| __timestamp | Automatic Data Processing, Inc. | XPO Logistics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2616900000 | 56600000 |

| Thursday, January 1, 2015 | 2355100000 | 298000000 |

| Friday, January 1, 2016 | 2579500000 | 1108300000 |

| Sunday, January 1, 2017 | 2927200000 | 1196700000 |

| Monday, January 1, 2018 | 2762900000 | 1488000000 |

| Tuesday, January 1, 2019 | 3544500000 | 1594000000 |

| Wednesday, January 1, 2020 | 3769700000 | 727000000 |

| Friday, January 1, 2021 | 3931600000 | 741000000 |

| Saturday, January 1, 2022 | 4405500000 | 941000000 |

| Sunday, January 1, 2023 | 5244600000 | 860000000 |

| Monday, January 1, 2024 | 5800000000 | 1186000000 |

Infusing magic into the data realm

In the ever-evolving landscape of corporate finance, EBITDA serves as a crucial metric for evaluating a company's operational performance. Over the past decade, Automatic Data Processing, Inc. (ADP) and XPO Logistics, Inc. have showcased contrasting trajectories in their EBITDA growth.

From 2014 to 2023, ADP's EBITDA has seen a remarkable increase of approximately 122%, rising from $2.6 billion to $5.2 billion. This consistent growth underscores ADP's robust business model and its ability to adapt to market changes.

Conversely, XPO Logistics experienced a more volatile path. Starting at a modest $57 million in 2014, XPO's EBITDA peaked at $1.6 billion in 2019, before fluctuating in subsequent years. This volatility reflects the dynamic nature of the logistics industry.

As we look to 2024, ADP's continued growth is evident, while XPO's data remains incomplete, leaving room for speculation on its future performance.

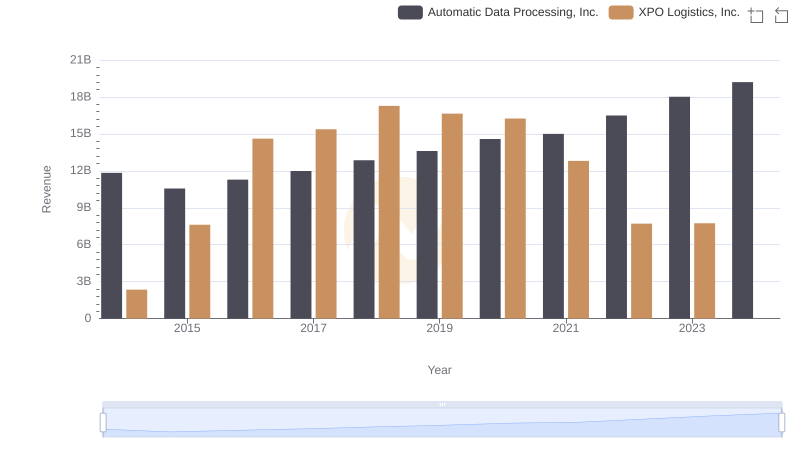

Automatic Data Processing, Inc. and XPO Logistics, Inc.: A Comprehensive Revenue Analysis

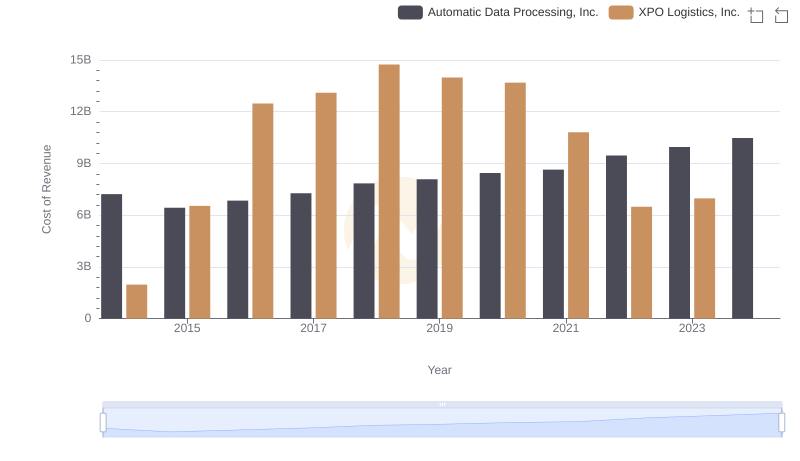

Cost Insights: Breaking Down Automatic Data Processing, Inc. and XPO Logistics, Inc.'s Expenses

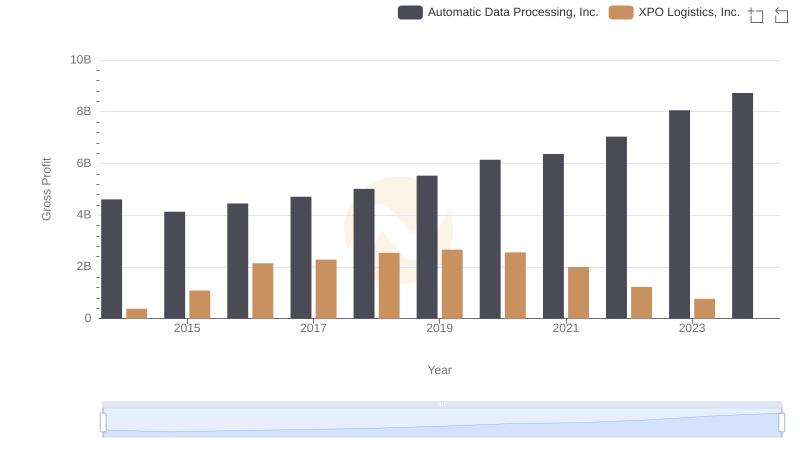

Gross Profit Comparison: Automatic Data Processing, Inc. and XPO Logistics, Inc. Trends

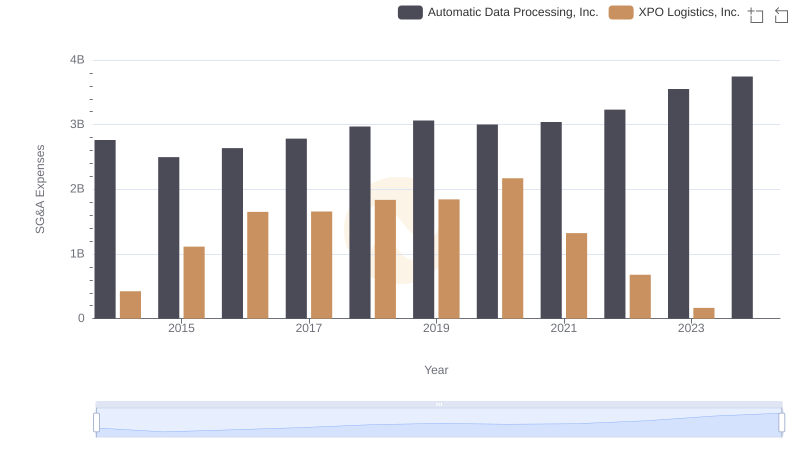

SG&A Efficiency Analysis: Comparing Automatic Data Processing, Inc. and XPO Logistics, Inc.

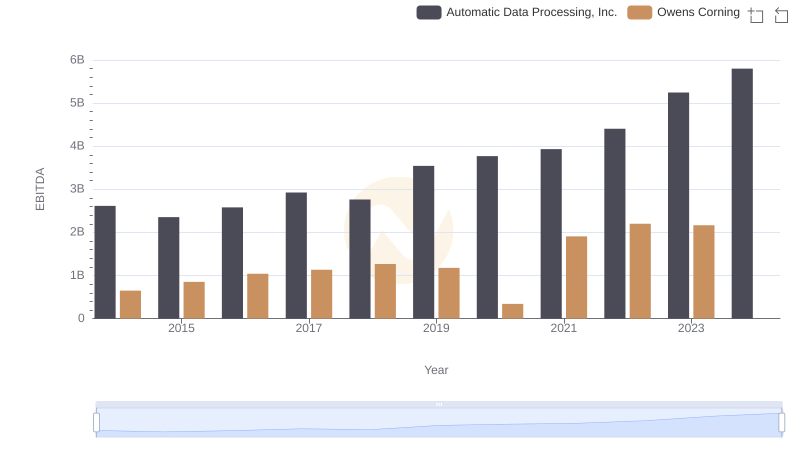

Automatic Data Processing, Inc. vs Owens Corning: In-Depth EBITDA Performance Comparison

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Avery Dennison Corporation

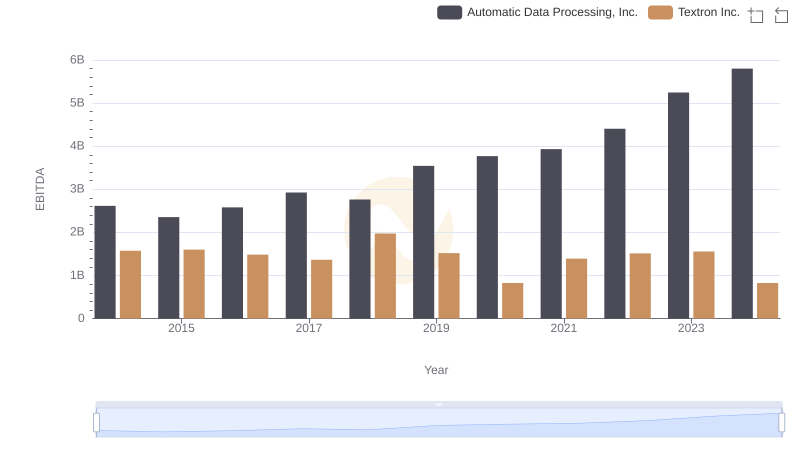

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Textron Inc.

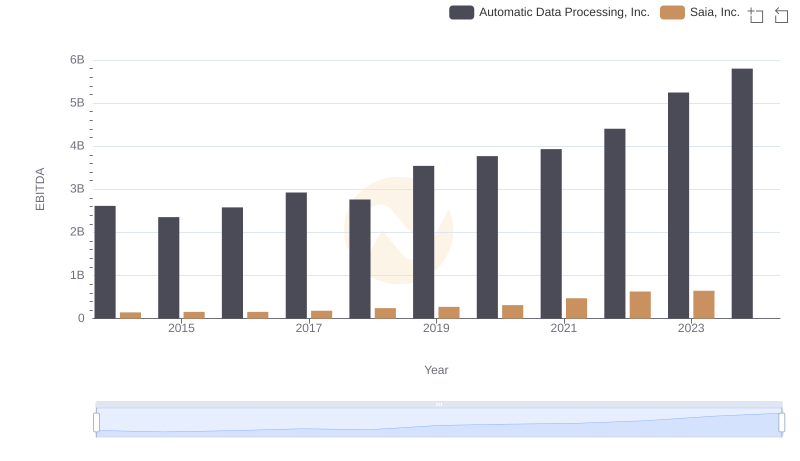

EBITDA Analysis: Evaluating Automatic Data Processing, Inc. Against Saia, Inc.

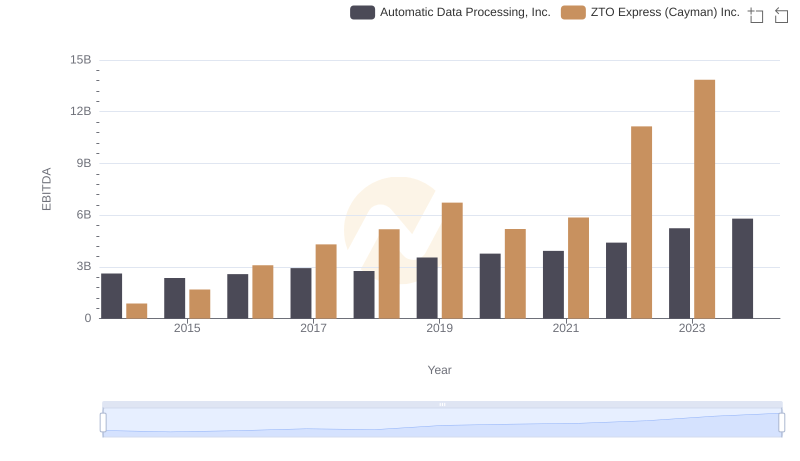

Automatic Data Processing, Inc. and ZTO Express (Cayman) Inc.: A Detailed Examination of EBITDA Performance

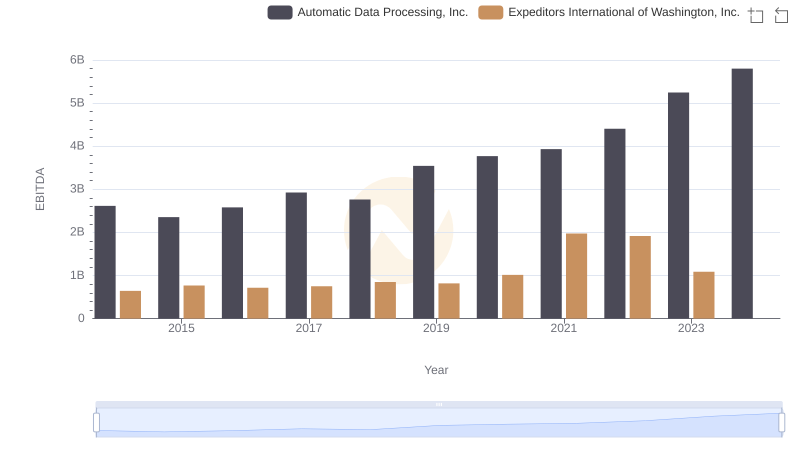

Professional EBITDA Benchmarking: Automatic Data Processing, Inc. vs Expeditors International of Washington, Inc.

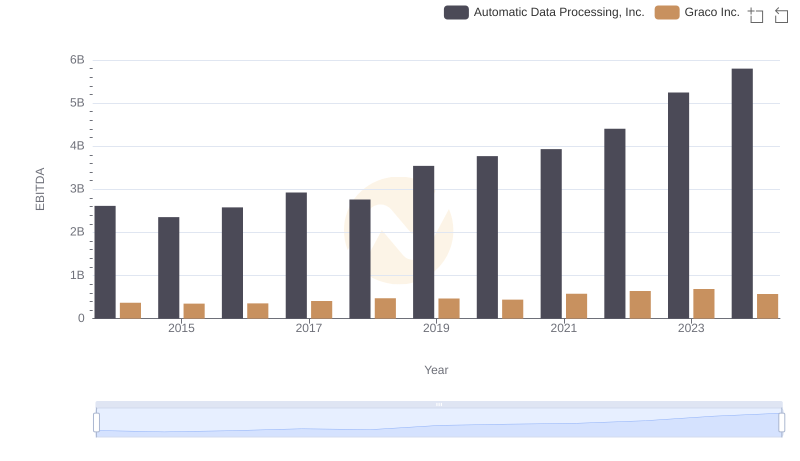

A Professional Review of EBITDA: Automatic Data Processing, Inc. Compared to Graco Inc.