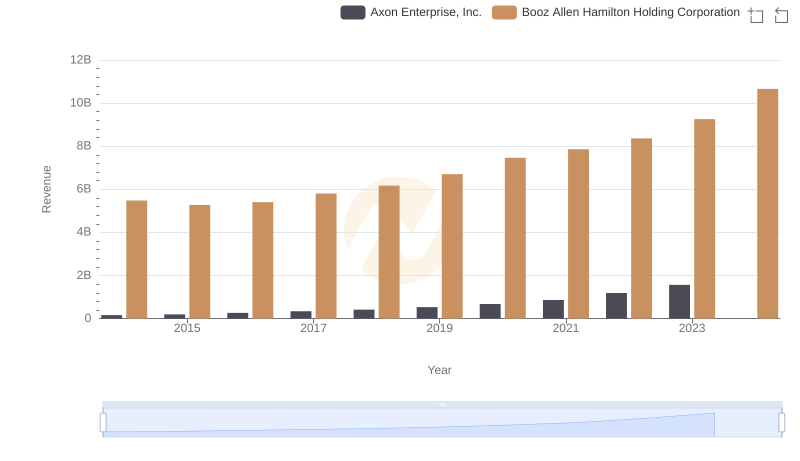

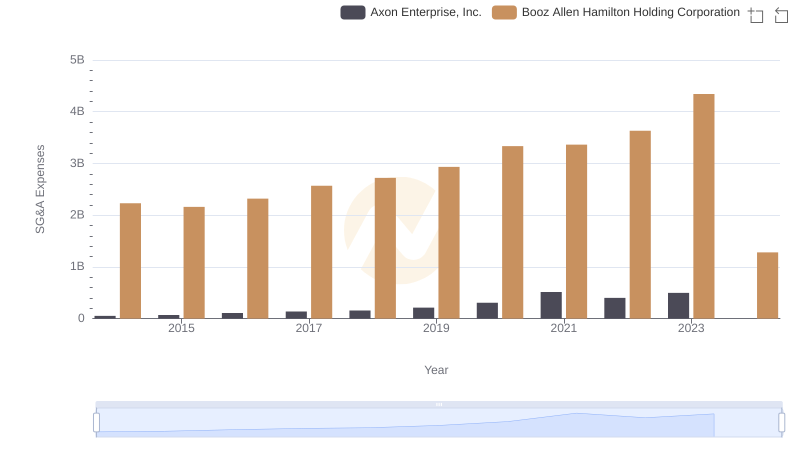

| __timestamp | Axon Enterprise, Inc. | Booz Allen Hamilton Holding Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 101548000 | 2762580000 |

| Thursday, January 1, 2015 | 128647000 | 2680921000 |

| Friday, January 1, 2016 | 170536000 | 2825712000 |

| Sunday, January 1, 2017 | 207088000 | 3112302000 |

| Monday, January 1, 2018 | 258583000 | 3304750000 |

| Tuesday, January 1, 2019 | 307286000 | 3603571000 |

| Wednesday, January 1, 2020 | 416331000 | 4084661000 |

| Friday, January 1, 2021 | 540910000 | 4201408000 |

| Saturday, January 1, 2022 | 728638000 | 4464078000 |

| Sunday, January 1, 2023 | 955382000 | 4954101000 |

| Monday, January 1, 2024 | 2459049000 |

Unleashing the power of data

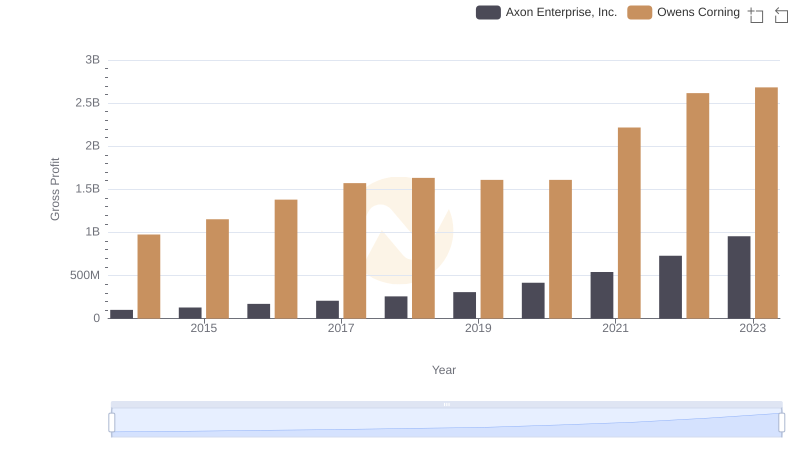

In the ever-evolving landscape of American business, Axon Enterprise, Inc. and Booz Allen Hamilton Holding Corporation stand as intriguing case studies in growth and resilience. From 2014 to 2023, Axon Enterprise's gross profit surged by an impressive 840%, reflecting its dynamic expansion in the public safety technology sector. Meanwhile, Booz Allen Hamilton, a stalwart in management consulting, saw a steady 79% increase in gross profit, underscoring its robust market position.

This analysis offers a window into the strategic maneuvers and market dynamics that define these two industry leaders.

Annual Revenue Comparison: Axon Enterprise, Inc. vs Booz Allen Hamilton Holding Corporation

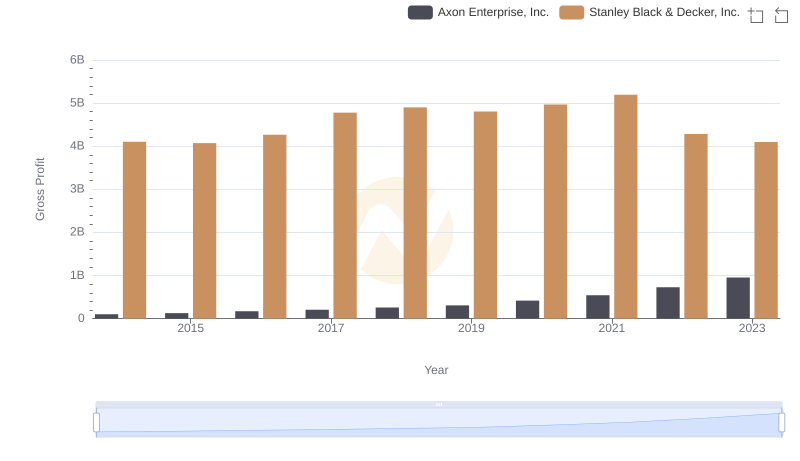

Axon Enterprise, Inc. and Stanley Black & Decker, Inc.: A Detailed Gross Profit Analysis

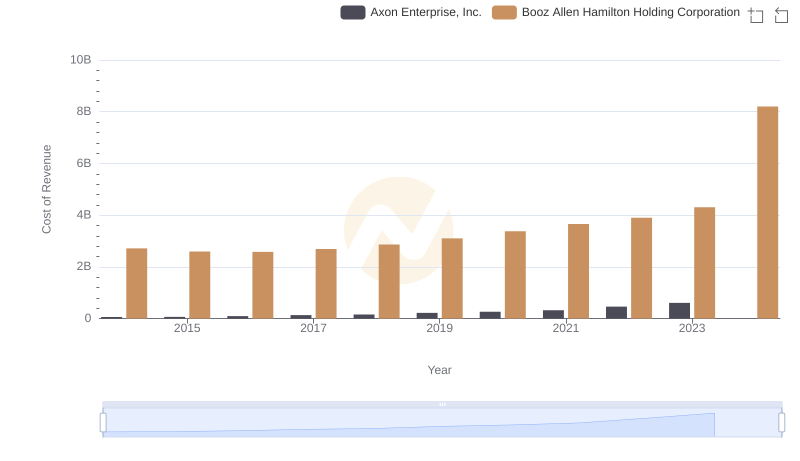

Cost of Revenue: Key Insights for Axon Enterprise, Inc. and Booz Allen Hamilton Holding Corporation

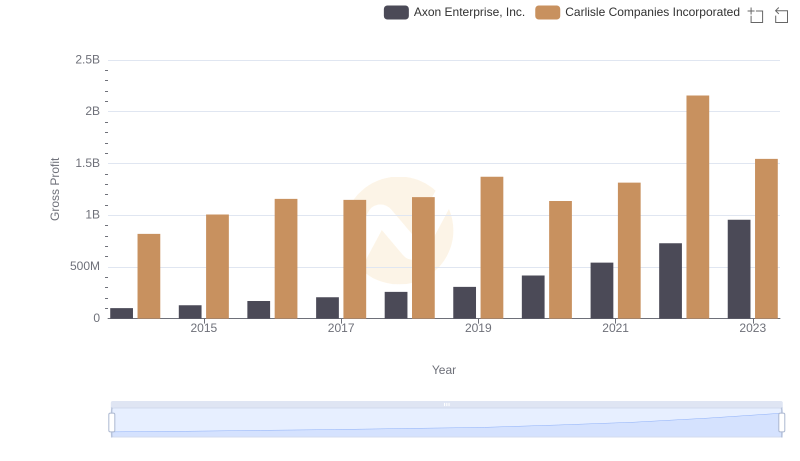

Gross Profit Trends Compared: Axon Enterprise, Inc. vs Carlisle Companies Incorporated

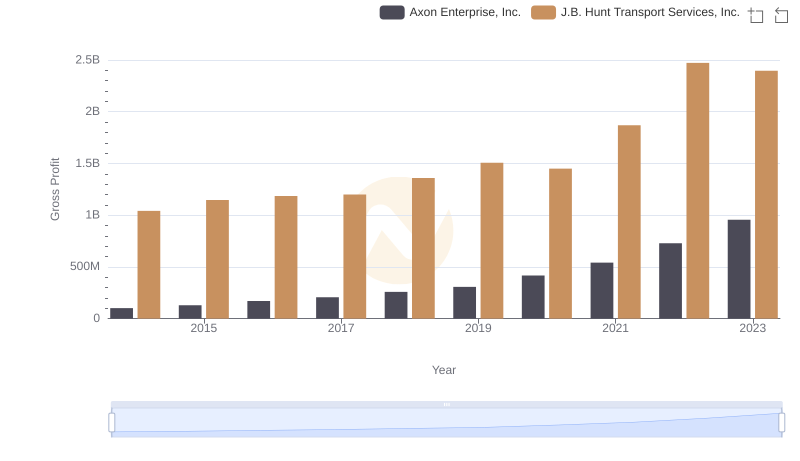

Gross Profit Comparison: Axon Enterprise, Inc. and J.B. Hunt Transport Services, Inc. Trends

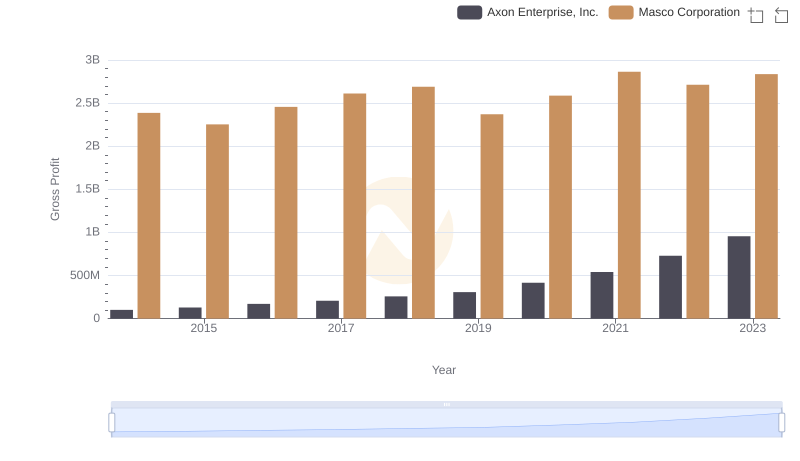

Axon Enterprise, Inc. and Masco Corporation: A Detailed Gross Profit Analysis

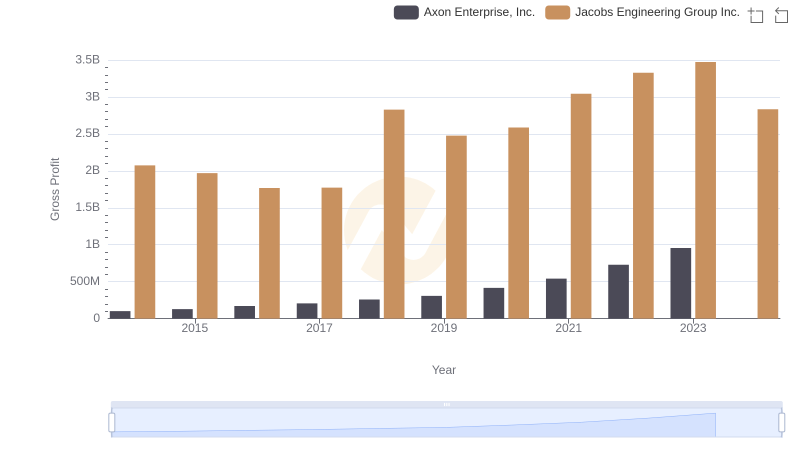

Axon Enterprise, Inc. vs Jacobs Engineering Group Inc.: A Gross Profit Performance Breakdown

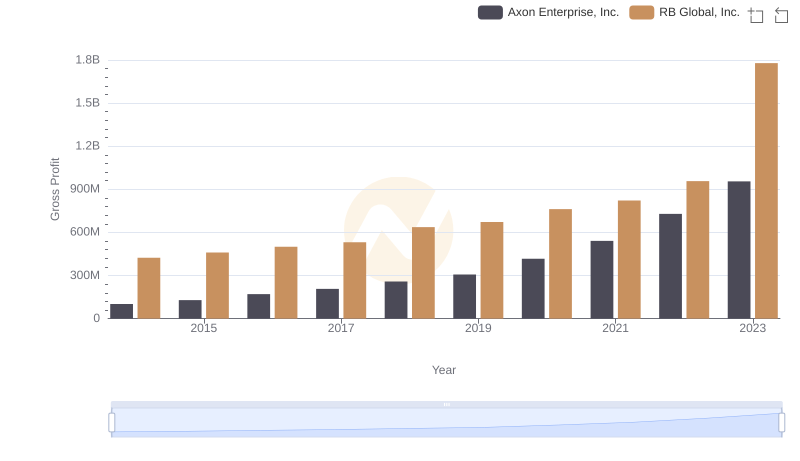

Gross Profit Trends Compared: Axon Enterprise, Inc. vs RB Global, Inc.

Axon Enterprise, Inc. vs Booz Allen Hamilton Holding Corporation: SG&A Expense Trends

Gross Profit Analysis: Comparing Axon Enterprise, Inc. and Owens Corning