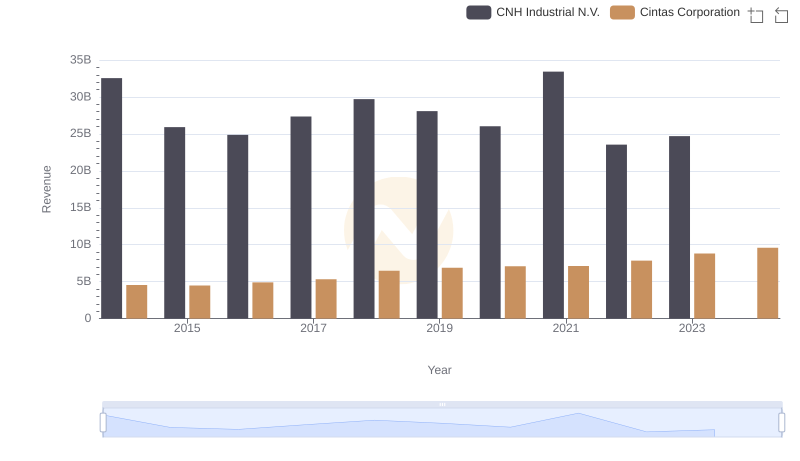

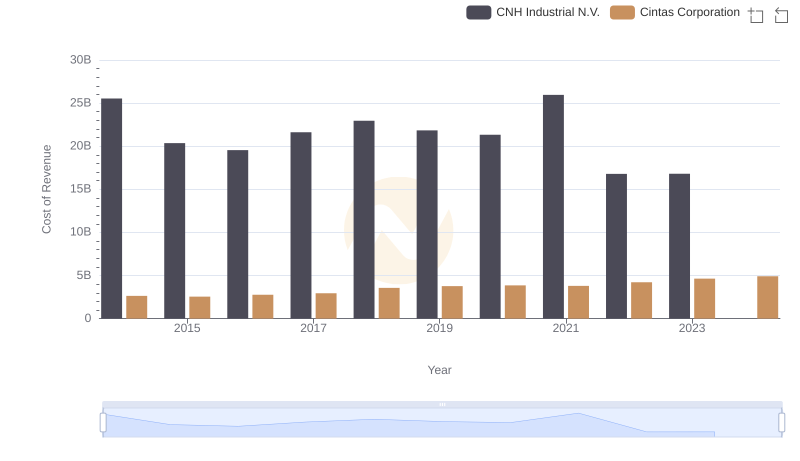

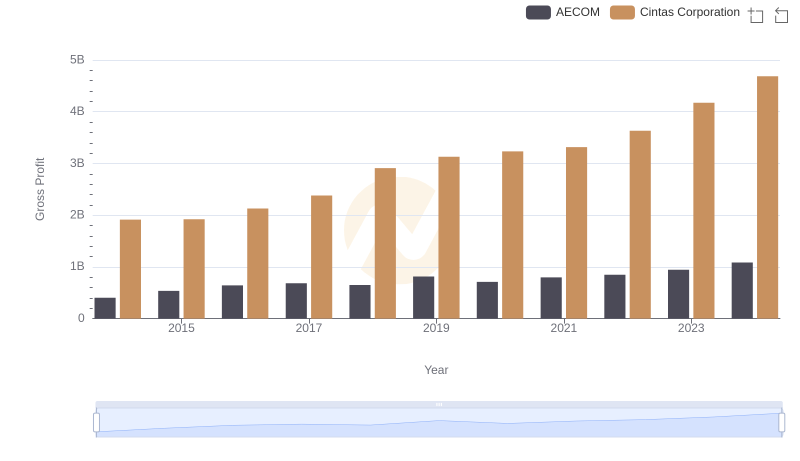

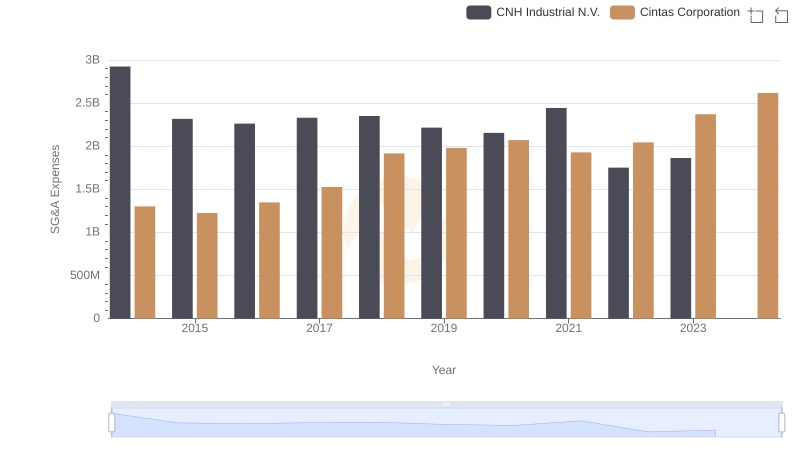

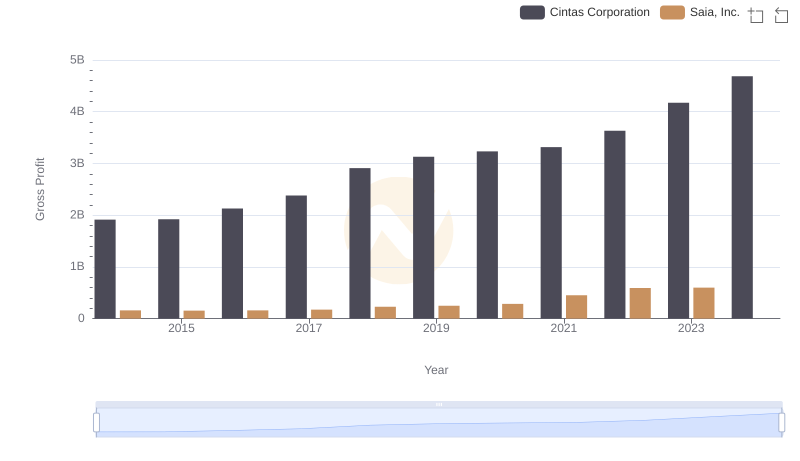

| __timestamp | CNH Industrial N.V. | Cintas Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 7021000000 | 1914386000 |

| Thursday, January 1, 2015 | 5555000000 | 1921337000 |

| Friday, January 1, 2016 | 5333000000 | 2129870000 |

| Sunday, January 1, 2017 | 5740000000 | 2380295000 |

| Monday, January 1, 2018 | 6748000000 | 2908523000 |

| Tuesday, January 1, 2019 | 6247000000 | 3128588000 |

| Wednesday, January 1, 2020 | 4705000000 | 3233748000 |

| Friday, January 1, 2021 | 7477000000 | 3314651000 |

| Saturday, January 1, 2022 | 6754000000 | 3632246000 |

| Sunday, January 1, 2023 | 7889000000 | 4173368000 |

| Monday, January 1, 2024 | 4686416000 |

In pursuit of knowledge

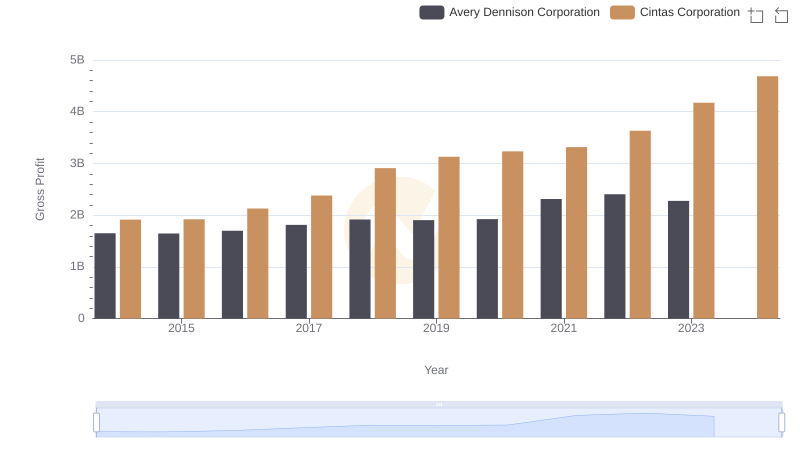

In the competitive landscape of global industries, understanding who leads in profitability is crucial. From 2014 to 2023, CNH Industrial N.V. consistently outperformed Cintas Corporation in gross profit, with CNH peaking at approximately $7.9 billion in 2023. However, Cintas has shown remarkable growth, nearly doubling its gross profit from $1.9 billion in 2014 to $4.2 billion in 2023, a staggering 120% increase.

While CNH Industrial's profits fluctuated, Cintas demonstrated steady growth, especially notable during the pandemic year of 2020, where it increased its gross profit by 3% compared to the previous year. This resilience highlights Cintas's strategic adaptability in challenging times. As we look to the future, Cintas's upward trend suggests a potential shift in the balance of power, making it a company to watch closely.

Cintas Corporation and CNH Industrial N.V.: A Comprehensive Revenue Analysis

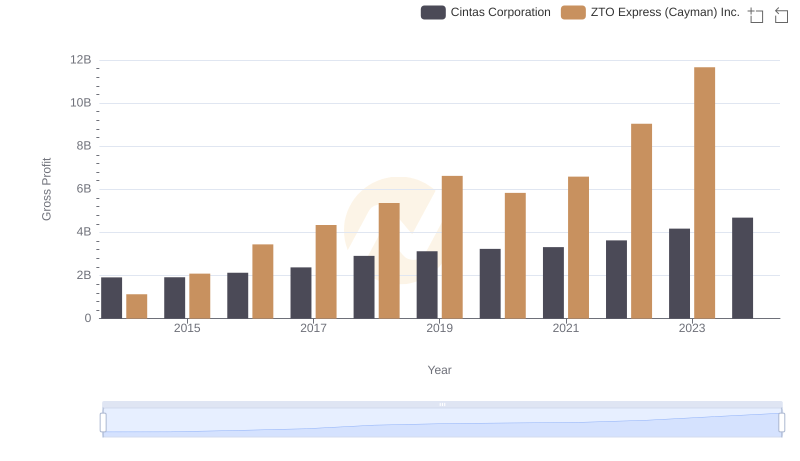

Cintas Corporation vs ZTO Express (Cayman) Inc.: A Gross Profit Performance Breakdown

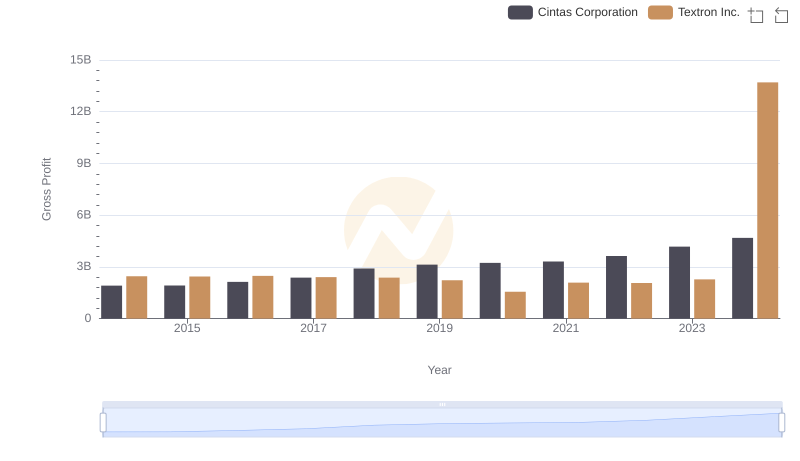

Key Insights on Gross Profit: Cintas Corporation vs Textron Inc.

Who Generates Higher Gross Profit? Cintas Corporation or Avery Dennison Corporation

Cost of Revenue: Key Insights for Cintas Corporation and CNH Industrial N.V.

Gross Profit Trends Compared: Cintas Corporation vs AECOM

Gross Profit Analysis: Comparing Cintas Corporation and Graco Inc.

Key Insights on Gross Profit: Cintas Corporation vs Comfort Systems USA, Inc.

Cintas Corporation or CNH Industrial N.V.: Who Manages SG&A Costs Better?

Who Generates Higher Gross Profit? Cintas Corporation or Saia, Inc.

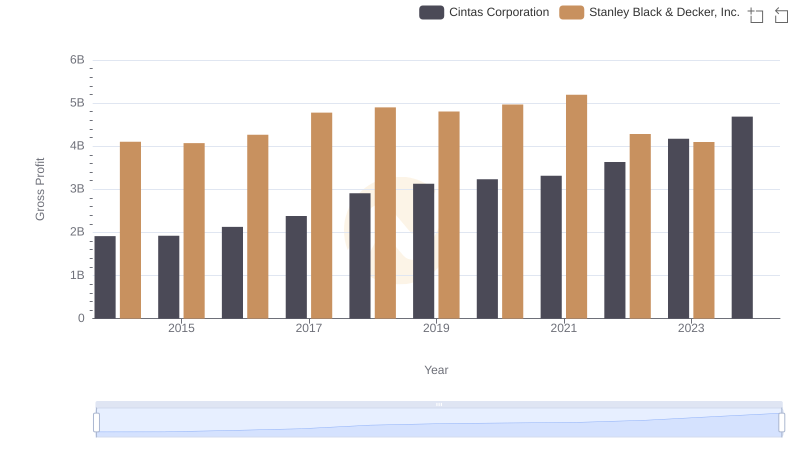

Key Insights on Gross Profit: Cintas Corporation vs Stanley Black & Decker, Inc.