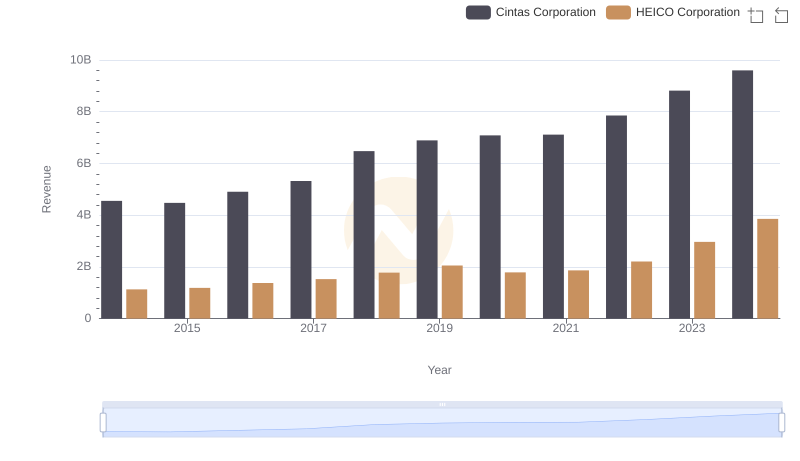

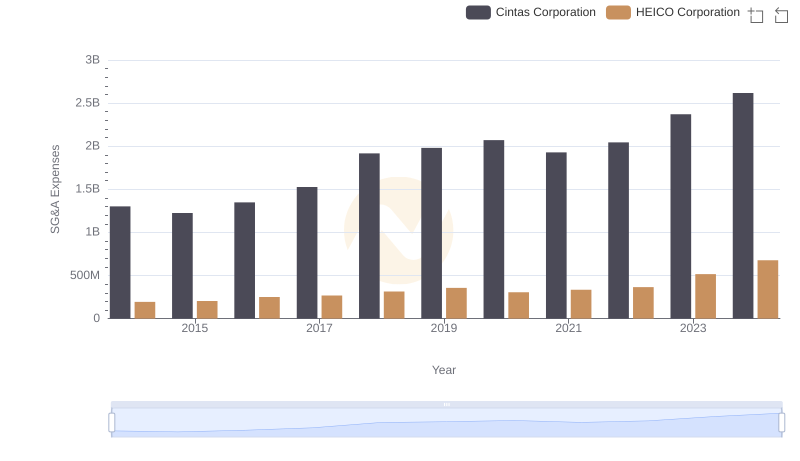

| __timestamp | Cintas Corporation | HEICO Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2637426000 | 733999000 |

| Thursday, January 1, 2015 | 2555549000 | 754469000 |

| Friday, January 1, 2016 | 2775588000 | 860766000 |

| Sunday, January 1, 2017 | 2943086000 | 950088000 |

| Monday, January 1, 2018 | 3568109000 | 1087006000 |

| Tuesday, January 1, 2019 | 3763715000 | 1241807000 |

| Wednesday, January 1, 2020 | 3851372000 | 1104882000 |

| Friday, January 1, 2021 | 3801689000 | 1138259000 |

| Saturday, January 1, 2022 | 4222213000 | 1345563000 |

| Sunday, January 1, 2023 | 4642401000 | 1814617000 |

| Monday, January 1, 2024 | 4910199000 | 2355943000 |

Infusing magic into the data realm

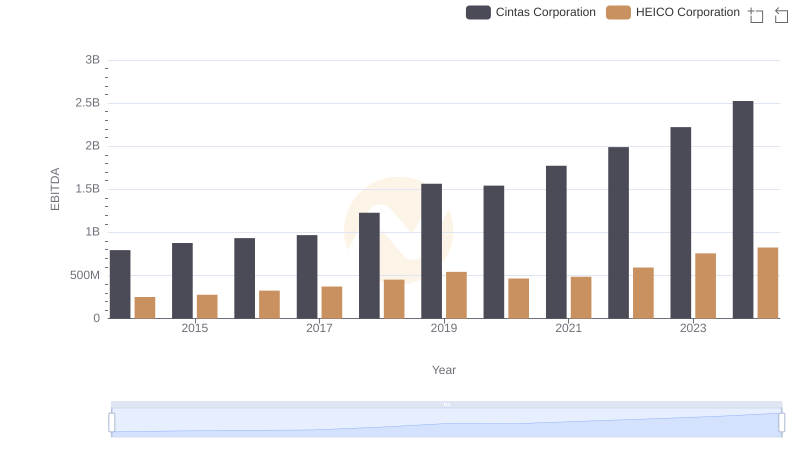

In the competitive landscape of corporate America, cost efficiency is a critical metric. Cintas Corporation and HEICO Corporation, two industry giants, have demonstrated contrasting trends in their cost of revenue from 2014 to 2024. Cintas, a leader in uniform rental services, has seen its cost of revenue grow by approximately 86% over the decade, reflecting its expansive growth strategy. In contrast, HEICO, a prominent aerospace and electronics company, has experienced a 221% increase, indicating a significant rise in operational costs.

From 2014 to 2024, Cintas maintained a steady upward trajectory, with a notable spike in 2023, reaching nearly 5 billion. HEICO, while starting at a lower base, accelerated its cost of revenue, peaking in 2024. This divergence highlights the distinct operational strategies and market dynamics each company faces, offering valuable insights for investors and industry analysts.

Breaking Down Revenue Trends: Cintas Corporation vs HEICO Corporation

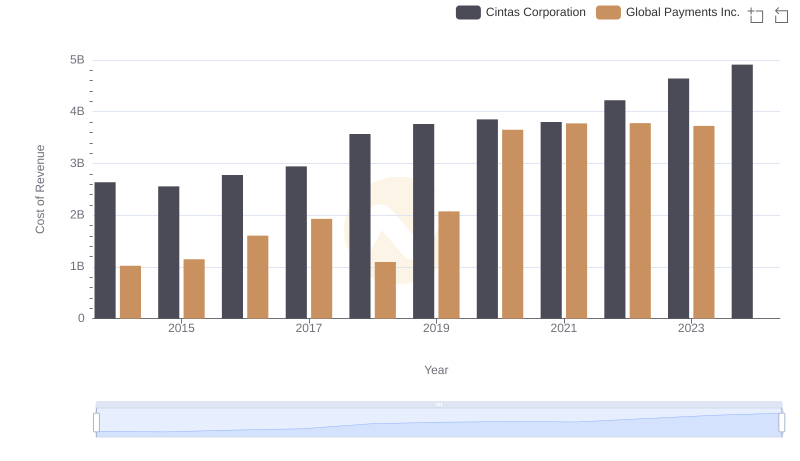

Comparing Cost of Revenue Efficiency: Cintas Corporation vs Global Payments Inc.

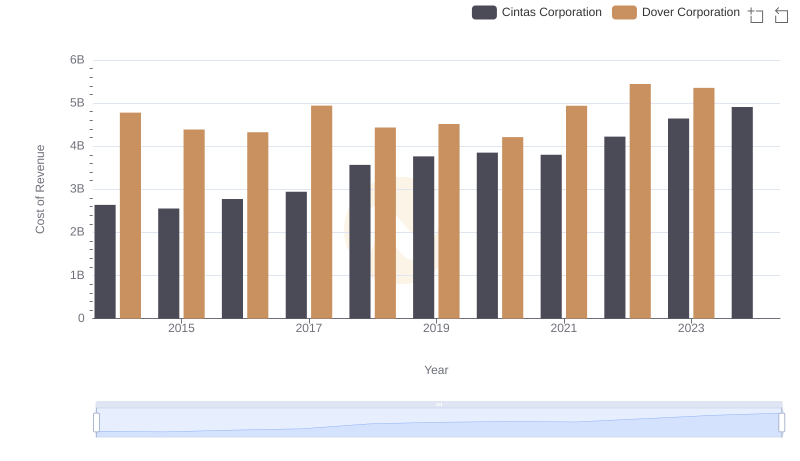

Cost of Revenue Trends: Cintas Corporation vs Dover Corporation

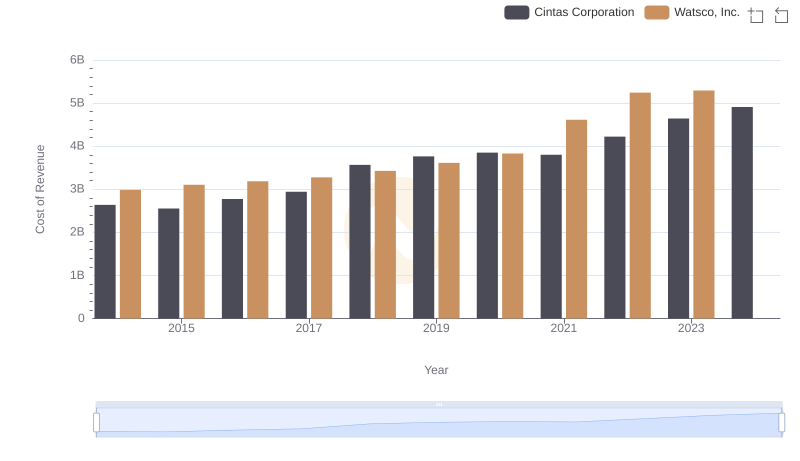

Cost of Revenue: Key Insights for Cintas Corporation and Watsco, Inc.

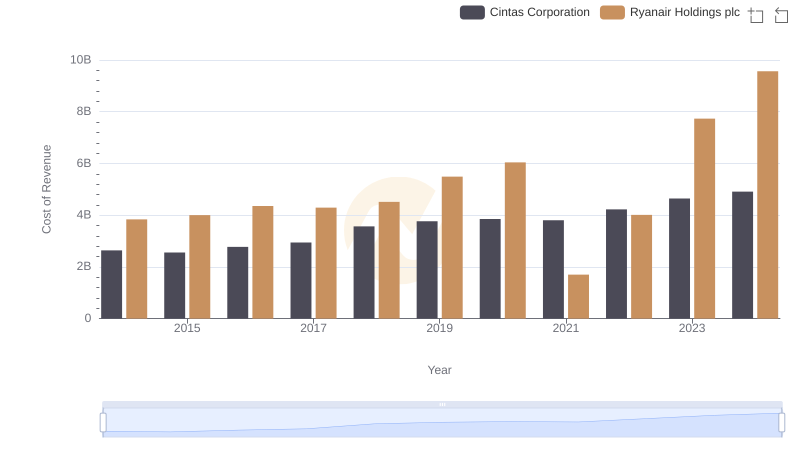

Cost Insights: Breaking Down Cintas Corporation and Ryanair Holdings plc's Expenses

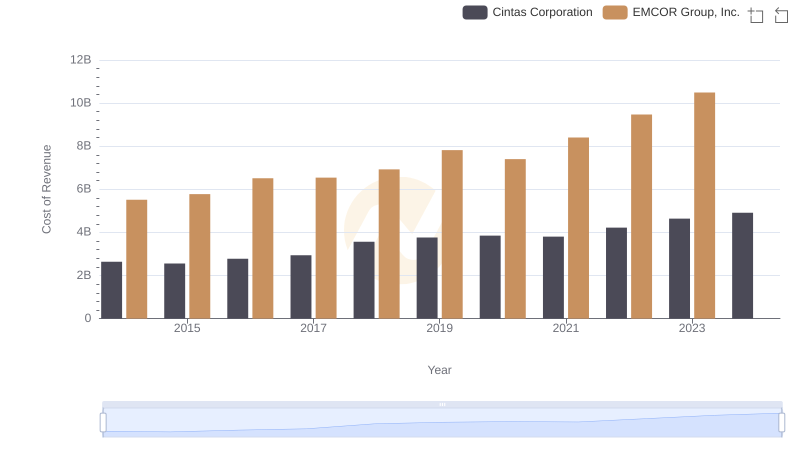

Comparing Cost of Revenue Efficiency: Cintas Corporation vs EMCOR Group, Inc.

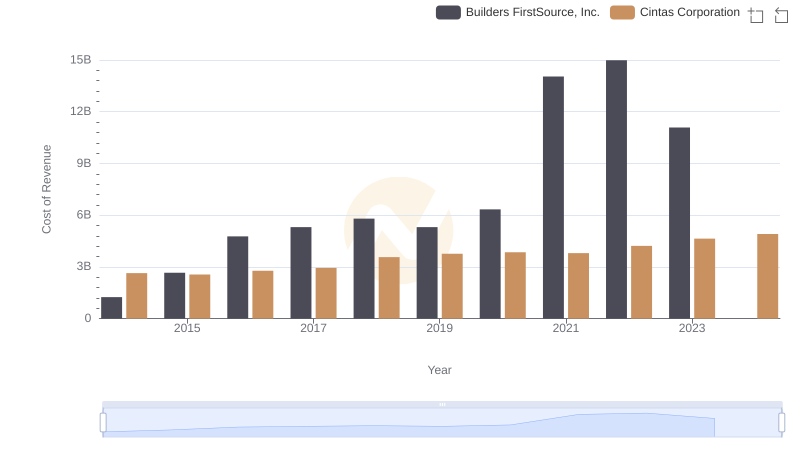

Comparing Cost of Revenue Efficiency: Cintas Corporation vs Builders FirstSource, Inc.

Cintas Corporation vs HEICO Corporation: SG&A Expense Trends

A Professional Review of EBITDA: Cintas Corporation Compared to HEICO Corporation