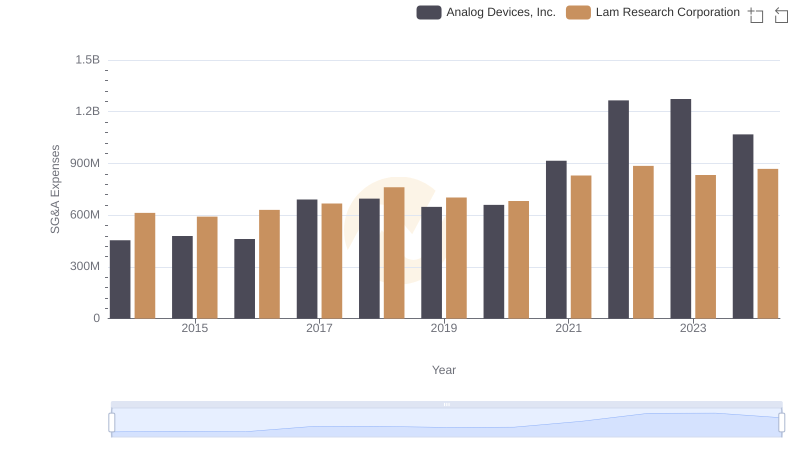

| __timestamp | Analog Devices, Inc. | Lam Research Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 943421000 | 977923000 |

| Thursday, January 1, 2015 | 1059384000 | 1155224000 |

| Friday, January 1, 2016 | 1255468000 | 1365284000 |

| Sunday, January 1, 2017 | 1665464000 | 2218837000 |

| Monday, January 1, 2018 | 2706642000 | 3539694000 |

| Tuesday, January 1, 2019 | 2527491000 | 2774013000 |

| Wednesday, January 1, 2020 | 2317701000 | 2942327000 |

| Friday, January 1, 2021 | 2600723000 | 4789174000 |

| Saturday, January 1, 2022 | 5611579000 | 5715561000 |

| Sunday, January 1, 2023 | 6150827000 | 5637608000 |

| Monday, January 1, 2024 | 2032798000 | 4905157000 |

Unleashing the power of data

In the ever-evolving landscape of the semiconductor industry, two titans, Analog Devices, Inc. and Lam Research Corporation, have showcased remarkable EBITDA performance over the past decade. From 2014 to 2023, both companies have demonstrated significant growth, with Lam Research Corporation leading the charge with an average EBITDA of approximately $3.3 billion, a 25% higher average than Analog Devices, Inc.

This comparison highlights the dynamic nature of the semiconductor sector, where strategic decisions and market conditions can significantly impact financial performance.

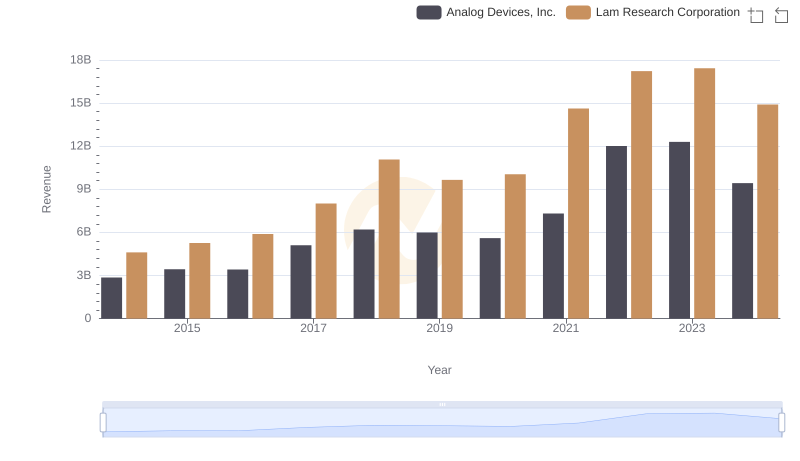

Breaking Down Revenue Trends: Analog Devices, Inc. vs Lam Research Corporation

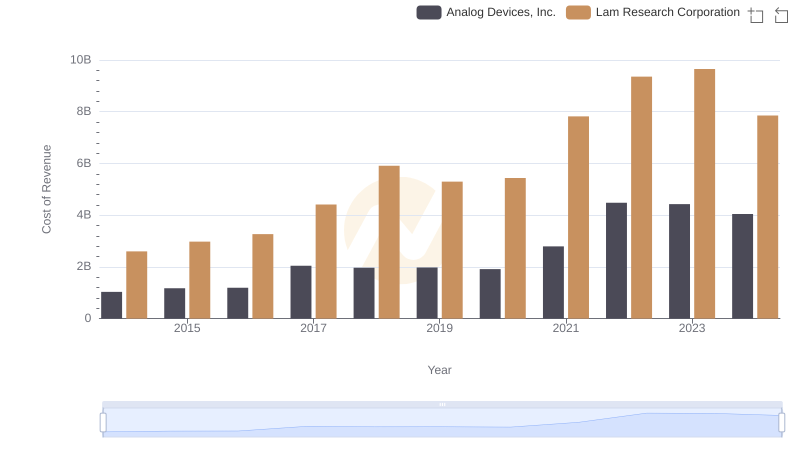

Comparing Cost of Revenue Efficiency: Analog Devices, Inc. vs Lam Research Corporation

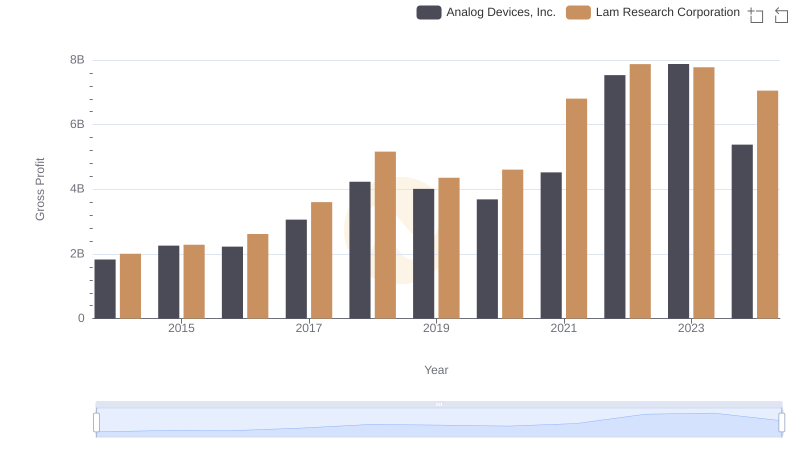

Analog Devices, Inc. vs Lam Research Corporation: A Gross Profit Performance Breakdown

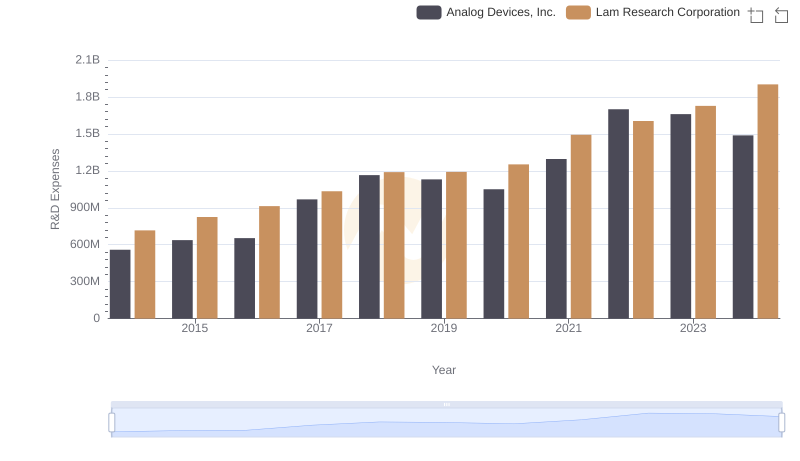

Analog Devices, Inc. or Lam Research Corporation: Who Invests More in Innovation?

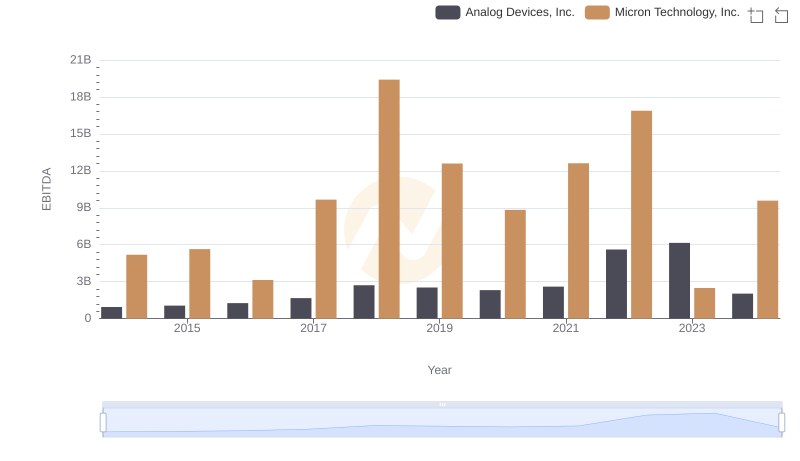

Comprehensive EBITDA Comparison: Analog Devices, Inc. vs Micron Technology, Inc.

Analog Devices, Inc. or Lam Research Corporation: Who Manages SG&A Costs Better?

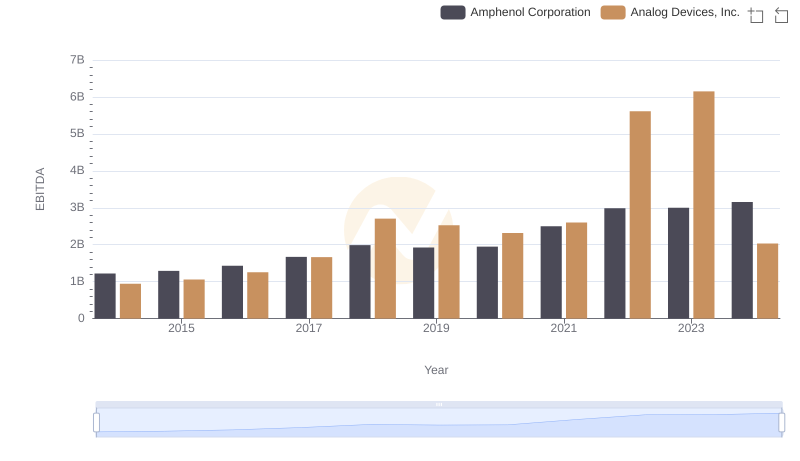

EBITDA Performance Review: Analog Devices, Inc. vs Amphenol Corporation

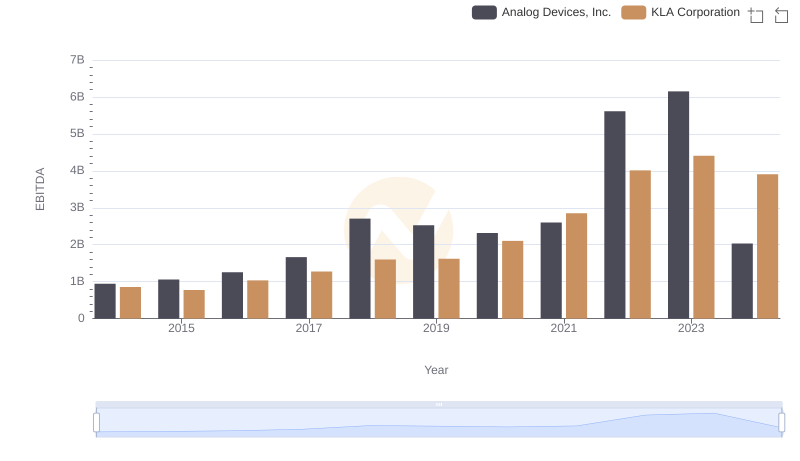

EBITDA Metrics Evaluated: Analog Devices, Inc. vs KLA Corporation

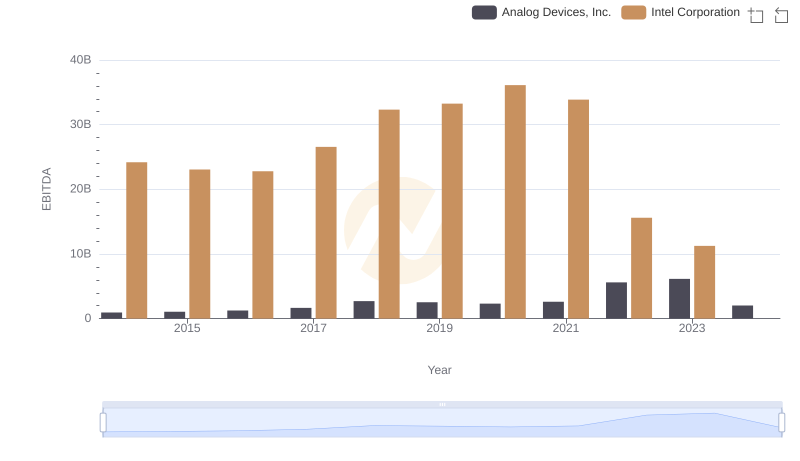

Professional EBITDA Benchmarking: Analog Devices, Inc. vs Intel Corporation

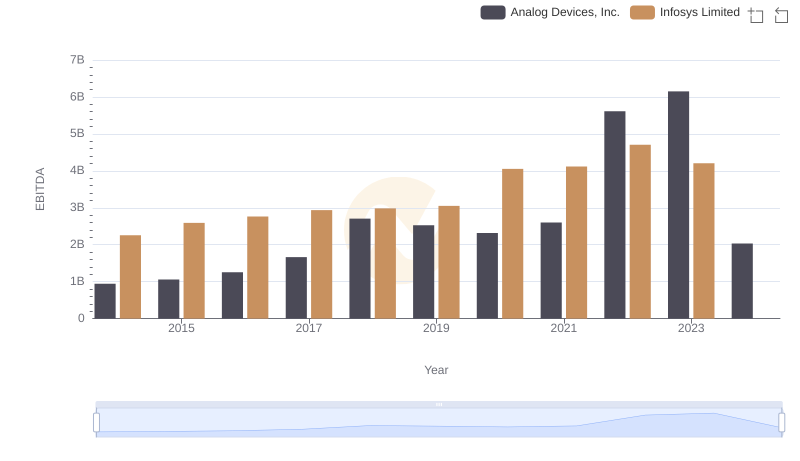

Comprehensive EBITDA Comparison: Analog Devices, Inc. vs Infosys Limited

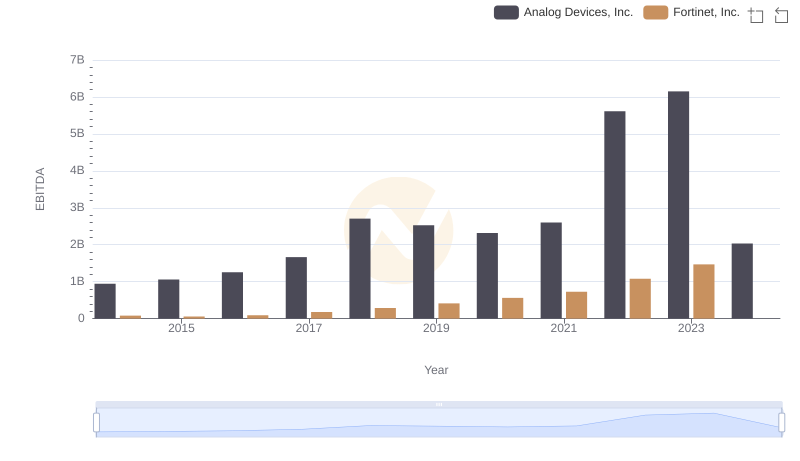

Analog Devices, Inc. and Fortinet, Inc.: A Detailed Examination of EBITDA Performance

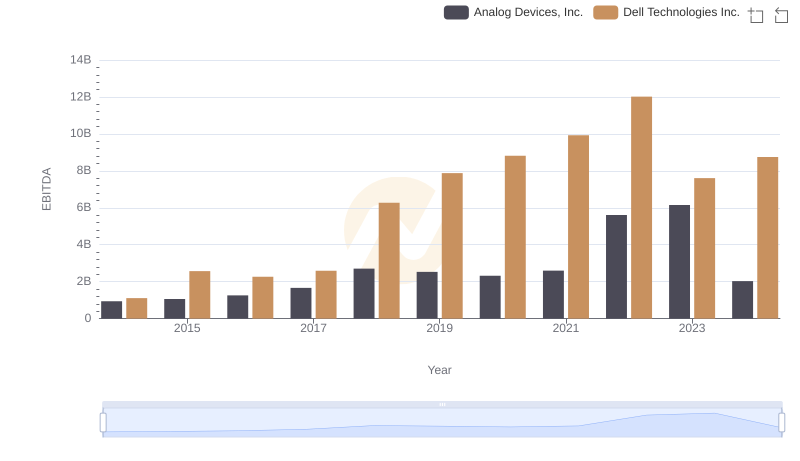

Analog Devices, Inc. vs Dell Technologies Inc.: In-Depth EBITDA Performance Comparison