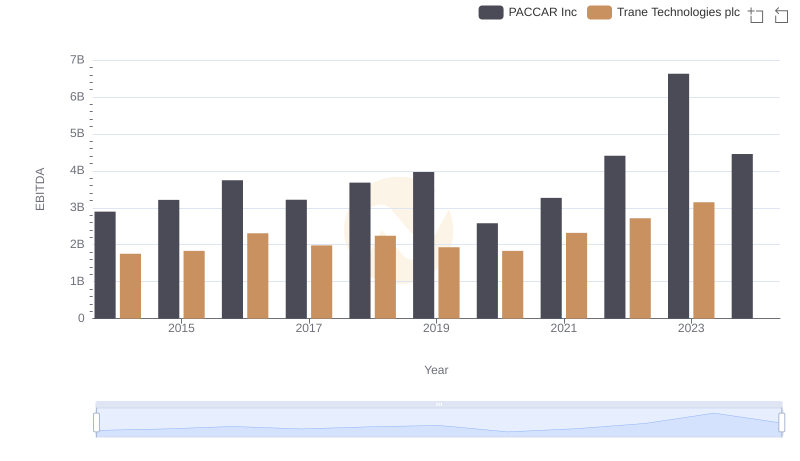

| __timestamp | PACCAR Inc | Trane Technologies plc |

|---|---|---|

| Wednesday, January 1, 2014 | 16203800000 | 8982800000 |

| Thursday, January 1, 2015 | 15993800000 | 9301600000 |

| Friday, January 1, 2016 | 14280100000 | 9329300000 |

| Sunday, January 1, 2017 | 16470800000 | 9811600000 |

| Monday, January 1, 2018 | 19839900000 | 10847600000 |

| Tuesday, January 1, 2019 | 21584300000 | 11451500000 |

| Wednesday, January 1, 2020 | 16276500000 | 8651300000 |

| Friday, January 1, 2021 | 20230400000 | 9666800000 |

| Saturday, January 1, 2022 | 24068100000 | 11026900000 |

| Sunday, January 1, 2023 | 27985500000 | 11820400000 |

| Monday, January 1, 2024 | 26069600000 | 12757700000 |

Unveiling the hidden dimensions of data

In the ever-evolving landscape of industrial giants, understanding cost structures is pivotal. Trane Technologies plc and PACCAR Inc, two stalwarts in their respective fields, offer intriguing insights into their financial strategies over the past decade. From 2014 to 2023, PACCAR Inc's cost of revenue surged by approximately 73%, peaking in 2023. This growth reflects a robust expansion strategy, possibly driven by increased production and market demand. In contrast, Trane Technologies plc exhibited a steadier trajectory, with a 32% increase in costs over the same period, indicating a more controlled growth approach. Notably, 2020 marked a dip for both companies, likely due to global economic disruptions. As we look to 2024, data for Trane Technologies is missing, leaving room for speculation on their future financial maneuvers. This comparative analysis underscores the dynamic nature of industrial cost management.

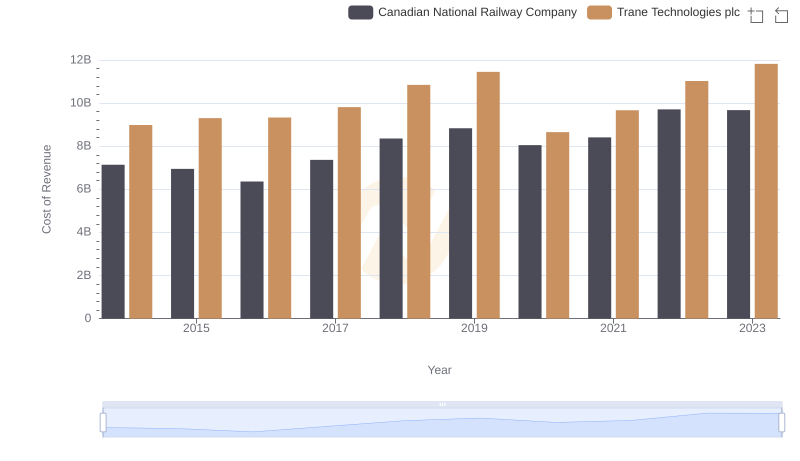

Cost of Revenue Comparison: Trane Technologies plc vs Canadian National Railway Company

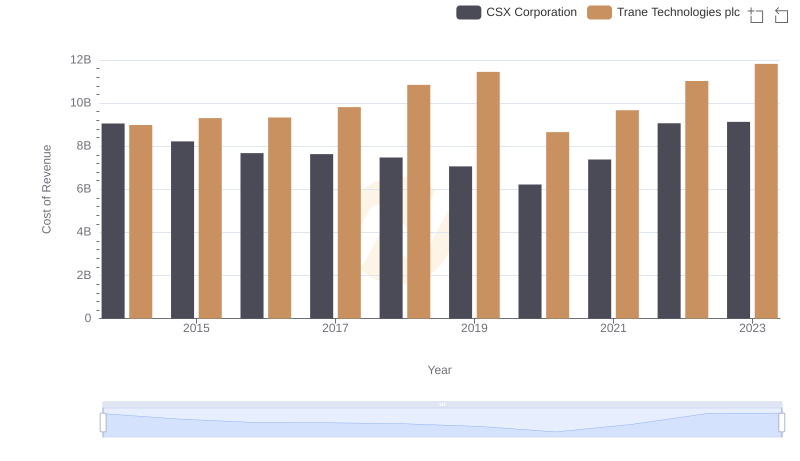

Cost of Revenue Trends: Trane Technologies plc vs CSX Corporation

Revenue Insights: Trane Technologies plc and PACCAR Inc Performance Compared

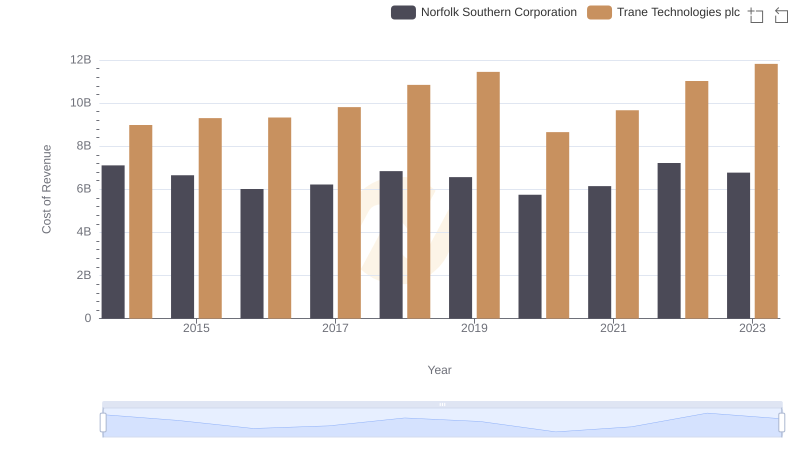

Analyzing Cost of Revenue: Trane Technologies plc and Norfolk Southern Corporation

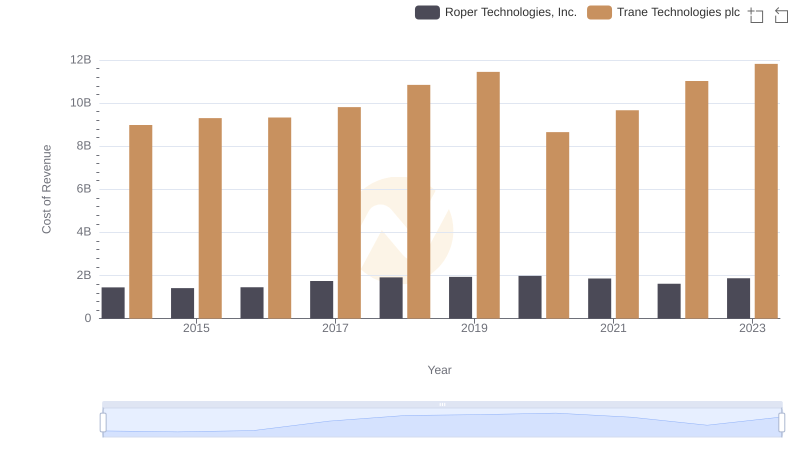

Cost of Revenue Comparison: Trane Technologies plc vs Roper Technologies, Inc.

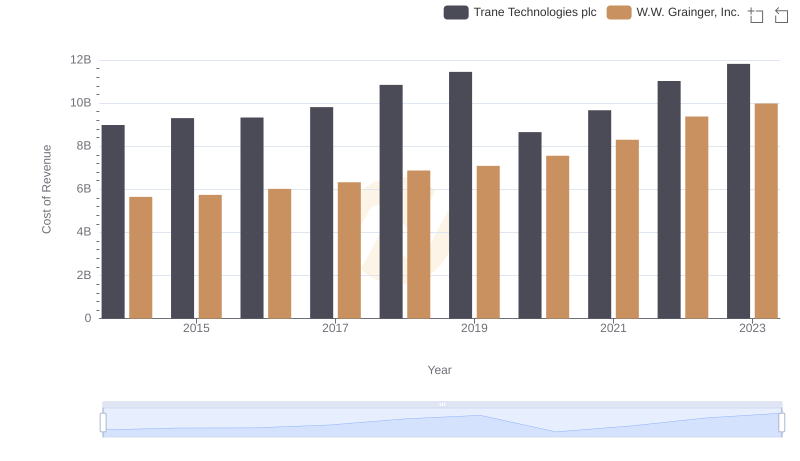

Cost Insights: Breaking Down Trane Technologies plc and W.W. Grainger, Inc.'s Expenses

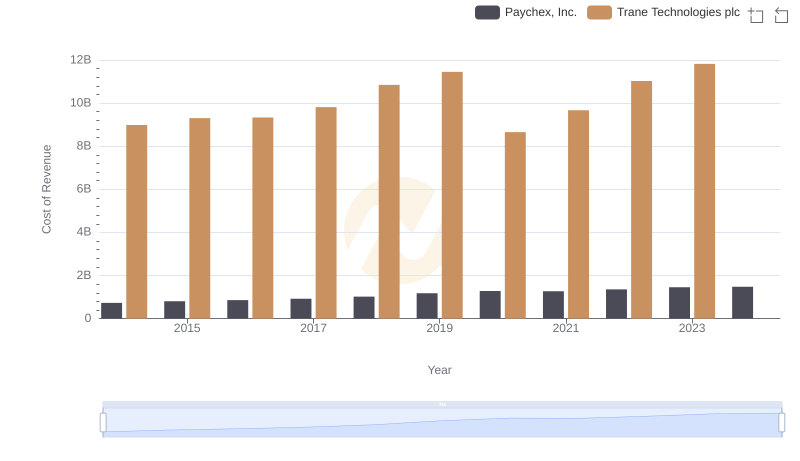

Cost Insights: Breaking Down Trane Technologies plc and Paychex, Inc.'s Expenses

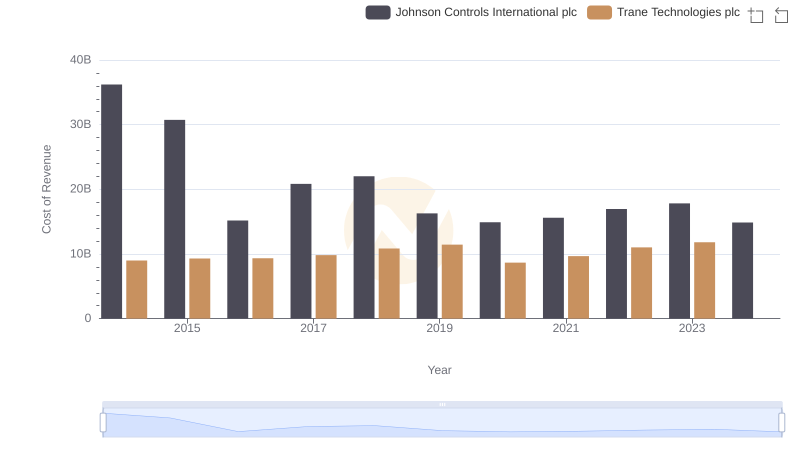

Cost of Revenue Comparison: Trane Technologies plc vs Johnson Controls International plc

Trane Technologies plc vs PACCAR Inc: In-Depth EBITDA Performance Comparison