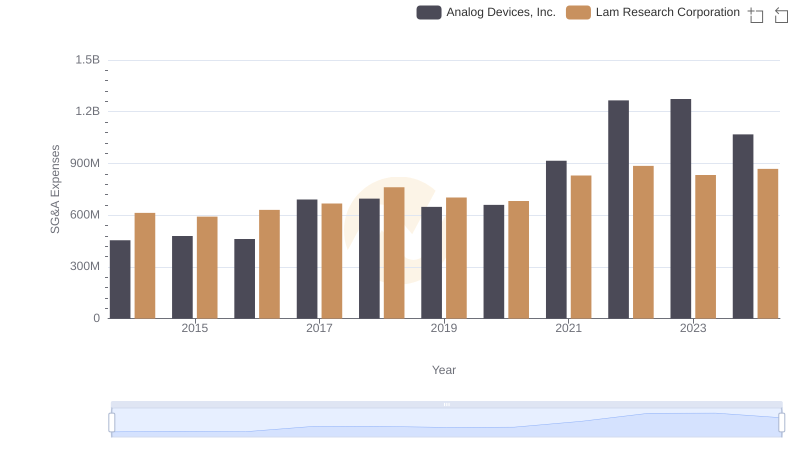

| __timestamp | Analog Devices, Inc. | Micron Technology, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 454676000 | 707000000 |

| Thursday, January 1, 2015 | 478972000 | 719000000 |

| Friday, January 1, 2016 | 461438000 | 659000000 |

| Sunday, January 1, 2017 | 691046000 | 743000000 |

| Monday, January 1, 2018 | 695937000 | 813000000 |

| Tuesday, January 1, 2019 | 648094000 | 836000000 |

| Wednesday, January 1, 2020 | 659923000 | 881000000 |

| Friday, January 1, 2021 | 915418000 | 894000000 |

| Saturday, January 1, 2022 | 1266175000 | 1066000000 |

| Sunday, January 1, 2023 | 1273584000 | 920000000 |

| Monday, January 1, 2024 | 1068640000 | 1129000000 |

In pursuit of knowledge

In the ever-evolving landscape of technology, cost management remains a pivotal factor for success. Over the past decade, Analog Devices, Inc. and Micron Technology, Inc. have demonstrated distinct strategies in managing their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2024, Analog Devices saw a remarkable 180% increase in SG&A expenses, peaking in 2023. Meanwhile, Micron Technology experienced a steadier growth of approximately 60%, with a notable surge in 2024. This divergence highlights the contrasting approaches of these industry leaders. While Analog Devices' expenses soared, possibly reflecting aggressive expansion or strategic investments, Micron's more measured increase suggests a focus on efficiency and cost control. As we look to the future, understanding these trends offers valuable insights into the financial strategies shaping the tech sector.

Analog Devices, Inc. vs Micron Technology, Inc.: Examining Key Revenue Metrics

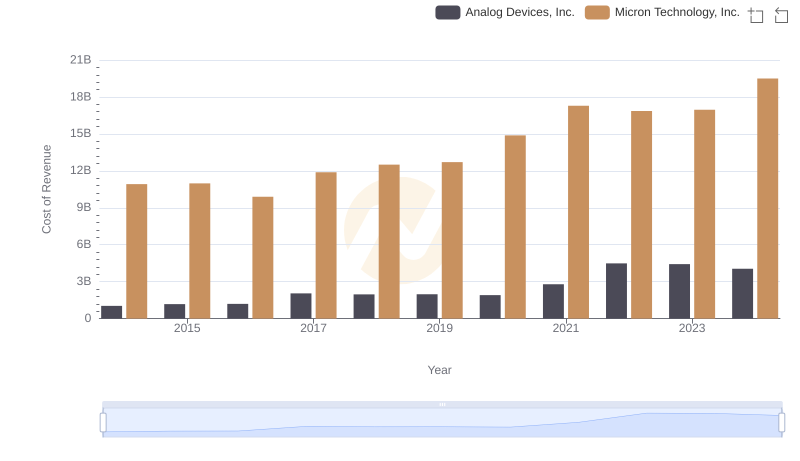

Analog Devices, Inc. vs Micron Technology, Inc.: Efficiency in Cost of Revenue Explored

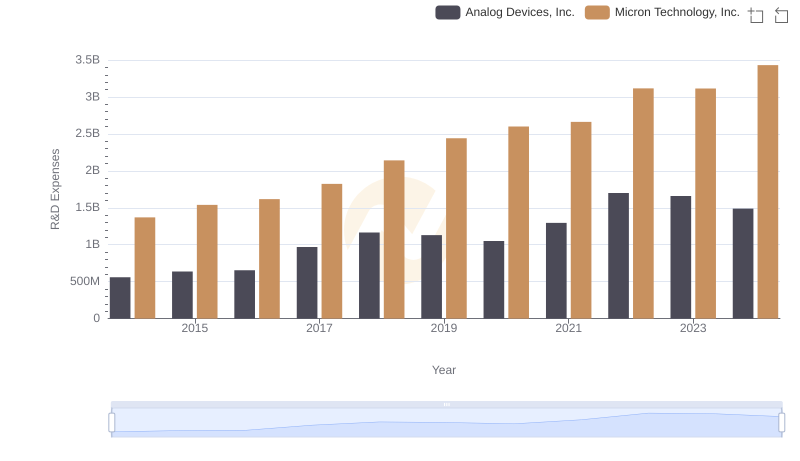

Research and Development Investment: Analog Devices, Inc. vs Micron Technology, Inc.

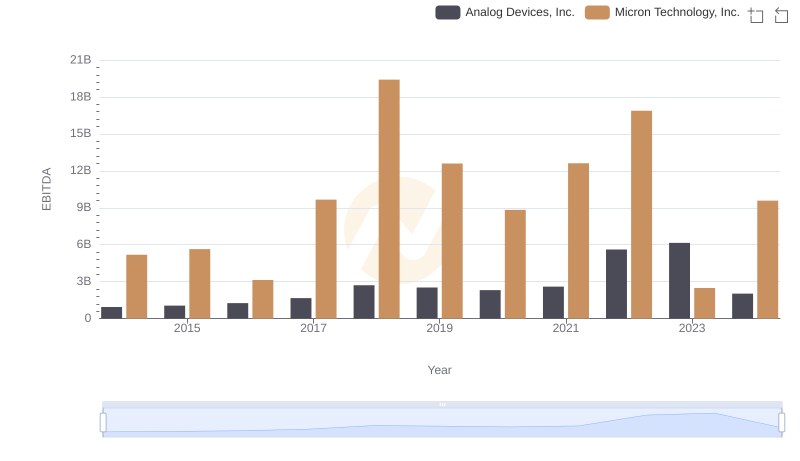

Comprehensive EBITDA Comparison: Analog Devices, Inc. vs Micron Technology, Inc.

Analog Devices, Inc. or Lam Research Corporation: Who Manages SG&A Costs Better?

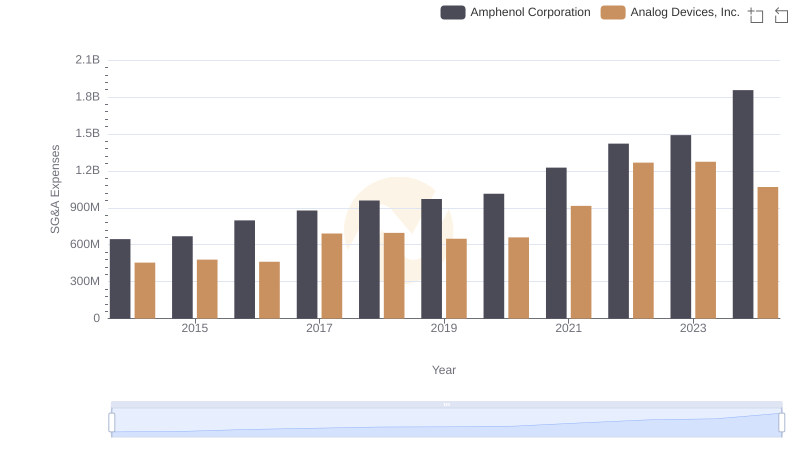

Operational Costs Compared: SG&A Analysis of Analog Devices, Inc. and Amphenol Corporation

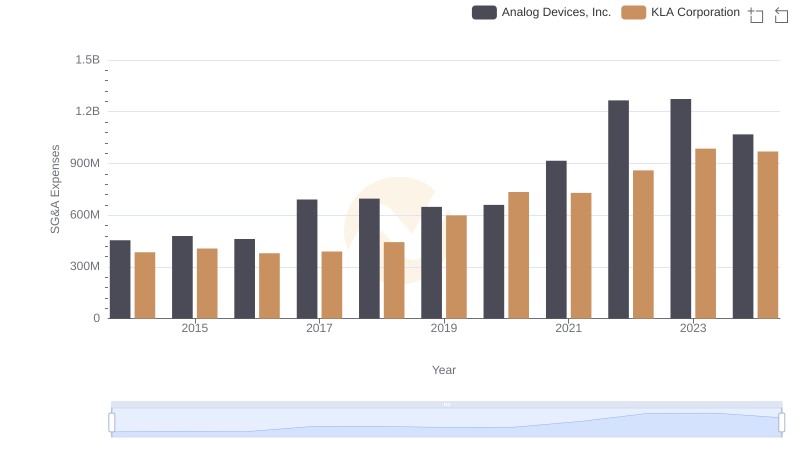

Who Optimizes SG&A Costs Better? Analog Devices, Inc. or KLA Corporation

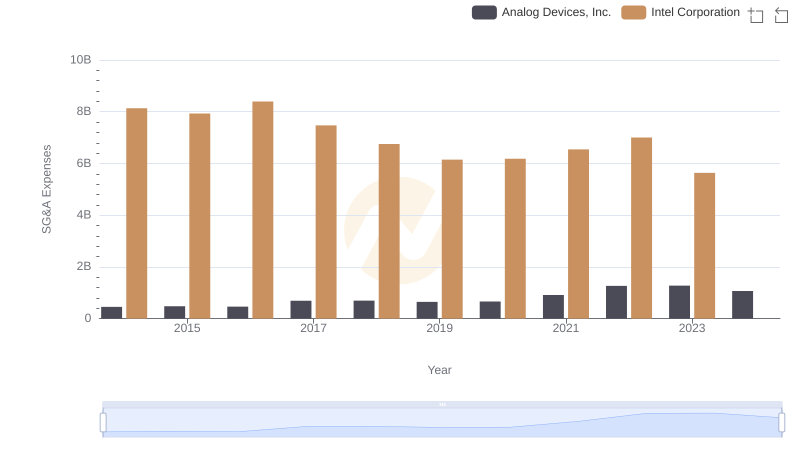

Selling, General, and Administrative Costs: Analog Devices, Inc. vs Intel Corporation

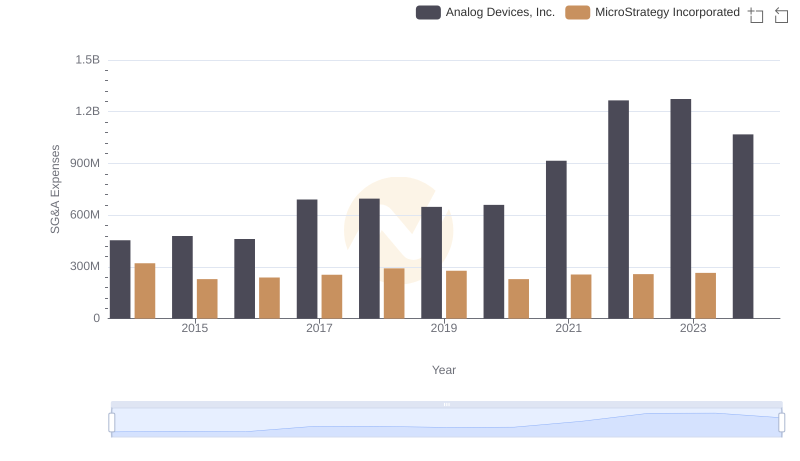

Comparing SG&A Expenses: Analog Devices, Inc. vs MicroStrategy Incorporated Trends and Insights

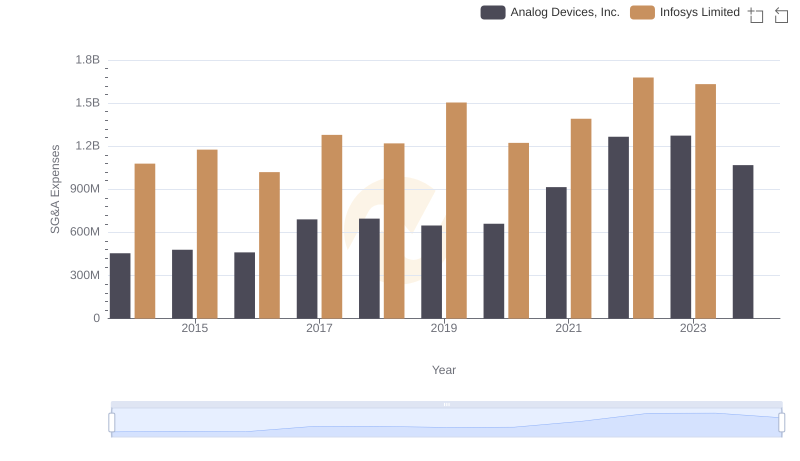

Cost Management Insights: SG&A Expenses for Analog Devices, Inc. and Infosys Limited

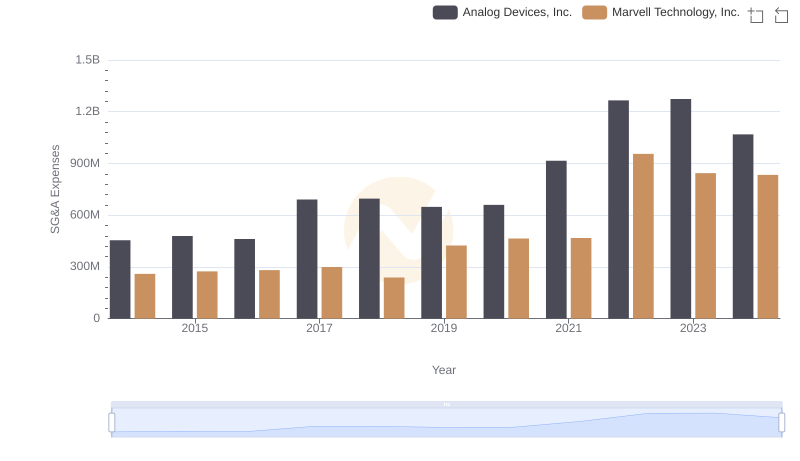

SG&A Efficiency Analysis: Comparing Analog Devices, Inc. and Marvell Technology, Inc.

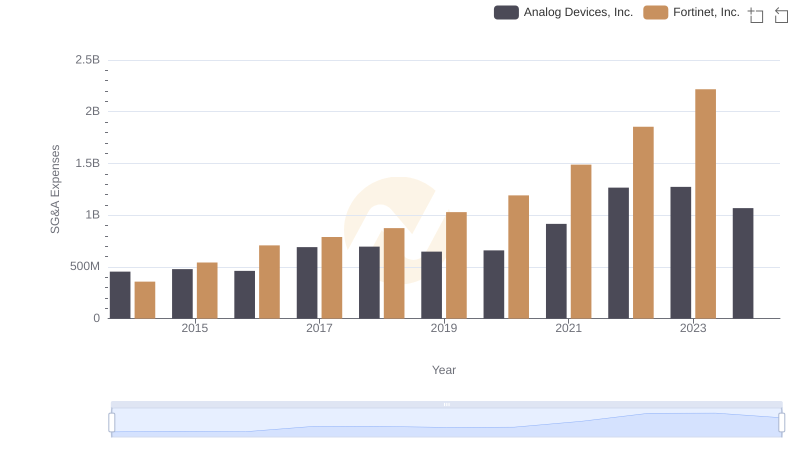

Operational Costs Compared: SG&A Analysis of Analog Devices, Inc. and Fortinet, Inc.