| __timestamp | Automatic Data Processing, Inc. | Textron Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 1575000000 |

| Thursday, January 1, 2015 | 2355100000 | 1601000000 |

| Friday, January 1, 2016 | 2579500000 | 1484000000 |

| Sunday, January 1, 2017 | 2927200000 | 1367000000 |

| Monday, January 1, 2018 | 2762900000 | 1974000000 |

| Tuesday, January 1, 2019 | 3544500000 | 1518000000 |

| Wednesday, January 1, 2020 | 3769700000 | 827000000 |

| Friday, January 1, 2021 | 3931600000 | 1391000000 |

| Saturday, January 1, 2022 | 4405500000 | 1515000000 |

| Sunday, January 1, 2023 | 5244600000 | 1556000000 |

| Monday, January 1, 2024 | 5800000000 | 1422000000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial metric for evaluating a company's operational performance. This analysis delves into the EBITDA trends of Automatic Data Processing, Inc. (ADP) and Textron Inc. from 2014 to 2024. Over this decade, ADP has demonstrated a robust growth trajectory, with its EBITDA increasing by approximately 122%, from $2.6 billion in 2014 to an impressive $5.8 billion in 2024. In contrast, Textron's EBITDA has shown a more modest fluctuation, peaking at $1.97 billion in 2018 before declining to $825 million in 2024. This stark contrast highlights ADP's consistent upward momentum, while Textron faces challenges in maintaining its financial performance. As businesses navigate the complexities of the modern economy, understanding these financial dynamics is essential for investors and stakeholders alike.

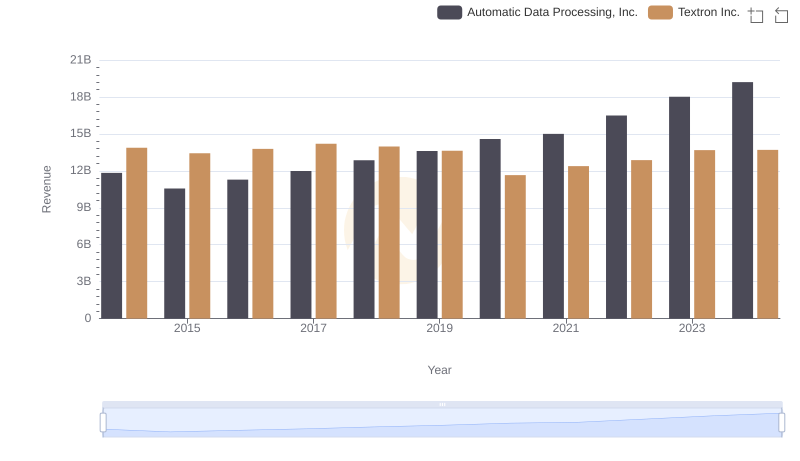

Revenue Showdown: Automatic Data Processing, Inc. vs Textron Inc.

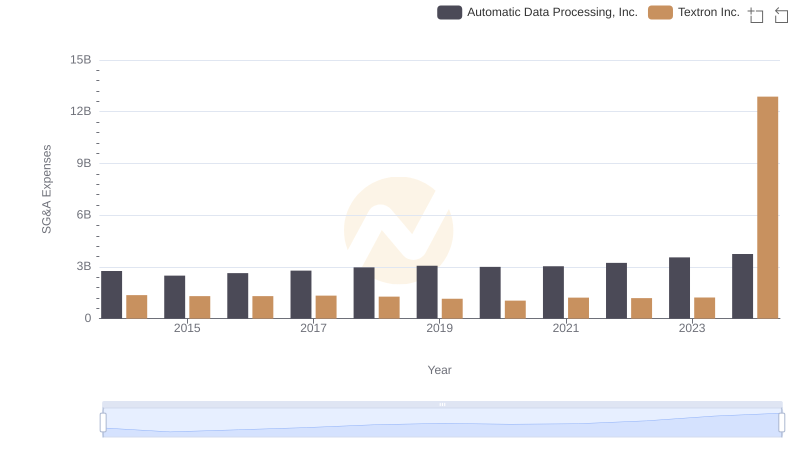

Operational Costs Compared: SG&A Analysis of Automatic Data Processing, Inc. and Textron Inc.

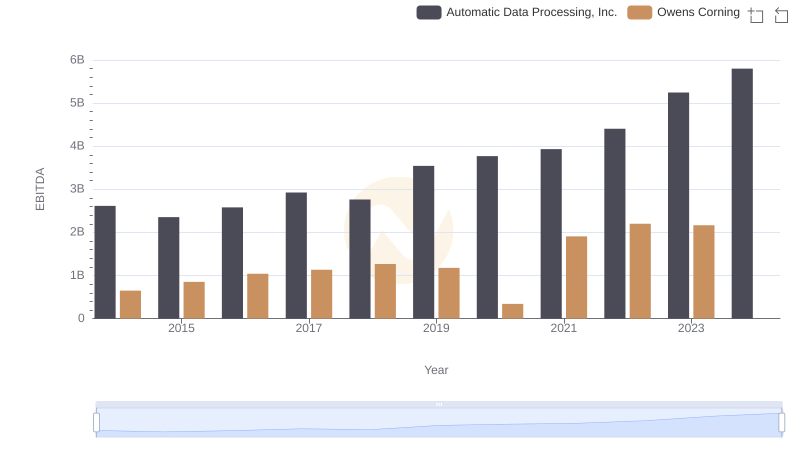

Automatic Data Processing, Inc. vs Owens Corning: In-Depth EBITDA Performance Comparison

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Avery Dennison Corporation

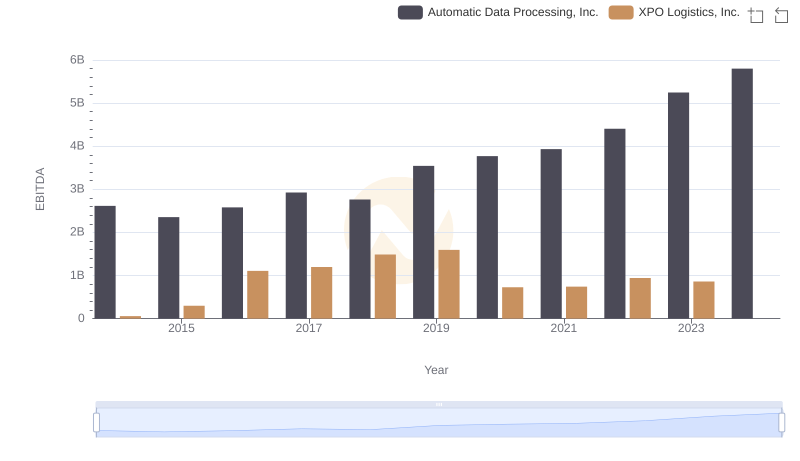

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to XPO Logistics, Inc.

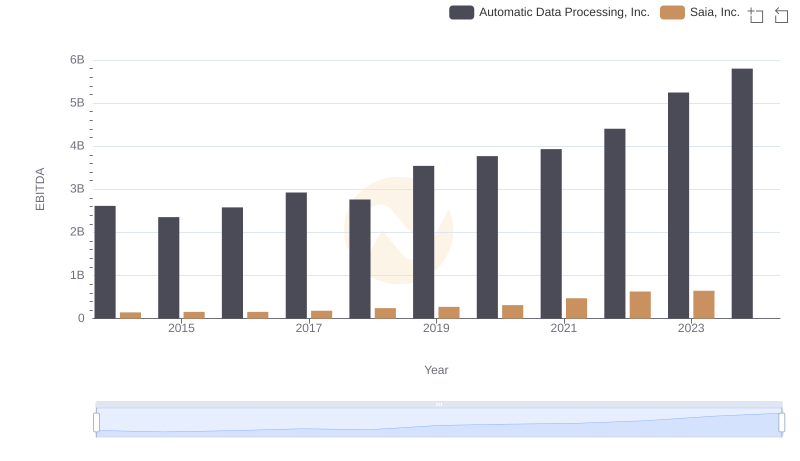

EBITDA Analysis: Evaluating Automatic Data Processing, Inc. Against Saia, Inc.

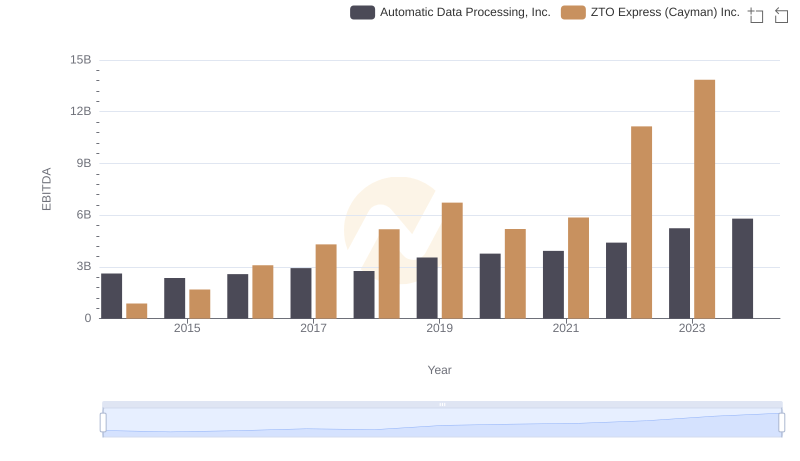

Automatic Data Processing, Inc. and ZTO Express (Cayman) Inc.: A Detailed Examination of EBITDA Performance

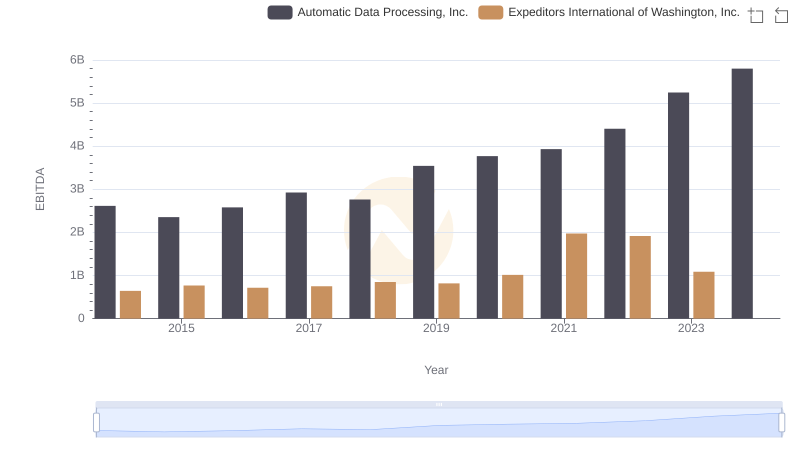

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Expeditors International of Washington, Inc.

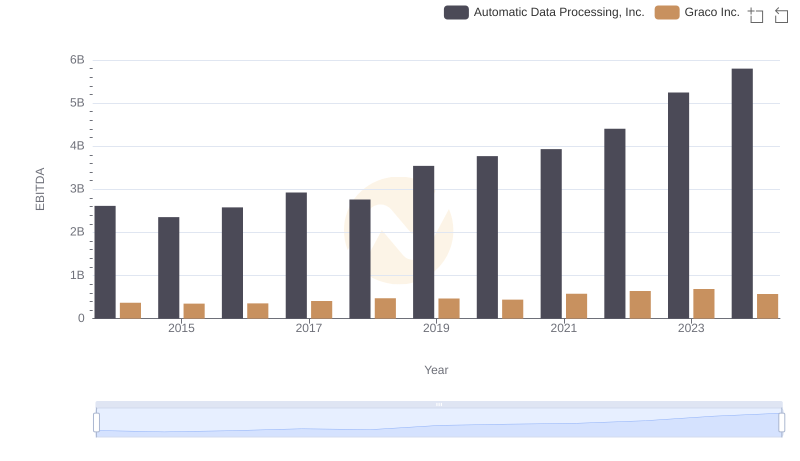

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Graco Inc.

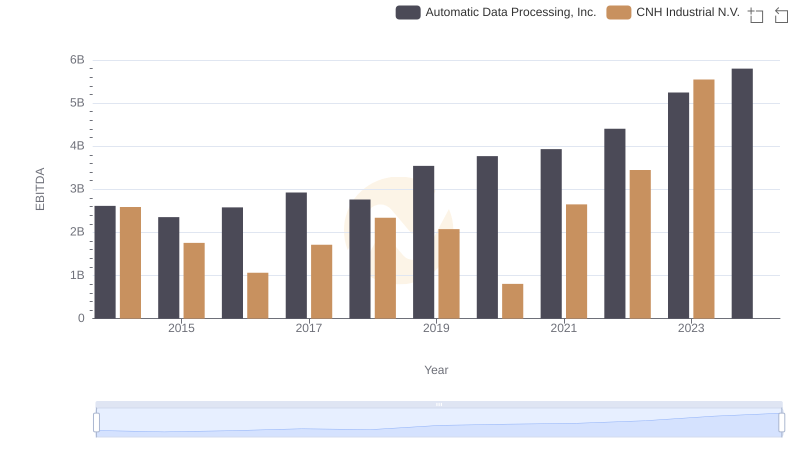

Automatic Data Processing, Inc. vs CNH Industrial N.V.: In-Depth EBITDA Performance Comparison