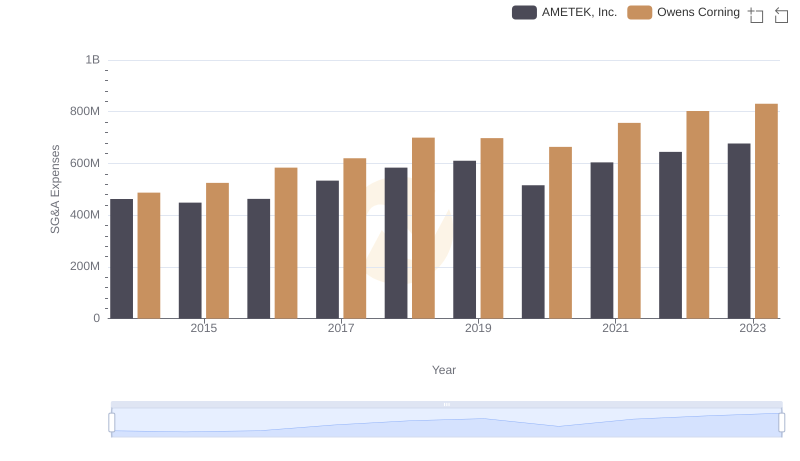

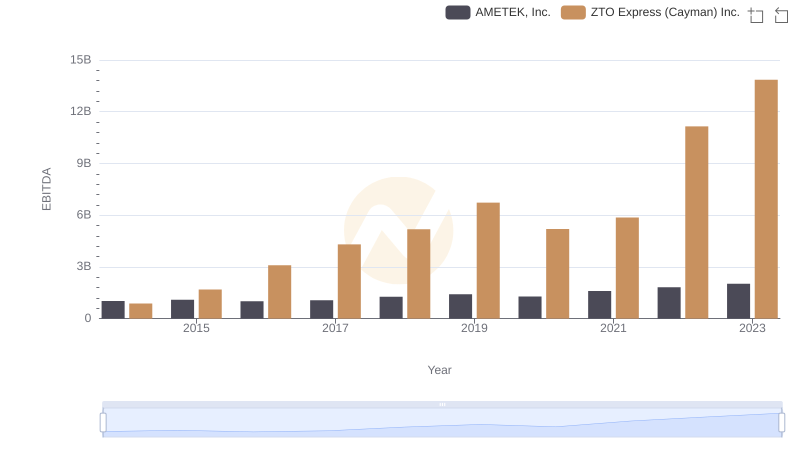

| __timestamp | AMETEK, Inc. | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 462637000 | 534537000 |

| Thursday, January 1, 2015 | 448592000 | 591738000 |

| Friday, January 1, 2016 | 462970000 | 705995000 |

| Sunday, January 1, 2017 | 533645000 | 780517000 |

| Monday, January 1, 2018 | 584022000 | 1210717000 |

| Tuesday, January 1, 2019 | 610280000 | 1546227000 |

| Wednesday, January 1, 2020 | 515630000 | 1663712000 |

| Friday, January 1, 2021 | 603944000 | 1875869000 |

| Saturday, January 1, 2022 | 644577000 | 2077372000 |

| Sunday, January 1, 2023 | 677006000 | 2425253000 |

| Monday, January 1, 2024 | 696905000 |

Unveiling the hidden dimensions of data

In the competitive landscape of global business, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. From 2014 to 2023, AMETEK, Inc. and ZTO Express (Cayman) Inc. have shown distinct strategies in handling these costs. AMETEK, Inc. maintained a steady increase in SG&A expenses, growing approximately 46% over the decade. In contrast, ZTO Express saw a staggering 354% rise, reflecting its rapid expansion in the logistics sector.

While AMETEK's approach suggests a focus on controlled growth, ZTO's significant increase indicates aggressive scaling. By 2023, ZTO's SG&A expenses were nearly 3.6 times higher than AMETEK's, highlighting different operational strategies. This comparison offers valuable insights into how companies in diverse industries manage their operational costs, impacting their bottom line and market positioning.

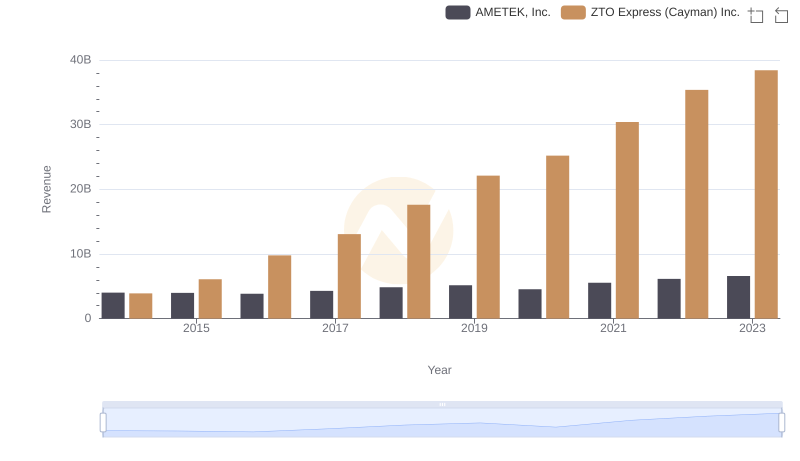

AMETEK, Inc. and ZTO Express (Cayman) Inc.: A Comprehensive Revenue Analysis

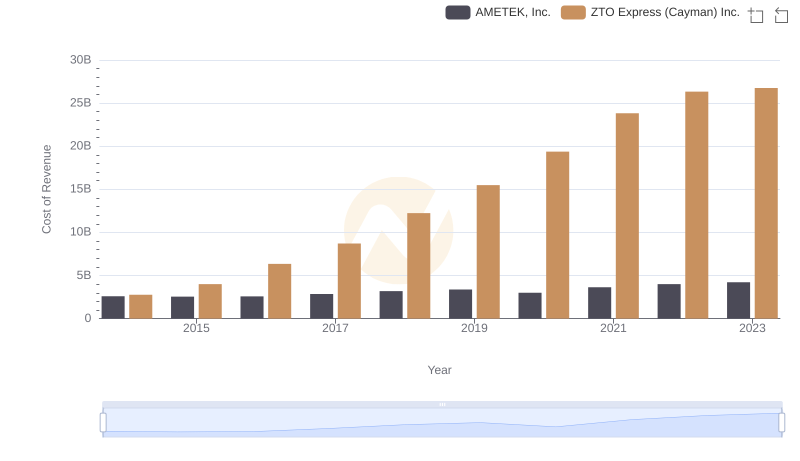

Cost Insights: Breaking Down AMETEK, Inc. and ZTO Express (Cayman) Inc.'s Expenses

Comparing SG&A Expenses: AMETEK, Inc. vs Owens Corning Trends and Insights

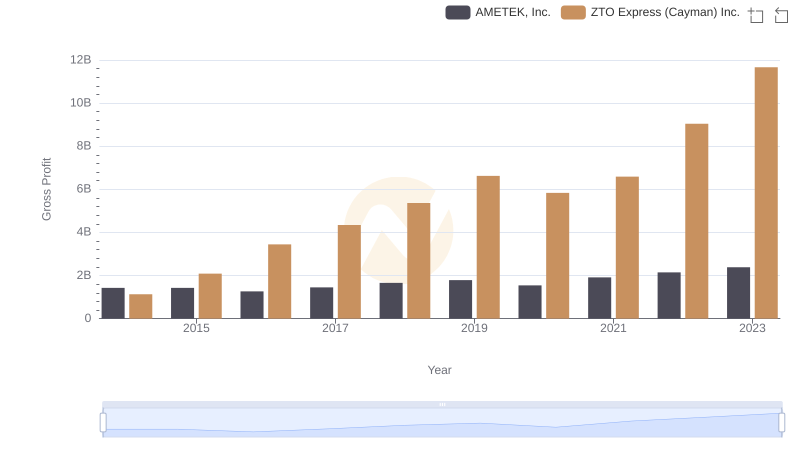

Gross Profit Comparison: AMETEK, Inc. and ZTO Express (Cayman) Inc. Trends

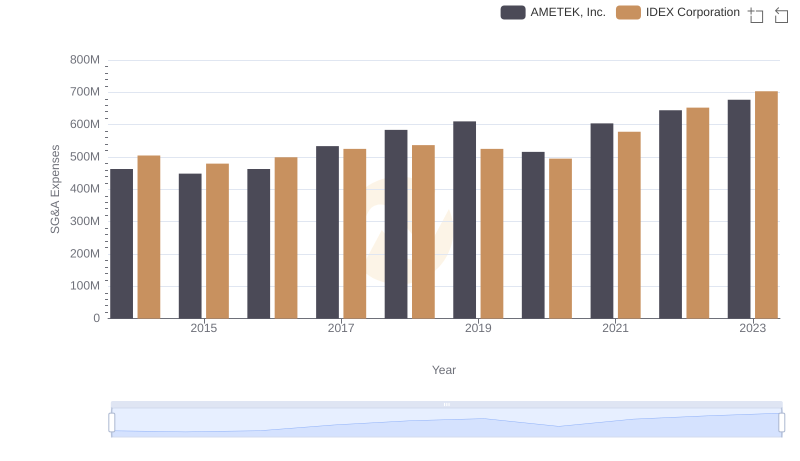

AMETEK, Inc. or IDEX Corporation: Who Manages SG&A Costs Better?

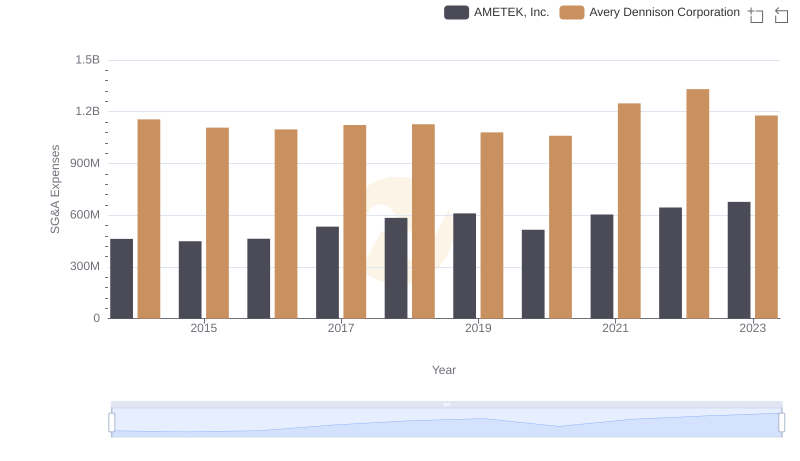

Cost Management Insights: SG&A Expenses for AMETEK, Inc. and Avery Dennison Corporation

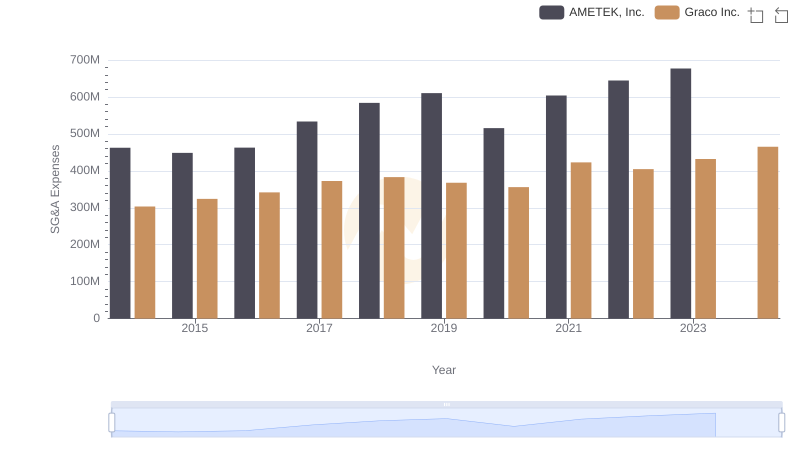

AMETEK, Inc. or Graco Inc.: Who Manages SG&A Costs Better?

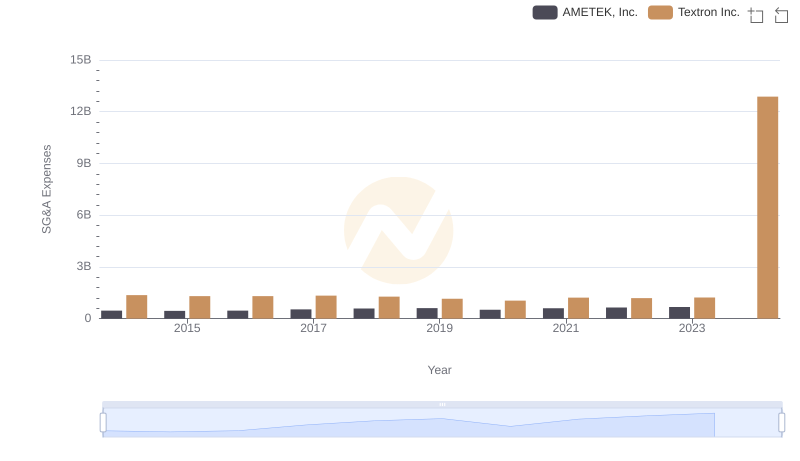

SG&A Efficiency Analysis: Comparing AMETEK, Inc. and Textron Inc.

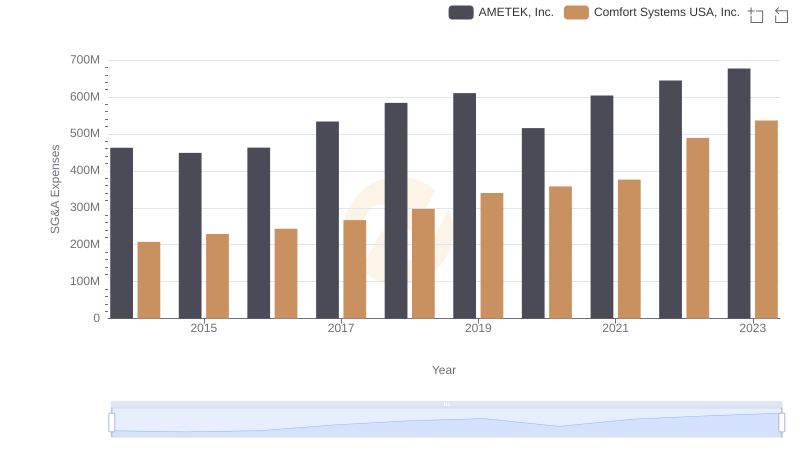

Who Optimizes SG&A Costs Better? AMETEK, Inc. or Comfort Systems USA, Inc.

EBITDA Analysis: Evaluating AMETEK, Inc. Against ZTO Express (Cayman) Inc.

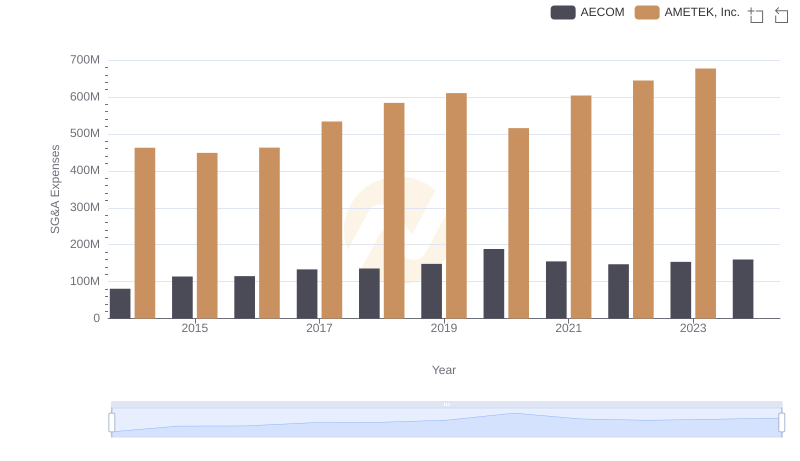

SG&A Efficiency Analysis: Comparing AMETEK, Inc. and AECOM

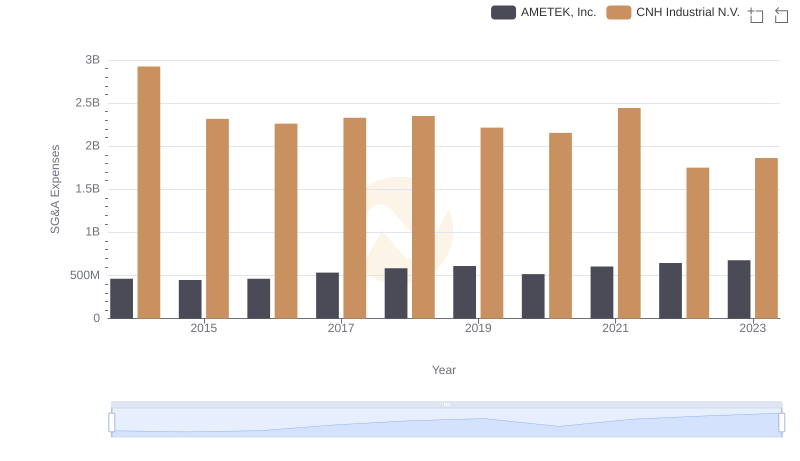

Who Optimizes SG&A Costs Better? AMETEK, Inc. or CNH Industrial N.V.