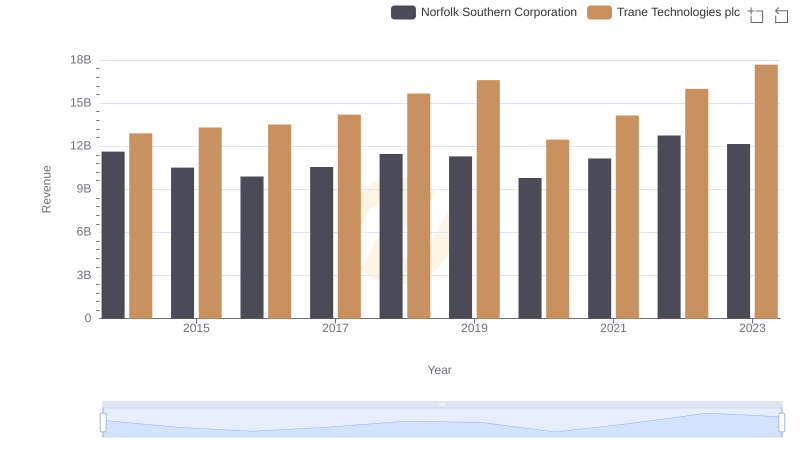

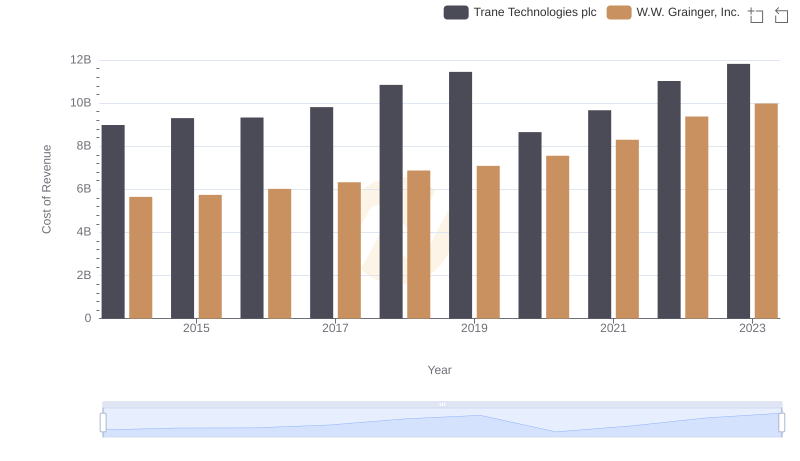

| __timestamp | Norfolk Southern Corporation | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 7109000000 | 8982800000 |

| Thursday, January 1, 2015 | 6651000000 | 9301600000 |

| Friday, January 1, 2016 | 6015000000 | 9329300000 |

| Sunday, January 1, 2017 | 6224000000 | 9811600000 |

| Monday, January 1, 2018 | 6844000000 | 10847600000 |

| Tuesday, January 1, 2019 | 6567000000 | 11451500000 |

| Wednesday, January 1, 2020 | 5749000000 | 8651300000 |

| Friday, January 1, 2021 | 6148000000 | 9666800000 |

| Saturday, January 1, 2022 | 7223000000 | 11026900000 |

| Sunday, January 1, 2023 | 6774000000 | 11820400000 |

| Monday, January 1, 2024 | 7580000000 | 12757700000 |

Infusing magic into the data realm

In the ever-evolving landscape of industrial giants, understanding cost efficiency is paramount. Trane Technologies plc and Norfolk Southern Corporation, two stalwarts in their respective sectors, have shown intriguing trends in their cost of revenue over the past decade. From 2014 to 2023, Trane Technologies has consistently outpaced Norfolk Southern, with a notable 18% increase in cost of revenue, peaking at approximately $11.8 billion in 2023. In contrast, Norfolk Southern's cost of revenue fluctuated, with a 5% decrease from its 2014 high, reflecting strategic shifts and market challenges. This comparative analysis highlights the dynamic nature of operational costs and the strategic maneuvers companies employ to maintain profitability. As we delve deeper into these trends, it becomes evident that cost management remains a critical factor in sustaining competitive advantage in the industrial sector.

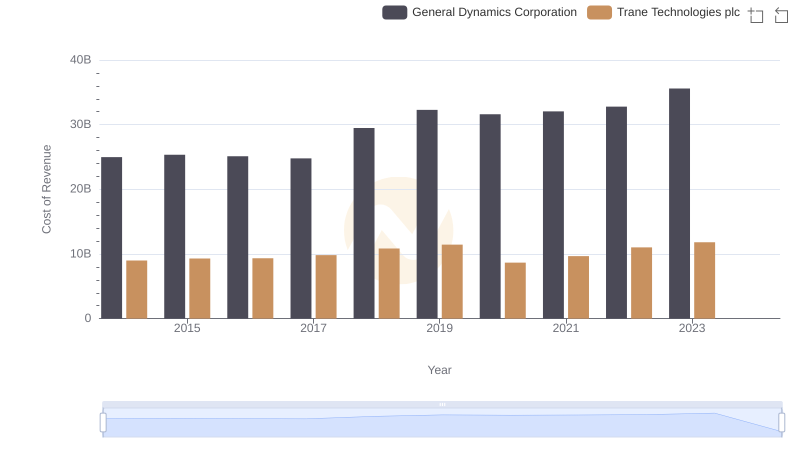

Cost of Revenue Trends: Trane Technologies plc vs General Dynamics Corporation

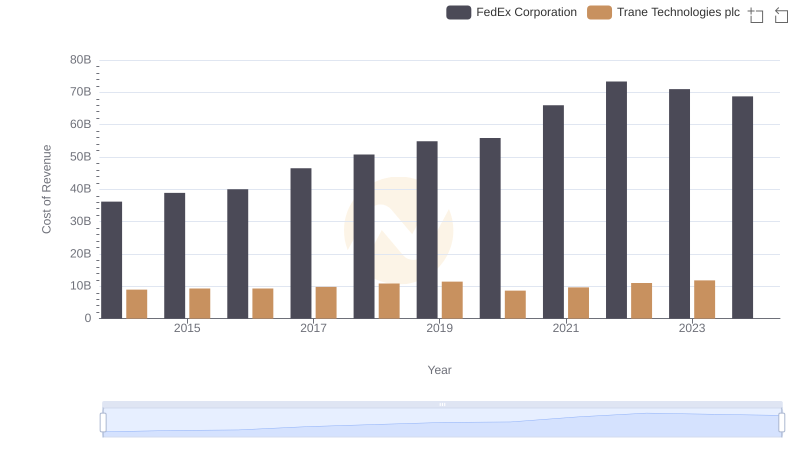

Cost of Revenue Trends: Trane Technologies plc vs FedEx Corporation

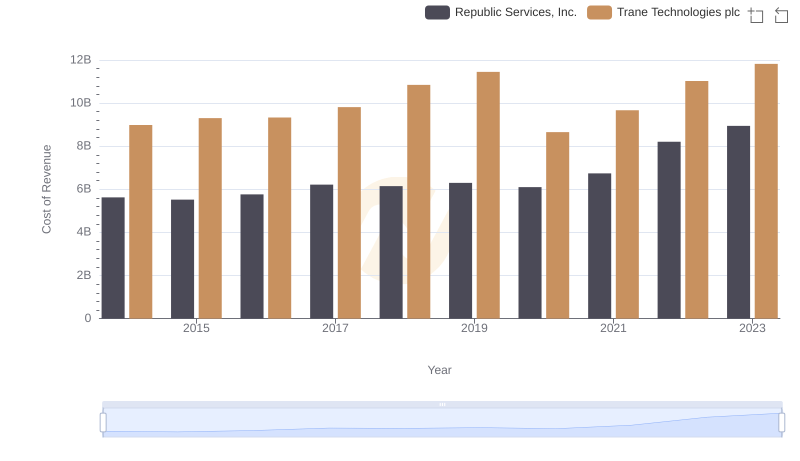

Analyzing Cost of Revenue: Trane Technologies plc and Republic Services, Inc.

Trane Technologies plc and Norfolk Southern Corporation: A Comprehensive Revenue Analysis

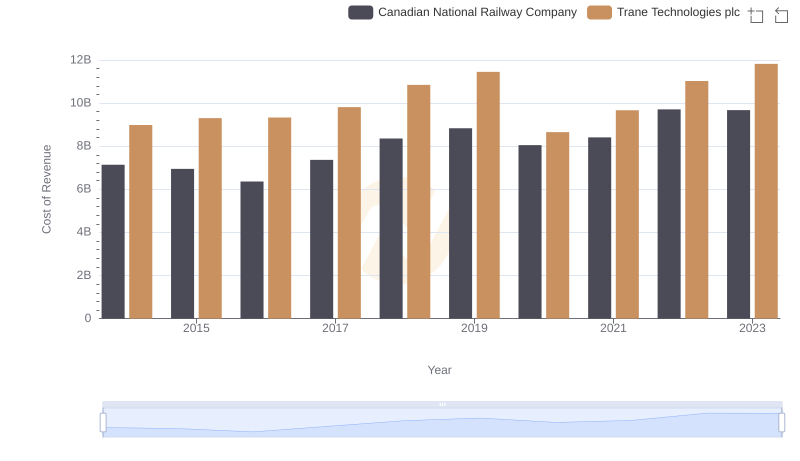

Cost of Revenue Comparison: Trane Technologies plc vs Canadian National Railway Company

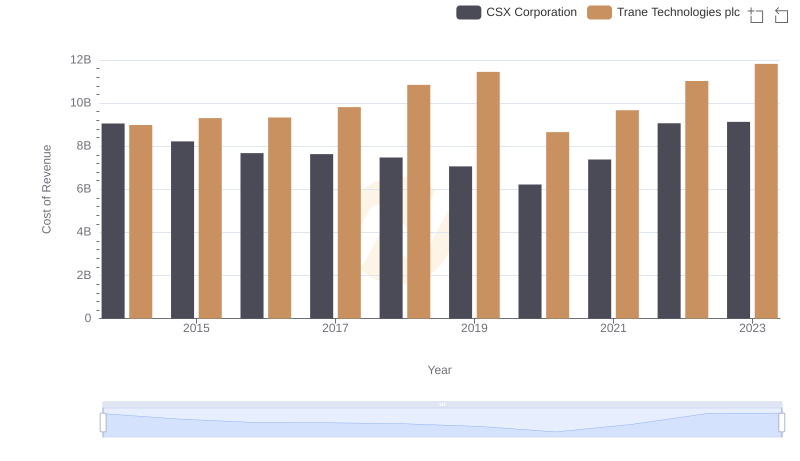

Cost of Revenue Trends: Trane Technologies plc vs CSX Corporation

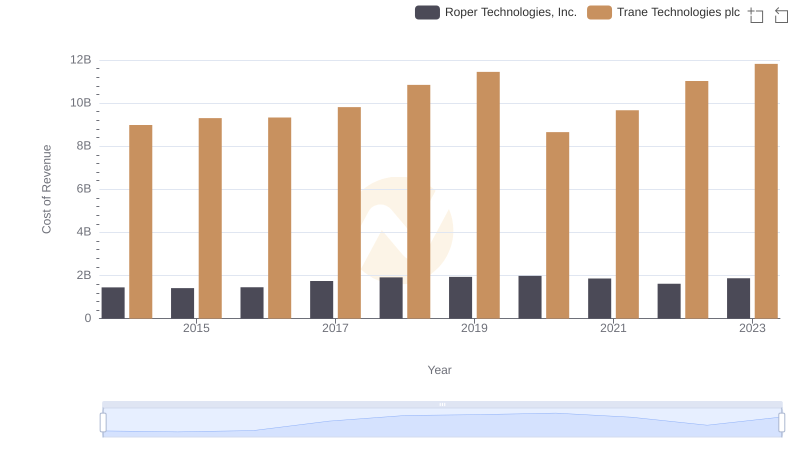

Cost of Revenue Comparison: Trane Technologies plc vs Roper Technologies, Inc.

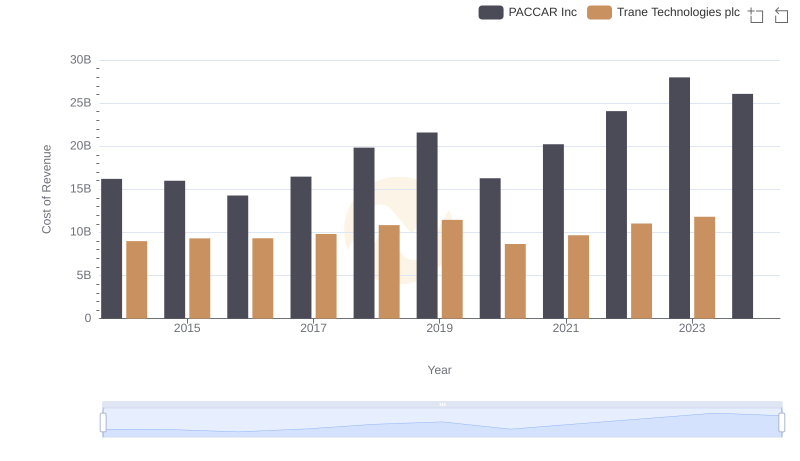

Cost Insights: Breaking Down Trane Technologies plc and PACCAR Inc's Expenses

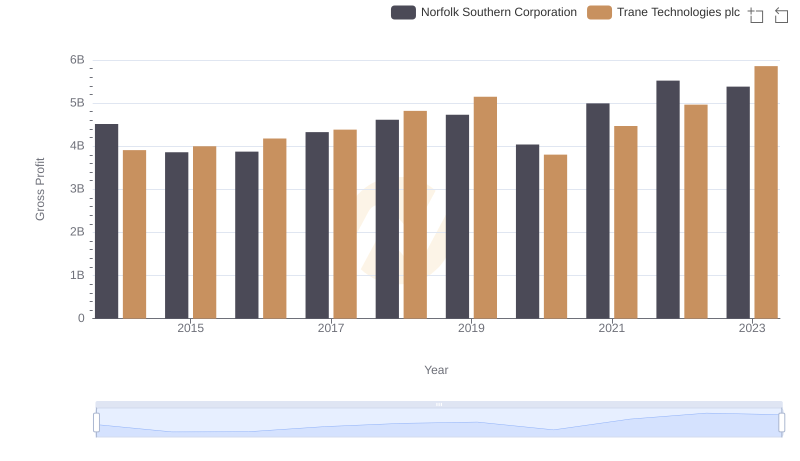

Trane Technologies plc and Norfolk Southern Corporation: A Detailed Gross Profit Analysis

Cost Insights: Breaking Down Trane Technologies plc and W.W. Grainger, Inc.'s Expenses

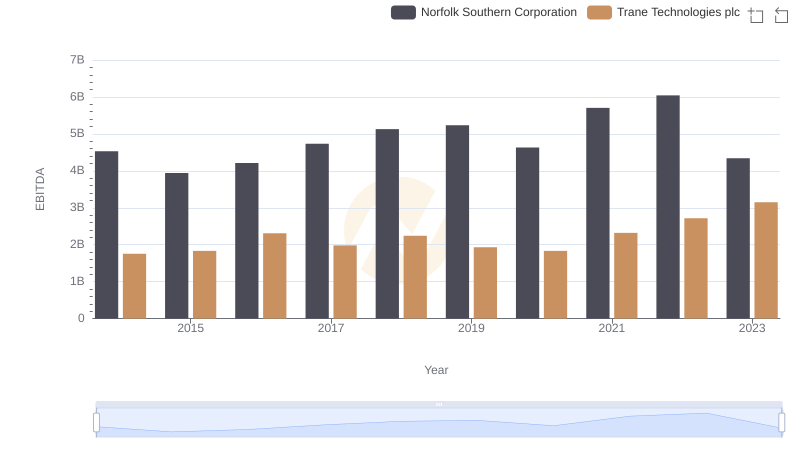

EBITDA Analysis: Evaluating Trane Technologies plc Against Norfolk Southern Corporation