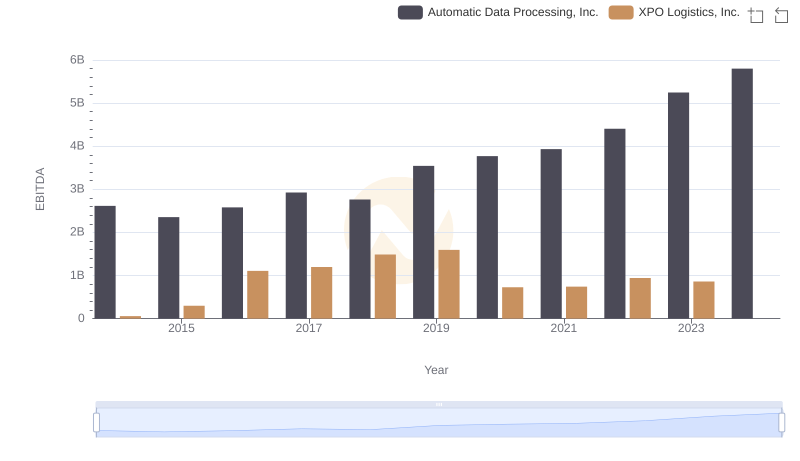

| __timestamp | Automatic Data Processing, Inc. | Owens Corning |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 650000000 |

| Thursday, January 1, 2015 | 2355100000 | 853000000 |

| Friday, January 1, 2016 | 2579500000 | 1041000000 |

| Sunday, January 1, 2017 | 2927200000 | 1134000000 |

| Monday, January 1, 2018 | 2762900000 | 1266000000 |

| Tuesday, January 1, 2019 | 3544500000 | 1178000000 |

| Wednesday, January 1, 2020 | 3769700000 | 341000000 |

| Friday, January 1, 2021 | 3931600000 | 1909000000 |

| Saturday, January 1, 2022 | 4405500000 | 2200000000 |

| Sunday, January 1, 2023 | 5244600000 | 2166000000 |

| Monday, January 1, 2024 | 5800000000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial indicator of a company's operational efficiency. From 2014 to 2023, Automatic Data Processing, Inc. (ADP) and Owens Corning have showcased contrasting trajectories in their EBITDA performance. ADP, a leader in human resources management, has seen its EBITDA grow by approximately 122%, peaking at $5.8 billion in 2024. This growth underscores ADP's robust business model and adaptability in a competitive market.

Conversely, Owens Corning, a stalwart in the building materials industry, experienced a more modest EBITDA increase of around 233% from 2014 to 2023, reaching $2.2 billion. Despite facing industry-specific challenges, Owens Corning's steady growth highlights its resilience and strategic focus. Notably, data for 2024 is missing for Owens Corning, leaving room for speculation on its future performance. This comparison offers a fascinating glimpse into the diverse strategies and market dynamics shaping these two industry titans.

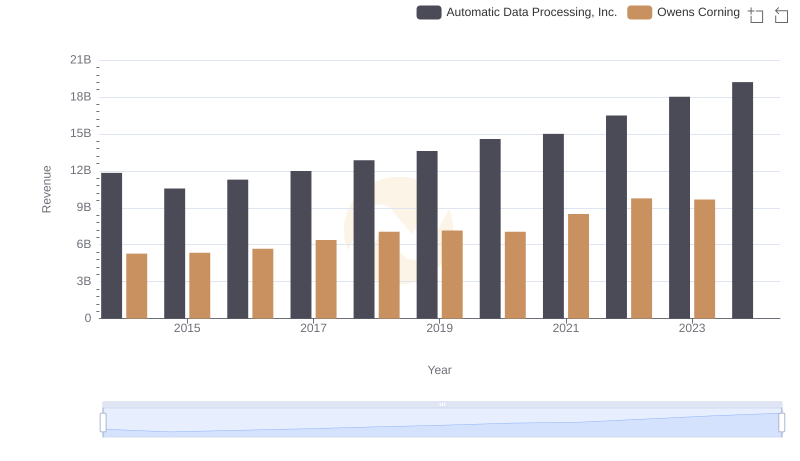

Automatic Data Processing, Inc. vs Owens Corning: Annual Revenue Growth Compared

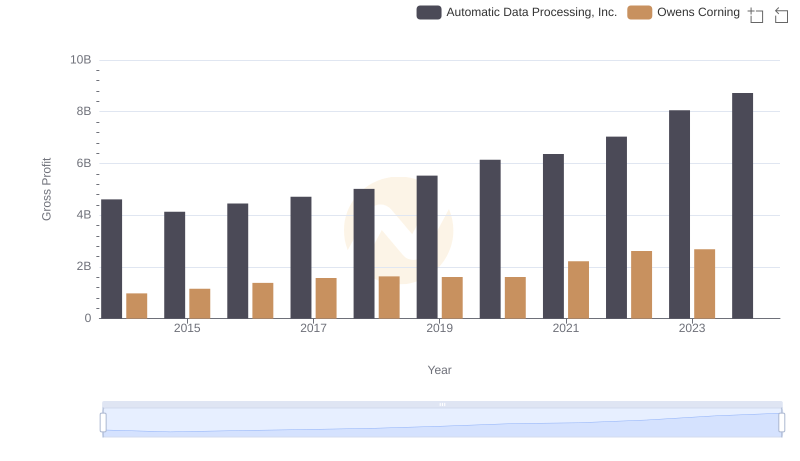

Gross Profit Analysis: Comparing Automatic Data Processing, Inc. and Owens Corning

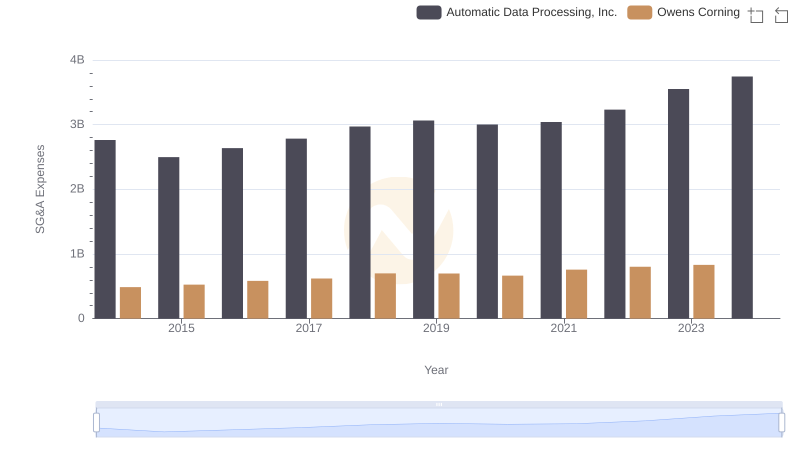

Automatic Data Processing, Inc. vs Owens Corning: SG&A Expense Trends

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Avery Dennison Corporation

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to XPO Logistics, Inc.

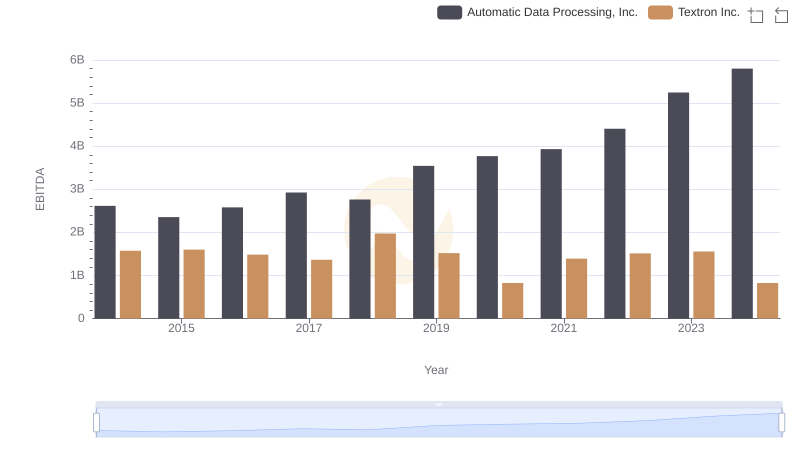

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Textron Inc.

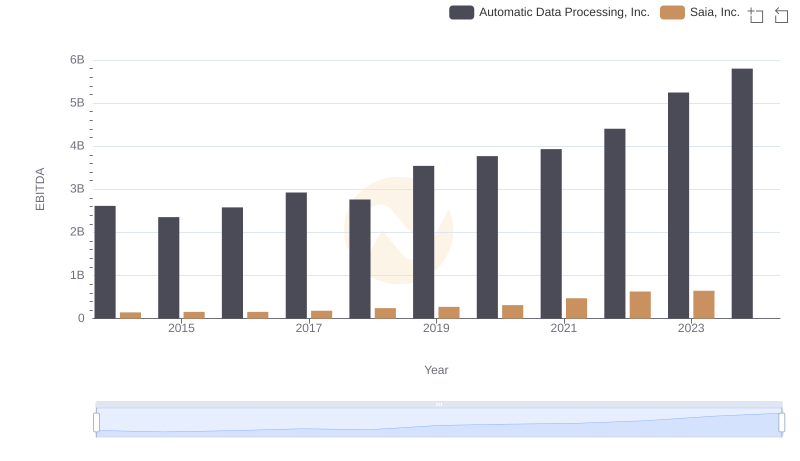

EBITDA Analysis: Evaluating Automatic Data Processing, Inc. Against Saia, Inc.

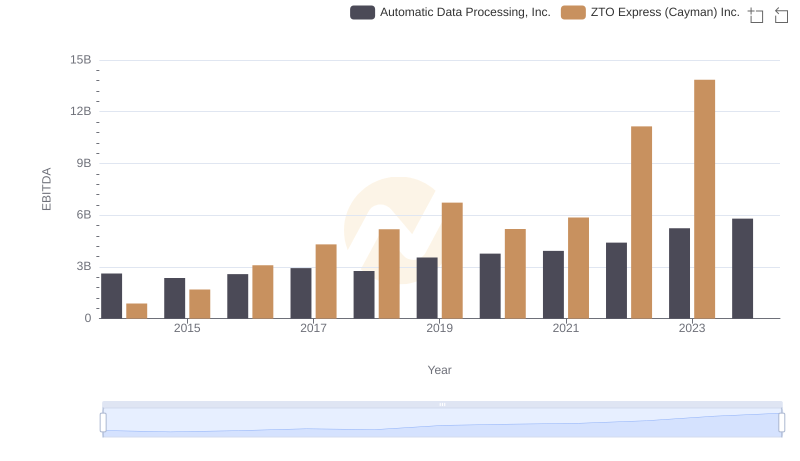

Automatic Data Processing, Inc. and ZTO Express (Cayman) Inc.: A Detailed Examination of EBITDA Performance

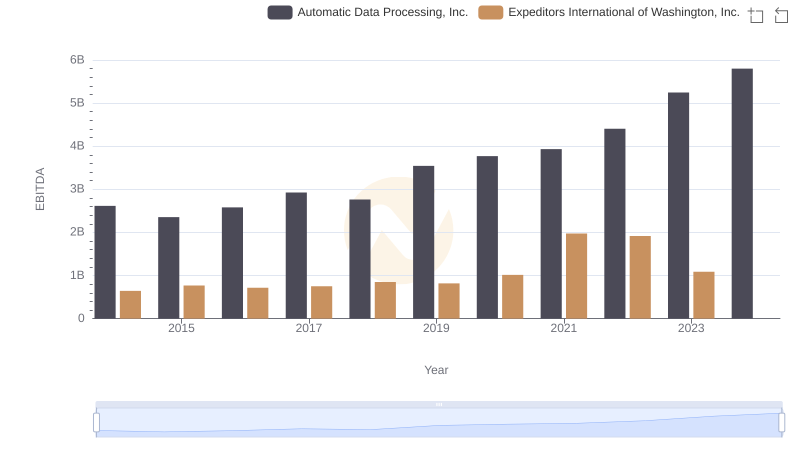

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Expeditors International of Washington, Inc.