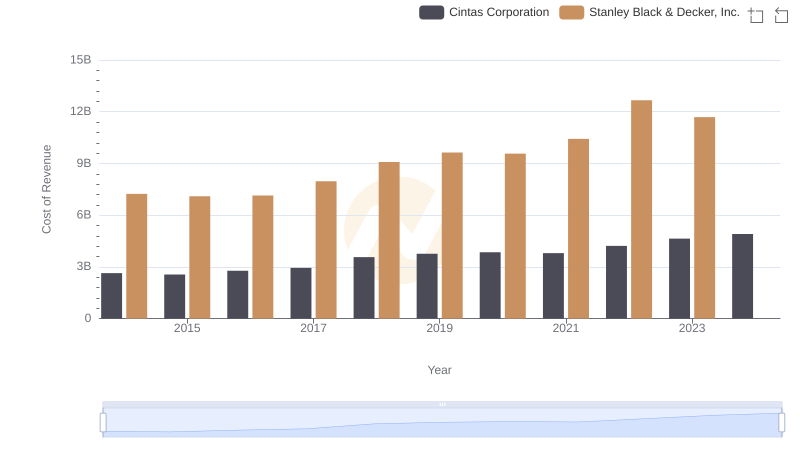

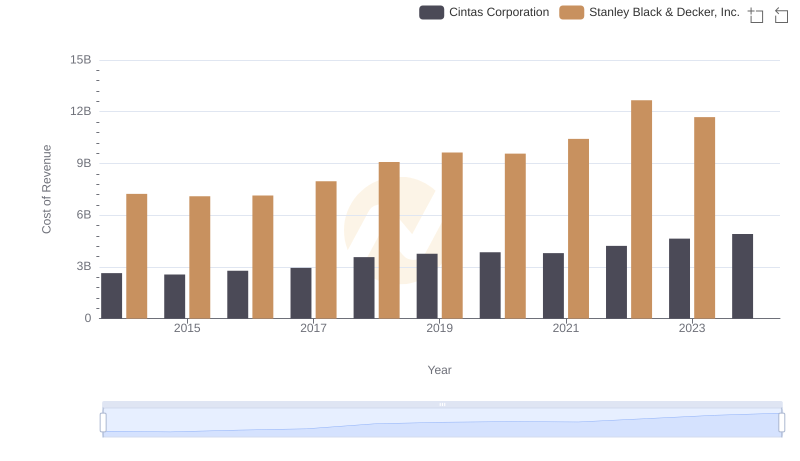

Cost of Revenue: Key Insights for Cintas Corporation and Stanley Black & Decker, Inc.

Key Insights on Gross Profit: Cintas Corporation vs Stanley Black & Decker, Inc.

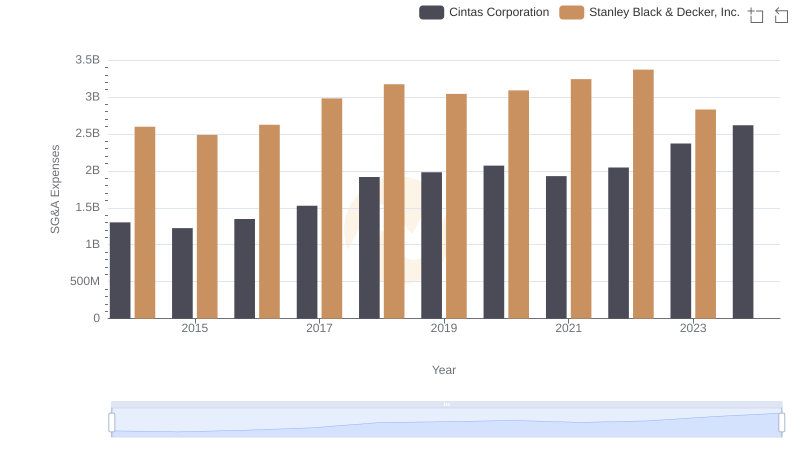

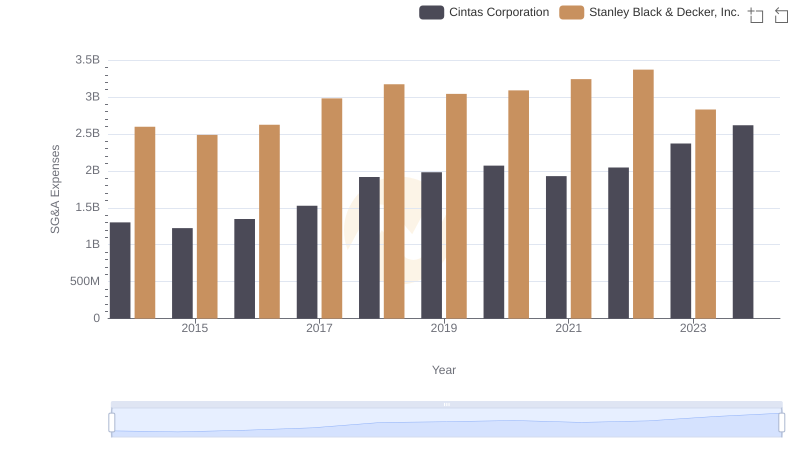

Operational Costs Compared: SG&A Analysis of Cintas Corporation and Stanley Black & Decker, Inc.

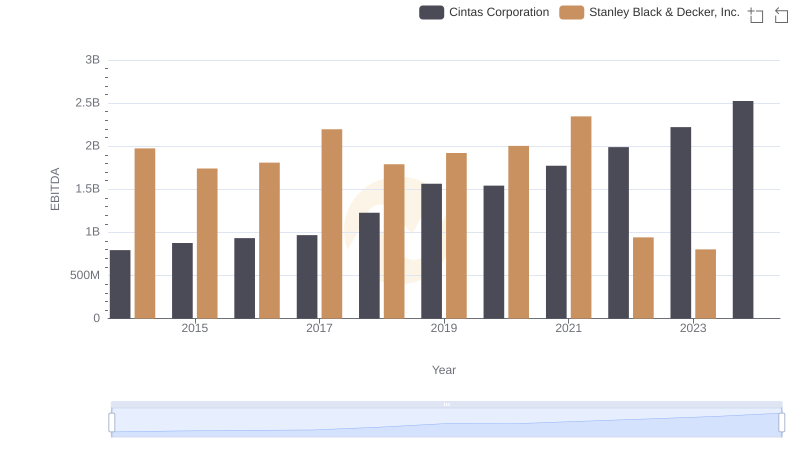

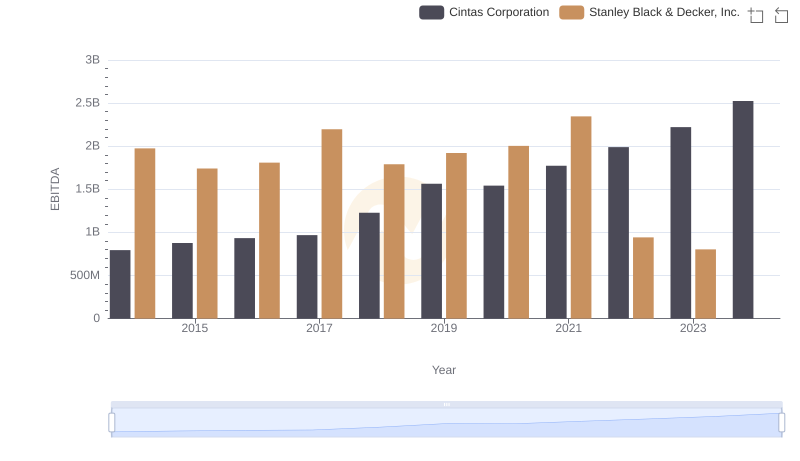

Cintas Corporation vs Stanley Black & Decker, Inc.: In-Depth EBITDA Performance Comparison

Breaking Down Revenue Trends: Cintas Corporation vs Stanley Black & Decker, Inc.

Analyzing Cost of Revenue: Cintas Corporation and Stanley Black & Decker, Inc.

Who Generates Higher Gross Profit? Cintas Corporation or Saia, Inc.

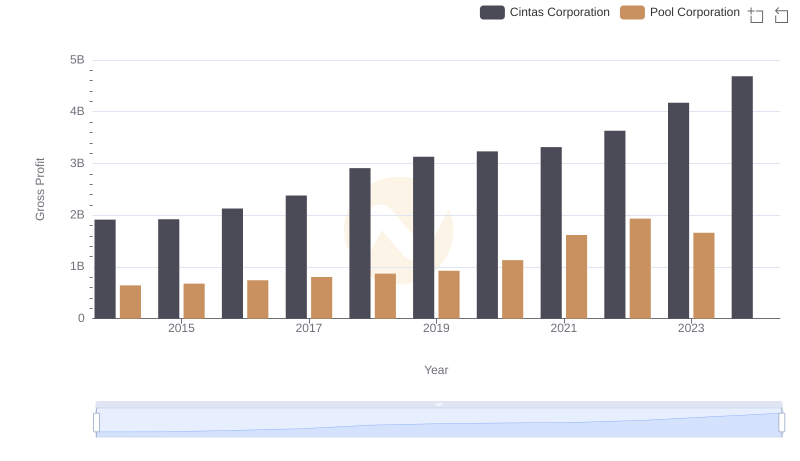

Who Generates Higher Gross Profit? Cintas Corporation or Pool Corporation

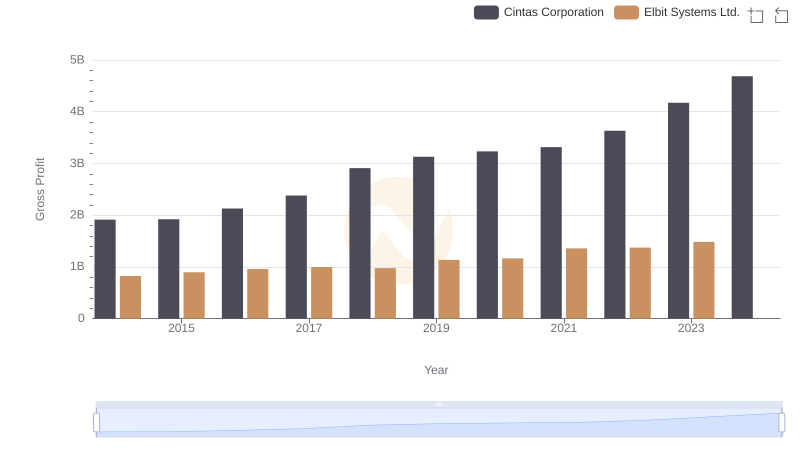

Gross Profit Trends Compared: Cintas Corporation vs Elbit Systems Ltd.

Cintas Corporation or Stanley Black & Decker, Inc.: Who Manages SG&A Costs Better?

Comprehensive EBITDA Comparison: Cintas Corporation vs Stanley Black & Decker, Inc.