| __timestamp | EMCOR Group, Inc. | Equifax Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 6424965000 | 2436400000 |

| Thursday, January 1, 2015 | 6718726000 | 2663600000 |

| Friday, January 1, 2016 | 7551524000 | 3144900000 |

| Sunday, January 1, 2017 | 7686999000 | 3362200000 |

| Monday, January 1, 2018 | 8130631000 | 3412100000 |

| Tuesday, January 1, 2019 | 9174611000 | 3507600000 |

| Wednesday, January 1, 2020 | 8797061000 | 4127500000 |

| Friday, January 1, 2021 | 9903580000 | 4923900000 |

| Saturday, January 1, 2022 | 11076120000 | 5122200000 |

| Sunday, January 1, 2023 | 12582873000 | 5265200000 |

| Monday, January 1, 2024 | 5681100000 |

Igniting the spark of knowledge

In the competitive landscape of the U.S. stock market, Equifax Inc. and EMCOR Group, Inc. have shown distinct revenue trajectories over the past decade. From 2014 to 2023, EMCOR Group, Inc. has experienced a robust growth, with its revenue surging by nearly 96%, from approximately $6.4 billion to $12.6 billion. This impressive growth reflects EMCOR's strategic expansion and operational efficiency.

On the other hand, Equifax Inc. has demonstrated a steady, albeit slower, revenue increase of around 116%, climbing from $2.4 billion in 2014 to $5.3 billion in 2023. This growth underscores Equifax's resilience and adaptability in the face of evolving market demands.

The contrasting revenue trends of these two industry giants highlight the diverse strategies and market conditions influencing their financial performance. As we look to the future, these trends offer valuable insights into the potential trajectories of these companies.

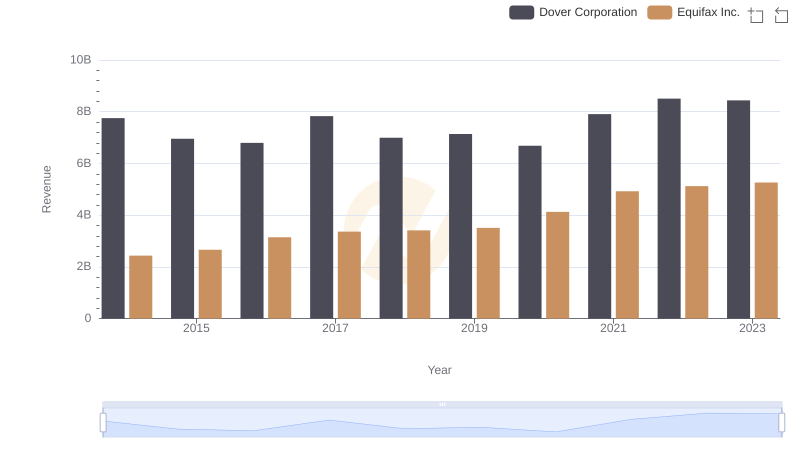

Equifax Inc. vs Dover Corporation: Annual Revenue Growth Compared

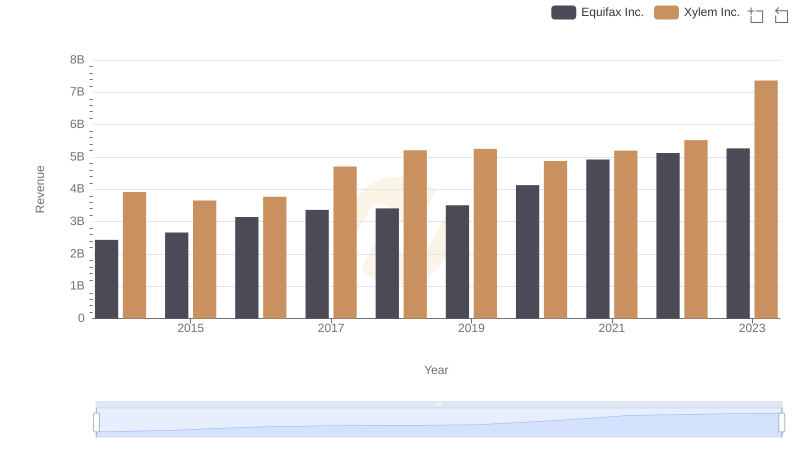

Annual Revenue Comparison: Equifax Inc. vs Xylem Inc.

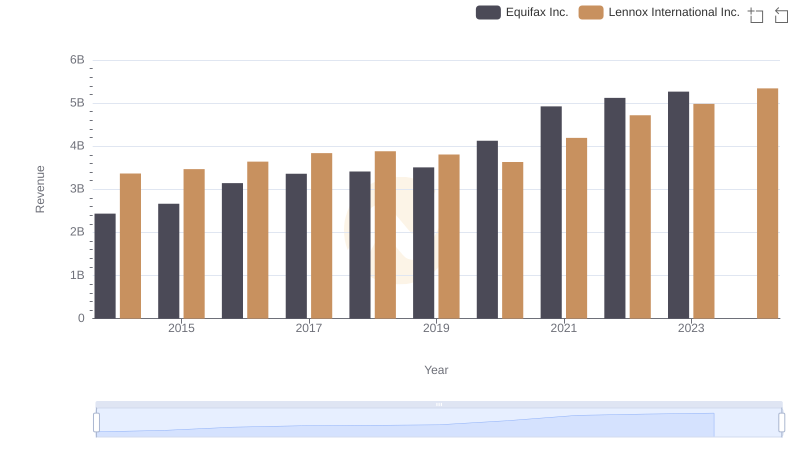

Annual Revenue Comparison: Equifax Inc. vs Lennox International Inc.

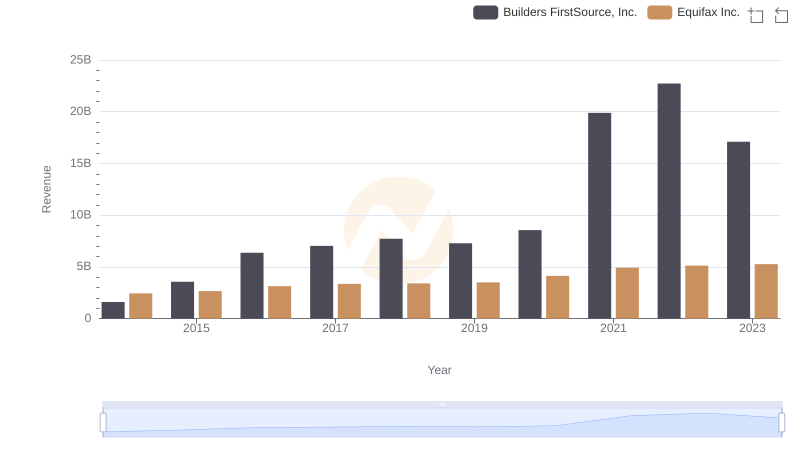

Annual Revenue Comparison: Equifax Inc. vs Builders FirstSource, Inc.

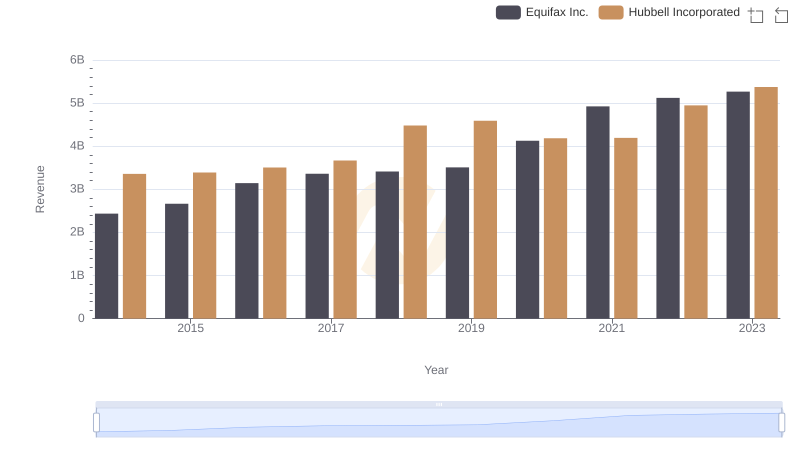

Breaking Down Revenue Trends: Equifax Inc. vs Hubbell Incorporated

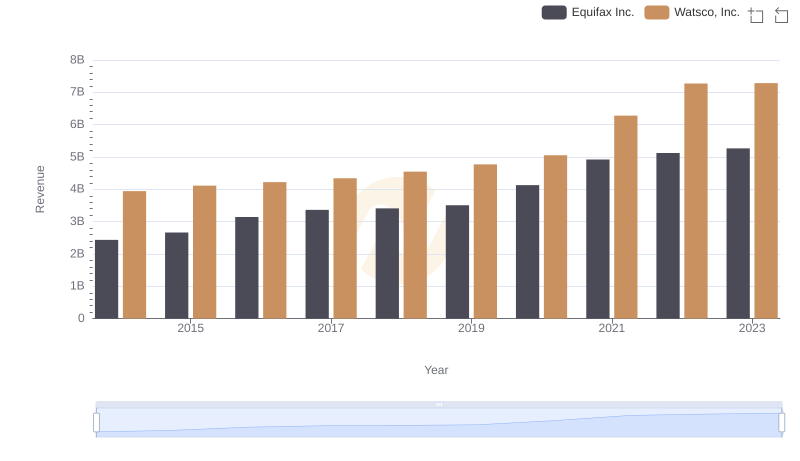

Equifax Inc. or Watsco, Inc.: Who Leads in Yearly Revenue?

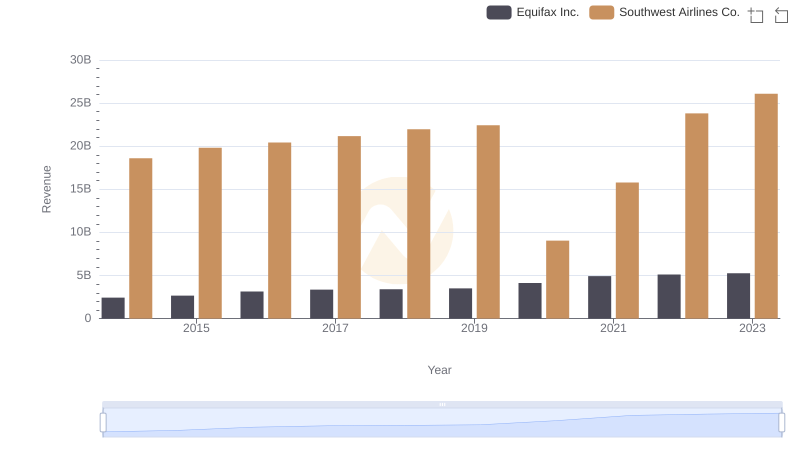

Equifax Inc. vs Southwest Airlines Co.: Annual Revenue Growth Compared

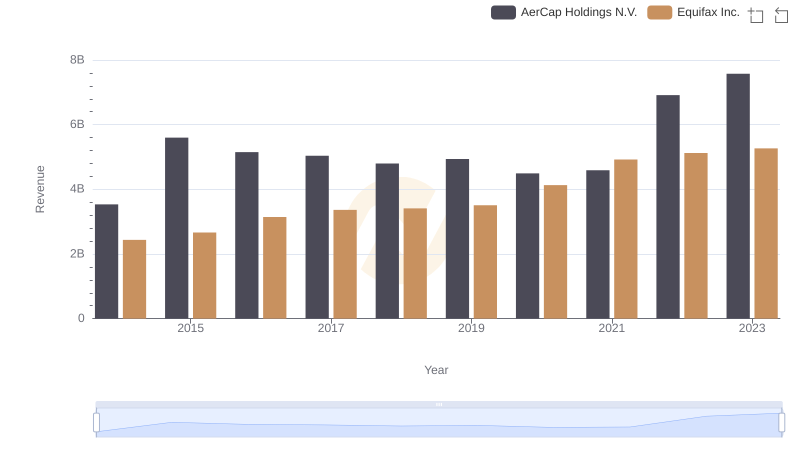

Revenue Showdown: Equifax Inc. vs AerCap Holdings N.V.

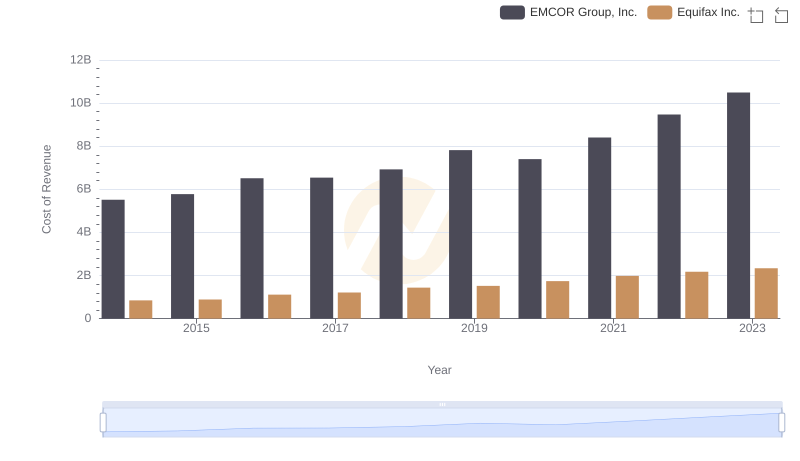

Equifax Inc. vs EMCOR Group, Inc.: Efficiency in Cost of Revenue Explored

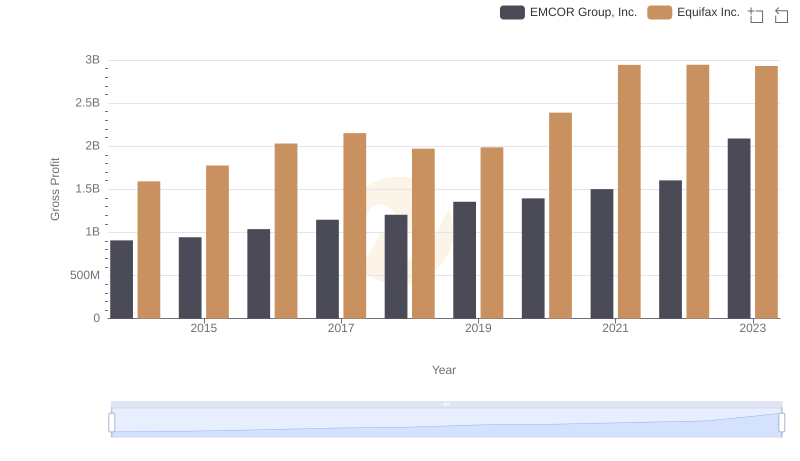

Key Insights on Gross Profit: Equifax Inc. vs EMCOR Group, Inc.

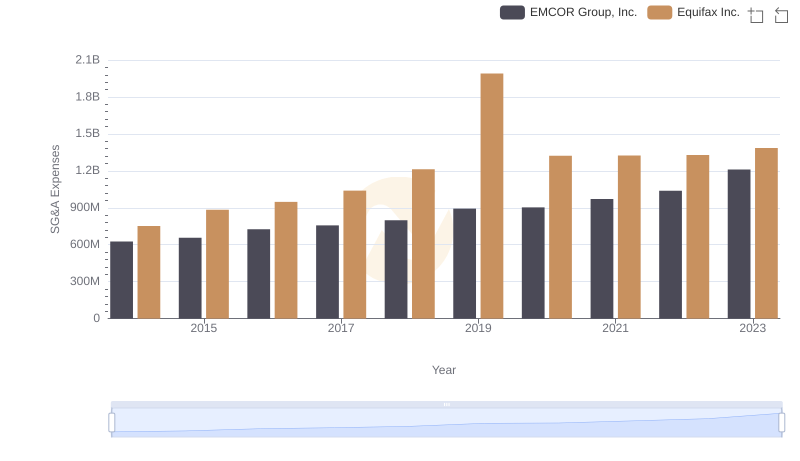

Breaking Down SG&A Expenses: Equifax Inc. vs EMCOR Group, Inc.

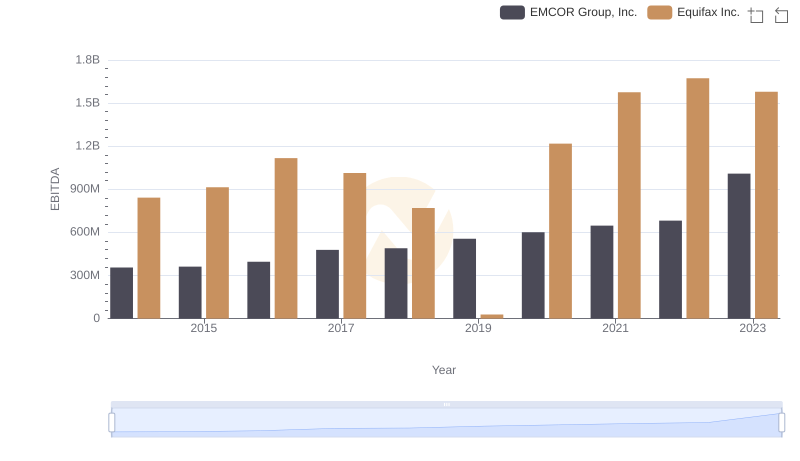

Equifax Inc. and EMCOR Group, Inc.: A Detailed Examination of EBITDA Performance